Today’s letter is brought to you by Sidebar!

Ready to accelerate your career? As we all know, navigating a big career transition is hard to do. It’s one thing to set a lofty goal, and it’s another thing to have the support system for yourself to follow through.

Sidebar is a private, highly vetted leadership program for those who want to do more, do it better, and do it faster.

Sidebar’s approach to helping members level up their careers is focused around small peer groups, a tech-enabled platform, and an expert-led curriculum. Members say it’s like having their own Personal Board of Directors.

93% of members say that Sidebar has made a significant difference in their career trajectory.

"Providing and receiving support from others who play a similar role to you is one of the best ways to grow your capabilities and succeed." - Vice President, Roku

“The facilitation has been great. I love the timer bar, the way the conversation is structured, the commitment and accountability.” - Vice President, Clip

“I've been impressed by Sidebar’s technology platform. The real time agenda tracker at the top of our weekly meetings really helps the group stay on track.” - Senior Director, Microsoft

Nothing will get you further in your career than learning from your peers - it’s a true competitive advantage. Join the growing waitlist of top senior leaders, and apply to become a founding member.

To investors,

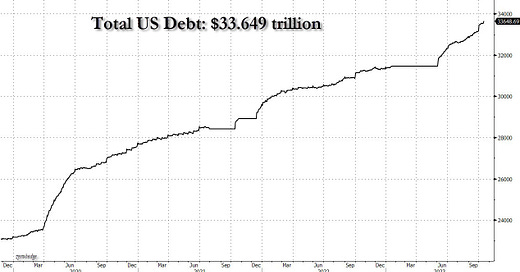

The national debt has increased by more than $600 billion in the last month. That is $20 billion every day or $833 million every hour. We are now at a total of $33.65 trillion. It is hard to wrap our heads around how insane this pace has become.

Unfortunately, there is no end in sight.

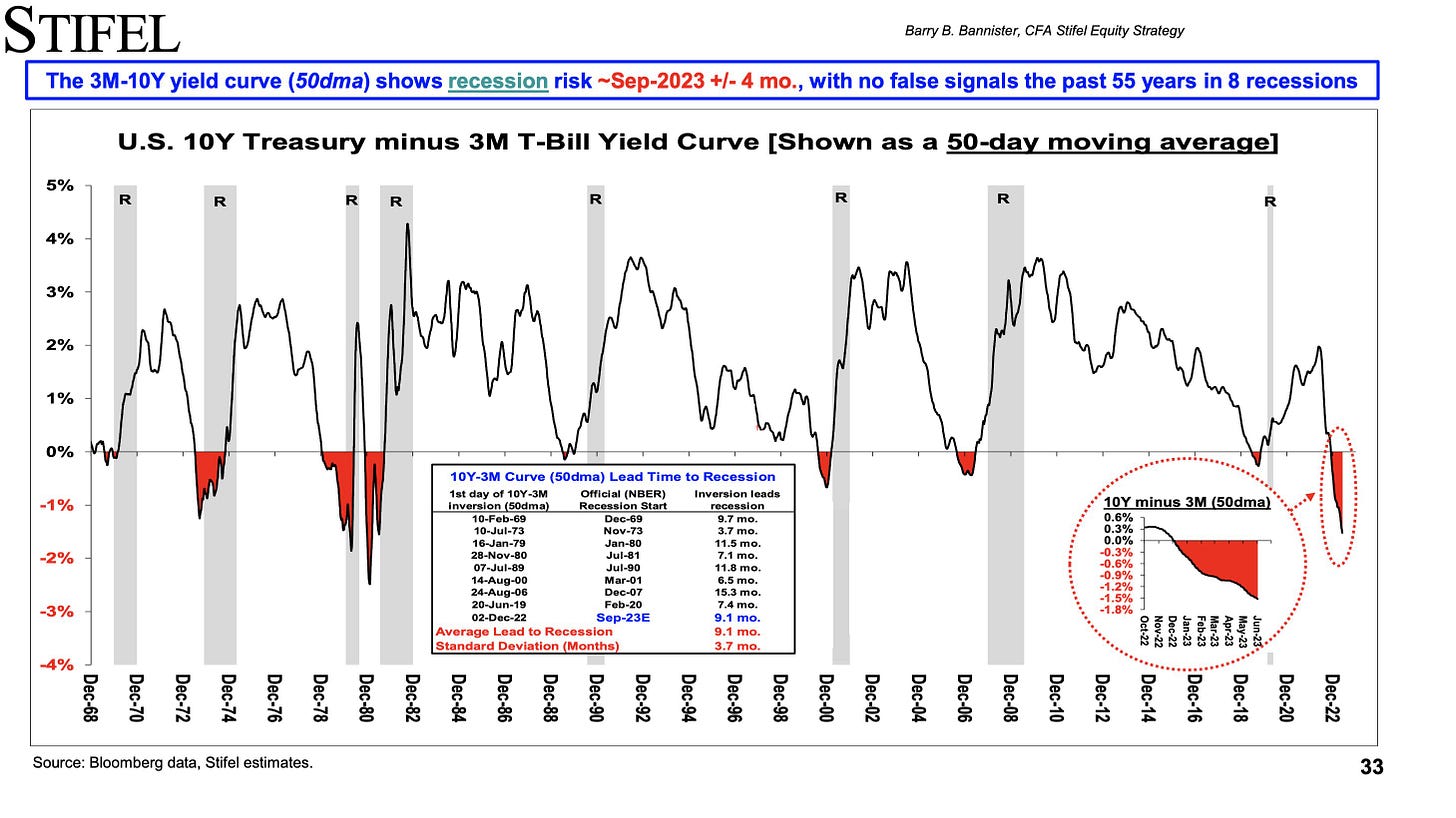

At the same time as the debt is exploding higher, the US economy is showing signs of an incoming recession. Take the inverted yield curve as an example — short-term Treasury yields are higher than long-term Treasury yields.

Over the last 55 years, every inversion between the 3-month and 10-year yield curve was followed by a recession. The shortest lag between inversion and the recession was 3 months and the longest lag was 15 months.

But an economic indicator like yield curve inversion seems to be at odds with the public narrative that a soft landing will be possible, right? Well, Bloomberg recently did a study that showed a rapid increase in articles talking about a soft landing was usually followed by a recession.

You can see the large spike in recent articles mentioning a soft landing would suggest that a recession is incoming. Humans are optimistic and like to think that bad things are not on the horizon, but this study shows that we should be fearful when others are not.

Anna Wong and Tom Orlik have also pointed out that American household’s savings is beginning to run out. This savings had drastically increased during the quantitative easing period related to the pandemic, but households can only hold on for so long before the money starts to run dry.

To recap, we have yield curves inverting, a spike in soft landing articles, and households running out of money — what is the Fed going to do?

The answer is easy: If we enter a recession, the Fed will be forced to cut interest rates and print money.

Herein lies the problem. The national debt has been growing at a rapid pace, so any additional money printing would only compound the problem. Without this acceleration in debt accumulation, we are on pace to hit $41 trillion by simply extrapolating the last month’s growth rate for the next 12 months.

The number gets even more concerning if the Fed is forced to combat a recession in the US economy.

As if that situation is not difficult enough to navigate, the Fed is not operating in a vacuum of economic data. The United States is also providing monetary support to two international conflicts in Ukraine and Israel to the tune of hundreds of billions of dollars. Each of those wars does not appear to have a clear objective or end date, so we run the risk of new forever wars putting a financial strain on an already bleak US financial health outlook.

Lastly, the United States is going to be faced with hard decisions domestically as well. The southern border has become porous and there are reports that hundreds of thousands of migrants are crossing the border each month. These individuals, who are mostly seeking a better life provided by the democratic and capitalist society of America, are arriving in cities that are ill-equipped to properly support them, which has led to a series of calls from local and state leaders for more federal aid.

This obviously adds to the financial strain on the national financial situation and accelerates the national debt issue.

There are many people who will argue that the national debt does not matter. We are the controllers of the global reserve currency and we can print money whenever we want. My response is always the same, “if the national debt doesn’t matter, then we should print $500 trillion tomorrow and solve all of our problems!” If you think we could do that and there would be no problems, I am very worried for you.

The national debt does matter. We will eventually pay for our sins if we do not get this situation under control. The US dollar can’t hold its value while the debt continues to accelerate at such an incredible pace. At some point, the US may face the nearly impossible decision—save our allies or save our country?

I don’t have all the answers. This situation is very complex. I don’t envy the position of our leaders. There is no known solution on the monetary policy side that can address each problem we are facing, but monetary policy discipline would be a good step in the right direction. The concept of a balanced budget feels impossible in the United States given the current situation, but we had one less than 25 years ago—there is no reason why the right leadership team could not bring us back to that position of strength.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Elbridge Colby is the co-founder and principal of the Marathon Initiative, a policy initiative focused on developing strategies to prepare the United States for an era of sustained great power competition. He is the author of “The Strategy of Denial: American Defense in an Age of Great Power Conflict.”

In this conversation, we talk about the threat from China, Ukraine & Russia, what is happening between Hamas & Israel, how this all feeds into the economic strength of America, how private sector can make an impact, and what America can do right now to put us in a better position.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

How America Can Prepare For Conflict With China

Podcast Sponsors

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post