Today’s letter is brought to you by Cal.com!

What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)?

We are all early investors in Cal.com and we use it instead of Calendly. Cal.com is the leading open-source scheduling platform, which gives you the same superpowers of efficiency previously reserved for elite corporations and tech gurus.

Stop wasting your time with scheduling software that doesn’t work. Use technology to make your life easier.

Cal.com is transforming sophisticated calendar management into an accessible tool for all via a user-friendly interface. Set up is quick, easy, and you will never go back to your boring calendar tool.

Exclusive for Pomp Letter subscribers, use code “POMP” for $500 off when you set your team up with Cal.com. Save time. Save money. Use Cal.com.

To investors,

There was peak hysteria at the top of the market in 2021. Most people were convinced that stocks, real estate, bitcoin, and other assets could only go up. Amid that chaotic environment, there were a few sane voices that issued words of caution.

Lux Capital’s Josh Wolfe was one of them. Here was the tweet that caught my eye back then:

At the time, I agreed with Josh that the market was frothy, but I disagreed with his conclusion that young people would get wrecked by a market correction. In fact, I made the opposite argument. I wrote on December 1, 2021 to each of you the following in a letter titled Young People Have Lived Through More Market Downturns Than Any Other Generation In History:

“The public narrative is that young people have never experienced a market downturn. The older generations, the cynics, and the persistent bears like to propel a narrative that asset prices are being pushed up by young, naive investors who have never seen a bear market. That simply isn’t true though.

The generation of investors who are under the age of 35 have actually lived through worse financial markets than any other generation of financial investors. How many of them can claim to have lived through at least five market downturns in 12 years? Additionally, how many folks in the older generations can say they lived through an 80-95% market downturn and didn’t sell their assets, but instead bought more?

Young investors are the most resilient investors in history. They truly have diamond hands. The incumbents don’t have the stomach for this type of volatility. You could actually argue, digital natives are just built different. They store majority of their wealth in assets that have 80 vol and fluctuate 5-10% a day.

This is what happens when we live in a world with undisciplined monetary and fiscal policy. The young people refuse to play the game based on old rules. They understand that bear markets in the stock market have been outlawed and market corrections are banned. The central bank and politicians have to step in every time and prop up asset prices. And alternative assets, like bitcoin and cryptocurrencies, are the only honest market left.”

My perspective was not popular at the time. The commonly held belief by people in traditional finance is that market corrections hurt retail investors, but can be navigated by expert financial minds. This thought process presents the idea that inexperienced investors will simply get shaken out of their positions and sell at an inopportune time of market despair.

That may have been true in past market cycles and with other asset classes, but as I said — bitcoin holders are built differently.

Since my letter in December 2021, we have seen Wolfe’s prediction of a market crash play out. The S&P dropped about 25% from the market high to the market low in October 2022. Bitcoin was much more volatile. The digital currency dropped from a high of $69,000 to under $17,000 within less than a year.

This nearly 80% drop in bitcoin was right in line with my analysis from previous market crashes.

So what did these young, digitally-native investors do? Did they fall victim to human nature and sell in a panic as prices fell? Or did they brush off the market crash as a nothing burger as I had predicted they would?

Two years later we finally have our answer — bitcoin holders have the strongest hands in financial markets.

First, we can see that more than 57% of all bitcoin in circulation did not move in the last two years. This means that nearly 2 out of every 3 bitcoin being held was unfazed by a drop from $69,000 to sub-$17,000, followed by a rapid rise from sub-$17,000 to nearly $45,000. That is a drop of 80% quickly followed by an almost 300% increase.

This would be an insane data point if it merely showed that bitcoin holders didn’t sell. But that is only the start of the story. These holders were not only refraining from selling, but they appear to have been buying aggressively once we got to the market bottom.

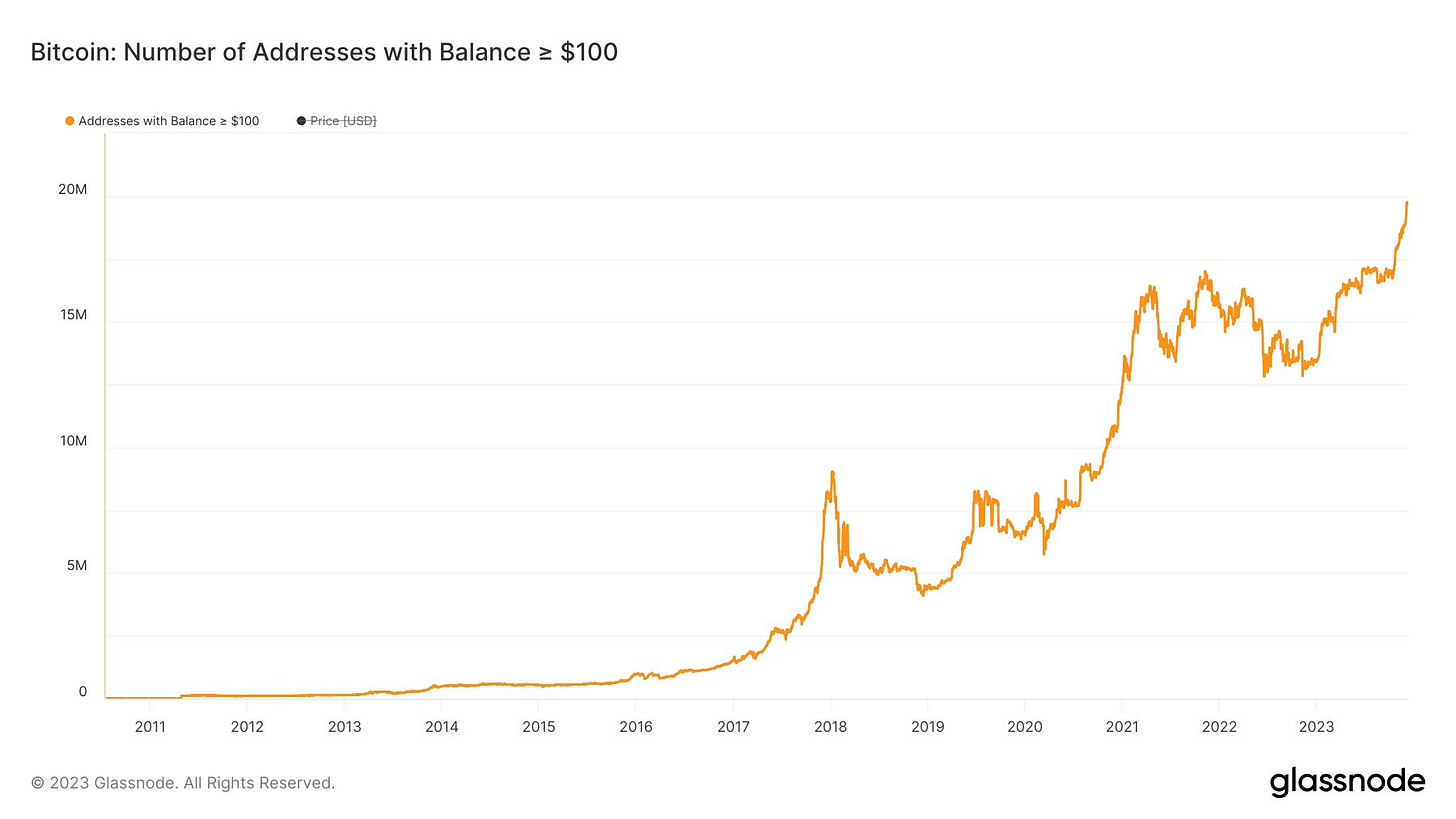

We can see that bitcoin wallet addresses with at least $100 of bitcoin have been growing aggressively since November 2022, including a severe acceleration in the last month that brought us to a new all-time high in the measurement.

So the market crash came as many intelligent people in the traditional financial world anticipated, but the young people allocated to bitcoin didn’t sell and instead began buying discounted bitcoin at the market bottom. I am not sure we have ever seen something like this before.

Many of you will ask why I think this has happened — my best answer is that the culture around bitcoin has taught holders to dollar cost average into the digital currency and then never sell. You see it in marketing materials. You see it in the memes online. At every turn, a bitcoin holder is having great financial discipline reinforced to them.

Yes, dollar cost averaging and never selling a great asset is financial discipline. Warren Buffett is famous for saying, “Our favorite holding period is forever.” Although he doesn’t like bitcoin, he has a lot more in common with the bitcoin holders than he realizes.

Ok, now we know that these maniacs are not selling, but what about the dollar cost averaging strategy?

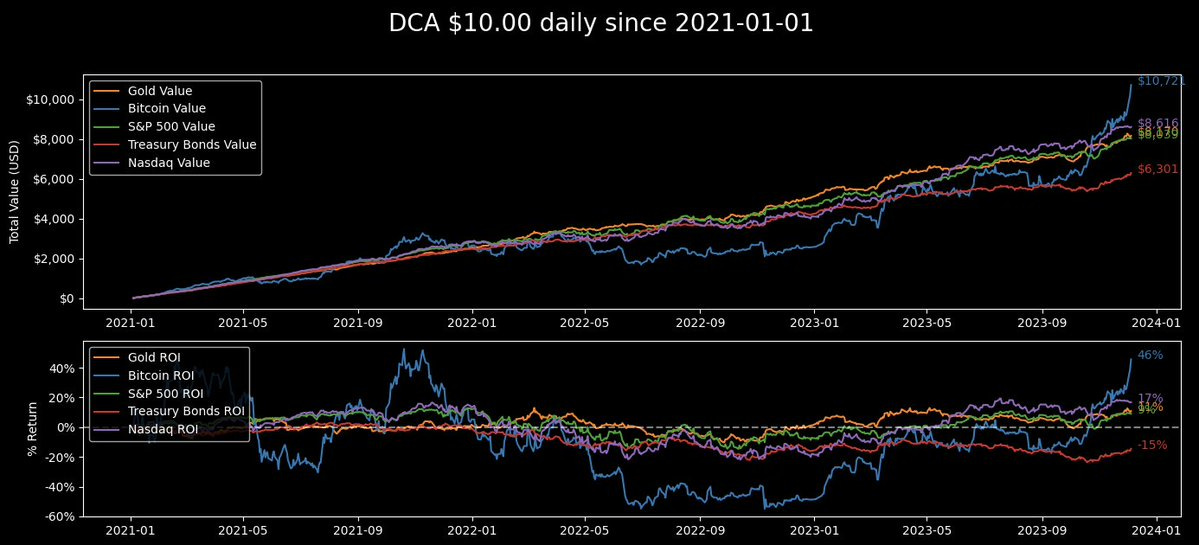

That includes buying throughout the bull market at elevated prices and buying as the price fell 80%. If you closed your eyes and didn’t look at the price of an asset, here is how you would have done across asset classes during this time frame:

Bitcoin: +46%

Nasdaq: +17%

Gold: +11%

S&P 500: +9%

U.S. Bonds: -15%

It is crazy to think that bitcoin has doubled the performance of these other assets, even though it had the largest drawdown by far.

This brings me to my conclusion from these various data points — bitcoin is disciplined financial investing codified. It takes the wisdom of Warren Buffett’s “never sell a great asset” and combines it with “keep buying over time regardless of price.”

Your financial advisor or wealth manager may not like it, but bitcoin has taught an entire generation to be fantastic investors. And just as I suspected, this generation used the bear market to make even more money.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin.

Peter Berg is a Managing Partner at M12, Microsoft’s venture capital arm. He leads the fund’s vertical SaaS invests & work. Peter is also a two-time founder, and most recently ran strategy & business development for Very Good Security.

In this conversation, we talk about corporate venture capital, success stories for M12 & his career, artificial intelligence, recent OpenAI news, and advice for founders & entrepreneurs.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Anthony Pompliano’s Fox Business Appearance From Friday

Podcast Sponsors

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post