To investors,

Gold has been dominating Bitcoin’s performance this year. The precious metal is up 27%, while bitcoin is only up 4% year-to-date.

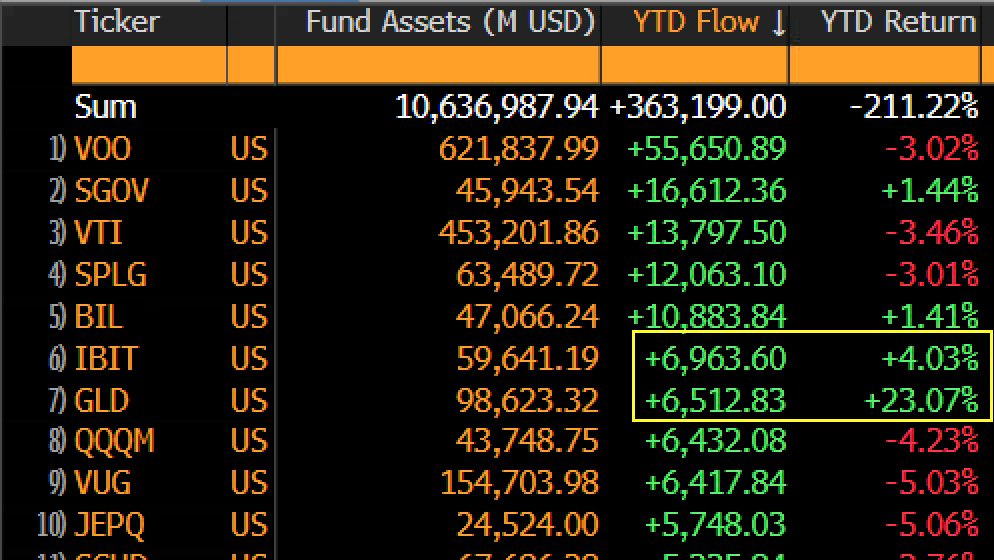

But there is something fascinating happening — investors are pouring capital into the bitcoin ETFs at an unprecedented rate. Split Capital points out that inflows for BlackRock’s bitcoin ETF have now surpassed inflows this year for GLD, the most popular gold ETF.

Bitwise’s Hunter Horsely said it well when he tweeted “I don’t know if people appreciate how significant this is. Gold is having its moment. And despite that, investors are buying more Bitcoin than gold. Now imagine when it’s flipped.”

Think of how crazy this situation is. Investors are not chasing the better performing store of value in 2025, but rather they are looking forward to position themselves to benefit from what is about to happen.

So what do these investors see?

Global liquidity is just ramping up. Take China as one example — ZeroHedge writes “China's central bank cuts key rates [and] injects 1 trillion yuan 3 hours after agreeing to trade talks to prop up economy and give communist party ammo for negotiations.”

Remember, Treasury Secretary Scott Bessent is meeting with China this weekend in Switzerland to start trade negotiations.

Wait, what?! China is throwing every monetary stimulus tool they have at their economy. Maybe those 145% tariffs are extracting more pain than the media wants you to believe. But if China is stimulating, you can bet that most central banks will start doing the same over the coming 6-12 months.

Charles Edwards asks “Are we entering the next big wave of global fiat expansion?”

No one can predict the future, Charles, but it sure looks like we are about to get a rush of cheap capital into the market. And asset prices, especially stocks, bitcoin, and gold, have never seen cheap capital they didn’t like.

This brings me to the Federal Reserve. The market believes the Fed will hold rates constant right now. I think this is a major policy mistake. The central bank has been behind the curve for years and right now is no different. We are seeing an economic slowdown because of the tariffs, which can be easily seen by inflation crashing, so the stimulus from a rate cut would help spur economic growth.

Regardless of whether the Fed decides to make the move today or over the summer, the setup is obvious — the Fed and other central banks around the world have to return to lower interest rates.

Bitcoin is the single biggest beneficiary from global liquidity and cheap capital. As we enter another round of quantitative easing, bitcoin should push much higher. Which makes sense when you remember investors are pouring more capital into Blackrock’s bitcoin ETF than the largest gold ETF.

Investors are forward-looking. They are positioning themselves for what is going to happen. And capital flows are telling us to brace for asymmetry to the upside.

Let’s see what happens. Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Why Isn’t Bitcoin At $150,000 If Everyone Is Buying?

Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss bitcoin, what you need to know about the economy, jobs, Warren Buffet, Berkshire Hathaway, and future market outlook.

Enjoy!

Podcast Sponsors

Figure Markets – Bitcoin backed loans so you can buy more Bitcoin with your Bitcoin or earn 8% lending cash to HELOC providers! Learn more about Figure Markets and their Crypto Backed Loans!

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post