Today’s letter is brought to you by Consensus

Consensus is Crypto’s Most Influential Event

20,000 of the world’s most ambitious builders and boldest investors are coming to Consensus to make connections and shape the future of the digital economy in Toronto this May 14-16, 2025.

Here’s a glimpse at what’s ahead:

New! Bitcoin & Mining Summit: Discover Bitcoin’s potential with insights on energy, hardware, L2s, ETFs, and more

World-Class Content: Gain and grow with firsthand advice from 400 expert speakers on Web3, Crypto, and AI

Business & Dealmaking: Shake hands and set meetings onsite with high-caliber VCs, institutions, startups, and enterprises

With over ten years of seeing tens of thousands of attendees, Consensus remains your best bet for market-moving intel, meaningful connections, and career-defining deals. You can’t afford to miss it.

To investors,

Technologists are assaulting Wall Street and it looks like the technologists are winning. Nowhere is this more obvious than Robinhood, the commission-free investing platform started in 2013.

The $40 billion market cap business is using software to attack every corner of the legacy financial system. But the ride hasn’t been completely smooth since they went public in 2021. The stock debuted at $35, ran up and peaked at $55 in August 2021, and then fell to $7 by the summer of 2022.

Not exactly the start to your public market life that company CEOs dream of.

But the good news is that Robinhood has been shipping products, driving solid financial performance, and they have risen from the dead.

So what exactly is driving this financial performance?

In my opinion, Robinhood has perfected the Costco model for finance. They are offering every financial service you could imagine for the lowest cost possible. We already know they have no commissions on trading. The finance app also launched a $5 per month subscription service called Robinhood Gold that gives members up to 4% on their uninvested cash, extended trading hours, and interest-free margin borrowing.

All that for only $5 a month is basically a no brainer. Like I said, Costco of Finance.

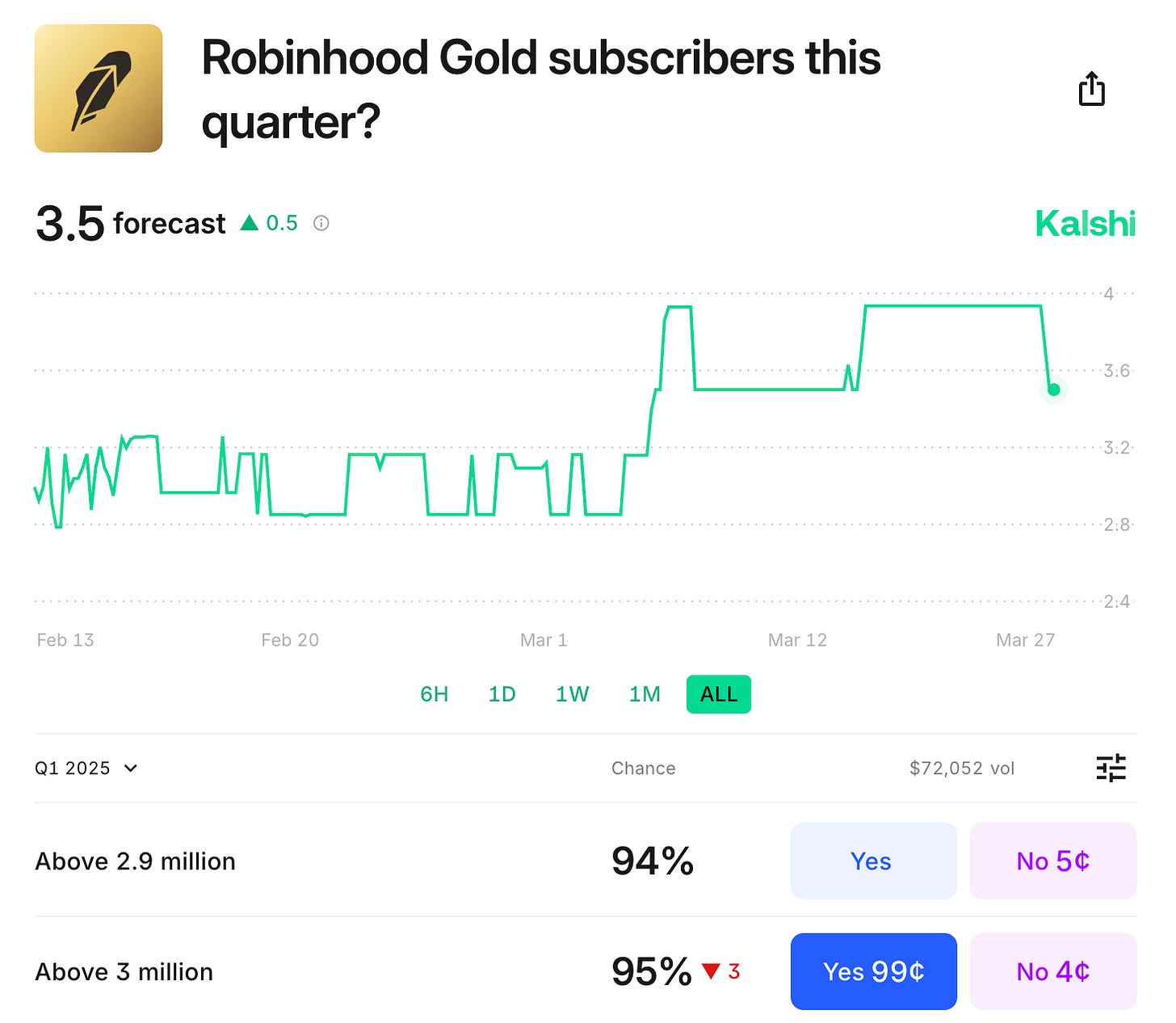

Prediction market Kalshi is showing 95% odds that Robinhood reports more than 3 million Robinhood Gold subscribers this quarter.

Yesterday the company took it a step further — Reuters writes the company launched “'Robinhood Strategies' — a wealth management service with a 0.25% annual fee, capped at $250, for its premium 'Gold' subscribers.

Users with as little as $50 in investments can access portfolios of exchange-traded funds managed by Robinhood's investment experts.”

And if that wasn’t good enough, the fintech also launched a new feature where you can have physical cash hand-delivered to your front door. It is going to be hard for legacy banks to compete if software companies are able to pull off intricate services like that.

So this brings me to the question of whether Robinhood is a good stock or not. Rather than pontificate on the question myself, I asked Perplexity AI to become a professional stock market analyst and then evaluate HOOD 0.00%↑ stock.

Here is what Perplexity told me:

Robinhood Markets (HOOD) has shown resilience and strategic evolution in 2025, but its stock carries distinct advantages and risks. Here’s a balanced analysis of its pros and cons:

Pros

1. Expanding Product Ecosystem

Launched Robinhood Legend, a new web-based platform with advanced tools like Level II market data and upgraded charting for active traders.

Plans to introduce index options and futures trading on mobile, broadening its asset offerings beyond stocks, ETFs, crypto, and event contracts (e.g., presidential election derivatives).

Growing focus on cryptocurrency and prediction markets, aligning with fintech innovation trends.

2. User Growth and Retention Incentives

Robinhood Gold ($5/month) offers a 3% IRA contribution match (vs. 1% for basic users), high-yield cash sweeps (4% APY), and interest-free margin borrowing up to $1,000.

Presidential election event contracts and crypto trading attract retail investors seeking speculative opportunities.

3. Financial Resilience and Analyst Confidence

Rebounding as Yahoo Finance’s “Comeback Stock of the Year” after a 90% post-IPO decline, with revenue at $1.87B and gross margins of 71.2%.

Major banks like Deutsche Bank and Barclays raised price targets (up to $54–$60), citing strong Q4 2024 trading volumes and crypto activity.

4. Retail-Friendly Features

Zero-commission trading, fractional shares, and an intuitive interface remain core strengths.

Free stock rewards and recurring investment tools enhance accessibility for new investors.

Cons

1. Limited Sophistication for Advanced Traders

Research tools and screening capabilities lag behind competitors like Charles Schwab, despite recent upgrades.

No mutual funds or bonds, restricting portfolio diversification4.

2. Revenue Dependency on Volatile Streams

Heavy reliance on payment for order flow (PFOF) and crypto trading fees, which are sensitive to market volatility and regulatory scrutiny.

Meme-stock trading restrictions in 2021 eroded trust; transparency around outages and order routing remains a concern.

3. Profitability Challenges

Pretax profit margin at -59.5% (despite a 21.8% net margin), signaling unresolved operational costs.

Stock price volatility: Forecasts suggest a potential drop to ~$42 by April 2025 before recovering, reflecting market skepticism.

4. Regulatory and Competitive Risks

Event contracts and crypto offerings face regulatory uncertainty, particularly under shifting political administrations.

Competitors like Public and J.P. Morgan now offer similar zero-commission models, diluting Robinhood’s first-mover advantage.

Summary

Robinhood’s 2025 strategy emphasizes innovation (e.g., Legend platform, crypto expansion) and user retention (Gold perks), buoyed by analyst optimism. However, its reliance on speculative trading, uneven profitability, and regulatory headwinds pose risks. While the stock could capitalize on retail trading resurgences, investors should weigh its high volatility against long-term scalability challenges.

Not bad for an artificial intelligence stock analyst, right? As I mentioned in the open, technologists are assaulting Wall Street. Robinhood is doing a great job creating products to serve their customers. Other platforms like eToro, Public.com, and Webull are doing their best to do the same thing. The real winner in this cutthroat competition is the user.

They get better services at cheaper prices.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Nik Bhatia on Bitcoin Making Everything Cheaper With Bitcoin

Nik Bhatia is the Founder of the Bitcoin Layer, and the author of a brand new book called “Bitcoin Age.”

In this conversation we talk about bitcoin, it’s relationship between the dollar and other traditional assets, why self-custody is protected under the first amendment, what the US government should be doing with bitcoin, how they plan on helping the middle class, and what Nik thinks the future looks like.

Enjoy!

Podcast Sponsors

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit here to learn more.

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more at www.reedsmith.com.

Franzy - Ready to leave the 9-to-5, start a side hustle, or expand your portfolio? Franzy is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot - a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post