To investors,

I found a number of interesting data points while I was digging into the bitcoin market over the weekend. First, there are now more than 1 million addresses on the bitcoin network with at least 1 bitcoin. That is growth of more than 100,000 addresses to this club in less than a year.

The percent of bitcoin in the circulating supply that has not moved in the last two years is now at a new all-time high of 56%. This means that more than one out of every two bitcoin in circulation has not moved in two years.

The percent of circulating supply that has not moved in 5 years is also at an all-time high of 29%.

Over 70% of all bitcoin addresses are “in profit,” which means they acquired the current bitcoin they are holding at a lower price than today’s price point.

Although there have been many people selling their bitcoin at a loss in recent months, bitcoin holders who have sold in the last few days are selling at a profit again.

Miners had been selling bitcoin throughout the second half of 2022. These same market participants have been buying/holding bitcoin year-to-date. It is a strong sign to see the lack of sell pressure from miners in the market.

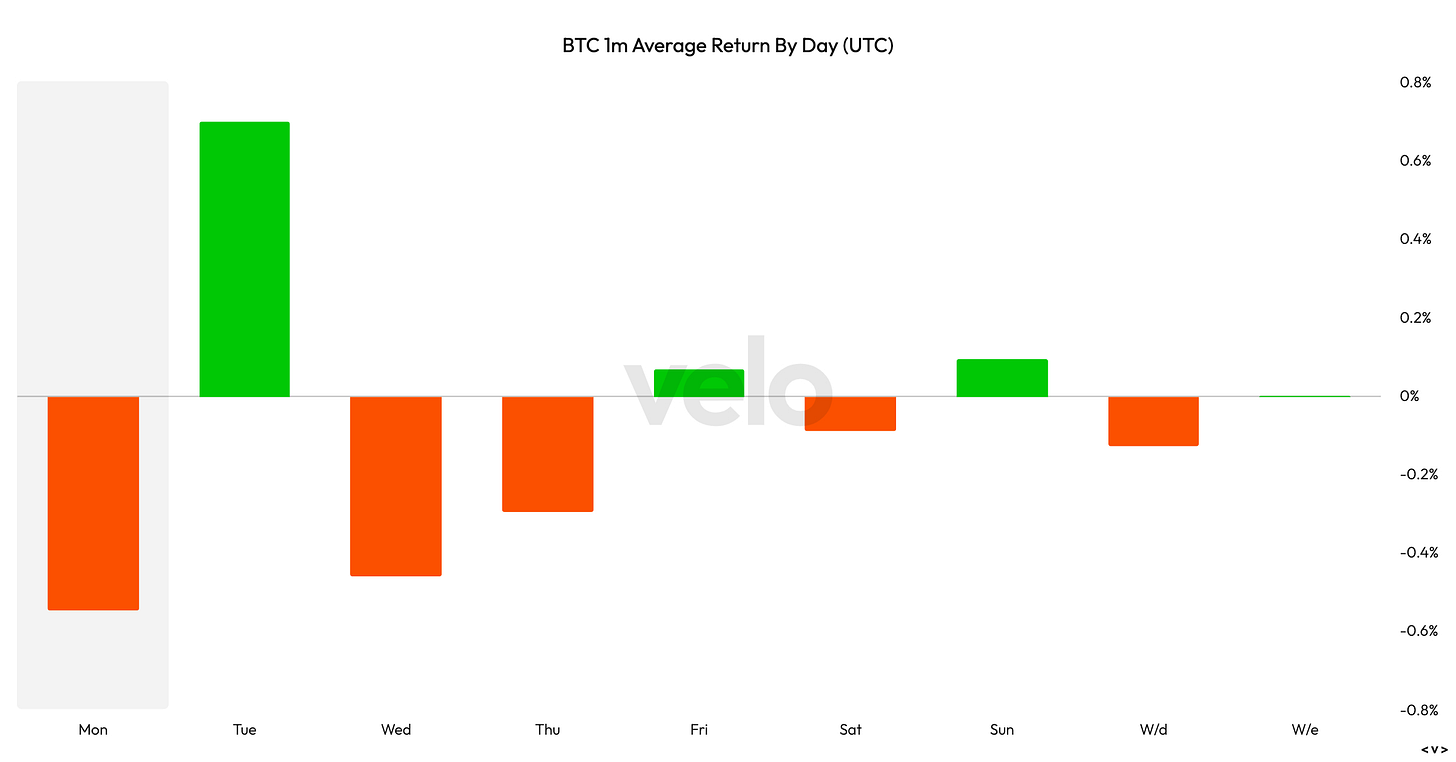

Using the new data platform Velo Data, we can see the best day for bitcoin futures returns in a given week is Tuesday. The average futures return over the last year on Tuesday is more than double the average return for any other day of the week.

Bitcoin is still down more than 50% from the 2021 all-time high in price, but the digital currency’s compound annual growth rate for the last decade remains more than 75%.

The narrative over the last few months has been focused on the regulatory environment, along with a continued belief in the mainstream media that bitcoin was a bubble. These data points, along with various fundamental analysis, suggest that bitcoin is actually in a very strong position.

Any time you have a highly illiquid asset that could potential see a large influx in demand (Wall Street ETF applications as one example), it is worth paying attention to. The supply/demand lesson you learned in Economics 101 still rules the day.

Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Pomp

Anthony Pompliano breaks down billionaire David Rubenstein’s thoughts on bitcoin, BlackRock, and why he believes bitcoin is not going away.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Joe Rogan and Post Malone Discuss Risks of CBDCs

Podcast Sponsors

Velo Data: Do you want faster, easier crypto data? Sign up for Velo Data, a new product that we have been working on to solve this problem.

StartEngine - Sign up for a StartEngine account today explore live investment opportunities where you can start investing with as little as $100.

Range - Get started today with code POMP15 for 15% off any quarterly plan for your first year.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post