Today’s letter is brought to you by Bitcoin Investor Day!

I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for sophisticated Wall Street investors who are interested in bitcoin.

Speakers include Cathie Wood, Mike Novogratz, Anthony Scaramucci, Mark Yusko, Head of Digital Assets at BlackRock, Bitwise CEO, Head of Research at Fidelity & VanEck, and many more.

Tickets are only $50 and the venue is incredible. This will be one of the highest quality bitcoin conferences of the year. See you there!

To investors,

The consensus across Wall Street is that inflation has dropped and the Fed is ready to start cutting interest rates. Investors have positioned themselves to benefit from rising asset prices. The central bank is preparing to wave the victory flag. The media can’t stop writing about the elusive “soft landing.”

But what if the consensus is wrong?

This is an idea that Bianco Research founder Jim Bianco and I discussed yesterday in our recorded conversation. Neither one of us believe that interest rate hikes is the likely scenario, but it is hard to ignore that the odds are becoming higher with each passing month of new data that we receive.

According to Bianco, here is a refresher on what has occurred so far:

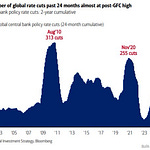

“On January 12th, the market was pricing in 7 interest rate cuts for all of 2024. There are only 8 Fed meetings per year, so they were saying the Fed wasn’t going to move on January 31st, which they didn’t, and then they were going to cut rates at every other meeting for the rest of the year. That was on January 12th. Now it (market prediction for the number of rate cuts) is down to 3. So we have already removed 4 rate cuts for the year and now the first rate cut is not priced in until June…the June probabilities are around 75%, but 10 days ago they were at 100%.”

This degradation of confidence on how many interest rate cuts, and how quickly they will occur, is a direct response to the concerning inflation data that has been reported for the last 2-3 months.

You can see in this chart from the BLS report of January’s inflation measurement that the month-over-month change has been accelerating for the last 3 months.

The higher that monthly inflation goes, the harder it becomes for the Fed to justify cutting interest rates. One of the worst things that could happen for the central bank is a re-acceleration of inflation right before we finally cross the finish line of the inflation fight. This would not only be devastating to Chairman Jerome Powell’s legacy, but it would also create significant damage in the US economy.

Consumers would be hurt by higher inflation and investors would be caught offsides since majority of them are prepared for asset prices to rise on the perceived incoming interest rate cuts.

So why are so few people talking about potential interest rate hikes?

Bianco highlights a little known fact — the central bank of New Zealand has been one of the leaders over the last few years in global monetary policy. He said:

“New Zealand is a developed world and its central bank, the Reserve Bank of New Zealand, has been one of the forward-looking central banks in the world. They developed inflation targeting in 1989. It took the Fed 23 years to adopt it. Maybe it wasn’t a good idea, but they have been ahead of it.

The New Zealand central bank was the first one to raise rates in early 2022…in January 2022. They were the first ones to pause in early 2023. They have been the leader.

What are they talking about in New Zealand? Inflation is not solved. We have to raise rates again. And so they are now debating when and how they are going to raise rates, and how high they are going to go, and it looks like they are going to hike rates maybe two more times to 6% sometime by summer. So the leading central bank….they are talking about raising rates again.”

This information will be shocking to many people. It was to me. But it makes sense. A small country has an easier time thinking independently than a large, globally important country because the smaller country has less scrutiny and pressure.

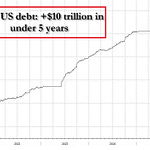

If inflation is not going away, and it is continuing to accelerate month-over-month at a rate close to 4% annualized, central banks would continue increasing interest rates. However, the problem now is that the Fed told the market that they were done hiking interest rates. Market participants don’t want an unreliable Federal Reserve.

They rely on the Fed to do what they said they were going to do.

The Fed violated this once already in the last four years. They told the market that the interest rates were going to stay near 0% for years. By the time the central bank began hiking interest rates at the fastest pace in history, market participants found themselves completely unprepared. Remember when regional banks were failing on a daily basis? That was a direct result of the Fed doing something other than what they had said they were going to do.

So now the Fed has backed themselves into a corner — they told the market that the interest rate hikes are done. The fight against inflation is almost won. Be prepared for multiple interest rate cuts in 2024.

It would be very unfortunate if inflation remains sticky and the Fed has to change their mind. But with each passing day, those odds are getting higher. I am not prepared yet to argue that it is likely the Fed is going to hike interest rates, but I believe the odds to be much higher than most of the market thinks.

That spells opportunity and potential disaster depending on how you look at it. Keep your eye on the inflation data and start thinking critically about how the Fed may respond if the data gets worse. It could help you see around the corner before everyone else.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Jim Bianco is the President and Macro Strategist at Bianco Research. He also has an ETF, called the WisdomTree Bianco Fund (WTBN).

In this conversation, we talk about the pros and cons of bitcoin ETF, similarities to the gold ETF, centralized ownership of bitcoin, macro economy, federal reserve, interest rates, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.