To investors,

This is my last letter to you of 2023. I figured I would leave you all with some alpha on how to put yourself in a better financial position during the new year. Below is a simple idea that will require no changes to your current investment exposure, yet can help you capture significant benefit thanks to new technology and innovation.

Before I explain what you can do, we must first understand how innovation works.

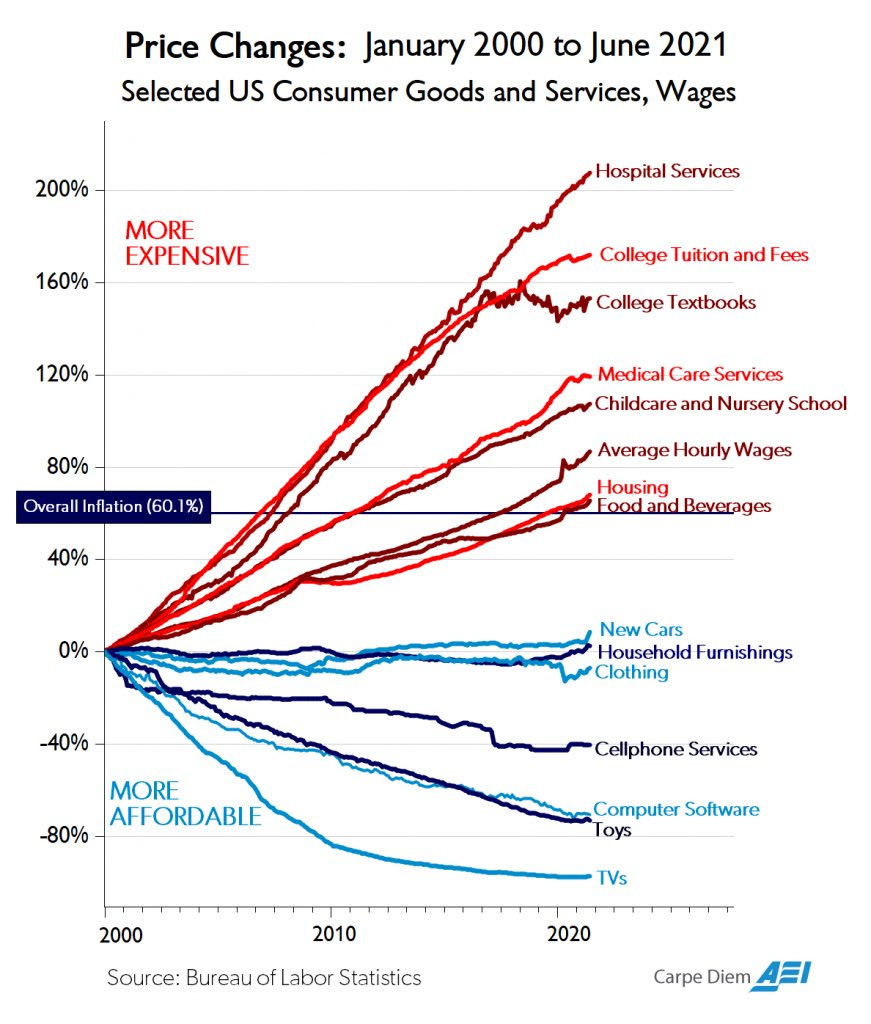

The promise of technology innovation is that costs come down causing a deflationary tailwind in society, while simultaneously democratizing access to products and services that were historically reserved for the wealthy.

You can see how innovation, particularly from the private sector, leads to cost decreases over time. Bureaucracy and the public sector have the opposite effect (red lines).

This phenomenon is worth paying attention to because I believe it is coming to financial markets in a big way over the next decade. We have already seen fractionalized shares, ETFs, and other innovations lead to more capital invested in markets, but there is an even more powerful trend on the way in my opinion.

Let’s use direct indexing and tax-loss harvesting as an example.

I previously invested in a company called Frec that allows investors to invest in the S&P 500 stocks and leverage technology to automate tax-loss harvesting throughout the year. Some people will call it artificial intelligence. Others will call it automation. The nomenclature doesn’t matter nearly as much as the benefit it provides to the average investor.

Here is how it works:

A key difference between buying the traditional S&P 500 index vs the same individual stocks via direct indexing is that an investor can now use tax-loss harvesting to significantly decrease their capital gains tax when they ultimately sell the exposure.

So why is this important?

Tax-loss harvesting previously required a sophisticated team to execute and could be extremely expensive. Essentially the wealthy were the only people able to access and afford this nuanced strategy.

The innovation that has occurred over the last few years is changing that. Frec and others can introduce new investment opportunities, bring costs down, and democratize access to tools and strategies.

If you want Frec to help you with tax-loss harvesting, check them out here:

Financial markets are riddled with data, so the explosion of technology related to artificial intelligence and automation is likely only beginning. We know that large financial firms such as Citadel and others have been making billions of dollars using some of these technologies for years, so imagine what happens when mass access is created for the average investor.

My expectation is that the Robinhood effect of fractional shares and low dollar amounts was only the beginning of a financial technology revolution. As the more sophisticated technology is brought down market, not only will it lead to more interest in investing, but the financial returns that the average investor can capture will be materially increased.

With Frec, they estimate a tax-loss harvesting amount equivalent to 40% of your invested capital over a few years. So if you invest $10,000, then Frec could generate a $4,000 tax savings bill. That sounds cool, right?

Imagine when the technology is not only focused on helping reduce taxes — eventually the technology will help to generate outperformance as well.

Remember, humans are arrogant enough to believe that we can outperform machines. The machines have proven us wrong in almost all aspects of our life so far. Finance will be no different. The costs will come down, the access to tools will go up.

Technology innovation is a net positive for the world. Frec is a great example. There will be many more over time. I hope each of you has a great end to the year. My wish for everyone is that 2024 will bring abundance and happiness to your lives.

Talk to everyone on Tuesday.

-Anthony Pompliano

Joe McCann is the Founder, CEO, & CIO of Asymmetric Financial.

In this conversation, we discuss meme coins & internet culture, bitcoin vs BONK, macro environment, portfolio construction, and meaning behind “full blown depression, or dog coins to a trillion.”

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Macro Trader Explains Bitcoin, BONK, Meme Coins, and Internet Culture

Podcast Sponsors

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.