This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 190,000 other investors today.

To investors,

Bloomberg reported last night that insiders have confirmed the SEC will not oppose the Bitcoin Futures ETF applications that are set to begin trading on Monday. This led to a short term price appreciation of bitcoin, along with quite a bit of excitement on Twitter.

It is important to remember that the ETF is not approved and trading….until it is approved and trading. There is always the chance that someone steps in at the last second and tries to prevent the inevitable from happening. Barring that attempt being successful, the Bitcoin Futures ETFs will bring the first bitcoin-related ETF structure to American financial markets.

The journey to a bitcoin ETF started back in 2013 with the first ETF application from Cameron and Tyler Winklevoss. Now eight years later we are on the doorstep of the very first approval. As the saying goes, the best things take time.

But is the Bitcoin Futures ETF actually the best thing?

Honestly, probably not. The approval of a bitcoin “spot” ETF would be better from investors, both from a price tracking and fee structure standpoint. But beggars can’t be choosers in the beginning. So we are likely going to see the Bitcoin Futures ETFs trading at the start of next week.

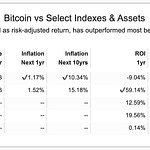

The crazy part about this entire thing is that the government will now be complicit in two actions that contribute to significant bitcoin price appreciation. During Q2 of 2020, they printed trillions of dollars right into the bitcoin halving. This type of market manipulation sent investors seeking safety in inflation-hedge assets, which led the professionals, such as Paul Tudor Jones, to describe bitcoin as “the fastest horse.”

Remember, bitcoin is completely unaware of any macro economic forces. It doesn’t know, nor does it care, if people are printing money or if they are decreasing interest rates. Bitcoin’s network continues to produce block of transactions after block of transactions without fail. That is the beauty of a decentralized, open monetary network.

But the government is not done yet.

The SEC appears poised to approve the Bitcoin Futures ETF at a very opportune time for bitcoiners. Approximately 85% of bitcoin’s circulating supply has not moved in the last 90 days. There is extreme illiquidity in the market, so if demand were to increase because of an ETF approval, the price is likely to rocket upwards in an insane way. Add in the fact that we are still experiencing persistent levels of 5%+ inflation and you can quickly see why there are so many forces pushing investors into bitcoin.

The equation is simple — a highly illiquid asset is going to increase access to large capital pools while being overlaid with a macro backdrop that has investors scurrying to every corner of financial markets to find inflation-hedge assets.

This is an absolutely gorgeous setup. The best part? It has been available to anyone in the world for years.

There were no insiders. No one was able to get access in the private market at the expense of the public market retail investor. There were no special deals. It all came down to whether someone was willing to put in the work, educate themselves, and have the courage and conviction to convert their assets to digital sound money. Some people did it. Others thought they were too smart for the market.

Ultimately, bitcoin is the most free market asset that we have. It is being repriced in real-time by investors. A decentralized, digital, open monetary network is worth multiples of the current $1 trillion in my personal opinion. But what do I know? I’m just a random volunteer on the internet who plugged into the bitcoin network and is doing my best to help us advance along to a better world.

Hope each of you has a great end to your week. I’ll talk to everyone on Monday.

-Pomp

TODAY’S SPONSORS:

Arculus is the crypto cold-storage wallet that combines the world’s strongest security protocols with an easy-to-manage app. Unlike other storage solutions that are less secure and more difficult to use, Arculus doesn’t compromise security or usability. You can store, swap, and send your crypto all with a simple tap of your Arculus Key™ card. Order the safer, simpler, smarter crypto cold storage solution at getarculus.com today.

Gains in the number of crypto wallet holders have doubled over the past year—bringing millions of new users into the crypto space. In a major win for global crypto adoption, Unstoppable Domains and their alliance of 32 wallets and exchanges around the world just made moves to eliminate the stress of sending crypto for 40M+ crypto users; a great sign that wallet adoption rates will continue to accelerate. This global initiative aims to make Unstoppable's '.wallet' NFT username a universal standard. This .Wallet Alliance is creating a solution to address the largest pain point in crypto payments: taking the hassle and fear out of sending crypto by simplifying the user experience.The Unstoppable .Wallet Alliance will work together to integrate support for '.wallet' domain ending amongst its 32 founding members and future partners to accelerate decentralized peer-to-peer transactions.Global mass adoption of crypto is finally here—don't miss it.Ditch your inconvenient, error-prone cryptocurrency address and claim your username for the web3 future.

THE RUNDOWN:

Bitcoin Futures ETF Won’t Face SEC Opposition at Deadline: The Securities and Exchange Commission is poised to allow the first U.S. Bitcoin futures exchange-traded fund to begin trading in a watershed moment for the cryptocurrency industry, according to people familiar with the matter. The regulator isn’t likely to block the products from starting to trade next week, said the people, who asked not to be named while discussing the decision. Read more.

Cathie Wood’s Ark, 21Shares Team Up on Bitcoin Futures ETF Application to SEC: Noted investor Cathie Wood’s Ark Investment Management and investment-product firm 21Shares are part of a new application to the U.S Securities and Exchange Commission to list a bitcoin futures exchange-traded fund. The Wednesday filing was submitted by Alpha Architect ETF Trust, with 21Shares listed as the fund’s sub-adviser. Ark Investment will provide marketing support, but not make investment decisions or provide investment advice, the filing said. Read more.

Coinbase Proposes US Create New Regulator to Oversee Crypto: Crypto exchange Coinbase wants the U.S. government to create a new regulator to oversee the cryptocurrency industry. Unveiled Thursday, Coinbase’s Digital Asset Policy Proposal suggests Congress pass legislation to regulate Marketplaces for Digital Assets – its term for crypto exchanges that offer custody and trading services, as well as borrowing and lending services – and create a registration process for those entities. The exchange also proposed that the crypto industry establish a self-regulatory organization for crypto businesses. Read more.

Coinbase Jumps After Sign-Up Numbers for NFT Marketplace Revealed: Coinbase shares rose 6% Thursday after reports that the crypto exchange’s new non-fungible token marketplace has a waiting list of more than one million people who signed up on the first day it was announced earlier this week. As of Thursday morning, the waiting list was at 1.35 million, which is four times the 300,0000 users that OpenSea, the world’s largest NFT marketplace, has, according to a note from financial services firm BTIG. Read more.

Second Biggest Mortgage Provider in US Stops Accepting Crypto Payments: United Wholesale Mortgage, the second largest mortgage lender in the U.S., has stopped accepting cryptocurrency for home loans, the company announced on Thursday. In August, the company said it would start offering the crypto payment option via a pilot program to gauge demand for this service. It was the first mortgage lender to do so. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Nic Carter is a Partner at Castle Island Ventures and a Co-Founder of CoinMetrics.

In this conversation, we discuss bitcoin mining, renewable energy, Texas, inflation, and debunking FUD.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Coin Cloud has been serving customers since 2014 and has established itself as the world's leading digital currency machine (DCM) operator. More than just a Bitcoin ATM, Coin Cloud machines make it easy to buy and sell Bitcoin and 30+ other digital assets with cash. To get your $50 in free Bitcoin, visit www.Coin.Cloud/Pomp

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Compass was founded with the goal of making it easy for everyone to mine bitcoin. Visit compassmining.io to start mining bitcoin today!

App Sumo is giving away their entire $1 million Black Friday marketing budget to creators! If you have an ebook, online course, template, or any other digital product — this is for you. List your product on AppSumo between September 15th - November 17th and the first 400 products to go live will receive $1,000. The next 2,000 to list a product and go live get $250. And everyone who lists gets entered to be one of 10 lucky winners of $10k! Go list your product today to cash in on this amazing deal.

Cosmos is building the Internet of Blockchains, marking a new era of interoperability, scalability, and usability. The free flow of assets and data between blockchains with bridges to Ethereum and Bitcoin will unleash the potential of DeFi, NFTs, and much more. Dive into Cosmos at cosmos.network/pomp

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in bitcoin and 19 other digital assets inside your IRA. Choice enables you to trade real bitcoin, other crypto, and stocks without having to pay a dime in capital gains. Join me and the 20,000 other bitcoiners who have started their tax-efficient stack, and open your Choice Account today. Search ‘stack sats’ in the app store or visit www.choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

AG1 by Athletic Greens is the category-leading superfood product bringing comprehensive and convenient daily nutrition to everybody. One scoop of AG1 contains 75 vitamins, minerals and whole food-sourced ingredients, including a multivitamin, multimineral, probiotic, greens superfood blend. They are giving readers an immune supporting FREE 1 year supply of Vitamin D AND 5 free travel packs with your first purchase if you visit athleticgreens.com/pomp today.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy, sell, store, and earn bitcoin, ether, and over 40 other cryptocurrencies. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

CityCoins are programmable tokens that allow citizens to become stakeholders in their favourite cities. MiamiCoin was the first CityCoin launched and within it’s first two months it has already raised over $10 million USD in donations for the City of Miami. Join the CityCoins Discord to become part of the community, and help us build towards a crypto civilization.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user-friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp” when you sign up for one of their metal cards today.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services - offering clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Arculus is the crypto cold-storage wallet that combines the world’s strongest security protocols with an easy-to-manage app. Unlike other storage solutions that are less secure and more difficult to use, Arculus doesn’t compromise security or usability. You can store, swap, and send your crypto all with a simple tap of your Arculus Key™ card. Order the safer, simpler, smarter crypto cold storage solution at getarculus.com today.

Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Godownload the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.