To investors,

Silvergate Bank announced they would liquidate earlier this week. Now Silicon Valley Bank has come under immense pressure as a bank run commenced yesterday. There is a lot to unpack in this situation, so let’s dig in.

Silicon Valley Bank is the leading bank for Silicon Valley tech companies. Great marketing in their name. Their customer base is dominated by businesses, not retail. And the bank is notorious for extending lines of credit to companies and venture capital firms as well, which many banks are more shy about participating in.

The main issue at play is a liquidity issue. Silicon Valley Bank is the perfect example of what happens when central banks intervene in markets and distort the free market forces. The financial organization had approximately $62 billion in deposits at the end of 2019 and that grew to almost $190 billion by the end of 2021. That sounds great, right?

Yes, of course. The bank was becoming more popular and they were collecting more assets. But banks aren’t in the business of merely collecting more deposits. They are in the business of making money. This meant that Silicon Valley Bank could do two things — they could lend these new deposits out to companies and individuals to earn a yield, or they could buy financial assets to generate a yield.

Given how difficult it would be to find borrowers for $130 billion in 2 years, Silicon Valley Bank ended up putting majority of these new deposits into financial assets. As Jamie Quint pointed out, the $80 billion or so that SVB invested was heavily concentrated in mortgage-backed securities. But not just any type of MBS — about 97% of these were 10-year maturity MBS that SVB was determined to hold till maturity.

In layman terms, the bank took lots of money and bought long-duration assets. Why were they doing this? Because at the time, US Treasuries were providing 0-0.25% yield and the bank was seeking something higher. The MBS products that SVB was purchasing had a yield above 1.5%, which is obviously more attractive if your business is to make money for shareholders.

There is only one problem though — the money that SVB was using to buy these long-duration assets was not their money to keep forever. This money was deposits from customers. And customers could ask for their money back at any time. Normally, this is not a big deal. A few customers ask to withdraw and the bank can easily process that from a day-to-day basis. But in a fractional reserve banking system, the problem arises when a lot of customers all want their money back at the same time.

That would never happen though, right? Customers wouldn’t ask for tens of billions of dollars back all at once, right? Well, never say never.

The last 36 hours have been a whirlwind for Silicon Valley Bank. Venture capitalists and technology companies are withdrawing assets at a frenetic pace. This is putting immense pressure on SVB and forcing the bank to make decisions that they would otherwise avoid. Before we get to those decisions, let’s look at why so many people are withdrawing.

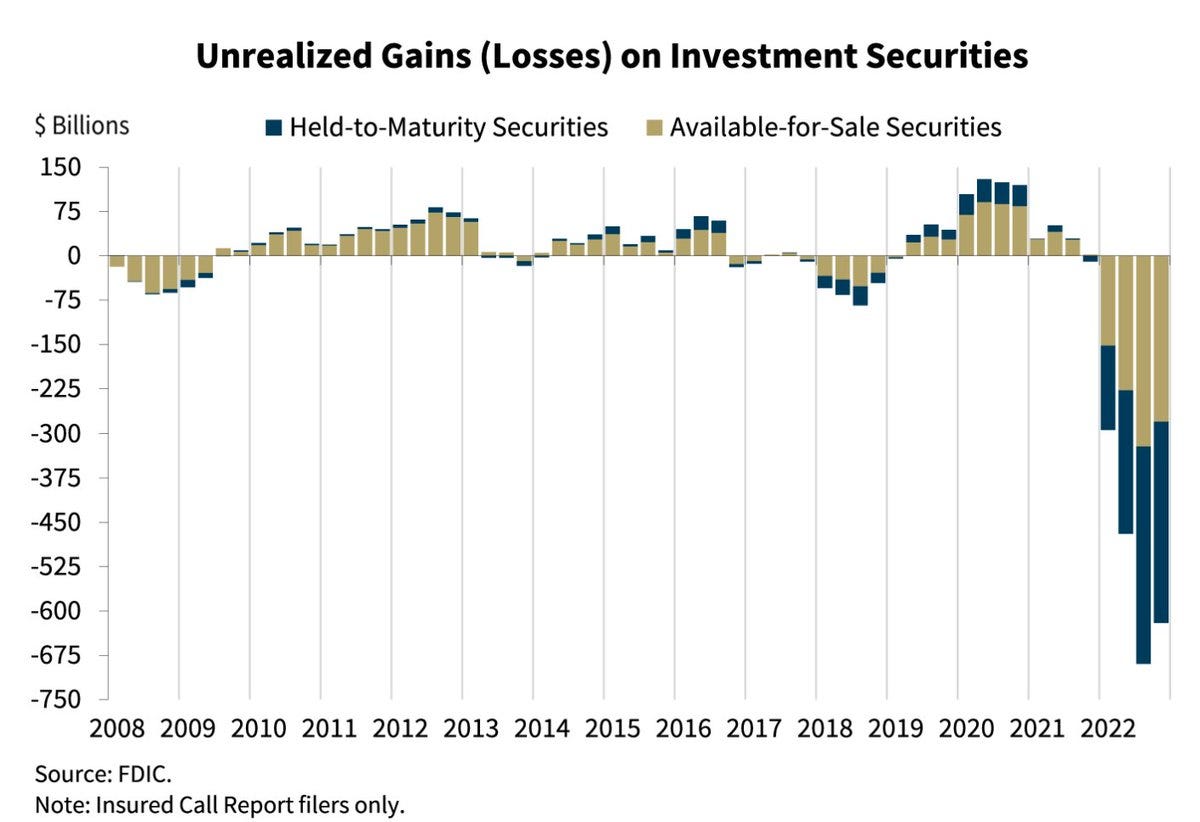

Silicon Valley Bank and many other financial organizations are all holding these long-duration bonds with low yields because of the investment decisions they made in a zero interest rate environment. As these assets have traded down in value because the Fed is increasing interest rates aggressively over the last 12 months, the banks are technically underwater on their investments.

Joseph Wang tweeted “a graph from the FDIC's recent quarterly report showing that banks have a few hundred billion in unrealized losses on securities.”

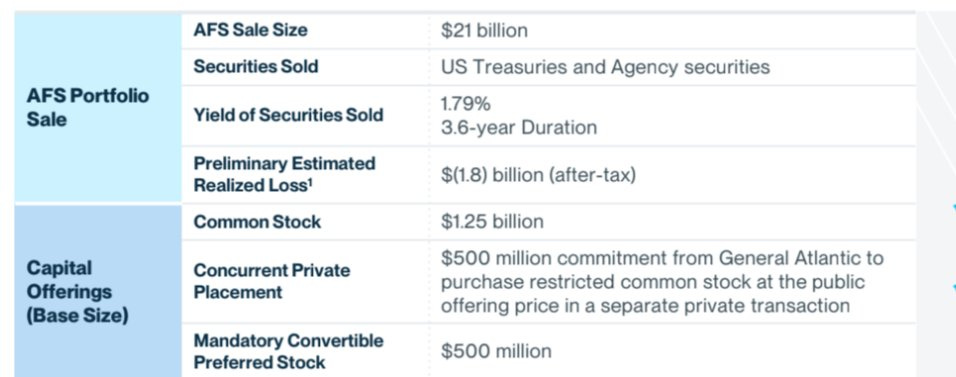

Not a good situation. But Silicon Valley Bank recently had to crystalize some of these losses in order to reduce risk and put the bank in a better financial position. Samir Kaji pointed out that SVB’s sale of $21 billion in medium-duration securities created a $1.8 billion loss for the organization.

This wouldn’t be a huge deal normally, but we are living through uncertain times. Add in the fact that Silvergate Bank announced their intention to wind down operations and liquidate assets due to a duration mismatch in their portfolio and it is easy to see why SVB customers began to get a little uneasy. But SVB then made a second unintended mistake — they announced a large capital raise this week.

The bank publicly stated that they were taking on $500 million from General Atlantic and would simultaneously conduct a $2.25 billion equity and debt offering to raise additional capital. Sounds fine, right? Ehhhh.

Investors and customers just saw a financial organization with unrealized losses measured in the billions have to crystal a multi-billion dollar loss, which happened right after a similar business had to wind down for the same reason, and now that financial organization is trying to raise approximately $3 billion to help solidify their financial position. You can’t yell FIRE! in a movie theater, but you sure as hell can withdraw your money from the bank in an abundance of caution.

And that is exactly what began to happen yesterday. Founders and venture investors started to aggressively withdraw funds, which puts additional pressure on SVB to sell their underwater securities and crystalize losses in order to honor those withdrawal requests. It is a reinforcing mechanism that has each withdrawal putting the bank in a worse financial position, which leads to more people wanting to withdraw, which adds more stress to the finances of the organization.

So what is the current state of SVB? The stock is down almost 70% in pre-market trading. There has been a complete destruction of market cap in the last 36 hours. The stock is now halted and CNBC is reporting that the bank has hired advisors to help them sell the business after they failed to raise enough capital to shore up their financial position.

This is one of the historic downfalls of a regulated bank in the United States. Thankfully, it appears that depositors will be unaffected and only equity shareholders will deal with repercussions of the situation. The 16th largest bank in the country will have a new owner in the coming days or weeks — all of this because of a nearly impossible economic environment to navigate.

It is hard to watch this happen. Silicon Valley Bank has been an incredible partner to Silicon Valley and the technology industry for decades. There are very smart, hard-working, genuine people who work there. They have always done the right thing in my experience, including going above-and-beyond the normal course of business to help their customers. The tech industry is better off with a strong Silicon Valley Bank, but this week is a rough one for the legendary institution.

To be clear, this situation with Silicon Valley Bank is not exclusive to them. Every bank in the United States is in a similar situation. If there is an accelerated withdrawal tempo, these banks will come under immense stress. They are all holding long-duration assets that were bought in a zero interest rate environment and now those assets are under water.

You could even go as far as to say that the Federal Reserve, and their constant intervention in the market, has created this situation. They artificially held interest rates at 0% and banks were forced to search for yield by buying longer duration assets. Then when the Fed reversed course and increased interest rates to over 4%, these banks are left holding the bag.

As I have continued to reiterate in my letters to each of you over the last few months, it is impossible for banks, companies, and individuals to plan their life when there is constant central bank intervention. It may sound like I am exaggerating when I say that the central bank’s decision has put every single bank and financial institution in a high-risk position, but I’m not joking. The distortion of free markets changes the incentives and forces companies to make bad decisions. It ultimately hurts individuals and organizations in the long run.

This story is not over yet though. There is immense issues in the financial system lying under the tip of the iceberg. As Nick Gerli points out, the contraction in money supply “has only happened 4 previous times in last 150 years. Each time a Depression with double-digit unemployment rates followed.”

Keep paying attention to what is happening. The Fed will likely continue to raise interest rates in the coming months, so that will add more complexity and chaos to the market. When you whip people from a low interest rate environment to a high interest rate environment, it is impossible for things to break. No one thought the things to break first would be US-based, regulated banks though.

Stay safe out there. Keep your head on a swivel. Hope you all have a great weekend. I’ll talk to everyone on Monday.

-Pomp

Want A New Job?

My team and I have helped almost 2,000 people get a new job in the bitcoin and crypto industry. A big part of our success has been a training program we run, which teaches people the fundamentals of the industry and technology. If you are interested in transitioning into this new sector, I recommend you check out the training program for our April cohort.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post