Today’s letter is brought to you by Trust & Will!

Trust & Will is the most trusted name in online estate planning and settlement.

The company has helped hundreds of thousands of families create their estate plans, and they’re just getting started. Trust & Will enables every American to create a plan that’s customized to fit their needs, their life, and their legacy.

Their mission is to make estate planning simple, affordable, and inclusive.

All of Trust & Will’s documents have been designed and approved by estate planning attorneys to meet the highest legal standards. Their process is simple, secure, complete, and customized for your specific needs and state requirements.

To investors,

The Federal Reserve pledged to “destroy demand” in early 2022 when they revealed their plan to begin hiking interest rates. For once, the Fed did what they said they would do and their actions had the intended consequences on the American consumer.

These rate hikes did not simply destroy demand, but rather they turned the American consumer into an economic punching bag.

For example, we can look at car loans. Financing for new cars can range from just over 5% for a great borrower (based on credit score) to 14% for the worst credit scores. Used car loan interest rates are slightly over 7% for the best borrowers and more than 21% for those on the other end of the quality spectrum. Imagine paying 21% interest on a loan for a used car — insane.

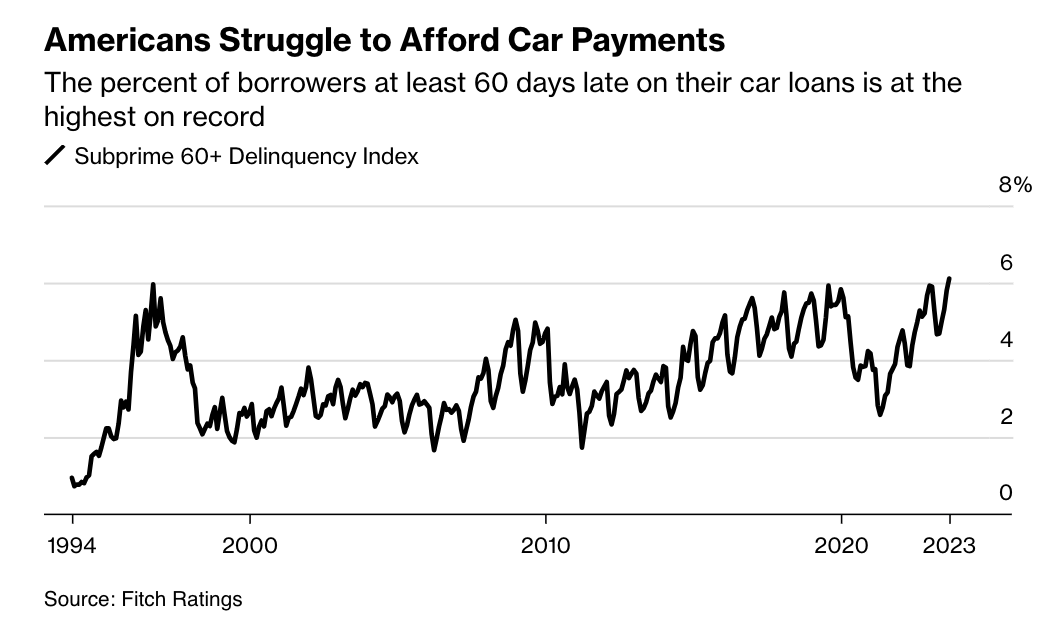

These rising interest rates are forcing borrowers to miss their payments at a record rate. Claire Ballentine at Bloomberg writes “the percent of subprime auto borrowers at least 60 days past due on their loans rose to 6.11% in September, the highest in data going back to 1994, according to Fitch Ratings.”

It makes sense that more consumers will fall behind on their payments as the payments become more expensive. But remember, majority of Americans need their car to get to work, school, the grocery store, etc. These are usually not exotic purchases, especially at the subprime level, rather they are for a car that is essential to the livelihood and survival of the owner.

The Fed’s interest rate hikes has beaten up car owners.

This is not the only place we can see this issue. Credit card delinquencies have been an interesting development. The second quarter credit card delinquency rate sat at 2.8%, which is not particularly concerning given that the delinquency rate was 6.8% during the Global Financial Crisis. The concerning aspect is how quickly the rate has almost doubled from 1.6% in 2021 to 2.8% in 2023.

You can see the historical context and the rate of rapid acceleration in these charts from the St Louis Fed.

Speaking of Fed data, one of the wildest charts is how depleted the personal savings of the American consumer has become. As interest rates have risen, coupled with the persistent appreciation of consumer good prices, citizens have to spend the money that is available to them, including from their hard-earned savings.

The last time that the personal savings rate was this low? Leading up to the Global Financial Crisis. That doesn’t exactly instill confidence in market participants who are watching the American consumer get punched over and over again from every angle as interest rates rise.

Related to consumer prices, food continues to be an area of concern for the American consumer as well. We have seen inflation ravage this area of citizen’s budget. There were times in the last 12 months where food prices has increased by more than 10% over the preceding year. According to the most recent data, food prices are up almost 4% in the last 12 months, which is slower growth than we have had previously, but the dirty secret is that none of the past price increases to food are going to be rolled back. Once food prices increase, they create a new normal at the elevated level.

As Bloomberg showed, food price growth can fluctuate from year-to-year but the aggregate prices of food only continues to grow at a ridiculous rate. Food prices grow faster than wages, so people have a more difficult time affording food each year.

This is just another example of the American consumer becoming a punching bag for the US economy.

There is no end in sight for the economic pain that citizens are feeling right now. To make matters worse, there is an elevated chance of a recession on the horizon, which would punish consumers who are already in a precarious financial position. The Fed’s mandate to get inflation under control has worked to a degree, but there are concerns that much of the “wins” that have been attributed to the Fed can be explained by high base effects in the CPI numbers.

Regardless of whether you think the Fed has done a good job or a bad one, it is objectively true that the American consumer is on the losing end of the current economic situation. We didn’t even get into the fact that according to the US government’s data, $1 in 2020 is worth only $0.83 today. These economic data points showcase why Americans constantly feel like they are falling behind, while simultaneously our national debt continues to explode higher signaling persistent pain in our future.

I wish I had better news for you all to start your Monday. We have to call the situation like we see it though. Strengthen your balance sheets. Prepare for more pain. And, of course, hope that I am wildly wrong and things turn out to be much more positive than they seem.

I’ll talk to everyone tomorrow.

-Anthony Pompliano

If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and the business world.

Elbridge Colby is the co-founder and principal of the Marathon Initiative, a policy initiative focused on developing strategies to prepare the United States for an era of sustained great power competition. He is the author of “The Strategy of Denial: American Defense in an Age of Great Power Conflict.”

In this conversation, we talk about the threat from China, Ukraine & Russia, what is happening between Hamas & Israel, how this all feeds into the economic strength of America, how private sector can make an impact, and what America can do right now to put us in a better position.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

How America Can Prepare For Conflict With China

Podcast Sponsors

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post