To investors,

The last 15 years of investing have been dominated by private market investors. The average venture capital fund returned ~ 17% compounded. During the same time period, QQQ compounded at 13% annually.

This 400 basis points of outperformance would make any market participant salivate.

But the analysis is not that simple. First, the average venture fund is probably holding shares in companies that haven’t been marked-to-market, so those companies are worth much less than currently stated.

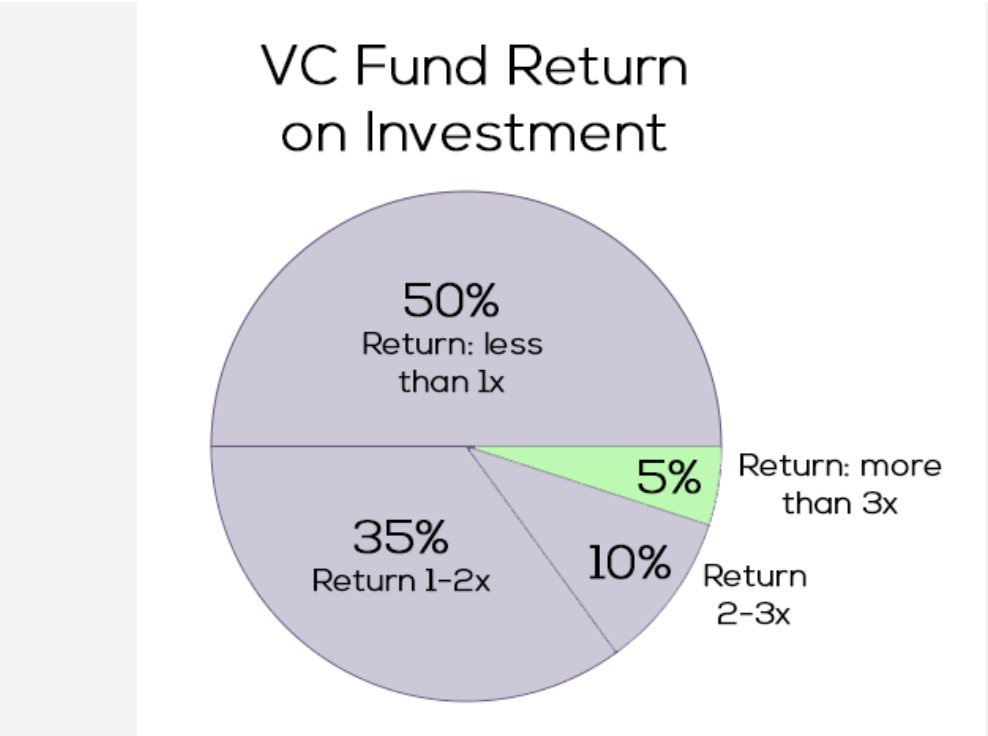

Remember, the data can be very confusing. On one hand, reports are that about 50% of venture funds fail to return their original investors’ capital.

But other reports claim that 50% of all venture funds actually outperform the stock market.

Regardless of which it is, everyone agrees that venture funds keeps investors illiquid for 8-12 years.

The story seems messier now, right? Are venture funds worth the complexity and uncertainty?

Just wait - it is only going to get more complex. There are nearly 3x more venture capital funds today compared to 15 years ago.

On top of the increase in venture funds, investors are also gaining new ways to access private market deals. The secondary market is more liquid than ever and we even have a closed-end, publicly traded fund that gives investors exposure to the most popular private companies.

These developments mean that competition is significantly increasing for venture capitalists. When competition increases, returns begin to compress.

My guess is that the average venture fund will not outperform QQQ by 400 basis points moving forward. The best VCs in the world will continue to dominate (and beat the market by a large margin), but the new competition is going to arb the outperformance away for the average fund.

Why is that important to understand?

Because I believe we are about to see a renaissance of public market investors. In a way, this is not some profound insight. Crypto has popularized publicly available, liquid financial markets. These digital assets are now collectively valued at more than $2.5 trillion.

So if you combine the popularity of crypto with the incoming competition in venture capital, you can see why the younger generation will start investing in the public stock market more often.

You have already seen public market hedge funds crossing over to invest in private markets, but now I am starting to see private market investors crossing over to invest in public markets. The largest example is Sequoia, but there are many others who have not explicitly stated their strategy expansion.

Critics of the “public markets will become more popular” view will point to the decline in number of US public companies. According to Google AI, “the number of publicly traded companies in the United States has been declining since the 1990s. In 1996, the number of companies peaked at around 8,090, but by 2019 it had dropped to 4,266. As of April 2024, the number was around 4,300.”

Proponents of the view will simply point to the current trend of public market infrastructure blending with crypto assets, which is highlighted by the ETFs, mainstream exchanges evaluating crypto, and legacy finance investment firms allocating billions of dollars to the new asset class.

I will take it one step further though — the best investors of the new generation won’t simply invest in crypto companies in the public market, but rather they will seek out the best investment opportunities regardless of the industry.

Venture capital will always have a place in an investors’ portfolio, especially if you invest with the best VCs. But public markets are going to make a roaring comeback in popularity over the coming years.

I see it in my own personal investing. I see it in my friends’ investing. And I can’t find a reason why the trends will slow down. Thankfully, more investors participating in the public market is ultimately a positive development for financial markets.

Now we need the amazing private companies to go public earlier. That won’t happen as long as the private market is flooded with cheap capital though.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Matthew Sigel is the Head of Digital Assets Research and Portfolio Manager at VanEck.

In this conversation, we talk about bitcoin, ethereum, miners, global adoption, regulation, conversations VanEck is having with their clients, where opportunities exist, and how crypto and politics are intersecting with each other.

Listen on iTunes: Click here

Listen on Spotify: Click here

VanEck’s Matthew Sigel Explains What The $100 Billion Asset Manager Is Doing In Crypto

Podcast Sponsors

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

ResiClub - Your data-driven gateway to the US housing market.

Opening Bell Daily - Get the 5-minute newsletter that Wall Street reads.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post