This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

To investors,

Investing is a game of risk and reward. If you take intelligent risks, you can profit handsomely. If you take the wrong risk, the market can humble you quickly. This framework is important to remember as we enter a world where interest rates are hovering around 0% and the Federal Reserve has made it clear they won’t be increasing them any time soon.

This low interest rate environment creates a big problem for public pension funds. They are already heavily underfunded. According to The Pew Charitable Trusts data from fiscal year 2017 (the most recent data available), there is “a combined $1.28 trillion in state pension plan funding deficits. While massive, this was actually a decrease from Fiscal Year 2016’s $1.35 trillion gap.”

So how exactly did we get to this point and why are public pension funds so underfunded?

The issues are quite complex, so I am going to focus on only one of the major issues — investment returns. The National Association of Retirement Administrators (NASRA) describes the importance of investment returns best:

As of December 31, 2019, state and local government retirement systems held assets of approximately $4.8 trillion. These assets are held in trust and invested to pre-fund the cost of pension benefits. The investment return on these assets matters, as investment earnings account for a majority of public pension financing. A shortfall in long-term expected investment earnings must be made up by higher contributions or reduced benefits.

Each public pension fund has an actuary assumed rate of return. This is the percentage return that the plan is targeting on an annual basis in order to have enough capital in the future to fulfill the plan’s obligations.

The assumed rate of return is calculated using a complex formula, and it is different for each pension fund, but the average assumed rate of return for public funds is 7.3%, according to a survey by the NASRA. This means that the Chief Investment Officer and their staff need to attain a 7.3% annual return to keep the average pension fund on track to have the adequate amount of capital in the future.

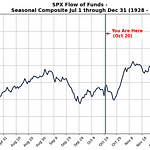

The last few years have been incredibly kind to these public pension funds. The average investment return for 2018 was 13.4% for all plans reporting that year, which was much higher than the 7.8% average return that occurred in 2017. Most of these increases in returns have been driven by (1) higher interest rates and (2) the longest bull market in stocks in history.

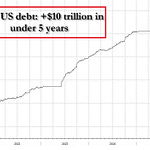

The world has changed now though. COVID-19 ushered in a lot of uncertainty, while also forcing the Federal Reserve and other organizations to take drastic measures in an attempt to deal with the ensuing economic shock. One of those drastic measures was to drop interest rates to 0% through two emergency rate cuts. This floods the market with cheap capital, but it also significantly decreases the return expectations of fixed income portfolios.

Who is one of the largest holders of fixed income portfolios? Public pension plans! So now we have a low yield environment that will create a drag on performance for a group of investors that are already under immense pressure to beat their 7.3% targets. In order to highlight what is happening, I am going to use the California Public Employees' Retirement System (CALPERS) as an example.

CALPERS is the largest public pension plan in the United States. They have almost $350 billion in assets under management, are responsible for the benefits for nearly 2 million beneficiaries, and employ almost 3,000 employees. This is not a simple operation by any stretch of the imagination and it is incredibly important that they come as close as possible to hitting their actuary rate of return every year.

CALPERS currently has 28% of their portfolio allocated to fixed income. This includes 15% in long-spread fixed income, 10% in long Treasury bonds, and 3% in high yield fixed income. The low yield environment means that more than 1/4th of their portfolio is likely to come under significant pressure now. So what are they going to do?

Rather than reallocate their funds to other asset classes or strategies, CALPERS is considering a move that would add incredible amounts of leverage to their fund and allow them to allocate this “new money” to illiquid assets. The Financial Times summarized it by saying:

“Calpers is to move deeper into private equity and private debt by adopting a bold leverage strategy that the $395bn Californian public sector pension fund believes will help it achieve its ambitious 7 per cent rate of return.

In a presentation to the Calpers board, Ben Meng, chief investment officer, said the giant fund would take on additional leverage via borrowings and financial instruments such as equity futures. Leverage could be as high as 20 per cent of the value of the fund, or nearly $80bn based on current assets. The aim is to juice up returns to help the scheme, the largest public pension in the US, achieve its growth target.

The move comes after a 2019 investment strategy review that found Calpers needed greater focus on the excess returns potentially available from illiquid assets compared with public equity and debt. Under Calpers’ previous asset allocation strategy it was estimated to have a less than 40 per cent probability of achieving its 7 per cent return target over the next decade.”

Why are they doing this? Well, they feel they really have no choice. The largest pension fund in the United States returned only 6.7% in 2019 and they currently sit around 70% funded (which means that they are behind where they need to be by 30%). Desperate times leads to desperate measures as the saying goes.

But CALPERS, and other public pension funds, don’t need to seek immense leverage to drive their target returns. The solution can be much simpler than that. Each of these pension funds should add a 1-5% allocation to Bitcoin. Yes, I’m dead serious.

Bitwise recently published a white paper that “explores the case for including a small but meaningful allocation to cryptoassets in a diversified portfolio. Specifically, it examines the impact that a 1%, 5%, and 10% allocation to Bitcoin would have had on a traditional 60% equity/40% bond portfolio since Jan. 1, 2014.” The study found that “allocating to Bitcoin would have significantly increased the portfolio’s risk-adjusted returns, assuming the portfolio was systematically rebalanced over time. This result was consistent across all three allocations using multiple rebalancing strategies.”

Sounds pretty good, right? The white paper goes on to state that “the potential impact was large: With a 5% allocation, for instance, the Sharpe ratio of the portfolio nearly doubled, total returns more than doubled, and the maximum drawdown was substantially reduced. The paper finds that Bitcoin’s unique combination of high potential returns and low correlations with traditional asset classes make it uniquely attractive as a diversifying asset for long-term investors.”

This is just math. There is no emotion in an analysis like this. I’ve actually been saying this since December 2018 (Bitcoin is up almost 3x since then). The qualitative argument is thrown out the window. It is as clear as possible — adding an allocation to Bitcoin would increase the risk-adjusted returns for a public pension fund.

The best part? CALPERS would not have to be the first to add the allocation. As many of you know, two of the public pension plans in Fairfax County, Virginia already invested in our funds at Morgan Creek. So why is this idea so controversial or at least not getting more air time in the public pension world?

In my opinion, it is way too simple. There is an incredible amount of intellectual olympics that goes on in the institutional investment world. Everyone thinks they are a genius. The goal is to seek alpha and find those who can create outperformance. But as you would expect, humans generally stink at beating markets.

Meb Faber, someone I find incredibly intelligent and who has come on the podcast previously, has a great post about public pension investing. In the piece, he states “CalPERS would have been just as well off just firing their whole staff and buying some ETFs. It would certainly make the record keeping a lot easier! And they would save a whopping $500 million a year on operating costs (2,700 employees) and another few hundred million on external fund fees. And you get to avoid all that nasty press on how much you are paying those evil hedge fund managers and their performance fees (disclosure, written by someone with two private funds).”

This has always fascinated me. There is an entire circus of suits and ties running around seeking a return profile that could be captured by simply buying ETFs over a significant period of time. Now I will be the first to say that investments in innovation, particularly venture capital, are probably the area of outperformance that still makes sense.

The best performing institutions have large allocations to venture capital as an example (GMO, Dietrich Foundation, etc). This requires courage though. It isn’t considered “safe” in the halls of large, conservative institutions. But ultimately, it is the main driver of returns. As my partners and I continue to say, returns come from investments in innovation. Even Jeremy Grantham, who recently was on the Invest Like The Best podcast, suggested that young people seek job opportunities in venture capital.

After the interview, host Patrick O’Shaughnessy wrote:

“The big idea that stuck with me was a surprising one coming from an investor known as a contrarian value investor focused on public markets: namely that young people interested in investing should go into venture capital instead of public markets or private equity. He says, "Private equity and regular investing is shuffling shares between one player and another. It doesn't change anything. I sell a share, you buy it, who cares?" His personal portfolio is 70% venture capital, which I did not expect at all!”

And you want to know where the greatest innovation is occurring at the moment? Bitcoin. There is a group of individuals who have built a $150+ billion asset with the goal of assuming the position of the next global reserve currency. If that happens, it will be the best performing asset for the next 20+ years. But even if that doesn’t happen, things will be okay.

About 8 months ago, we ran the numbers for a 1% allocation in Bitcoin on a 60/40 global portfolio. If you had invested 5 years prior and just held it, your portfolio return would have gone from 7.2% to 9.2%. This was a 200 basis point upside. If you had made the Bitcoin investment and it had gone to $0 in value (you lost all your money), your return would have dropped from 7.2% to 7%. This 200 basis point upside and 20 basis point downside type investment is the exact asymmetry that public pension funds need today.

They don’t need to panic and do ridiculous things like adding $80 billion of leverage to their portfolios. At some point we have to ask the question, “when does it become a violation of fiduciary duty if investment managers are levering up with enormous amounts of debt, yet they don’t have exposure to the best performing asset in the last 10 years?”

-Pomp

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

THE RUNDOWN:

JPMorgan Says Bitcoin Crash Survival Shows It Has Staying Power: In March, Bitcoin -- like many other areas of the market -- underwent a stretch of severe disruption as world economies started to shut down and investors fled riskier assets due to the coronavirus outbreak. But Bitcoin emerged relatively unscathed, according to a report from the bank titled “Cryptocurrency takes its first stress test: Digital gold, pyrite, or something in between?” Read more.

Quadriga Downfall Stemmed From Founder’s Fraud, Regulators Find: The collapse of crypto-exchange QuadrigaCX was the result of fraud by its founder Gerry Cotten, the Ontario Securities Commission concluded in an investigation. The Canadian securities regulator has taken the rare step of publishing its findings on its 10-month investigation into QuadrigaCX, whose collapse in 2019 caused at least C$169 million ($125 million) in losses for 76,000 investors in Canada and abroad. QuadrigaCX shut down in January 2019, weeks after Cotten died unexpected while on his honeymoon in India, leaving behind a mystery of what happened to the Bitcoin and other cryptocurrencies on the platform. Read more.

How an Art Collective Is Using Blockchain to Protest Police Brutality: A blockchain-centric art project is pushing the boundaries of modern art with a controversial digital display. The DADA Art Collective, a loosely affiliated group of roughly a dozen visual artists across the globe, teamed up with the non-fungible token marketplaces OpenSea and Mintbase plus the file-storage blockchain Arweave to publish the names and faces of American police officers accused of killing unarmed black people. Read more.

Hedge Fund Elliott Management Shifts to Elephant Hunting as Fund Size Balloons: In the past few years, a gradual but noticeable transformation has taken place at Elliott: The technology targets have gotten bigger. In 2019, Elliott bought stakes in eBay ($34 billion market capitalization), SAP ($159 billion) and AT&T ($217 billion market cap). This year, Elliott has already targeted Twitter ($26 billion market cap) and SoftBank ($93 billion). Read more.

Drug Dealer Just Sentenced to 25 Years Hoped to Build a Better Bitcoin Miner: Paul Calder Le Roux, an admitted drug dealer with a background in encryption, planned to build a bitcoin miner had he beaten the rap. In a last-ditch attempt to avoid incarceration, Le Roux wrote a letter to District Judge Ronnie Abrams, of the Southern District of New York (SDNY), this week detailing his personal history and addressing his alleged crimes. He was indicted on drug charges in 2012, pleaded guilty two years later and has been sitting in detention since. On Friday, he was reportedly sentenced to 25 years in prison, though he can appeal this decision. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Dustin Wilson is a Master Sommelier and a co-founder of Verve Wine. He was previously the Wine Director at Eleven Madison Park, a 3 Michelin-starred restaurant in New York City. Dustin was also featured in Somm, a popular documentary about the challenging Master Sommelier exam. We had a lot of fun recording this one, so hope you enjoy it!

In this conversation, Dustin and I discuss:

The Master Sommelier process

How he built Verve Wine

The COVID-19 impact on the hospitality industry

The recent cheating scandal in the wine world

An overview of wine as an investment asset

His favorite wines

The most underrated wine region

Biodynamic wines

I really enjoyed this conversation with Dustin. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

We have started a new show exclusive to YouTube called Lunch Money. The goal is to cover current events in business, finance, and technology from the perspective of the every day citizen, rather than the talking heads on television. It is just as funny and entertaining as it is educational. Hope you enjoy it and make sure you go subscribe to the YouTube channel!

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Blockset by BRD is your hosted blockchain infrastructure. Blockset enables enterprises and developers around the globe to deliver high-quality blockchain-based applications in a fraction of the time, at a fraction of the cost.

If you enjoy reading “The Pomp Letter,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.