To investors,

The $20.7 trillion commercial real estate market is in big trouble. A few weeks ago Treasury Secretary Janet Yellen publicly stated “I do think that there will be issues with respect to commercial real estate.” Famed entrepreneur Elon Musk tweeted “Commercial real estate is melting down fast. Home values next.”

Yellen and Musk don’t agree on much when it comes to economics, so it is important to pay attention when they are both sounding the alarm on the same issue.

The first thing to understand is that demand for large commercial real estate buildings, such as office towers in big cities, has been rapidly declining as work from home trends turn into the market standard. According to a recent National Bureau of Economic Research Working Paper, attendance in the 10 largest business districts in the US is still below 50% of its pre-COVID level, as white-collar employees spend an estimated 28% of their workdays at home.

The percentage of full days working from home was ~5% before the pandemic, so the recent trend has caused a more than 5x increase in the baseline.

The national average vacancy rate is 19%, including Los Angeles at 26%, NYC at 23%, and even Miami—which has been a winner of the pandemic migration trend—at 16% vacancies.

These are staggering numbers. As demand has dropped, equity and debt investors have been trying to identify the current value of these properties. We have seen a building in San Francisco, which was previously valued at ~$300 million, put on the market for an 80% discount.

This was followed by reports last week that two office buildings in Midtown Manhattan sold for almost 50% less than asking price.

As you can see in this data from the IMF, commercial real estate prices rarely go down, so it can quickly become catastrophic if the market does not correct and stabilize.

The good news is that the blended delinquency rate on all commercial real estate debt is still relatively low compared to the historical trend.

It is true that the overall US CMBS delinquency rate jumped to 3.62% up 53 basis points for the month of May, but the all-time high on this basis was 10.34% registered in July 2012. The COVID-19 high was 10.32% in June 2020.

The problem in the debt market is not what has happened already. It is the tsunami of debt refinancing that will need to happen over the second half of 2023. Megan Henney writes:

“About $1.5 trillion in commercial mortgage debt is due by the end of 2025, but steeper borrowing costs, coupled with tighter credit conditions and a decline in property values brought on by remote work, have increased the risk of default.

Fitch Ratings already estimated that 35% — or $5.8 billion — of pooled securities commercial mortgages coming due between April and December 2023 will not be able to be refinanced.”

This is problematic because interest rates have more than doubled in the last two years.

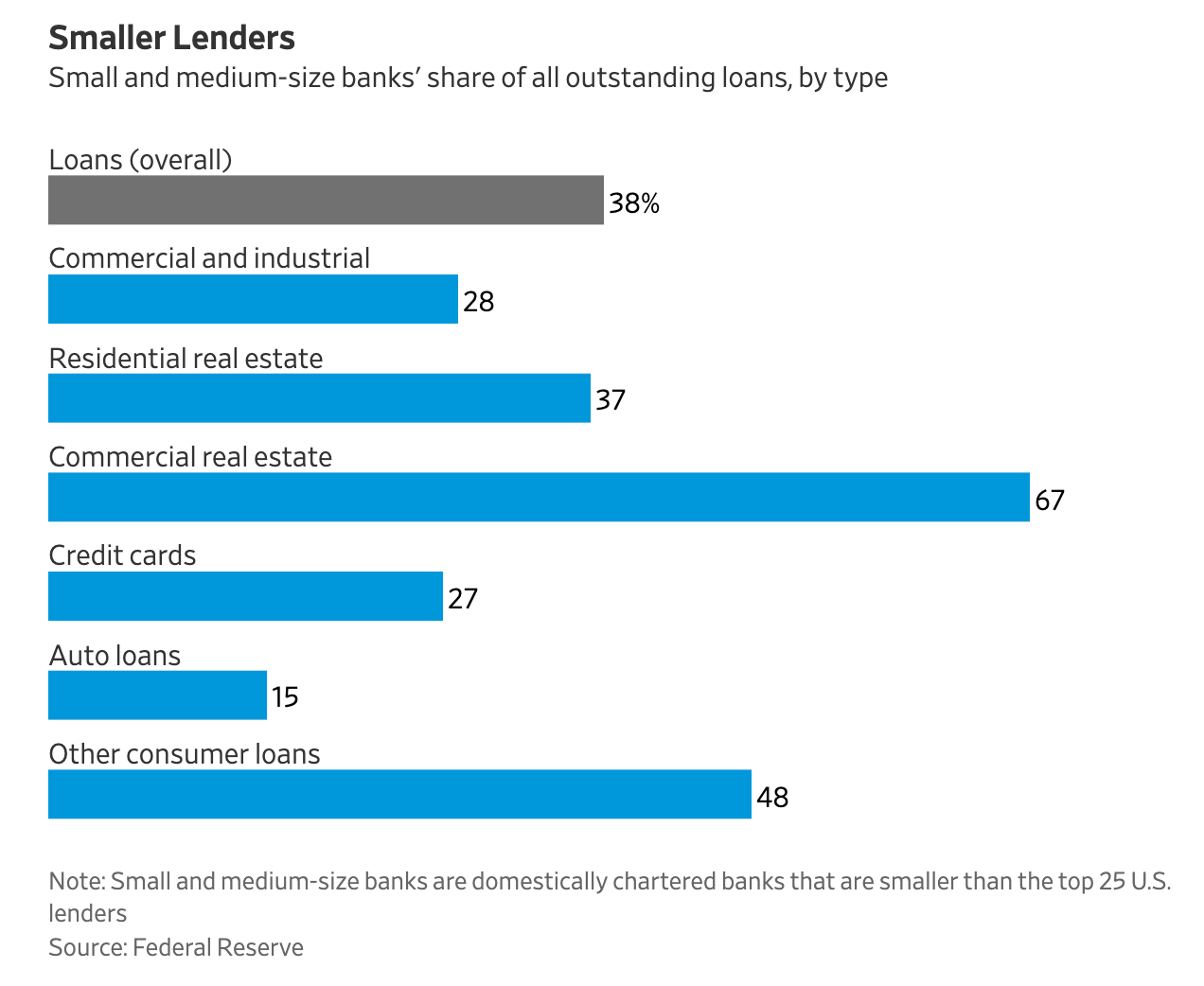

To make matters more complicated, 67% of commercial real estate loans are issued by small and mid-sized banks. These are the same banks that have felt the brunt of the recent banking crisis which was induced by the Fed’s 500 basis point hike in interest rates at the fastest pace in history.

Although most banks did not fall victim to the market in the way that SVB, Signature, and Silvergate did, there is still immense pressure on these institutions in the current environment. Add in the idea of the Fed conducting further rate hikes later this year and the doomsday scenario becomes clearer.

As John Maynard Keynes observed, when you owe your banker $1,000, you are at his mercy, but when you owe him $1 million, “the position is reversed.”

But there is a second-order effect that we need to call out. There is a very real chance that municipal government finances will take a hit as well. As Dror Poleg explains for The Atlantic:

“Municipal governments have even more to worry about. Property taxes underpin city budgets. In New York City, such taxes generate approximately 40 percent of revenue. Commercial property—mostly offices—contributes about 40 percent of these taxes, or 16 percent of the city’s total tax revenue.

NYU professor named Arpit Gupta and others estimate a 6.5 percent “fiscal hole” in the city’s budget due to declining office and retail valuations. Such a hole “would need to be plugged by raising tax rates or cutting government spending.”

The potential solutions to this problem are few and far between. One idea is that private equity investors will step in to gobble up commercial real estate assets. This is probably true, but it will only happen at significantly depressed prices. There is significant economic pain between where we are today and where prices would have to trade in order to get transaction volume growing again.

Another idea is that these commercial buildings could be converted into residential buildings. Theoretically this makes sense, yet there are a number of complexities that developers will have to navigate to make it a reality. Zoning and permitting is the obvious one. There are other more technical issues like plumbing infrastructure in the building having a low probability of being adapted to the residential use case, so there would be significant construction needed to retrofit these assets.

There are also a number of people who believe the commercial real estate crisis could be averted. Marco Santarelli uses three examples of risk mitigators in the market:

Diversification of Commercial Real Estate: While the office sector is facing significant challenges, other segments of commercial real estate, such as industrial, retail, and hotels, are performing relatively well. The diversity of assets in the commercial real estate market provides a buffer against potential risks, as the struggles in one segment can be offset by the strength of others.

Manageable Refinancing: Despite the refinancing cliff, a considerable portion of commercial real estate debt appears capable of being refinanced without major issues. Banks have maintained strict lending standards, and most debt in the market generates sufficient income to meet these standards. This indicates a certain level of stability and preparedness in the industry.

Strong Credit Performance: Banks have reported excellent credit performance in commercial real estate lending, with low delinquency rates and minimal losses. This suggests that lenders have been cautious in their underwriting practices and have managed risk effectively. The overall health of the commercial real estate market's credit performance indicates a level of resilience in the face of potential challenges.

It is unclear how bad the commercial real estate market will get. There is significant risk here, not only for investors but also local governments, so I anticipate this topic will gain coverage through the end of the year. The Federal Reserve and the Treasury are supposedly watching it closely. Various banks will have to navigate the obstacles ahead or risk going under.

And none of this analysis has even touched on the knock-on effect of the commercial real estate stress to residential real estate. If we enter a recession in H2 2023, it may be the most telegraphed recession of all time. That doesn’t mean that the economic pain and destruction will be avoided though.

Hope you all have a great start to your week. I’ll talk to you all tomorrow.

-Pomp

Get Better Crypto Data: Do you want faster, easier crypto data? Sign up for Velo Data, a new product that we have been working on to solve this problem: velowaitlist.com 🚨

Eric Balchunas & James Seyffart are two ETF experts at Bloomberg.

In this conversation, we break down BlackRock's announcement that they are filing for a publicly traded bitcoin trust, that essentially will give investors all of the benefits and exposure to a spot bitcoin ETF. Eric & James explain what the difference between this fund vs Grayscale's fund, potential market implications, how the regulatory environment could change, and predictions on if it will get approved & how much capital will flow into this fund if approved.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Bloomberg’s ETF experts break down BlackRock’s Bitcoin Filing

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post