This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 75,000 other investors today.

To investors,

One of the recurring themes in this letter over the last few weeks has been a “K-shaped" recovery. The idea is that coming out of the economic shock earlier this year, the wealthiest Americans were recovering quickly, while those without significant assets or income were continuing to struggle.

Putting the debate over a specific letter in the alphabet aside, this idea of two Americas and their polar opposite responses to the economic shock made sense. We just didn’t have material data to unpack around the thesis.

Thankfully, Harvard economist Raj Chetty has been working diligently to solve that problem. He and his team released a new tool in the last few months that highlights the economic situation on a county, city, and neighborhood level across the United States. Bloomberg wrote a great article about Chetty and the work he has been doing, which you can read here.

I played around with the tool for awhile this morning and was impressed with the insights that it provided. First, it is obvious that high-wage worker employment has basically recovered to pre-COVID levels, but low-wage workers are still suffering significantly.

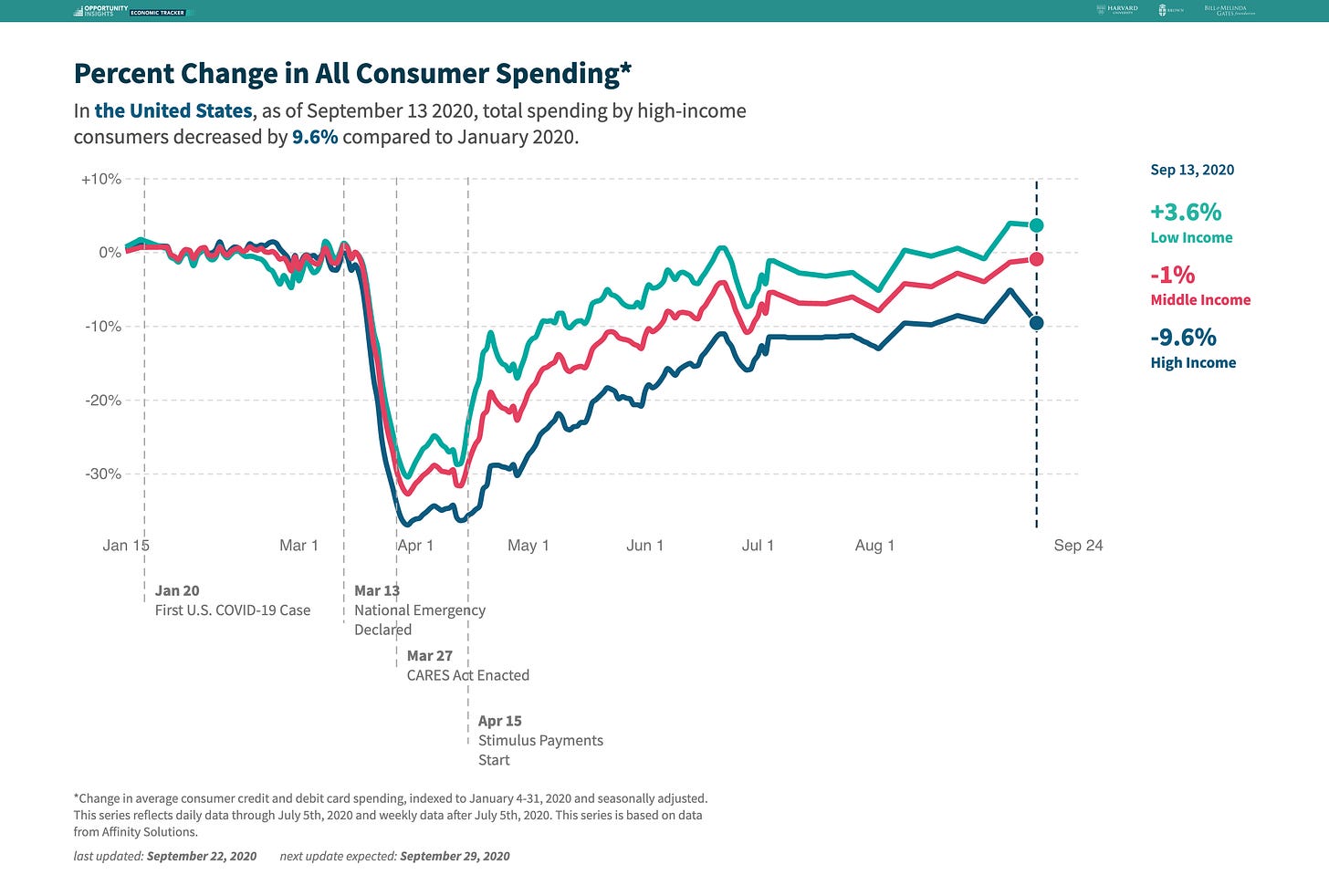

As of September 2020, total consumer spending in the United States is only down 3.8% compared to January of this year.

But when you break consumer spending down by socioeconomic class, you realize that low income citizens are spending more today than they were in January and high income citizens are spending almost 10% less.

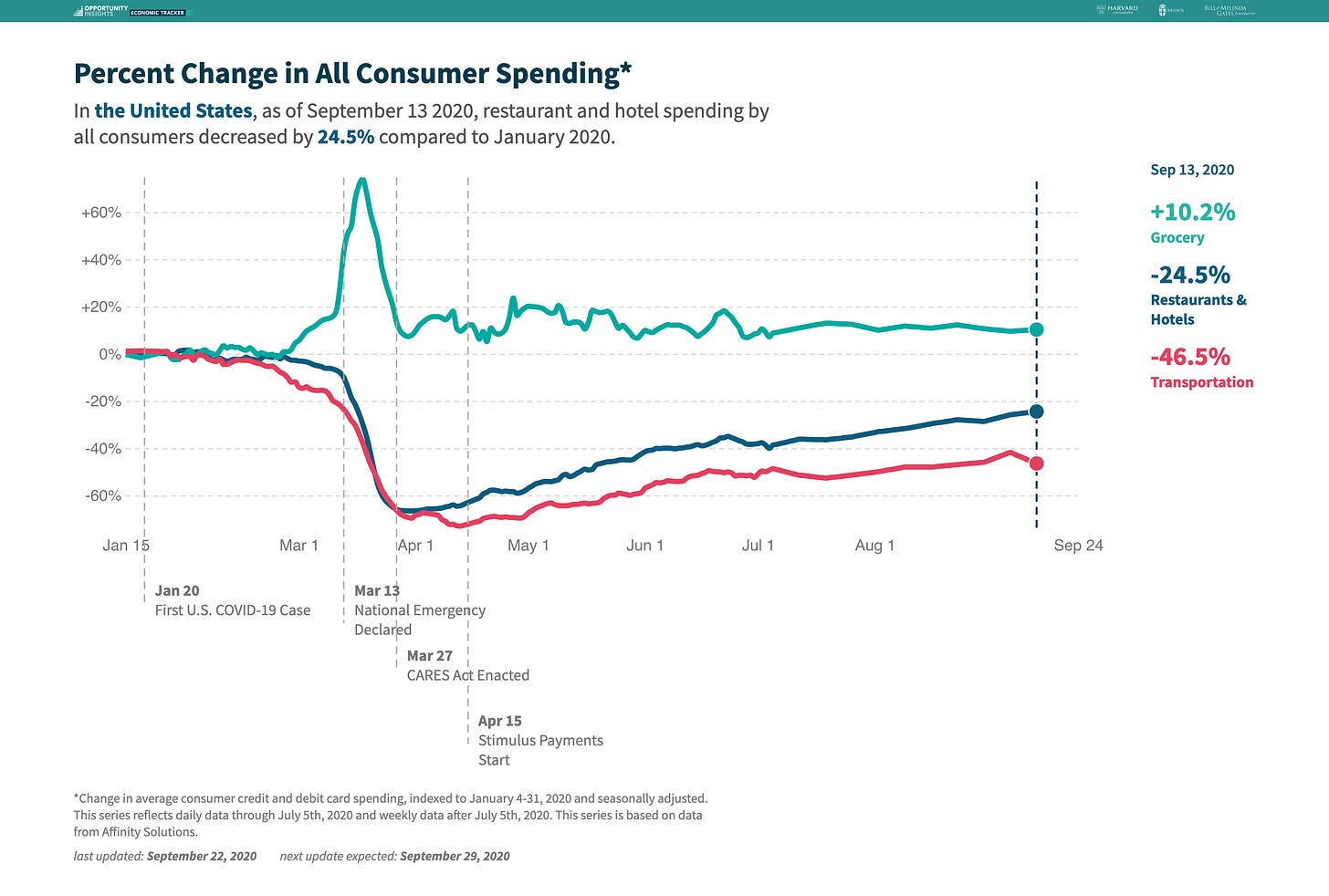

So what industries are winning and losing during this volatility of consumer spending? Across all socioeconomic classes, grocery spending is up 10% year-to-date, and restaurant/hotels (-24%) and transportation (-46%) are down significantly.

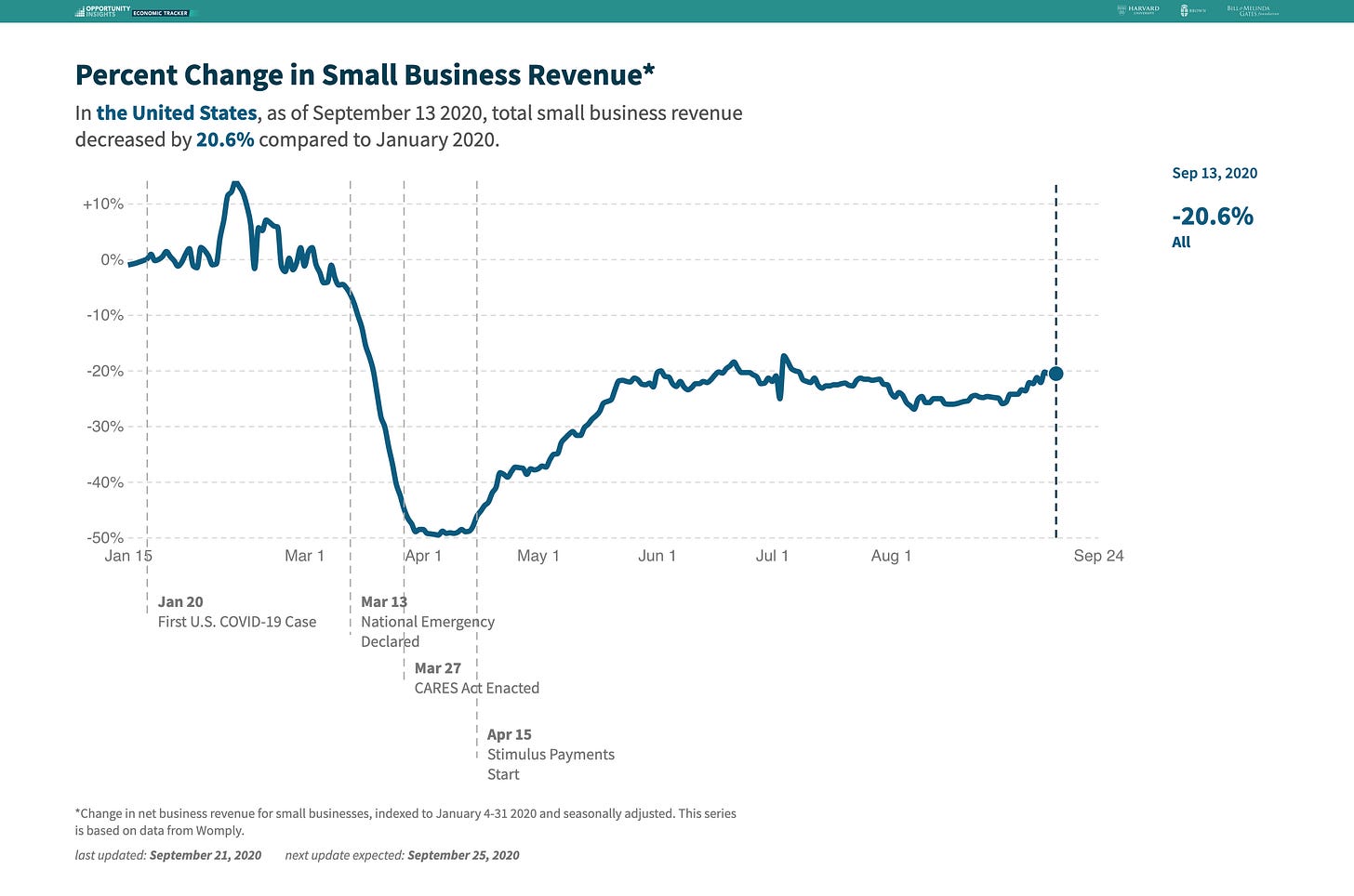

Chetty’s team also tracks small business revenue. As you would imagine, the national small business revenue across industries is down more than 20% since January.

Leisure and hospitality are down almost 50% nationally, while other industries are hovering around 10% decreases year-to-date.

Some of the drop in revenue may be attributed to the percentage of small businesses that are open. Unsurprisingly, more than 20% of small businesses remain closed compared to January of this year.

And Leisure and Hospitality businesses are more than twice as likely to be closed at the moment compared to other industries.

If so many businesses are still closed, you would expect open job roles to be down as well. While this is true, the 6% decrease in job postings compared to January 2020 was a much lower drawdown than I would have anticipated.

What is interesting is that the job postings that require the highest amount of education are down more than job postings that require minimal education.

Lastly, the student progress in math is actually up nationally since January 2020.

But when broken out by socioeconomic class, we see a very different story.

Raj Chetty and his team are finally presenting data that supports the idea of a “K-shaped” recovery. If you’re wealthy or have high income, the recession is essentially over for you. If you are less fortunate, you are still struggling to navigate the economic carnage.

Hope each of you has a great day.

-Pomp

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 75,000 other investors today.

THE RUNDOWN:

Coinbase Hires Executives From Venmo, Adobe and Google: Cryptocurrency exchange and wallet platform Coinbase announced it has hired Shilpa Dhar, Ravi Byakod and Frank Yoo for VP roles on its product, engineering, and design & research teams. In an announcement published on its website, Coinbase said it was also creating a new “Platforms” team across its product and engineering organisations and that Dhar and Byakod would head the new team. Read more.

Startup Behind Siacoin Storage Platform Raises $3M, Rebrands as Skynet Labs: The startup formerly known as Nebulous has raised a $3 million funding round led by Paradigm with participation from Bain Capital Ventures, Bessemer Venture Partners, A.Capital, Collaborative Fund, Dragonfly Capital Partners, Hack VC, INBlockchain, First Star Ventures and others. Read more.

Economist Stephen Roach Issues New Dollar Crash Warning: Economist Stephen Roach warns next year will be brutal for the dollar. Not only does he see growing odds of a double-dip recession, the Yale University senior fellow believes his “seemingly crazed idea” that the dollar would crash shouldn’t be so crazy anymore. “We’ve got data that’s confirmed both the saving and current account dynamic in a much more dramatic fashion than even I was looking for,” Roach said. Read more.

JPMorgan to Pay Almost $1 Billion Fine to Resolve US Investigation Into Trading Practices: JPMorgan Chase is close to paying almost $1 billion to resolve government investigations into the alleged manipulation of metal and Treasurys markets, according to a person with knowledge of the matter. A settlement between New York-based JPMorgan and several U.S. agencies could come as soon as this week, according to Bloomberg, which first reported news of the fine. The deal would resolve probes from the Justice Department, the Commodity Futures Trading Commission and the Securities and Exchange Commission. Read more.

Peterson Ventures Just Closed a $65 Million Fund: Peterson Ventures, a 12-year-old, Salt Lake City, Utah-based seed-stage fund, has long operated fairly quietly, but many of its bets have become known brands in the respective worlds of consumer and enterprise software investing. Among these is the shoe company Allbirds; the men’s clothing company Bonobos (acquired a few years ago by Walmart); and Lucid Software, which closed its newest, $52 million round back in April. Read more.

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Athletic Brewing is re-imagining beer for the modern adult. They love beer. But they also love being healthy, active and at their best. The non-alcoholic beers are fully flavored, clean ingredient, and a fraction of the calories of full strength beer - they fit in any occasion. Check out www.athleticbrewing.com for more details and free shipping nationwide.

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today.

Coinlist — Smart investors know being early is critical to success in crypto. CoinList is where early adopters invest in, earn, and trade the best new crypto assets before they list on other exchanges. Sign up via coinlist.co/pomp and earn $10 in BTC after you trade $100.

If you enjoy reading “The Pomp Letter,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post