To investors,

There was more than a 70% chance of a recession occurring in 2023, according to Kalshi prediction markets in July 2023. Not only did the recession never come, but nearly one year later the same Kalshi market is predicting an 8% chance of a recession throughout the rest of 2024.

People are obviously feeling good about where the economy is at the moment. Another way to gauge the positive sentiment is to see how low the odds are of inflation running higher.

For example, most people don’t see a world where inflation will be higher than 3.5% year-over-year based on April’s report.

If you are one of the people who believe inflation will come in higher than the predicted 3.5%, you can wager $100,000 to win more than $800,000 in profits.

This is fascinating because the Bureau of Labor Statistics reported a 0.4% increase in CPI month-over-month in March. Inflation has been accelerating for months, yet people continue to believe that the year-over-year number will remain at 3.5% or lower.

Some of this disconnect between the data and people’s perspective could be a psychological scarring from the last few years. We saw inflation eventually peak at over 9%, which will leave a lasting impact on the way people think and how they behave.

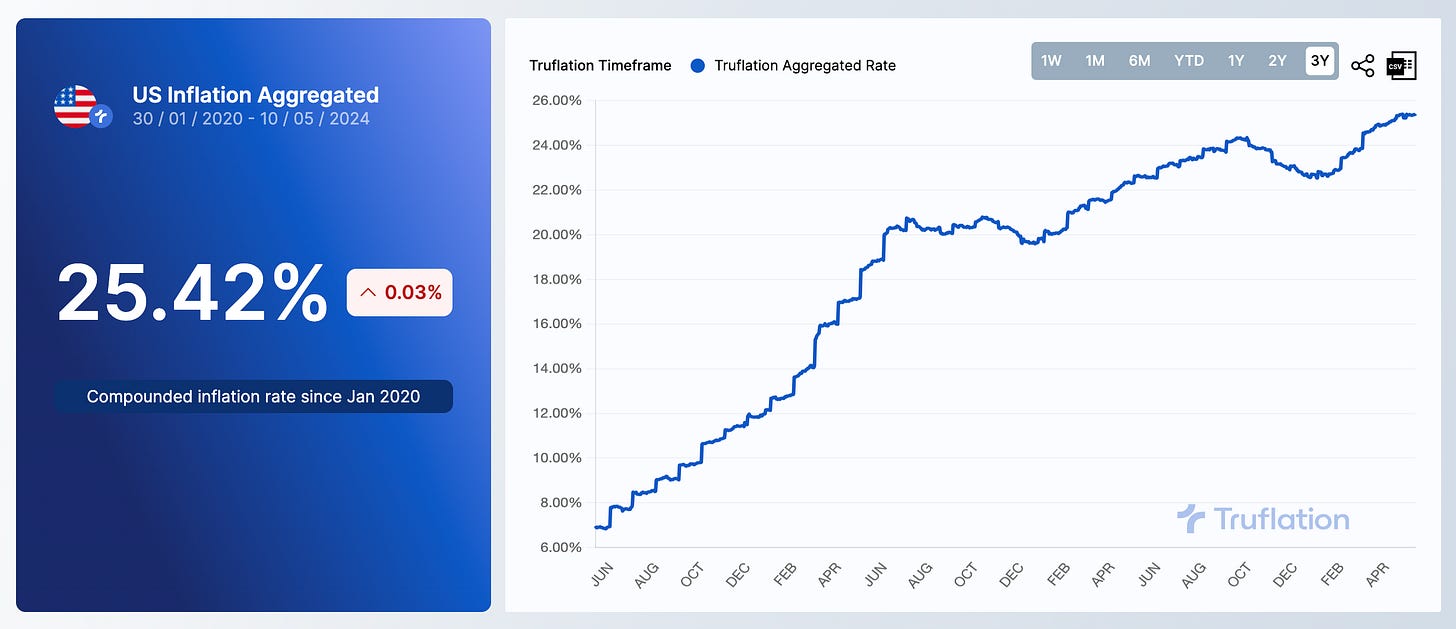

While all of this has been going on, the US dollar has lost purchasing power. Truflation estimates that the aggregated inflation since 2020 is more than 25%.

At the same time, bitcoin has done a fantastic job of protecting and increasing citizen’s purchasing power. The asset is up more than 200% over the last year.

So people feel positive about the economy. Inflation remains elevated and appears to be accelerating month-over-month. The US dollar is being devalued. Citizens are losing purchasing power. And bitcoin continues to be one of the best ways to provide economic protection to your hard-earned wealth.

Unfortunately, it looks like the bitcoin community is more right with each passing day. I say “unfortunately” because the vast majority of citizens around the world don’t hold bitcoin yet, so they are on the losing end of this situation.

Hopefully that will change in the coming years. Have a great end to your week. I’ll talk to everyone on Monday.

-Anthony Pompliano

Jihan Bowes-Little is the Co-Founder & Managing Partner at Bracket Capital, an investment firm focused on special situation opportunities in growth / late-stage private companies.

In this conversation, we talk about the similarities and differences investing in Coinbase, SpaceX, Stripe, landscape of private markets, financialization of venture capital, investing trends & sectors, cross-over investment example, market liquidity, bitcoin, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Bracket Capital’s Jihan Bowes-Little on Coinbase, SpaceX, Stripe, Bitcoin, and more

Podcast Sponsors

Core Scientific is one of the largest public Bitcoin miners and hosting solutions providers for Bitcoin mining in North America.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA.

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post