To investors,

Chamath Palihapitiya is executing better than anyone we have seen in the public markets in a long time. He has successfully taken an old financing mechanism, the SPAC, and popularized it in a way that unleashed billions of dollars of liquidity into the market. His first deal was to bring Virgin Galactic public, which was followed by the $4.8 billion deal for OpenDoor.

This morning Chamath unveiled the deal for his third SPAC — Clover Health. The Medicare insurance company will be valued at $3.7 billion and nearly $1.2 billion in cash proceeds. There will be $400 million PIPE transaction done by Chamath and additional investors as part of the deal as well.

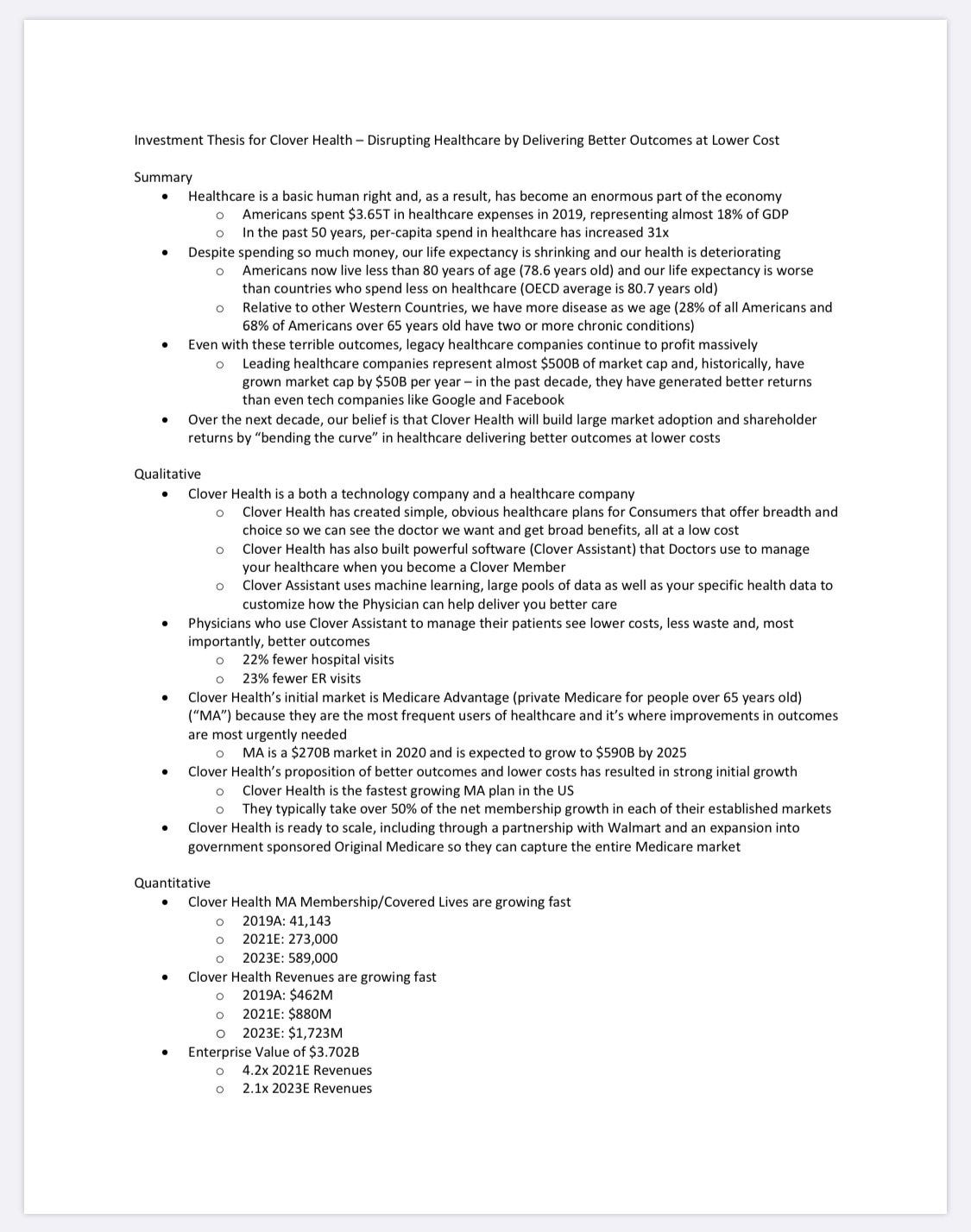

Here is the one page summary of the deal that Chamath tweeted out this morning:

The legacy media will do a good job covering what is happening here, so I want to talk about the why, along with a few trends that are starting to emerge. First, let’s start with healthcare investing in general. The quick summary is that we have seen very little innovation and large outcomes in US-based healthcare companies, which explains why American healthcare is worse than many other places around the world.

Josh Wolfe highlighted the lack of innovation and large outcomes yesterday in his tweet storm announcing Lux Capital’s new Health + Tech initiative:

“Today' medtech industry hasn't kept pace with the rate of innovation + value creation of TECH companies. VC-backed medtech has produced only a HANDFUL of innovative companies with large cap valuations since the turn of this century...There are incredible success stories — Insulet, Livongo, 10x Genomics, NovoCure, Guardant, Penumbra, and iRhythm, to name a few — but only ONE of the companies sits above $15 billion in market value....

To find larger success stories we have to look back to Intuitive Surgical (now $81 billion in market cap), which was founded in... 1995! Another huge success founded by Lux's late partner Larry Bock––last century––Illumina–– in 1998 is now over $45 billion in value. BUT...

Beyond that––slim pickings. In CONTRAST over the same time TECH created trillions of dollars in shareholder wealth from a blank canvas, propelling once humble start-ups to the upper echelon of the S&P 500: AMZN, FB, GOOG, Salesforce, Paypal, Netflix, Broadcom, ServiceNow…The list of multi-billion public TECH founded since 1995 is in the hundreds So too biotech––from 1976 creation of Genentech (+ Amgen in 1980) scores of public co's valued in billions — Gilead, Vertex, Biogen, Regeneron, Alexion, Incyte, BioMarin, Moderna... Medtech? BUBKIS.

Current crop of public US medtech — Abbott , Baxter , Becton Dickinson, Boston Scientific, J&J, Medtronic, Stryker, Zimmer — have an average founding date of... 1924. Their age creates one significant disadvantage––REALLY dated business models.

WHY? medtech VC for too long saw success in tuck-in M&A fetching relatively low price tags in the low-to-mid hundreds of millions. The result? Low ambitions + consolidation in the industry around a few REALLY old centenarian incumbents.”

This lack of innovation and ambition for large outcomes will have to change to drive significant improvements in American healthcare. It appears that investors like Lux Capital and Social Capital are both ready to help spearhead that change. They’re quite literally putting their money where their mouths are.

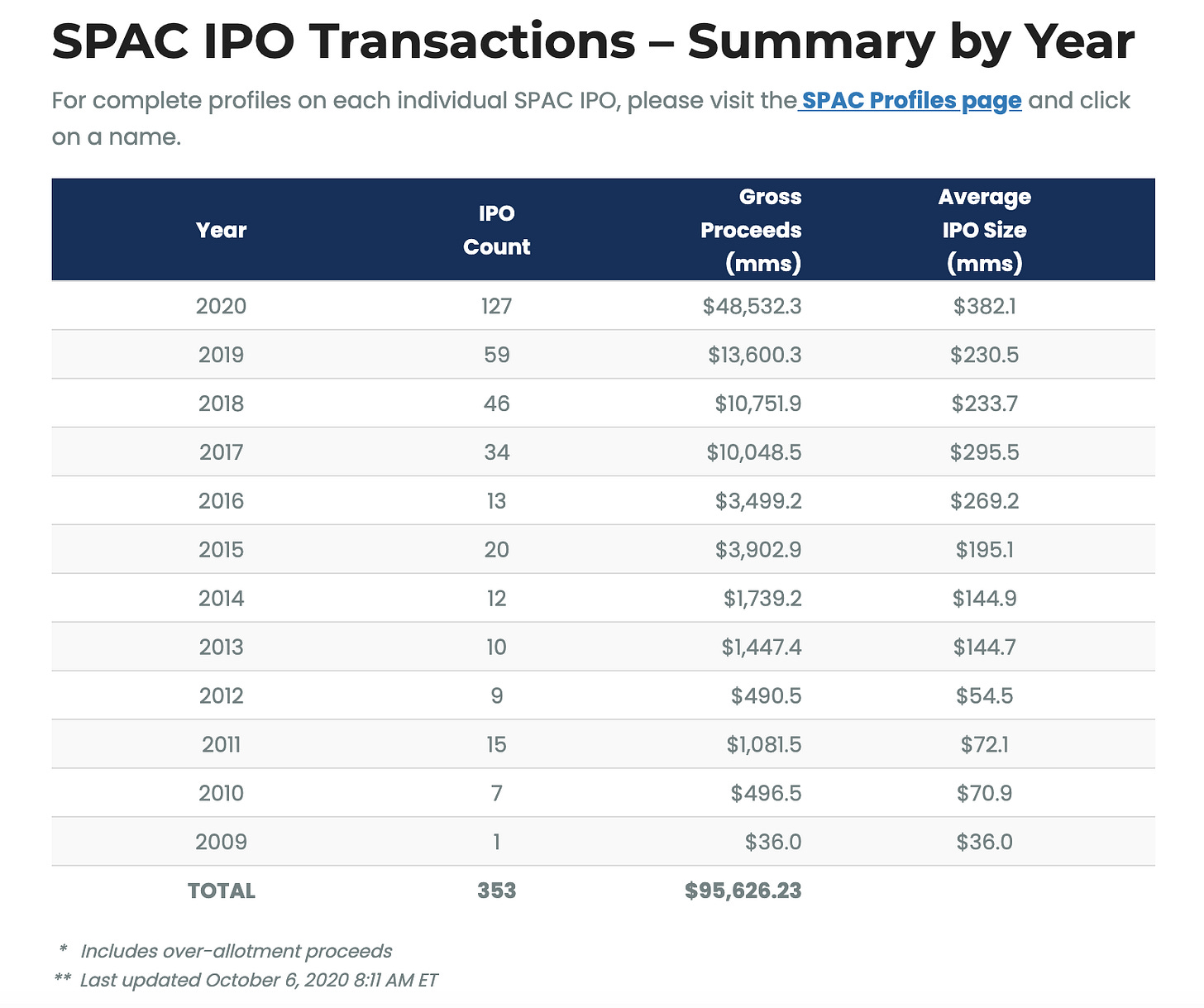

Another trend is that the SPAC mechanism is definitely here to stay. As of this morning, there have been 127 SPACs this year and over $48 billion in gross proceeds.

This process allows companies to get into the public markets faster and more efficiently. One fun statistic for you — Chamath has reserved ticker symbols IPOA through IPOZ, but he is only on IPOC right now. That means we could see another 23 SPACs from him before he runs out of ticker symbols :)

So what is driving the underlying investor interest in SPACs and the recent flip in founders’ minds about getting into the public markets?

The macro economy is going to be a gigantic tailwind for public equity asset prices. The Federal Reserve has publicly committed to keeping interest rates at 0% for the foreseeable future and it has become politically correct to pressure the government into unloading more and more quantitative easing on the market. With so much cheap capital sloshing around, it will be nearly impossible for stocks to avoid benefitting.

Given this macro environment, we are likely to see a significant shift in capital allocation strategy from investors. Everyone has been pouring money into the private markets over the last few years. Companies were staying private longer because of the enormous availability of cheap capital from private investors. But the shift is underway. There is going to be an explosion of startups looking to get into the public markets as quickly as possible, since that is where the returns are going to start flowing.

It has been taboo over the last decade for tech companies to attempt to go public if they were valued at less than $1 billion. People just didn’t talk about it, nor did founders desire it. Everyone had this mental block on $1 billion or more in value. That is quickly changing. We are about to return to the old days — the days where companies would go public with hundreds of millions of dollars in market cap.

It wouldn’t surprise me to see companies starting to get into the markets with $250M to $500M valuations. The hope would be to get liquid stock and become beneficiaries of the insane artificial inflation of asset prices. You still need to build a solid business, but the tailwind of the public markets will help entrepreneurs get there faster.

So expect more healthcare investing, expect more SPACs, and expect founders to start going public earlier and more frequently. Entrepreneurship is a game. When the game changes, the best investors and founders will capitalize on the opportunity.

I can’t wait to see who can change their strategy on the fly.

-Pomp

THE RUNDOWN:

John McAfee Arrested in Spain on US Criminal Charges: Today the Justice Department announced that a 2016 US presidential candidate has been indicted for tax evasion. After John McAfee was arrested in Spain, the Tax Division unsealed an indictment from June 15th claiming that he failed to file tax returns from 2014 to 2018 despite earning “millions in income from promoting cryptocurrencies, consulting work, speaking engagements, and selling the rights to his life story for a documentary.” Read more.

Fidelity, Vanguard, Schwab Funds Have Been Loading Up on Crypto Mining Stocks: Three of the largest asset managers are diversifying their funds to hold blockchain stocks, throwing more establishment financial might behind bitcoin’s technology. Charles Schwab has begun purchasing shares of Riot Blockchain, joining Fidelity and Vanguard – already investors in Riot, HIVE Blockchain Technologies, Hut 8 and BC Group – in allocating mutual fund holdings to a cryptocurrency company, according to financial filings with the U.S. Securities and Exchange Commission. Read more.

Estonia’s Central Bank to Research if Blockchain Can Support a Digital Euro: Eesti Pank, the central bank of Estonia, is undertaking a “multi-year” research project that will investigate the suitability of a blockchain-based digital currency to work alongside cash. Read more.

Pro-Crypto PAC Giving $50 in Bitcoin to the Campaign of Each Member of Congress: If your elected representative to the U.S. Congress has never heard of cryptocurrencies, how do you start telling him or her about it? Hoping to raise awareness, the blockchain advocacy group Chamber of Digital Commerce’s Political Action Committee wants to start by contributing $50 worth of bitcoin to the campaign of those running for re-election. Read more.

Record $616M of Wrapped Bitcoin Minted in September: Wrapped Bitcoin minted a record $616 million worth of tokenized bitcoins in September, according to transaction data analyzed by CoinDesk, a more than 160% increase over the $232 million minted in August. Record minting comes as strong over-the-counter demand for wrapped bitcoin continues, according to Chicago-based firm Grapefruit Trading, one of the first OTC desks to mint WBTC through BitGo. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Will Cole is the Chief Product Officer at Unchained Capital and Parker Lewis is the Head of Business Development at Unchained Capital. These two are true Bitcoiners and it was a lot of fun hearing their perspective on recent events.

In this conversation, Parker, Will, and I discuss:

The recent trend of corporations holding Bitcoin as a reserve asset on their balance sheet

The macro and micro trends driving this transition

Why corporations are the next group after individuals to do this

How businesses can hold their private keys

What Unchained is building currently

I really enjoyed this conversation with Parker and Will. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Athletic Brewing is re-imagining beer for the modern adult. They love beer. But they also love being healthy, active and at their best. The non-alcoholic beers are fully flavored, clean ingredient, and a fraction of the calories of full strength beer - they fit in any occasion. Check out www.athleticbrewing.com for more details and free shipping nationwide.

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Coinlist — Smart investors know being early is critical to success in crypto. CoinList is where early adopters invest in, earn, and trade the best new crypto assets before they list on other exchanges. Sign up via coinlist.co/pomp and earn $10 in BTC after you trade $100.

If you enjoy reading “The Pomp Letter,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.