Today’s letter is brought to you by Cal.com!

What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in Cal.com and we use it instead of Calendly.

Cal.com is the leading open-source scheduling platform, which gives you the same superpowers of efficiency previously reserved for elite corporations & tech gurus.

Top performing teams choose Cal.com to increase business productivity, get insights on their team, and their automated workflows.

Stop wasting your time with scheduling software that doesn’t work. Use technology to make your life easier. The best part? Set up is quick, easy, and you will never go back to your boring calendar tool.

Exclusive for Pomp Letter subscribers/Pomp Podcast listeners, use code “POMP” for $500 off when you set your team up with Cal.com. Save time. Save money. Use Cal.com.

To investors,

Financial markets are showing excitement for the potential spot bitcoin ETF. The digital currency is trading up approximately 8% after the first day of 2024.

My advice is to go into the spot bitcoin ETF approval with low expectations. If things go well and bitcoin's price rises, you will be pleasantly surprised. If things don't go well and bitcoin's price goes down, you will have expected it. Life is all about closing the gap between expectations and reality.

As we head into this milestone, I wanted to do an evaluation of where we sit with the asset, the network, and the current holder base. It is important to have a baseline understanding of the fundamentals, especially since many people are predicting such a large shift in the coming months.

First, we can see that bitcoin’s price has had a strong recovery from the sub-$17,000 mark just a year ago. The appreciation of 173% felt rather quiet throughout 2023, but it is hard to ignore now.

Second, retail investors spent much of the bear market buying more bitcoin. We can see the number of unique addresses holding at least 0.01 bitcoin (~ $450) has hit a new all-time high.

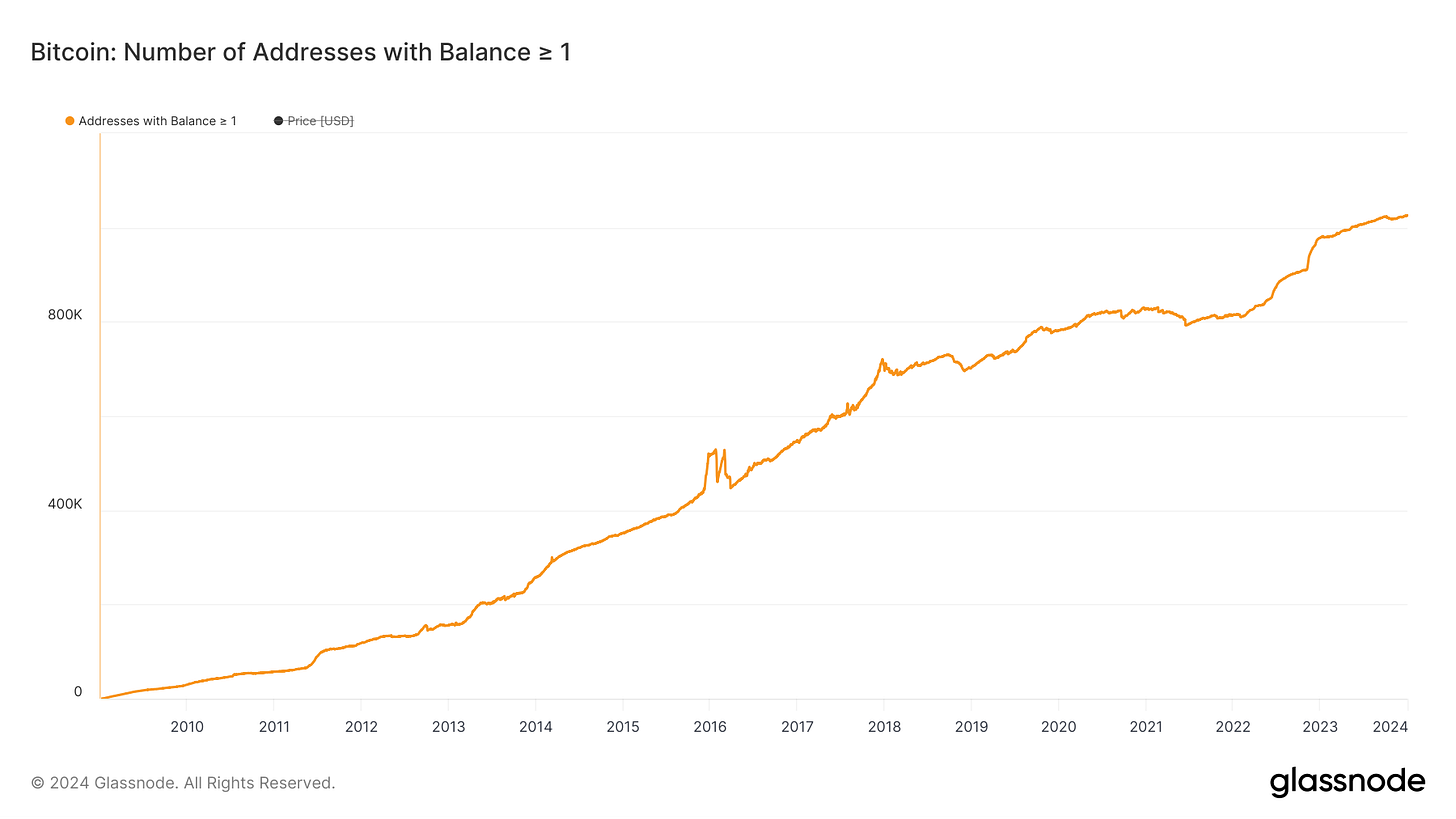

We can see that the number of unique addresses holding one full bitcoin has also hit a new all-time high as well.

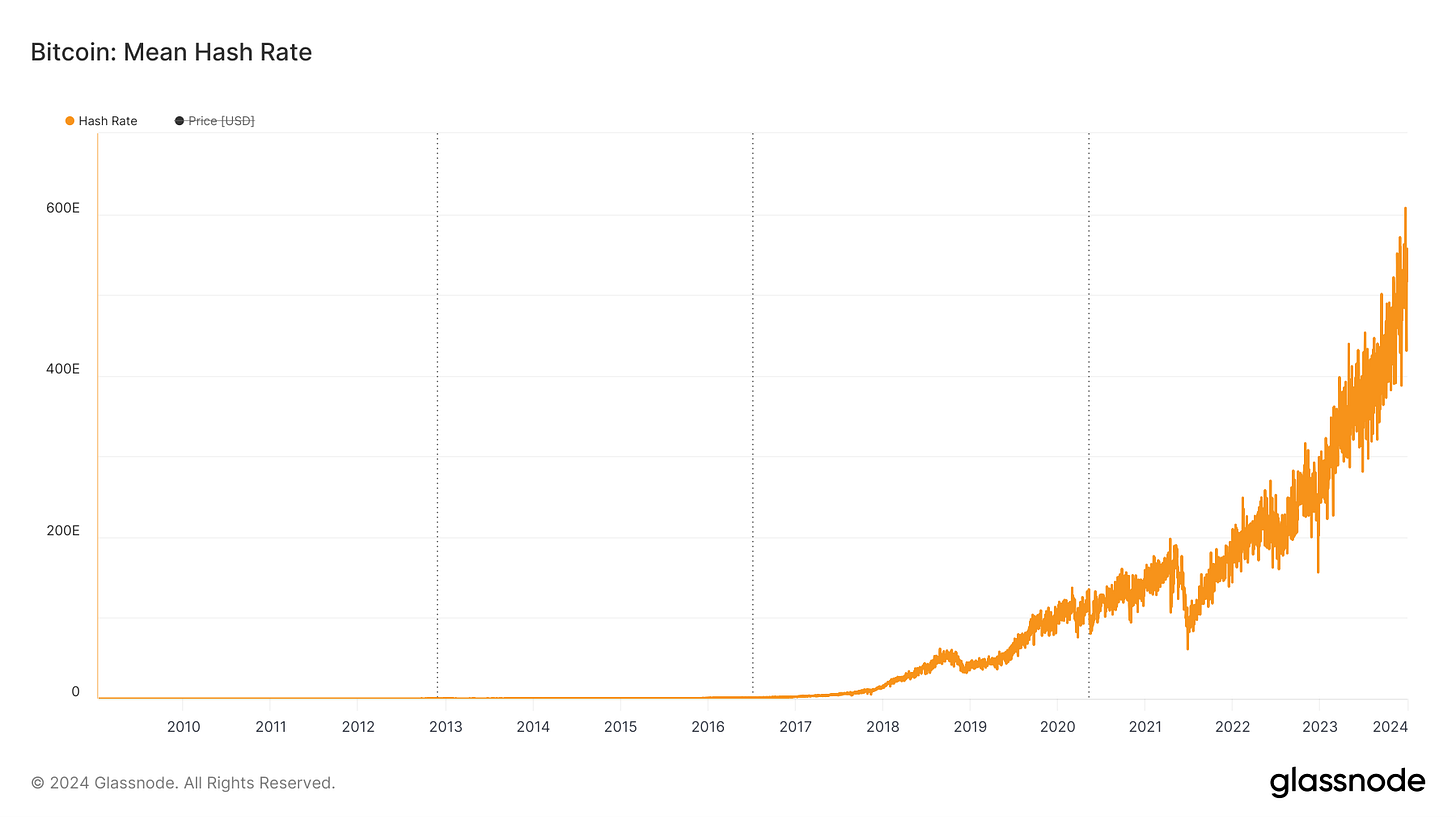

Next, we see hash rate from bitcoin miners has continued to go parabolic and is now sitting at fresh highs.

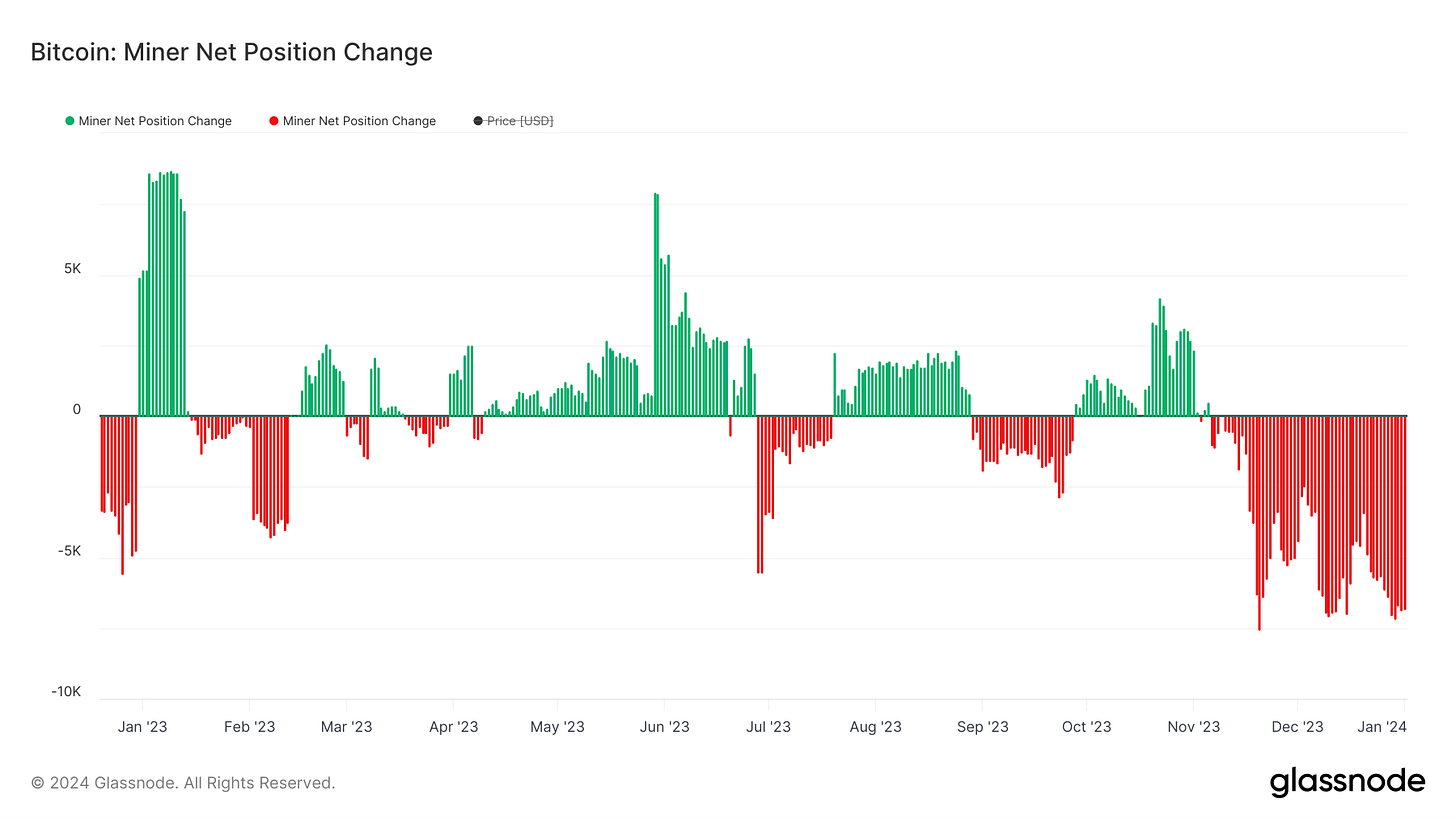

These miners are quite happy right now because they have seen multiple spikes in transaction fees throughout 2023, which can be attributed to a rise in Ordinals/Inscriptions.

As revenue has been rising, miners spent much of November and December as net sellers of the bitcoin on their balance sheet.

Exchanges were very similar. They spent most of the year as net sellers from their balance sheet too.

Speaking of exchanges, Binance remains the dominant player in the futures market even though they went through the recent legal issues.

Another interesting data point is that the number of successful transactions on the bitcoin network more than doubled in 2023 to approximately 650,000 per day.

Another positive point is that more bitcoin being moved in the last quarter of the year has been in a realized profit state. This means that people who have participated in these transactions are no longer under water.

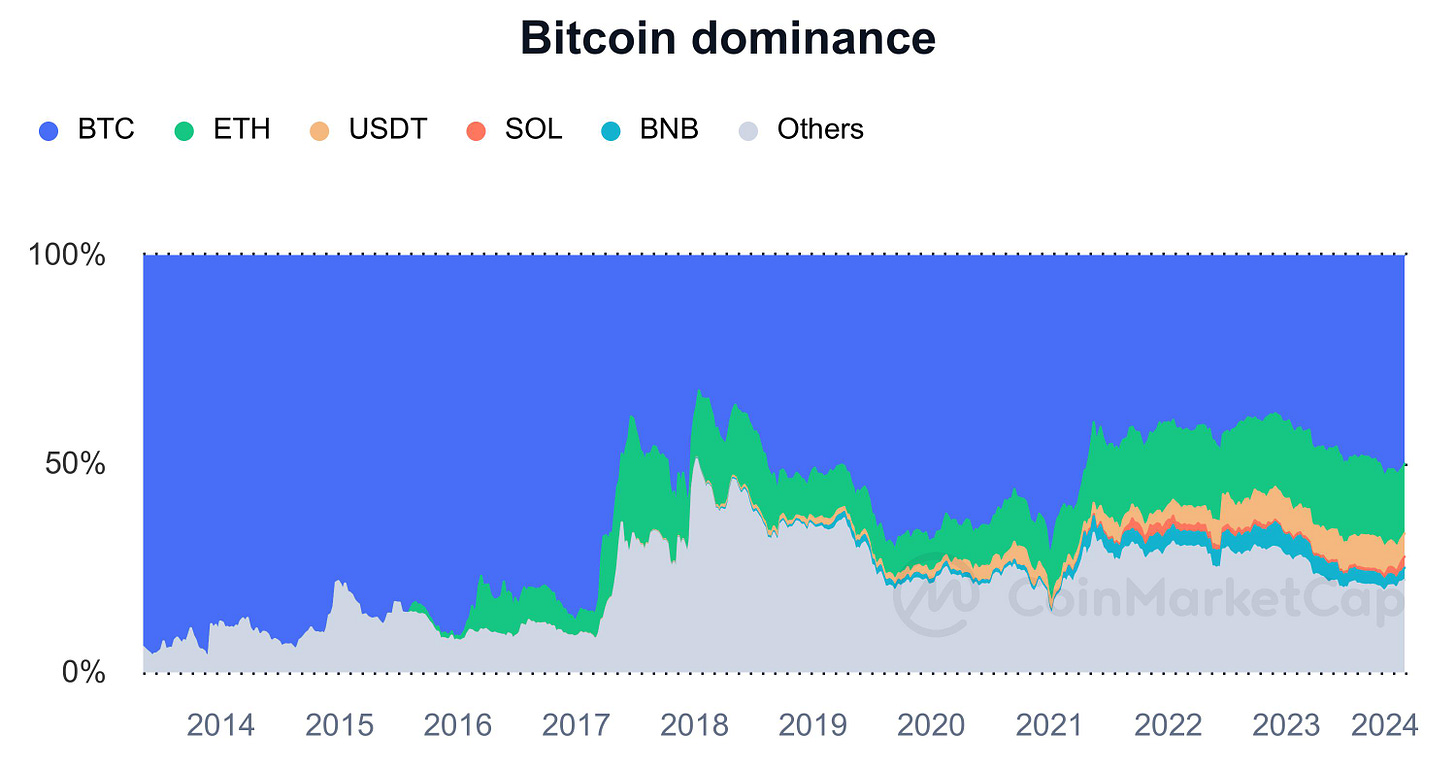

Lastly, bitcoin’s market cap dominance was over 50% until the end of Q1 2021. It had been sub-50% since, but that changed a few months ago in Q4 2023. Seeing 50%+ market dominance for the oldest asset in the space speaks to the importance of first mover advantage, superior technical structure, and the initial capture of mindshare.

There is a lot of speculation around the spot bitcoin ETF going into the next 9 days. The SEC has been feverishly working on the various applications and the consensus view in the market is that we will see an approval during this window.

What happens once the applications are approved is anyone’s guess. Remember, low expectations should rule the day. Either way though, bitcoin — both as an asset and as a network — is in a very strong position. The decentralized digital currency continues to gain adoption globally, while also lengthening it’s lead as the strongest computer network in the world.

Given the backdrop of a guaranteed monetary debasement in the fiat world, bitcoin’s best days are likely ahead of it.

Hope you all have a great start to the year. I’ll talk to you tomorrow.

-Anthony Pompliano

Joe McCann is the Founder, CEO, & CIO of Asymmetric Financial.

In this conversation, we discuss meme coins & internet culture, bitcoin vs BONK, macro environment, portfolio construction, and meaning behind “full blown depression, or dog coins to a trillion.”

Listen on iTunes: Click here

Listen on Spotify: Click here

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post