This installment of Off The Chain is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 40,000 other investors today.

To investors,

The main focus for many people right now is to stimulate economic activity. The COVID-19 issue has driven cities and states to heavily encourage people to stay in their homes, which is grinding the US economy to a halt across numerous industries. While airlines and hotels are seeing significant drops in demand, there are bars and restaurants in major cities that are being ordered to shut down for weeks on end.

This is a tough situation. We know that social distancing is effective in “flattening the curve” in the spread of COVID-19. We also know that many businesses, regardless of how fiscally prudent they have been, will suffer in a material way. In a way, we are watching those in positions of leadership have to make the decision between the health of the people and the health of the economy. Obviously the health of the people appears to be winning, but that doesn’t lessen the burden on the thousands of small businesses across the country.

Many people believe that the government should step in with relief for the small businesses, along with help for the average citizen. There are a lot of different ideas that have been floated, but many of them fall into two camps:

Monetary stimulus — The US government should inject capital into the small business through various forms of payment. This could be a one time payment per business, a payment per business per day affected by shutdowns, or a payment per employee that the business continues employing. A few other plans involve extending loans on attractive terms to these small businesses as well. The exact details of each proposal are thin at best, but the general idea would be that the government conducts a version of UBI for small businesses for a period of time.

Fiscal stimulus — The US government should lower tax obligations or provide tax credits to small businesses in an attempt to put more cash in their hands. These include payroll tax cuts, federally funded paid sick leave, and tax relief for specific industries. This could be done in a variety of ways, but again many of the proposals are thin on details given how early we still are.

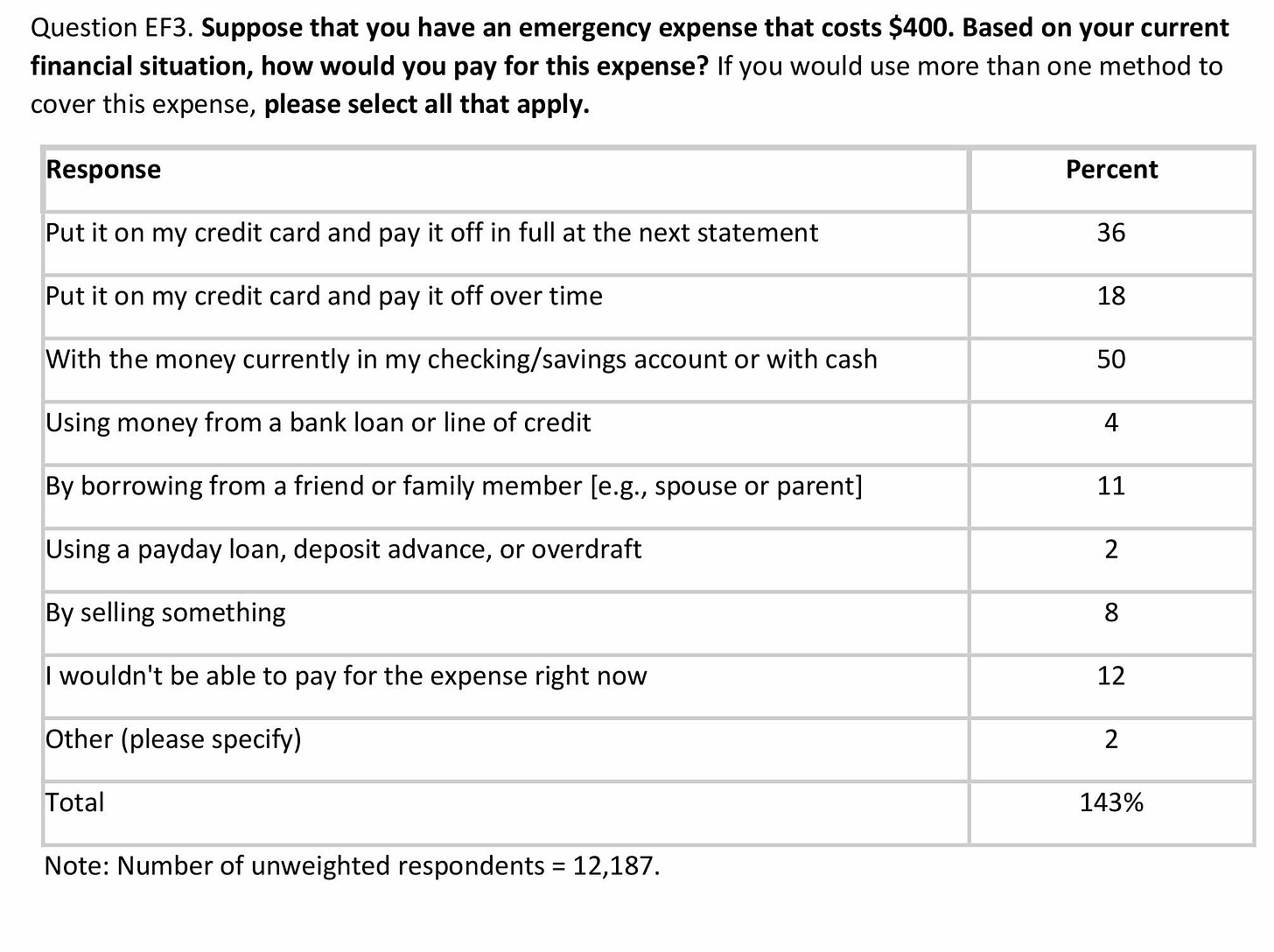

The short answer is that there is not a single bullet that is going to solve the current problem set. We have structural issues in the legacy finance system (credit bubble, etc). We have small businesses that are going to suffer to the point of possibly having to go out of business in a matter of weeks. We have half our country that lives paycheck to paycheck, so they will start to worry about financial demands within 2-4 weeks.

You need different solutions for different groups. Some of the solutions will have to be monetary stimulus and some will have to be fiscal. The ideal solution will expertly weave together both forms of stimulus to create the intended benefits, while mitigating the potential downside. Unfortunately, I’m not sure if there will ever be agreement on that ideal solution.

While I have been thinking through these challenges and the potential solutions, two things keep dominating my mental energy — federal tax income relief for people and the share buyback vs bailout debate. I’m going to do my best to explain both of these below.

First, lets look at the federal tax income relief for people. The argument would be that the federal government voids federal income tax for individuals for 2019. If you already paid your federal tax, you would receive a 100% refund. If you owe something for your federal taxes, you would be relieved from having to pay that amount. This would obviously be a big boost in cash for people, which could range from 10-37% of a single year’s income. The downside of this plan is that about 45% of Americans don’t pay federal income tax, so they wouldn’t receive a direct benefit from this effort.

As I said before, we shouldn’t expect every solution to have an impact on every potential group. Instead, we should try to find easy to enact solutions that will have a positive impact on large quantities of people quickly. I think the federal income tax relief could be one of those solutions. Additionally, someone sent me a tweet this morning that highlighted that France is doing something even more aggressive:

As many people pointed out, the payment of taxes is likely something that can be repeated in other countries, but the relief from utility bills is likely a France-only thing because much of their utilities are centralized via government control. Either way, it is interesting to see the suspension of taxes for companies, so it wouldn’t be a stretch to extend that same type of relief to the individual.

Speaking of companies vs individuals, this brings me to the highly controversial debate of stock buybacks and bailouts. The basics of the debate are that companies have been using a lot of their free cash flow, and at times even debt, to buyback their own stock. The proponents of the strategy would argue that companies only do this when they have nothing better to do with the money (think of this as “efficient use of capital”) or they believe their stock price is trading below market value. The detractors of the strategy would argue that executives’ compensation is usually tied to short term stock performance, so executives are merely propping up the stock price in order to enrich themselves.

Honestly, the proponents and the detractors are both probably right to a degree. Some companies are prudent and only buyback stock when it would make sense. Other companies are run by idiots and they pump their stock price so they can enrich themselves. For example, from 2010 to 2019 the companies in the S&P 500 on average used 52% of their free cash flow to buyback their stock.

For those that don’t know, share buybacks were illegal until 1982. There are many people who would argue that share buybacks should still be illegal. I am not one of those people. I generally think companies should be allowed as much freedom as they want, but I also believe that companies should be responsible for the risk they take.

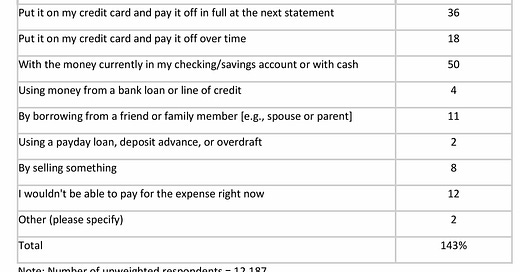

This brings us to the industry bailouts. Currently, the US airline industry is one of many that are asking the federal government for assistance. People are really cautious about using the word “bailout” because of the negative connotation, but there is really no other way to describe it. These same companies that are now asking for a bailout (due to slowing demand for their product because of COVID-19), have spent incredible amounts of their free cash flow on stock buybacks:

So what should happen here? The airlines obviously need the bailout or some of them will fail. The airlines would also have a lot stronger balance sheets if they hadn’t spent the last decade spending majority of their cash on buying their own shares. My solution would not be to eliminate stock buybacks, but instead ask companies to take ownership for the risk they take.

This would meant that companies could participate in stock buybacks, but if they do, they become ineligible for a bailout in the future. If a company refrains from participating in a stock buyback program, they remain eligible for a bailout in the future. My guess is that most companies would choose to participate in the stock buyback program, rather than be eligible for a potential rainy day, but they would proceed with much more caution in how they execute these programs.

Maybe United Airlines would only spend 10-20% of their free cash flow on stock buybacks, instead of the 80% they spent in the last decade. Or maybe they would continue to spend 80% — who knows. But with this positioning, the federal government wouldn’t be responsible for bailing out the organizations that are poor allocators of capital. Business is a game of survival and profits. Most of the executives who have been playing are solely focused on profits, but have forgotten the game of survival.

The problem is that you can’t make profits if you don’t survive. We are watching these poor allocators of capital ask the government to make up for their sins. That doesn’t make a lot of sense to me. Instead, we should allow the bad companies to fail and help new companies enter the market to compete for profits. Competition ultimately drives better products for the customer, more efficient allocation of capital, and ultimately more profits for the government to tax.

If you want to take risk, you have to be willing to live with the consequences. Not sure if that will happen this time (Buffett or the government is likely to bail these folks out), but a guy can dream of that day. In the meantime, many economies around the world are going to need help over the coming weeks and months. These economies are not alone though. The small businesses and individuals will need help too. The solutions are not black and white. They are quite complex and will involve both monetary and fiscal stimulus.

I remain confident that the United States will prevail in this challenge. We have done it before and we will do it again. The debate will rage on as to which solution is the correct one, but at the end of the day we should optimize for getting something done rather than chasing perfection.

-Pomp

This installment of Off The Chain is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 40,000 other investors today.

THE RUNDOWN:

Coinbase Chief Legal Officer Leaves to Take Senior Role at US Bank Regulator: Coinbase's chief legal officer, Brian Brooks, is leaving the crypto exchange to become the second in command at the U.S. Office of the Comptroller of the Currency. The OCC announced Brooks' appointment Monday, saying U.S. Treasury Secretary Steven Mnuchin designated Brooks as the new deputy effective April 1, 2020. Read more.

Retail Investors Are Buying the Bitcoin Institutions Are Selling, Traders Say: As institutions unload bitcoin along with stocks as part of the coronavirus-driven global sell-off, cryptocurrency’s traditional base – retail investors – is doing most of the buying, market participants said. And while pricing screens may still be flashing red, business is brisk at many trading platforms. Read more.

Gemini’s Nifty Gateway Bets on Celebs to Drive Interest in Crypto Collectibles: The “Bitcoin Billionaire” twins, Tyler and Cameron Winklevoss of the Gemini crypto exchange, now also have a regulated, fiat marketplace for non-fungible tokens (NFTs). Gemini first acquired Nifty Gateway in late 2019 with Tyler Winklevoss saying in a statement, “We believe that both real-world and digital collectibles will migrate onto blockchains in the form of nifties.” Read more.

Swedish Central Bank Bids to Host BIS Hub for Digital Currency Research: Sweden’s Riksbank says its digital currency researchers are the best in central banking. That lofty claim comes in Riksbank’s March 3 bid to host a Bank for International Settlements Innovation Hub, a new initiative by the "bank of central banks" that now wants to scatter the world with local financial innovation policy clearinghouses. Read more.

Binance Launches $50M ‘Blockchain for India’ Fund: Binance and its local subsidiary have set up a new fund to reinvigorate growth in blockchain startups in India following a Supreme Court decision to allow banks to service crypto firms. Binance and India-based bitcoin exchange WazirX – which Binance acquired last November – announced Tuesday their new "Blockchain for India" fund would incubate and invest in local startups that contribute to the creation of a sophisticated cryptocurrency and blockchain ecosystem for the subcontinent. Read more.

LISTEN TO THIS EPISODE OF THE OFF THE CHAIN PODCAST HERE

Duncan and Griffin Cock Foster are the founders of Nifty Gateway which was recently acquired by Cameron and Tyler Winklevoss' Gemini crypto exchange. This world of digital collectibles is new to me, so this conversation was super informative and entertaining. They convinced me that there will be large market opportunities in the space and I was impressed with how they are thinking about the future of Nifties.

In this conversation, Duncan and Griffin and I discuss:

What it was like growing up together

Why they pursued startups

How NFTs work

Why Nifties are likely to be so valuable in the future

How the Gemini acquisition came together

What artists are launching collections on their new US dollar centralized NFT exchange

I really enjoyed this conversation with Duncan and Griffin. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE OFF THE CHAIN PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

TaxBit automates your cryptocurrency taxes, enabling you to effortlessly track, calculate, and report your transactions. Get 10% off your tax plan today with a free trial by going to www.taxbit.com/invite/Pomp

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

If you enjoy reading “Off The Chain,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post