This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

To investors,

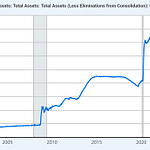

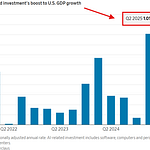

The current economic climate continues to get worse as millions of people are filing for unemployment each week and GDP falls further. The US government understands that the situation is dire, so they have done their best to inject liquidity into the economy. This has included various lending programs, asset purchases, and monetary stimulus packages directly aimed at helping businesses and individuals.

The last stimulus package was approximately $2 billion. It was obvious at the time that it wouldn’t be enough.

At the time of the package approval, I explained where the money was going and why this entire exercise was hard.

“Here are the high level details of the new deal:

There will be one-time checks sent to Americans under pre-determined income levels. Adults will receive $1,200 and children will receive $500.

There will be a significant increase in unemployment benefits, including new coverage for gig workers, freelancers, and other types of employees previously not covered. There will also be an increase of unemployment assistance of approximately $600 a week for four months as well.

There will be approximately $350 billion for loans to small businesses, which is intended to help keep more Americans on the payroll.

There will be around $500 billion in aid that is earmarked to be lent to corporations as part of a bailout effort.

The stimulus package has drastically increased in size (basically doubled) over the last few days, but the details that we know right now seem to be directionally positive. This is an impossible task for anyone, including politicians. They are being asked to come up with a highly complex solution for a highly complex problem, but to also do it while hundreds of millions of people are watching. Not to mention that they have to come up with the solution on a frantic timeline because people need help immediately.”

The exercise continues to remain difficult, because the current situation is so complex. There is a health crisis that is being evaluated based on inaccurate data. No one actually knows how many people have been infected. There are major questions about the death data as well. Either way, that health crisis has led to a government mandated shut down of majority of the economy. This reaction has now caused an economic crisis that has seen 30+ million Americans file for unemployment and thousands of businesses shut down for good.

The Democratic party believes that the situation is so dire that we need another $3 trillion of monetary stimulus to continue mitigating the economic impact. Yes, you read that correctly. If their most recent proposal was approved, there would be more than $5 trillion in stimulus in last than 90 days.

This doesn’t come as a surprise as you can see from this tweet in late March. The government was always underestimating how bad the economic carnage was. They were looking at various data points, but they weren’t talking to business owners on the ground. The data points are lagging indicators of the truth. The business owners were and are living it every day.

Before we get into the ramifications of the newest proposal, here is an overview of what is actually in the relief package:

Nearly $1 trillion in relief for state and local governments

A second round of direct payments of $1,200 per person, and up to $6,000 for a household

About $200 billion for hazard pay for essential workers who face heightened health risks during the crisis

$75 billion for coronavirus testing and contact tracing — a key effort to restart businesses

An extension of the $600 per week federal unemployment insurance benefit through January (the provision approved in March is set to expire after July)

$175 billion in rent, mortgage and utility assistance

Subsidies and a special Affordable Care Act enrollment period to people who lose their employer-sponsored health coverage

More money for the Supplemental Nutrition Assistance Program, including a 15% increase in the maximum benefit

Measures designed to buoy small businesses and help them keep employees on payroll, such as $10 billion in emergency disaster assistance grants and a strengthened employee retention tax credit

Money for election safety during the pandemic and provisions to make voting by mail easier

Relief for the U.S. Postal Service

Long story short, there are a lot of ways to spend $3,000,000,000,000. The Republican party is already publicly stating that there is no way that this proposal will be approved. The truth is that the package will likely grow in size, rather than shrink once the two political parties come to the table to negotiate. The latest $2 trillion stimulus package actually started out as a $1 trillion proposal before it doubled in size over a matter of days.

So how should we think about the actual uses of capital in the proposal?

I don’t actually think it matters. This is all funny money at this point. The US government is creating money out of thin air and they have no intention of paying attention to the national debt levels. We were on track to run a $1.5 trillion deficit this year, but now it looks like the deficit could be more than $5 trillion if we continue at the current pace. That would be an almost 25% increase in the national debt in a single year. Unreal.

The new stimulus proposal has approximately 1/3 of the money going to bail out state and local governments. This is out of a cartoon movie. The government is printing money to bail out the government. Why? Because state and local governments are incredibly poorly run and don’t have the financial balance sheets to withstand any sort of stress. Not only is their spending increasing to address the coronavirus and economic impact, but they are also seeing a significant decline in their revenue (taxes, fines, permits, etc).

These are unfortunate situations obviously. They may say more about the inefficient, bureaucratic nature of state and local governments pre-pandemic though. I always ask people “if you took a Fortune 500 CEO and put them in charge of your state or local government do you think they could do a better job than the current politicians?” I have never had someone tell me “no.” So the idea of printing money to hand to individuals that we know are historically horrendous allocators of capital feels like a weird way of lighting the money on fire.

Next, there is an extension of the beefed up unemployment benefits from end of July to January 2021. This additional $600 a week has created a scenario where many people are actually making more money on unemployment than they were at their previous jobs. The explanation for doing this originally was that the program would only last until July. As I stated at the time, it is really hard to give people free money and then take it away from them in the future. This is exactly what is happening right now. Politicians know that it is career suicide to take away benefits from people, especially during a time of crisis.

The extension of the additional unemployment payments through the end of the year will actually incentivize many people to not go back to work. This is a delicate balance. People are suffering in the short term. We have to figure out how to help them. They didn’t do anything wrong. They went to work every day, worked their asses off, and now find themselves unemployed because of an invisible enemy that shut down the country. On the other hand, there are serious implications to printing trillions of dollars and giving it to people. The incentive structures change. The capitalistic bent of our markets can disappear or erode.

This is why the current job of determining how much stimulus and for who is a nearly impossible job. You can’t please everyone. You will most certainly make mistakes. The goal is to make as few mistakes as possible and try not to be completely incompetent.

So where do we go from here?

The government is going to continue printing money and approving stimulus packages. They have no other choice. The people, both individually and through the media, are applying too much pressure. There will be lots of drama around the details, but ultimately the game theory points to one answer — print trillions of dollars and try to make people feel like you are helping them.

The dirty secret though is that all of these actions present the mirage of help in the short term, but they will crush the soul of a generation on the backend. It is simply impossible to print trillions of dollars and not see inflation over the long term. That inflation will drive the wealth inequality gap to the largest disparity that it has ever been. The 45% of Americans who can’t afford a $500 emergency payment will see their wealth decimated.

Welcome to the dark side of quantitative easing. It is the ultimate drug. You get high in the moment, but become addicted over time. Just as a drug ravages your body as you use it consistently, quantitative easing ravages a society as it is applied. The short term economic high feels great. Look at the stock market investors celebrating the recent rally in prices. But the long term impact destroys economies.

We have seen this happen over and over again in other parts of the world. The American mindset is that it would never happen here though. We are too smart. We are too powerful. We can’t fall from the top of the world order. But as we know, the greatest enemy in life is always yourself. And right now we are following the playbook of every great dynasty that has fallen before us.

We are devaluing our money at an accelerating pace. We are weakening ourselves economically. If we continue to do this, we will have to pay the price one day. That day may not be today or tomorrow, but it will eventually come. I’m not cheering for this to happen. I wish people would wake up and listen actually. We can reverse course. We don’t have to go down this path. I just don’t think that the people who are in charge care about the long term.

The average age of our political leaders is much higher than any other time in our history. This isn’t about ensuring that our country is strong and sustainable for hundreds of years to come. It is all about getting re-elected, going viral online, and having the egotistical satisfaction of having “won” at the negotiating table.

This isn’t a time for politics. We are currently engaged in an economic war. We don’t need stump speeches and pandering. We need strong leaders who are willing to do the unpopular thing so that our country doesn’t shoot itself in the foot.

Hopefully those leaders are out there and they’re listening.

-Pomp

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

The Art Market Is Projected to Grow Over $900 Billion by 2026: Jeff Bezos, Bill Gates, and other high-profile CEOs have been pumping approximately $65 billion each year into their collections. Why? Art has been one of the best investments of all time, outperforming the S&P by over 180% since 2000 alone—but reserved only for the ultra-wealthy. I have partnered with an exclusive platform called Masterworks that finally makes investing in multimillion-dollar masterpieces as easy as trading stock. Act fast and skip their 25,000 waitlist. Click here to sign up!

THE RUNDOWN:

JPMorgan Extends Banking Services to Bitcoin Exchanges: JPMorgan Chase JPM -3.27% & Co. has taken on two well-known bitcoin exchanges, Coinbase Inc. and Gemini Trust Co., as banking customers, according to people familiar with the matter, the first time the bank has accepted clients from the cryptocurrency industry. The move is the latest in a string of positive developments for bitcoin and another sign that Wall Street is becoming more comfortable with the business of cryptocurrencies. Read more.

Binance Invests in Regulated Indonesian Crypto Exchange: Binance is making a bet on the potential of the Indonesian crypto market, making an undisclosed investment into the Jakarta-based and regulated exchange, Tokocrypto. Binance, the crypto trading leviathan that doesn't like to reveal where it's based, announced Tuesday morning the funding would go toward growing Tokocrypto's business, such as building out new offerings and products, improving the tech stack, as well as expanding its customer base. Read more.

Novogratz: Now Is 'Perfect Timing' for Bitcoin: Mike Novogratz, founder and CEO of Digital Galaxy, says bitcoin "halving is really quantitative tightening." He thinks investors are considering digital currency because "the possibility that things go really poorly with classic monetary policy is rising." Read more.

House Democrats Unveil New $3 Trillion Coronavirus Relief Bill: House Democrats released their latest bill Tuesday designed to blunt the coronavirus pandemic’s devastating effects on the economy and health-care system. Party leaders expect to vote on the more-than-1,800-page package on Friday, along with a plan to allow proxy voting on legislation during the crisis. House Speaker Nancy Pelosi on Tuesday said Congress had a “momentous opportunity” to meet people’s needs, contending that “not acting is the most expensive course” as the GOP grows weary of taxpayer spending. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

This is an episode of The Pomp Podcast with host Anthony "Pomp" Pompliano and guest, Josh Wolfe, a cofounder of Lux Capital. His goal is to support scientists and entrepreneurs who pursue counter-conventional solutions to the most vexing puzzles of our time in order to lead us into a brighter future. Josh is one of the smartest investors that I know, so highly recommend this episode!

In this conversation, Josh and I discuss:

Finding the outcasts that build valuable companies

Why science is not based on consensusDeflation vs inflation

How censorship can stop innovation

Elon Musk & Tesla

Ray Dalio

Space travel & aliens

Bitcoin

I really enjoyed this conversation with Josh. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

We have started a new show exclusive to YouTube called Lunch Money. The goal is to cover current events in business, finance, and technology from the perspective of the every day citizen, rather than the talking heads on television. It is just as funny and entertaining as it is educational. Hope you enjoy it and make sure you go subscribe to the YouTube channel!

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

TaxBit automates your cryptocurrency taxes, enabling you to effortlessly track, calculate, and report your transactions. Get 10% off your tax plan today with a free trial by going to www.taxbit.com/invite/Pomp

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Blockset by BRD is your hosted blockchain infrastructure. Blockset enables enterprises and developers around the globe to deliver high-quality blockchain-based applications in a fraction of the time, at a fraction of the cost.

If you enjoy reading “Off The Chain,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.