To investors,

This morning CPI was reported right in-line with market expectations at 2.9% year-over-year. The big surprise came from core CPI, which was estimated to be at 3.3% and instead came in at 3.2%.

Adam Kobeissi and his team pointed out that immediately S&P 500 futures surge over +85 points when the report hit.

This response is interesting because it highlights the complexity of the situation we find ourselves in. On one hand, the market is looking for any sign of relief from the higher inflation levels. Optimism shows up for a simple 0.1% beat on expectations.

On the other hand, CPI is nearly 50% higher than the Fed’s target and it has been increasing in recent months. Add in the fact that critics believe Trump’s policies could be inflationary and you can clearly see one future scenario involving a return of higher inflation.

Asset prices aren’t waiting around to see what happens though. On top of the S&P 500 futures surging, bitcoin also jumped to nearly $99,000 after the CPI report.

Plenty of people continue to yell and scream about a potential market crash right around the corner, but those voices are becoming fewer in number. Even Blackrock’s Larry Fink came out this morning to say the US economy is in very good shape.

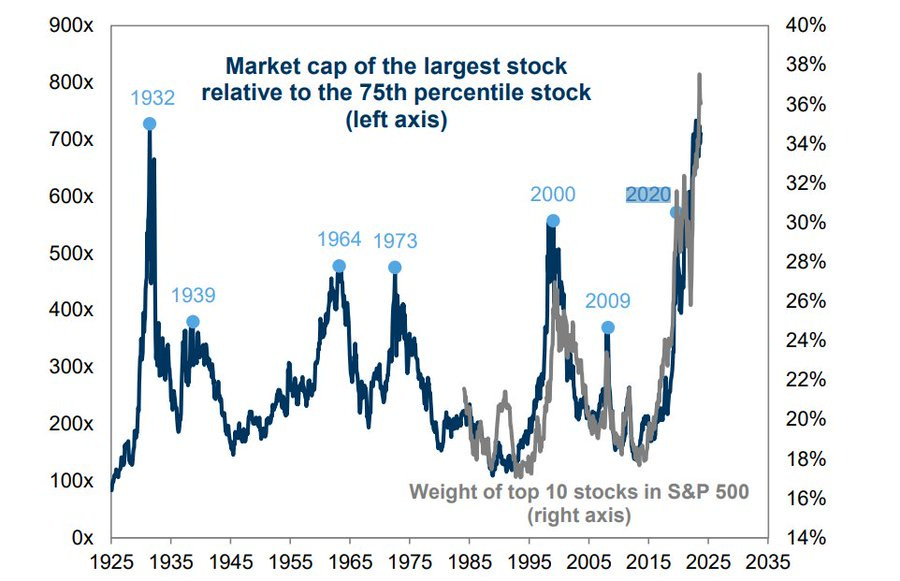

Just because the economy is in good shape doesn’t mean that risk is gone. Goldman Sachs sent out this chart. Mike Zaccardi highlights “the equity market is currently near its most concentrated level in 100 years.”

And Heritage’s EJ Antoni tweeted:

“This is the worst start to a fiscal year EVER:

Spending is up 10.9%

Receipts are down 2.2%

FYTD deficit up 39.4% at $711 billion

They're handing Trump a ticking time bomb...”

So the situation is not as straightforward as everyone wants to think. The economy is strong, but the first weeks of 2025 are showing signs of problems ahead. Trump is ready to come into office with his economic policies and people are excited — the big question remains though: What will these policies do to inflation that seems to be stuck around 3%?

The answer to that question is going to determine much of the market’s future in coming months.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: I am hosting Bitcoin Investor Week in NYC from February 24-28th. This will be the largest finance conference of the year focused on bitcoin. Speakers include Mike Novogratz, Cathie Wood, Jan van Eck, Anthony Scaramucci, Jack Mallers, and many others.

You can purchase tickets here: Get ticket for Bitcoin Investor Week

Anthony & Polina Pompliano Discuss Bitcoin, LA Fires, Joe Biden and Mark Zuckerberg

Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss Jamie Dimon’s recent comments about bitcoin, why global liquidity matters so much, what is going on with the LA fires, who is responsible, President Biden’s comments on the economy, and Mark Zuckerberg’s recent changes at META.

Enjoy!

Podcast Sponsors

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $500 in rewards.

Ledger - Ledger secures 20% of the world’s digital assets. Their latest devices, Ledger Stax and Ledger Flex, feature secure touchscreens for safer, easier crypto management.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post