This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185,000 other investors today.

To investors,

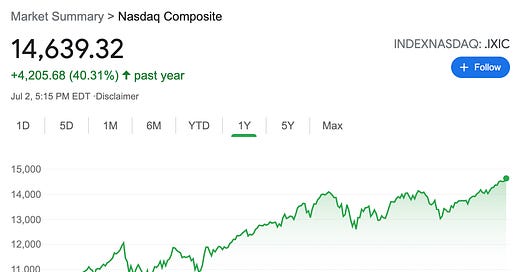

Something very unique is happening in the public markets. The S&P 500 has hit a new all-time high every day for the last 7 days. The Nasdaq also sits at an all-time high as well. Look at this chart — everything is up and to the right. The bull market rages on.

This is all happening while millions of Americans are still experiencing pandemic-related issues. It seems like the complex beast known as the economy has broken all preconceived notions of how it is supposed to work. Gasoline prices have increased $1 from a year ago, which brings the national average to $3.13 currently. The prices of commodities have increased so rapidly that home builders are throwing their hands up and refusing to participate in the market until they can better forecast their cost structures (read this epic thread for context).

This is not a problem specific to the United States though. The Washington Post had a great article highlighting the exploding food prices around the world. In the piece, Adam Taylor writes:

“The U.N. Food and Agriculture Organization said its food price index, which measures the global price of select foods, had in May hit highs not seen since 2011, up 40 percent year-on-year.

A variety of factors are to blame, including a surge in orders from China, fluctuating oil prices, a sliding U.S. dollar, and looming above all: the pandemic, and in some places, reopening.

But experts say that in the face of growing populations, globalization and climate change, higher prices may not be a blip.”

So what about the United States? Surely we couldn’t be experiencing the same thing in the most developed nation in the world, right? Wrong. Take this opening from Jaewon Kang’s article in the Wall Street Journal this morning:

“Supermarkets are stocking up on everything from sugar to frozen meat before they get more pricey, girding for what some executives anticipate will be some of the highest price increases in recent memory.

Some supermarkets said they are buying and storing supplies to keep their shelves full amid stronger demand. Grocery sales in the U.S. for the week ended June 19 rose about 15% from two years earlier and increased 0.5% from a year earlier, according to Jefferies and NielsenIQ data.

Stockpiling by food retailers is driving shortages of some staples, grocery industry executives said, and is challenging a U.S. food supply chain already squeezed by transportation costs, labor pressure and ingredient constraints.

The move is a reversal from last year when consumers hoarded groceries because of concerns about food availability, disrupting the food industry. Now, retailers themselves are stockpiling to keep costs down and protect margins.”

There is a level of insanity at the moment that is hard to comprehend. Grocery stores are acting like hedge funds through their speculation on future food prices. Think about that for a second. The current economy is so out of whack that the grocery stores are speculating.

Speaking of speculation, Robinhood revealed quite a bit of information in their S-1 filing. Here are a few statistics that stood out to me:

Robinhood has 18 million funded accounts

Almost 100% of the funded accounts are active monthly (17.7 million)

Robinhood has $81 billion of assets under custody

This is an incredibly large business, but there are some nasty sides to it too. For example, Tanay Jaipuria correctly identified one issue:

“The DAU/MAU ratio is ~47%. For context, the very best social networks tend to be in the 50-65% range, so it’s quite crazy that the daily usage rate for Robinhood is that high.”

Given the research around less trading historically equating to higher long-term returns, this level of activity is a big negative for the user base’s economic outlook. But that isn’t even the worst part. Check out this insanity:

Approximately 6% of Robinhood’s total revenue comes from users trading Dogecoin.

Approximately 37% of Robinhood’s total revenue comes from users trading options.

Over 6.5% of Robinhood’s total revenue comes from providing margin loans to users.

These statistics scream SPECULATION! to me. Speculation isn’t necessarily a bad thing on its own, but when you add in the context of the broader financial markets and economic calamities, the current situation is alarming to say the least.

But as I mentioned at the top of this letter, the S&P 500 and Nasdaq continue to hit all-time highs. That means the wealthiest people in our society continue to get richer and richer, while things like rising food costs continue to eat away at the financial well-being of the economy’s most vulnerable.

Rather than spend time complaining about the situation, my suggestion to every person is to get educated about how the economy works and position yourself to benefit from the macro economic forces. You, nor I, will be able to change the current situation. There is literally rumors of $6 trillion infrastructure bills being floated inside the current administration, so we actually may see things get even more crazy over time.

Education is the great equalizer in uncertain times. While it can be fun to speculate, remember the most common investment strategy of the world’s greatest investors: Buy good assets at discounted prices. That is it. Easy to understand, hard to execute.

Hope each of you has a great start to your day. I’ll talk to everyone tomorrow.

BONUS: We are running our 5th cohort for the Bitcoin and Crypto Training Course starting tomorrow, Tuesday July 13th. Graduates have already been hired at Coinbase, BlockFi, Gemini, Kraken, and many other great companies. Want to increase chances of being hired? Apply here: https://pompscryptocourse.com

-Pomp

🚨 SPONSORED: With the markets swinging wildly this year, the need for diversification has never been more apparent. Vinovest gives investors access to investment grade wines, an asset class that had only been available to the ultra wealthy until now.

Vinovest uses an algorithm to select and manage your portfolio, delivering clients 17.8% average returns in 2020.

For an investment opportunity uncorrelated to the stock market that has outpaced the S&P 500 over the last twenty years, check out Vinovest to invest today. They are giving Pomp Letter subscribers an exclusive offer to receive a $50 bonus credit if you open and fund an account before August 1, 2021. Click here to get started.

THE RUNDOWN:

Coinbase to Woo India Recruits With $1,000 in Crypto: Coinbase is looking to hire “hundreds” of recruits for its new hub in India, and is offering an incentive of $1,000 in crypto. The aim is for recruits to "leverage this offering to learn about crypto," Pankaj Gupta, VP of engineering and site lead in India, said a blog post Friday. The exchange is looking to tap the country's "world class community" of engineers, tech builders and entrepreneurs, Gupta wrote. Read more.

Fed’s Powell May Have Met With Coinbase CEO in May: U.S. Federal Reserve Chairman Jerome Powell was scheduled to meet with Coinbase CEO Brian Armstrong on May 11, according to an entry on the central bank’s calendar. It was unknown what the subject of the planned half hour meeting was or that it even took place. Former Speaker of the House Paul Ryan was also to have been in attendance. Read more.

UK Bank Barclays Blocks Payments to Binance: U.K. bank Barclays said Monday it is blocking customers from using their debit and credit cards to make payments to crypto exchange Binance. "With effect from today, Barclays intends to stop credit and debit card payments to Binance," Barclays said in an email to CoinDesk. "This action does not impact on the ability for customers to withdraw funds from Binance." Read more.

Revolut in Talks With SoftBank for Investment at $30B+ Valuation: U.K.-based digital bank Revolut is in “detailed talks” with SoftBank about a fundraising round that could value the firm between $30 billion and $40 billion, according to a Sky News report. Revolut and its advisers have asked investors at SoftBank's Vision Fund 2 to submit proposals for an investment of between $750 million to $1 billion with a deal expected to be “some weeks” away. Read more.

Digital-Asset Investment Funds See Net Inflows of $63M: Digital-asset investment funds attracted net capital inflows in the week to Friday after four consecutive weeks of redemptions, as bitcoin, the crypto-market leader, consolidated its quick recovery from sub-$30,000 levels. Data tracked by the U.S.-based CoinShares show crypto funds registered a net inflow of $63 million last week, of which nearly 62%, or $39 million, went into bitcoin-dedicated funds. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Patrick Stanley is the founder and CEO of CityCoins, a new product that allows you to support your favorite cities while earning yield in Bitcoin.

In this conversation, Patrick and I discuss:

CityCoins

How they work

Municipal equity vs debt

Government’s role

How citizens benefit

Why this benefits bitcoin

Why Miami was the first city

I really enjoyed this conversation with Patrick. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Exodus is an absolute game changer in the crypto wallet space. With over 100 assets supported, one-click built-in exchange, Trezor hardware wallet integration and 24/7 customer support, this is a no brainer for both newcomers and crypto heavyweights. Download Exodus on desktop, iOS, and Android using my code http://get.exodus.com/pomp

Cosmos is building the Internet of Blockchains, marking a new era of interoperability, scalability, and usability. The free flow of assets and data between blockchains with bridges to Ethereum and Bitcoin will unleash the potential of DeFi, NFTs, and much more. Dive into Cosmos at cosmos.network/pomp

OKEx is a leading crypto exchange known for providing the most options for crypto traders and investors. Whether you want to trade spot, futures, options or swaps, OKEx gives you institutional-grade tools and a best-in-class trading engine. The platform offers credit and debit card funding options and supports 40 different fiat currencies, including EUR, CAD, GBP, TRY, INR and RUB, to name just a few. You can invest, trade, and earn yield, all within one place at okex.com. OKEx is not available to customers in the United States.

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains makes crypto easier by replacing your address with [AnyName].crypto. They allow you to send and receive over 70 cryptocurrencies, including BTC, ETH, and LINK with a single blockchain domain. Go to unstoppabledomains.com and get [YourName].crypto to make your crypto life easier.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Public Rec is on a mission to make comfort look good. Their fan-favorite Flex Short is the ultimate crossover short you’ll need all summer long. From the beach to the gym, this quick-drying short has you covered. Comfort starts with a better fit. Free shipping. Free returns. Visit www.publicrec.com/pomp and use POMP at checkout for 10% off!

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy bitcoin, ether, and over 30 other cryptocurrencies. Offering industry-leading security, insurance and uptime, Gemini is the go-to trusted platform for beginner and sophisticated investors alike. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

Revolut is a finance app in the US and UK, that say they're the simplest way to access crypto. Sign up today at Revolut.com/pomp and make 3 card transactions to get $15, which you can exchange for any tokens Revolut supports. As usual, when you move your money from fiat to crypto your capital is at risk. See T&C's for details. Revolut is a financial technology company. Banking services provided by Metropolitan Commercial Bank, Member FDIC. Cryptocurrency services provided directly by Paxos Trust Company, LLC.

Did you know nearly 338 million dollars worth of NFTs were sent last year? And in 2021 that number is growing faster than ever. Looking to make your first NFT? Check out NEAR’s fast, scalable, low-cost, open-source platform. Learn why NEAR is the infrastructure for innovation at near.org

Amber - Invest, trade, swap, and earn crypto with Amber App, where new users can receive 16% APR on BTC, ETH, and USD Stablecoins! Click here to sign up now.

LMAX Digital - the market-leading solution for institutional crypto trading & custodial services - offers clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post