To investors,

There is something special happening in the bitcoin market right now. It feels like the global financial world has started to understand what the asset is and why it is important for them to own it.

We are not talking about small retail investors or family offices, but rather large institutions who want to invest hundreds of millions or billions of dollars to bitcoin.

There was $576 million of net inflow yesterday to the bitcoin spot ETFs according to BitMex Research.

Investors put $520 million into Blackrock’s IBIT fund alone. These are incredibly large numbers. But inflows are not the only area where you can see the demand from Wall Street.

Jim Bianco created this chart to show the number of individual trades in the bitcoin ETFs compared to SPY or QQQ.

Eric Balchunas pointed out “there were more individual trades yesterday in the bitcoin ETFs than there were in SPY or QQQ. And this is before they have options and/or are available on many advisory platforms.”

That is wild.

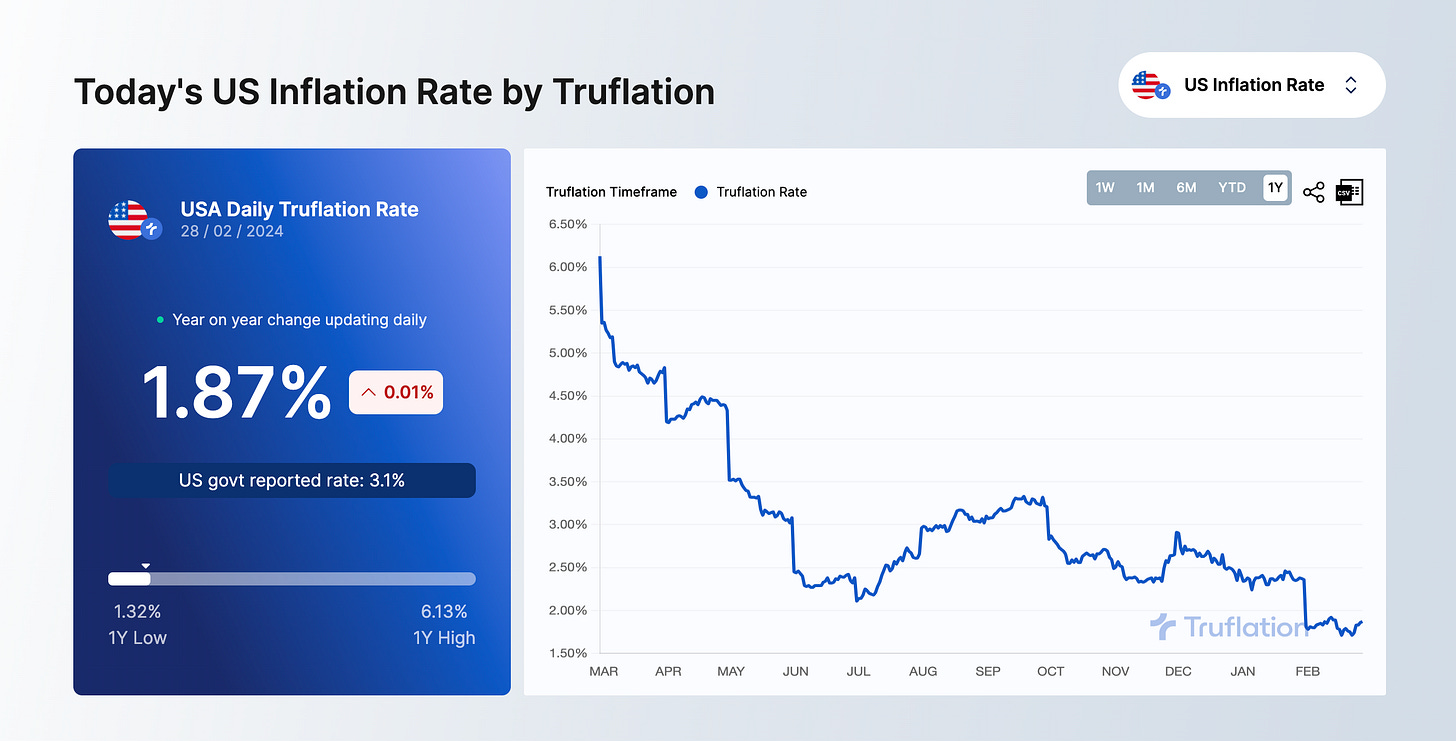

Why are so many people buying bitcoin? As I mentioned in yesterday’s letter, the risk of inflation is looming on the horizon. Bloomberg’s Lisa Abramowicz quantified this when she said “traders are betting on substantially stickier inflation in the US for the next few years. Breakeven rates on 2-year notes are current at 2.75%, the highest level in almost a year.”

There are not many places to hide in public markets if you think inflation is coming to make a serious comeback.

The increase in demand for bitcoin has created a reflexive response. The higher the price goes, the more interest there is in the asset. Balaji Srinivasan highlights “bitcoin has passed all-time highs in 30+ countries, including China and India.”

When price runs aggressively as it is doing right now, many people tell themselves that they will wait for a pullback. It makes them feel better if they can buy bitcoin at a price that they previously saw it trading for. The problem is that it can be nearly impossible to time a volatile market.

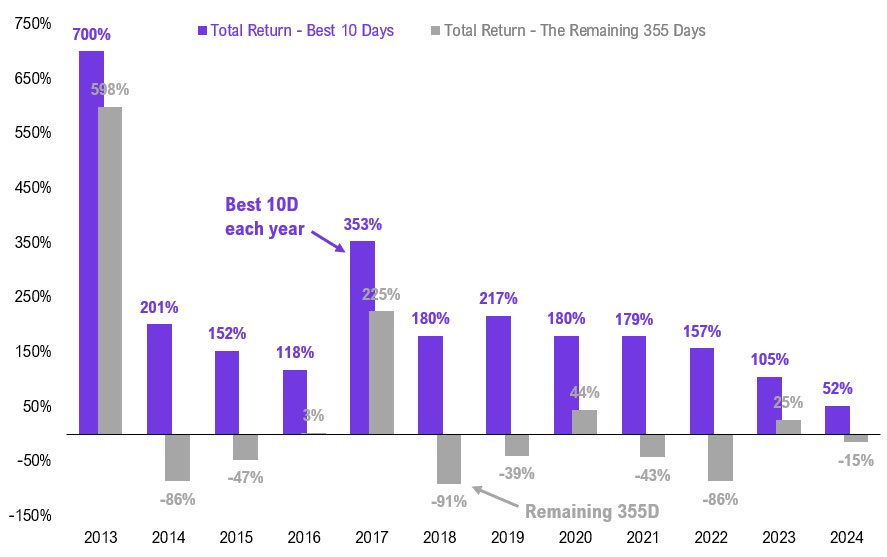

According to Fundstrat’s Tom Lee, if you miss the 10 best days of Bitcoins return each year, you miss majority of the return. The ultimate example of “time in the market is more important than timing the market.”

Humans are not built to time markets. Our fear and greed emotions get the best of us.

My thought process has always been to let the best performing asset over the last 15 years continue to do its thing. It will go up, it will go down, and it will go sideways. But over a long enough time period, bitcoin seems to go up because it serves as an index for global liquidity.

And the governments can’t help themselves — they’ll continue to print money, manipulate interest rates towards zero, and make sure there is liquidity is sloshing around forever.

Hope you have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Alex Tapscott is the author of a new book, "Web3: Charting the Internet's Next Economic and Cultural Frontier." Alex has been in the bitcoin and crypto industry for a long time.

In this conversation, we talk about the current adoption of bitcoin, AR/VR, NFTs, metaverse, Web3, regulation, and how artificial intelligence plays into all of this.

Listen on iTunes: Click here

Listen on Spotify: Click here

OG Bitcoiner Explains What He Is Excited About Now

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post