Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

To investors,

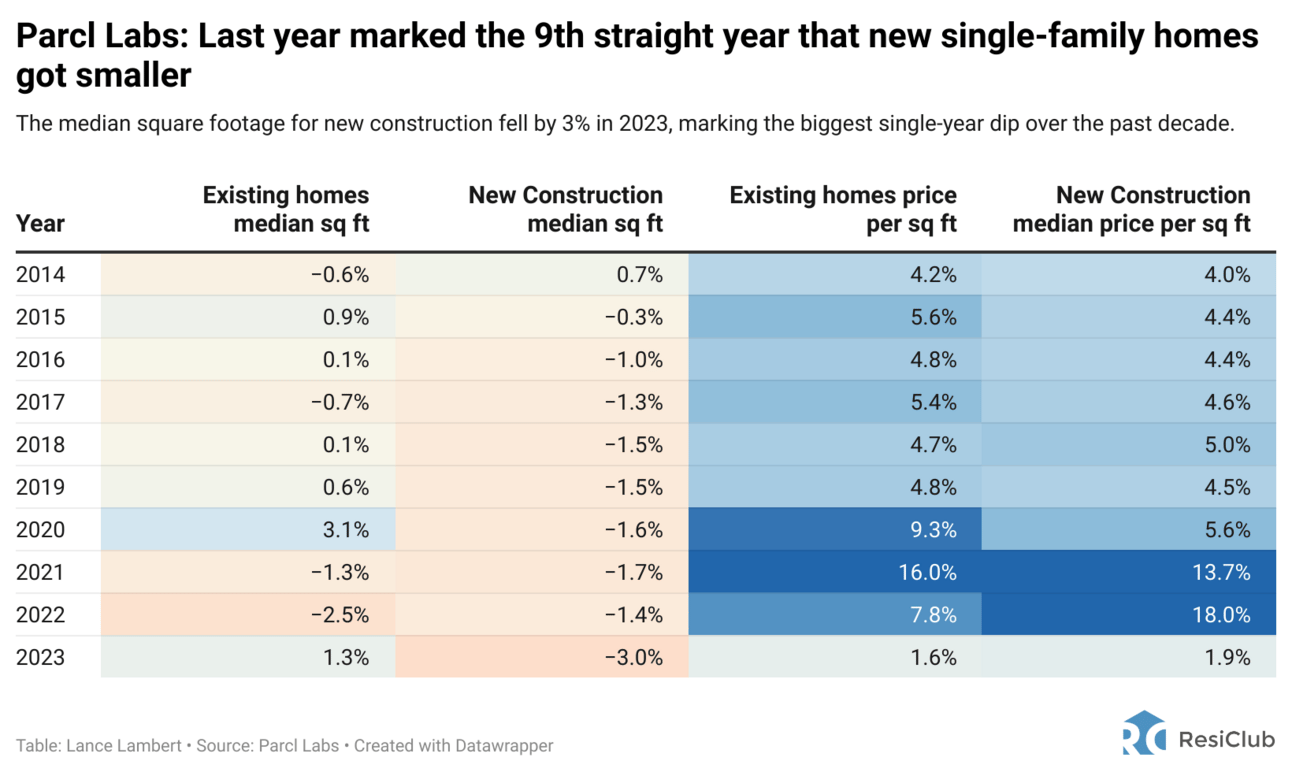

Everyone saw inflation spike in 2021 and 2022. You could feel it in the economy. Goods and services got more expensive. A single meal at a restaurant would shock you. Filling up your car at the gas pump became a horror show. The world had gone crazy and you were left wondering when it would end.

Now that inflation’s year-over-year growth has dropped significantly, many people are being lulled into believing things are going back to normal. That is not true. Majority of those price increases are not going to come back down. We have simply entered a new normal.

But there is another trend that you must be aware of — shrinkflation. Historically, this term has referenced manufacturers who sell goods at the grocery store putting less goods in their packaging, even thought they still sell the item for the same price.

We are now seeing this trend clearly playing out in the housing market. Yes, home builders are building smaller homes at the same prices! ResiClub’s Lance Lambert wrote a guest post below that breaks down exactly what is happening. (You can subscribe to read Lance’s analysis daily by clicking here). I hope this is helpful as you all try to better understand what is happening in the US economy.

Lance Lambert: On last month’s earnings call, D.R. Horton CFO Bill Wheat told analysts that “to adjust to changing market conditions during fiscal 2023 and into fiscal 2024, we have increased our use of incentives and reduced home prices and sizes of our home offerings, where necessary, to provide better affordability to homebuyers.”

In 2023, D.R. Horton reduced its average square foot by 3%. Heading forward, the nation’s largest publicly traded homebuilder told investors that they expect “continued gradual moves down from a mix shift perspective in terms of average square footage.”

In economics, there’s a term for when a business reduces the size or quantity of a product while keeping the price roughly the same: Shrinkflation.

To find out just how much shrinkflation might be occurring in the new construction sector, ResiClub reached out to Parcl Labs, a fast-growing real estate analytics firm, to get the hard data.

Before delving into the hard data, it's important to emphasize that ResiClub isn’t implying anything negative by our use of “shrinkflation.” From an economic perspective, it makes sense that a rapid deterioration in housing affordability—with mortgage rates rising from 3% to over 6% in 2022—would lead builders to opt for strategies that could, at the margins, keep affordability in check and maintain sales.

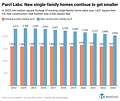

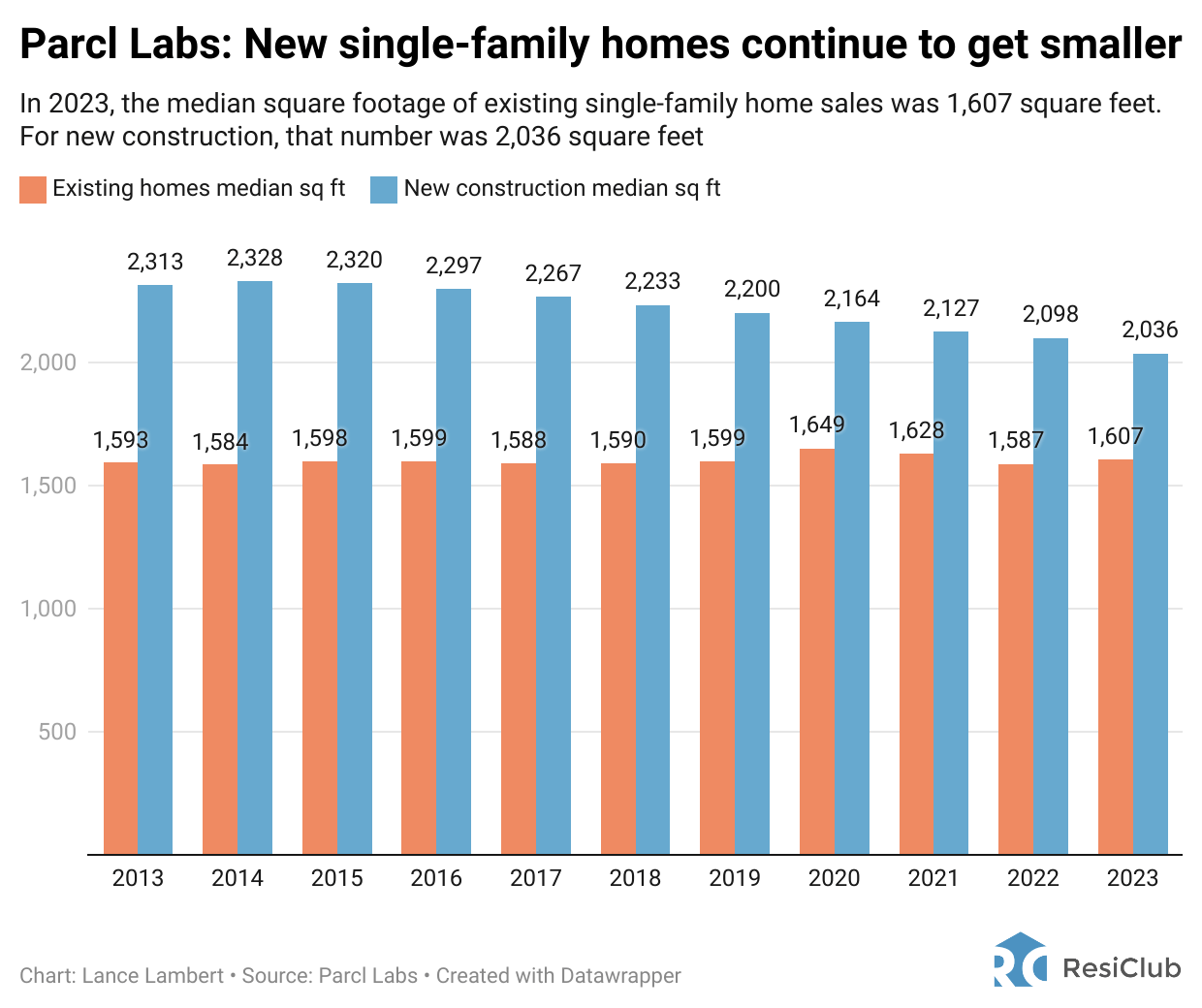

According to Parcl Labs, the median square footage for new construction fell from 2,098 in 2022 to 2,036 in 2023. That 3% year-over-year decline marks the biggest single-year dip over the past decade.

So it isn’t just D.R. Horton. A lot of homebuilders are reducing size.

The trend has been accelerated by strained housing affordability; however, new construction was already getting smaller before mortgage rates spiked.

In fact, Parcl Labs data shows that 2023 marked the 9th straight year that new single-family homes got smaller, going from a median square footage of 2,328 in 2014 to 2,036 in 2023.

“While the median size of single family home square footage has remained constant over the last 10 years, with a notable exception being during the pandemic where larger homes were trading hands as consumer preferences shifted from urban environments to suburban environments, new construction footprints have declined over 12% over the last 10 years,” writes Jason Lewris, co-founder of Parcl Labs.

While passing through Elm Trails, a community being built by Lennar in San Antonio, Scott Davis took the photo above last year. Single-family homes in the community range from just 350 square feet to 660 square feet and were priced last year from $135,000 to $171,000.

In the grand scheme of the U.S. housing market, tiny home communities like Elm Trails are still outliers. However, Davis, who is the president at Location Strategy, a real estate consulting firm, has seen more builders consider smaller lots and homes given the ongoing affordability crunch.

“Over the last few years we have seen home sizes decline slightly in response to pricing pressure. But that's after 40 years of increasing home sizes. What's new is builders are now going small—building homes that are similar to what we saw in the very early postwar suburbs. Builders are responding to more than price; the move to smaller houses is a result of demographics: more single households, fewer children and families having children later in life. Lack of buildable land is also a factor—builders have been pushed to sites previously considered undesirable for single-family [homes] where more lenient restrictions allow them to experiment with products that are more affordable and more responsive to the needs of a broader array of consumers,” Davis tells ResiClub.

In the view of James Hughes, a land developer in Charleston, S.C., this gradual shift to smaller lots and smaller homes is being pushed more so by “entitlement groups” who are trying to get as much development into the building plans as possible before exiting at top dollar.

“The market has been flooded with high density sites from entitlement groups. Entitlement groups are not land developers and they aren't home builders. These entitlement groups put land under contract, get the required permits, and have the site engineered. Then they sell "paper lots" to land developers and home builders. Land developers and home builders don’t necessarily want the high density, but that's what's on the market,” Hughes tells ResiClub.

Hughes added, “This is one factor contributing to smaller footprints.”

NOTE: If you would like to receive more analysis on the residential real estate market every day, you can subscribe to Lance Lambert’s ResiClub by clicking here.

Anthony’s Reaction: It is not surprising to see producers of any good or service trying to use shrinkflation to their advantage. Home affordability has reached a horrific position, so there are only so many options that the home builders have. It is not ideal to have an economy where the average family can’t afford a home. This is what happens when a debt-fueled, growth-at-all-costs approach is taken. Hopefully we can reverse the trend, but I am not holding my breath. Hope you all have a great day. Talk to you tomorrow.

-Anthony Pompliano

READER NOTE: I am hosting a webinar Wednesday Februrary 14th at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a massive amount of data, charts, and graphs to explain the US economy, inflation, the global liquidity situation, and where I think various asset prices are going in the next 24 months.

You can join us by becoming a paying subscriber here. I will send out the Zoom link to all members. Thank you.

Alex Kruger is a trader from Argentina, and he continues to figure out what is going on in the macro economic world, along with cryptocurrencies.

In this conversation, we talk about why he is incredibly bullish on risk assets, relationship between Milei, Bukele, Trump, Zelenskyy, United States national debt, bitcoin, cryptocurrencies, how he evaluates assets, and portfolio construction.

Listen on iTunes: Click here

Listen on Spotify: Click here

Trader Alex Kruger Explains Why Bitcoin ETF Is A Trojan Horse

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Shrinkflation Has Seeped Into The Housing Market - What You Need To Know