Today’s letter is brought to you by ResiClub!

ResiClub is the leading publication for the residential real estate market.

Housing affordability is the worst that it has been in 40 years and the team at ResiClub has covered the decline in great detail.

Readers get news, commentary, data, and analysis from industry insiders.

ResiClub is written by Lance Lambert, who is widely considered the best residential real estate reporter in the country.

Subscribe today and stay informed on the largest asset class in the world.

To investors,

Critics of the new digital financial system are fond of claiming that blockchain technology has not created any real products. Their view of the world is that crypto enthusiasts are merely trading digital tokens back and forth for speculation, but no real problems have been solved to date.

This is obviously not true.

Bitcoin is an $850 billion asset that has approximately $600 billion being held by long-term holders who are seeking to protect their purchasing power. That alone should negate the critics, but they rarely accept that argument as valid for some unknown reason.

This opens the door for an even more interesting response — stablecoins have become a killer app of blockchain technology.

Let’s use Tether, the leading stablecoin, as the example. The company has almost $100 billion in various fiat currencies that have been tokenized on different blockchains.

That money is held in a variety of investments to ensure the reserves are always available and protected.

This approach to a tokenized asset (cash!) has turned Tether into one of the best businesses in the world. Yesterday, CEO Paolo Ardoino published the following statistics about their Q4 performance:

profit for the quarter: $2.85B, of which ~$1B in net operational profit (mainly US t-bill interests), ~$1.85B from gold and bitcoin holdings.

total profit for 2023: $6.2B.

cash & cash equivalents cover now 90% of all issued tokens, highest percentage in the last years.

total US T-bill exposure (direct + indirect): $80.3B.

excess equity: $5.4B (excess equity = undistributed profits on top of 100% reserves that Tether holds to back all issued tokens. Company decided to keep vast majority of profits within the stablecoin reserves to ensure highest resiliency).

excess equity > remaining secured loans ($5.4B vs $4.8B). In 2023, as promised, Tether accumulated enough excess equity to remove the impact of secured loans on token reserves.

VC investments portfolio (outside of token reserves and consolidated report): $1.45B. Investments span across AI infrastructure, Bitcoin mining, P2P telecommunications and others. These are confirmed to remain outside of the consolidated reserves report within a new segregated VC umbrella, so that such investments don’t and won’t have any impact on the token reserves.

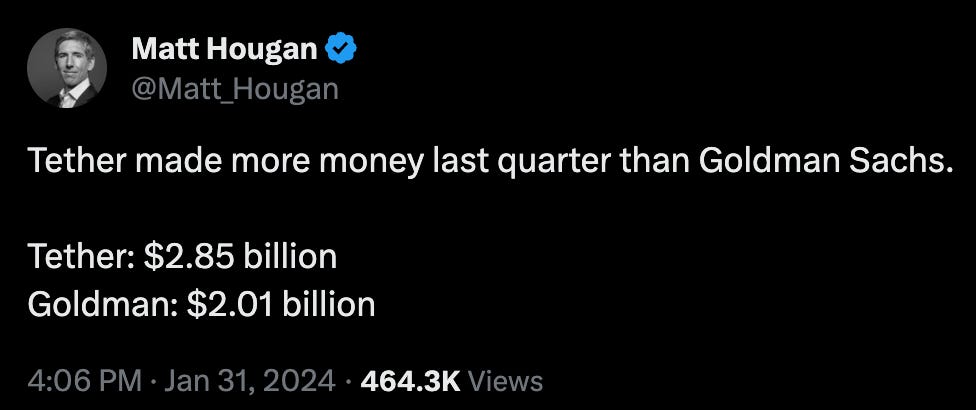

Any business that can do $2.85 billion in profit during a 90 day period is hard to ignore. This puts them on a $11.4 billion annual run rate in profit. As Bitwise CIO Matt Hougan pointed out, Tether made more money than Goldman Sachs last quarter.

Messari CEO Ryan Selkis points out that Tether is now 10% of JP Morgan’s net profit, but with way fewer employees.

As I have pointed out before, even if Tether has 100 employees, than the company would be doing more than $100 million per employee in profit.

That is the craziest statistic I have ever heard in business.

$100,000,000+ in annual profit per employee.

So much for those critics that continue to claim there are no problems solved with this new technology. The actual truth is that one of the most profitable businesses, which is used by millions of people globally, was built on top of the technology.

Stablecoins, including Tether, USDC, and others, will continue to be very popular around the world as people look for a way to send stable value quickly and inexpensively. Anyone arguing the opposite is either unaware of the facts of the market or has an incentive to see progress happen slower.

But markets don’t wait on anyone. And Tether is proving the critics wrong day-after-day. Maybe the naysayers will realize their error at some point. Just don’t count on it.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Darius Dale is the Founder & CEO of 42Macro.

In this conversation, we talk about the labor market, economics, Federal Reserve, interest rates, election year, and macro outlook.

Listen on iTunes: Click here

Listen on Spotify: Click here

My Conversation with 42 Macro’s Darius Dale

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post