Today’s letter is brought to you by Frec!

The wealthy have used a secret strategy to make money and save on taxes for decades — direct indexing and tax-loss harvesting.

The problem historically is that it takes a large team and lots of money to pull these strategies off. That is all changing now.

Frec makes direct indexing available to every investor at 1/10th the cost (0.1% annually to be exact).

It’s nearly identical to investing in ETFs, except it allows investors to take advantage of tax benefits — by owning the stock directly.

With Frec Direct Indexing, you can achieve index-like performance but end up with more money through tax loss harvesting.

Invest in popular indexes and we’ll automatically harvest your tax losses for you.

Automated and done for you. No extra effort required.

Sign up today and start saving money on your taxes!

To investors,

The US economy is in a precarious position. After decades-high inflation, the Federal Reserve jacked up interest rates at the fastest pace in history. We went from 0% to over 5% in less than 2 years.

The theory is that a rapid increase in the interest rate should crush asset prices and bring inflation down to the 2% inflation target.

Unfortunately, that hasn’t happened yet.

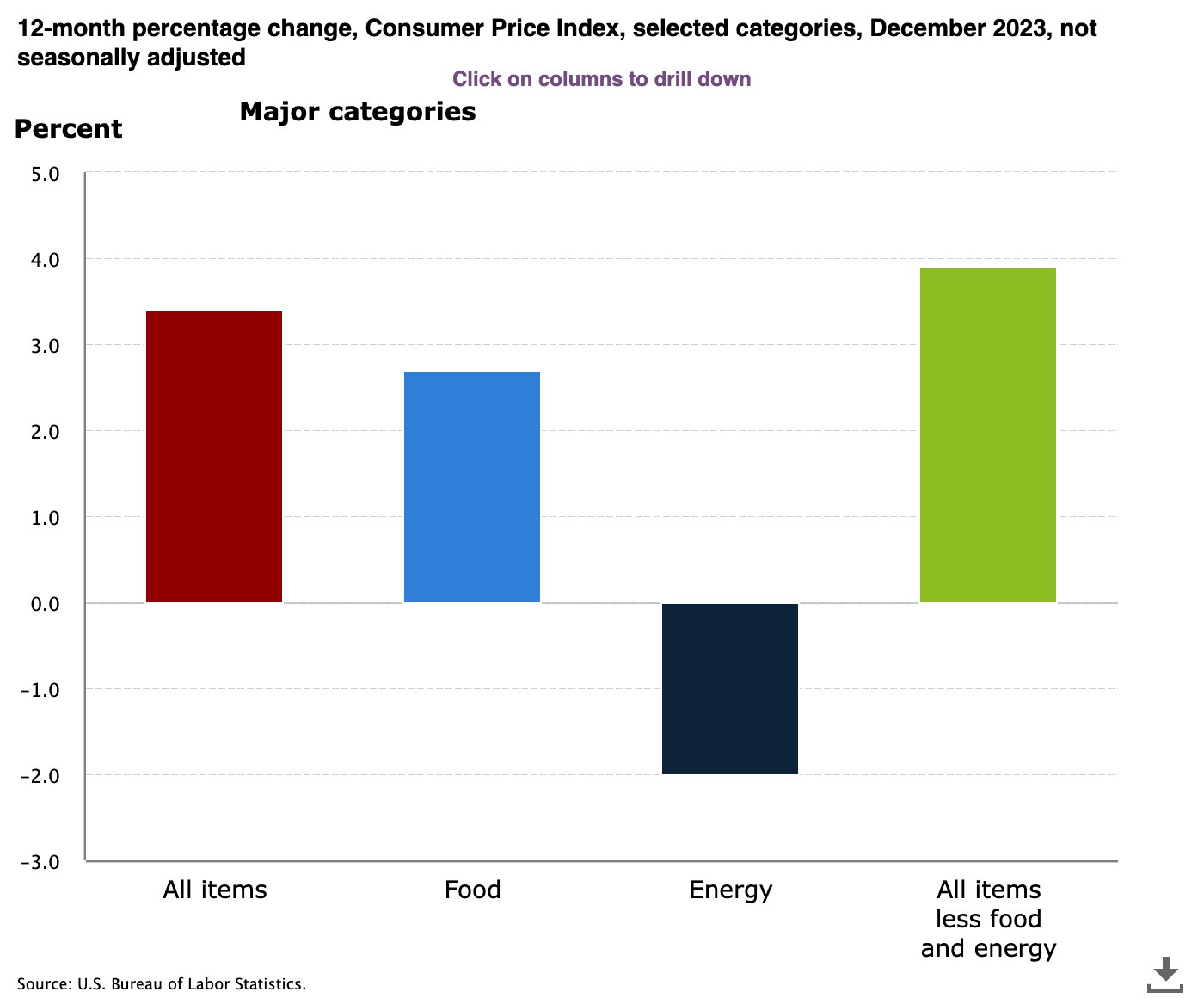

The government CPI report shows year-over-year inflation of 3.4%. If you remove food and energy, the measurement is 3.9% for major categories.

This is a big deal because inflation is 50-100% higher than the stated Fed target of 2%. But maybe this wouldn’t be so bad if asset prices have come down and people aren’t spending money on ridiculous things in the economy, right?

That hasn’t happened either. The S&P is sitting near all-time highs.

The Nasdaq 100 is up ~ 50% last year and hit a new all-time high.

The theory isn’t working. Asset prices should be going down. The academic equation is “interest rates up, inflation down, asset prices down.” That is how we have all been told the system works.

So something is wrong.

Maybe the inflation reading is inaccurate? This is a common argument on the internet. Let’s look at alternative inflation measurement Truflation.

They are showing an inflation rate of 2.14%, which is much closer to the Fed’s target. This would suggest that asset prices are merely forward-looking and investors believe the Fed will cut interest rates throughout 2024, so they are positioning to benefit.

Regardless of what the Fed does, the damage has already been done though.

The aggregated inflation since January 2020 in the United States is over 22%. This means that $1 of purchasing power at the start of 2020 is the equivalent of $0.77 today.

This type of currency devaluation is wrecking havoc on the American consumer. Household debt continues to skyrocket across the country and hit a record $17.2 trillion in Q3 2023.

Credit card balances are $1.08 trillion currently. Auto loan balances are $1.6 trillion. Student loans are $1.6 trillion. Everywhere you look, citizens are piling on debt and continuing to spend in the economy.

So why does this matter?

If markets are correct and the Federal Reserve begins cutting interest rates in the first half of 2024, there is significant risk of inflation coming roaring back. I am not arguing that we would see 9%+ CPI readings, but it wouldn’t surprise me if 3% or higher becomes the new normal.

As I have written to you all before, we could even see the Federal Reserve change their inflation target to 3% at some point in an effort to claim victory on this fight.

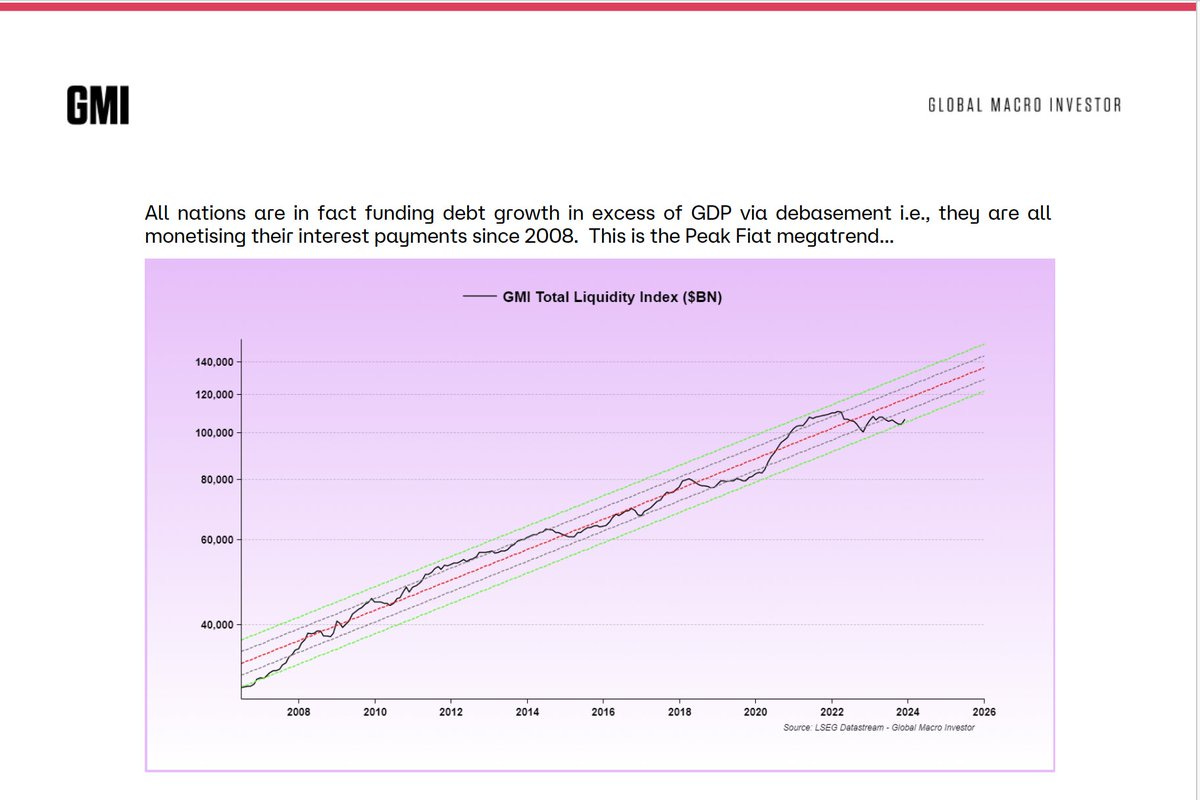

Add in the fact that we are heading into a Presidential election and the argument for interest rate cuts only get stronger. Then you take a look at the global liquidity cycle and, as Raoul Pal points out in Global Macro Investor, we appear to be headed back into an upwards cycle that will bring trillions of dollars sloshing into the global economy.

It is almost like we didn’t learn our lesson over the last 15 years. But there is nothing that you or I can do to reverse the path we are on. The only thing we can control is whether we are allocated to assets that will benefit from the incoming rate cuts and global liquidity injection.

Get long and chill. That seems to be the best strategy. The central banks work for us now. What a time to be alive.

Hope you all have a great day. I’ll talk to you tomorrow.

-Anthony Pompliano

Jeff Sands is the Founding Partner at Dorset Partners. He is also the author of a great book, “Corporate Turnaround Artistry: Fix Any Business in 100 Days.”

In this conversation, we talk about Jeff’s experience turning around struggling businesses, crisis mode, hard decisions & hard conversations needed, vendor relations, debt, labor, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Turnaround Expert Jeff Sands Explains How To Fix Any Business In 100 Days

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post