Today’s letter is brought to you by Dream Startup Job!

Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative companies.

Search over 10,000 roles and apply quickly to cutting-edge companies like Traba, Varda, Eight Sleep, Flowhub, and many others.

If you're looking to join a team that is making a difference in the world, create a job-seeker profile in minutes and start applying for roles.

If you're a startup, post your open roles today or schedule a call with the Dream Startup Job team by clicking here.

To investors,

The citizens of America are being forced to become market speculators. Historically, some portion of the population was drawn to the idea of wagering capital to drive a return on their investment, yet a majority of individuals chose to refrain from this activity and merely save their money.

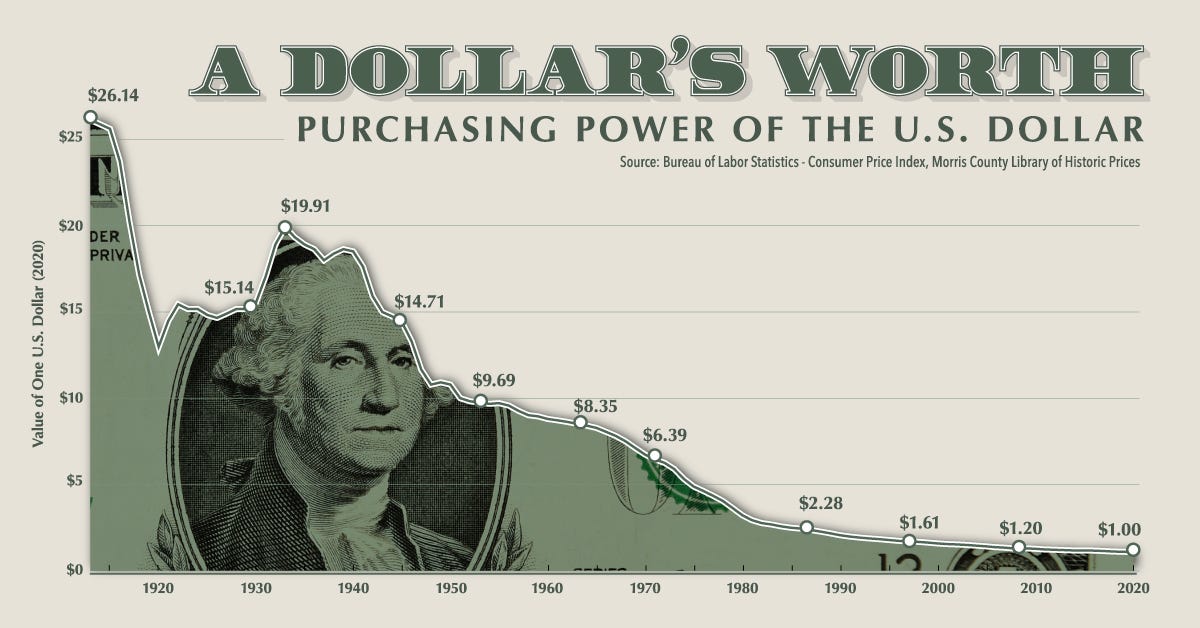

To understand the phenomenon, we must first identify a key structural change that happened in the 1970s — the United States went off the gold standard, the government became addicted to running an ever-increasing deficit, and the national debt has ballooned to $33+ trillion. This chart from Pantera’s Dan Morehead is eye-opening.

As the national debt became larger, the US government realized they had a more robust ability to devalue the currency so we theoretically could pay off a fixed debt amount with future devalued dollars. You can see a rapid decline in the purchasing power that began at the start of the 1970s.

While the devaluation of the dollar allows for debt to be paid off at advantageous terms later, even though it is unlikely that the US will ever pay off their debt, the largest negative repercussion from this decision is the erosion of citizens’ savings value. The majority of citizens were holding cash in the bank account trying to save their way to wealth, yet the government was destroying that value simultaneously.

This devaluation forced more citizens to seek paths to protect their wealth. Investment assets like stocks became a popular option because the belief has been that the stock market will outgrow any inflation implemented by the government.

So how significant was this trend?

Within 30 years, more than 50% of all US citizens owned stocks directly or indirectly. Last year the percentage of US citizens holding stocks hit an all-time high just under 60%.

The rise from 53% stock ownership in 2019 to 58% stock ownership in 2022 is largely driven by the mania ushered in from zero-interest rates and trillions of dollars in quantitative easing.

This problem is not going away.

The national debt chart looks like an exponential growth chart a Series A startup would show investors to elicit their next mega-round of funding. Up and to the right. No end in sight.

This runaway debt means the United States has no choice but to continue devaluing the US dollar. As they devalue the dollar, more citizens will seek investment assets like stocks, real estate, gold, or bitcoin to protect their wealth. We should see ownership of each of these assets, especially stocks, hit new all-time highs over and over again throughout the next decade.

At the same time more capital and investors has flooded into the public stock market, the number of public companies has been declining at an alarming rate. The folks at BlueTrust write “In 1996 the number of listed companies in the U.S. peaked at 8,090, but as of Q1 2023, it had fallen to 4,572, a drop of 43%. The chart below highlights this dramatic decrease in public companies, which occurred in spite of growth in the economy, global market expansion, and new industries and technologies.”

More capital chasing fewer companies. All this happening while the dollar, which stock prices are denominated in, continues to become less value over the long term.

This is what drives the stock market up forever. There is immense wealth to be built by simply buying stocks and letting the market structure take over from there.

If you take this analysis to the extreme, there is also more capital chasing a finite amount of bitcoin, so the same macro tailwind should work in the digital currency’s favor as well.

Investors win, savers lose. That is the story in America for the foreseeable future. Don’t get caught on the wrong side of the equation.

Hope everyone has a great day. I’ll talk to each of you tomorrow.

-Anthony Pompliano

If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin.

Bill Miller IV serves as CIO and Chairman at Miller Value Partners, he also serves as a Portfolio Manager.

In this conversation, we talk about the bitcoin market, ETF’s, miners, regulation, halving, stablecoins, artificial intelligence, and a non-bitcoin yield focus fund that Bill also manages.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Bill Miller IV Explains Why He Is So Bullish On Bitcoin

Podcast Sponsors

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post