To investors,

The economic volatility of the last three years has been well documented, but nowhere is it more obvious than in the plight of the average American worker. The alarming data point that originally sent me down a rabbit hole of research was that over 50% of Americans who make $100,000 or more report living paycheck-to-paycheck.

Think about that for a second.

It is estimated that 18% of individuals in the US make more than $100,000 per year and approximately 34% of all US households clear the same income threshold. That equates to tens of millions of Americans with a 6-figure income, yet an inability to achieve financial security.

If we lower the income threshold to include anyone in the workforce, it is estimated that more than 60% of all US workers are living paycheck-to-paycheck. Remember, we aren’t talking about a developing nation, but rather the United States of America who has one of the most developed economies in the world.

So what exactly is going on here?

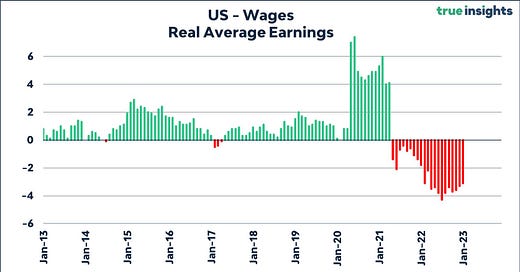

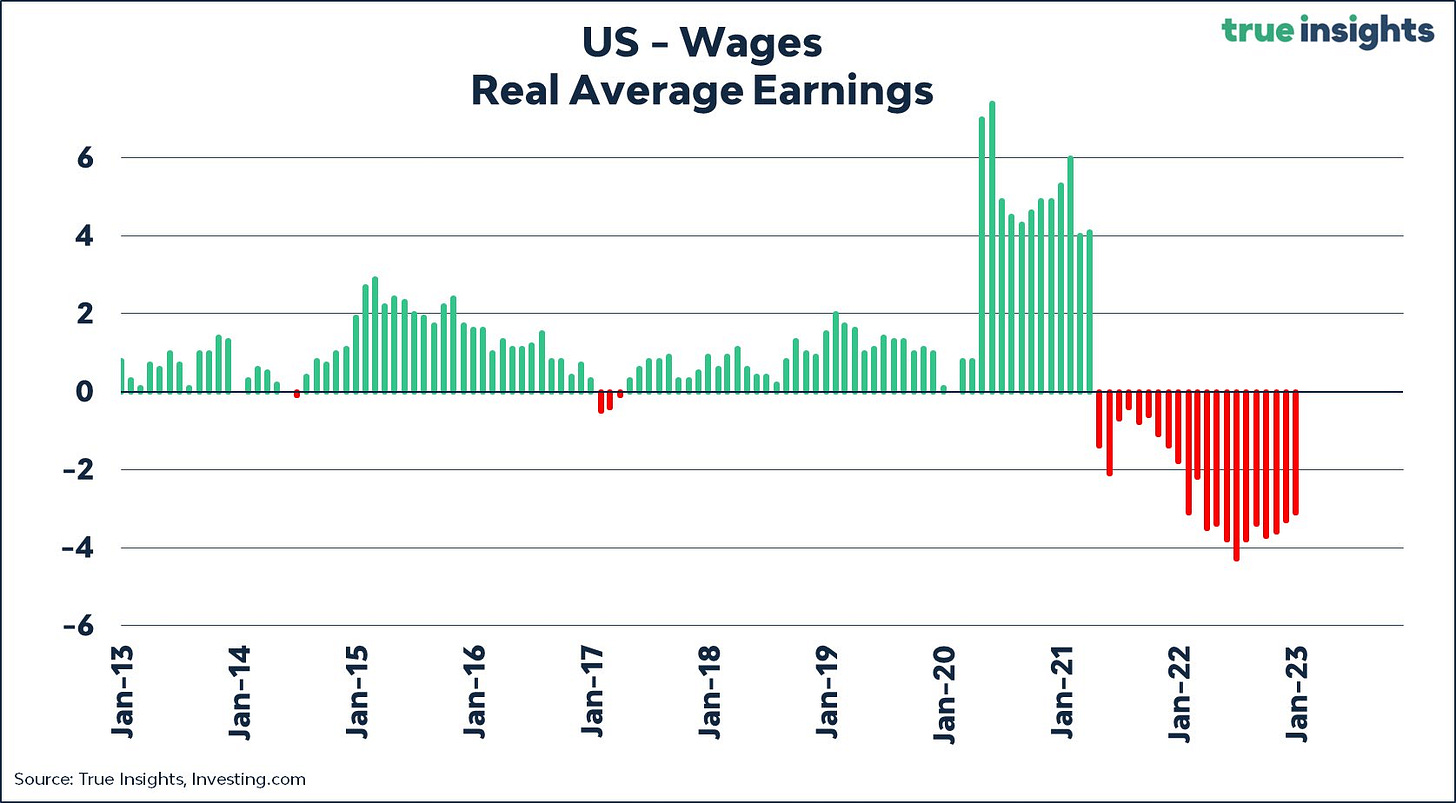

There are multiple factors, but a good starting place is the wages that private sector employees are being paid. The year-over-year change of these wages remains positive, but it sits at only 4.4% for all non-farm employees.

I say “only” because the increase in nominal average hourly earnings is growing at a slower rate than inflation, which means that the real average hourly earnings over the last year has actually been negative. In layman terms, workers on average are being paid less money in purchasing power terms for their work.

To illustrate how bad this phenomenon is, you can see in this graphic that the real average hourly wage has been negative since the start of 2021. That is two straight years of workers falling further and further behind, which puts immense pressure on their financial situation.

If you think this is bad, just wait until you see how bad the rest of the data is…