Today’s letter is brought to you by Dream Startup Job!

Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative companies.

Search over 1,000 roles and apply quickly to cutting-edge companies like Traba, Varda, Eight Sleep, Flowhub, and many others.

If you're looking to join a team that is making a difference in the world, create a job-seeker profile in minutes and start applying for roles.

If you're a startup, post your open roles today or schedule a call with the Dream Startup Job team by clicking here.

To investors,

Paul Krugman is a famous economist who teaches economics at the City University of New York. He writes a column for The New York Times. And in 2008, he won a Nobel Prize for his work on international trade and the distribution of economic activity globally.

Krugman is also wrong in public A LOT. Take, for example, his analysis of the internet in 1998:

“The growth of the Internet will slow drastically, as the flaw in ‘Metcalfe’s law’—which states that the number of potential connections in a network is proportional to the square of the number of participants—becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.”

This could be cited as one of the all-time great bad takes. Not only does Metcalfe’s law remain intact, but Krugman’s analysis that “most people have nothing to say to each other” highlights a serious misunderstanding of how humans and societies function.

Krugman has not been a fan of bitcoin either.

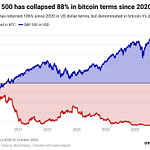

He wrote column’s titled Adam Smith hates Bitcoin and Bitcoin is Evil in 2013. The digital currency has appreciated thousands of percent since these inaccurate public declarations. That hasn’t stopped Krugman from doubling and tripling down on his disdain for bitcoin.

But nowhere has Krugman’s horrible takes been more apparent than on Twitter/X.

Yesterday, Paul Krugman gifted us with one of his best (worst!) takes in years. He tweeted a chart of CPI excluding food, energy, shelter, and used cars, while exclaiming that the war on inflation is over.

This is so ridiculous that it may not be worth responding to, but I honestly can’t help myself. The first problem is that Krugman is correct inflation is down as long as you don’t include anything we actually need to live, such as food, energy or shelter. That horrific take alone should be disqualifying, but I’m not done yet.

As for Krugman’s comment that “we won at very little cost,” he must be forgetting that we widened the income inequality gap, made housing unaffordable, and destroyed billions in retirement savings over the last three years. Again, not a big cost as long as you aren’t one of the hundreds of millions of Americans being affected by the undisciplined monetary policy coming from the Federal Reserve.

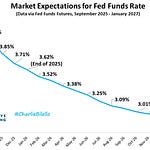

Lastly, the Bureau of Labor Statistics would like a word with the perpetually wrong economist regarding his commentary that the war on inflation is over. We saw a 0.6% increase in the month of August and a 0.4% increase in September of this year.

Not many people are arrogant enough to claim victory when inflation is still increasing by half a percent each month.

Now I don’t want to be too harsh on Paul Krugman. Everyone, including myself, is wrong in public if you play the investment game long enough. We shouldn’t condemn someone for inaccurate thoughts or predictions, especially since we are all trying to learn alongside each other, but we should vehemently call out the intellectual dishonesty that comes from a tweet like Krugman’s yesterday.

The inflation concern is not over. Our national debt is exploding to the tune of hundreds of billions of dollars per month at the moment, so the Federal Reserve and US government will be forced to debase the dollar in response given enough time. That easing of monetary policy, coupled with the recent month-over-month increases in CPI metrics, should be a word of caution to every economist.

Paul, if you’re reading this, buy some bitcoin, slow down on the ridiculous tweets, and stop fighting the inevitable. We either debase the currency to save our country and economy, or we risk falling victim to the same errors of past great civilizations.

Hope you all have a great weekend.

-Anthony Pompliano

Darius Dale is the founder & CEO of 42Macro.

In this conversation, we talk about their Weather Model, economy & financial market conditions, how US fiscal policy reacts to conflicts around the world, and how investors can think through various outcomes.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

How Markets Are Reacting To Global Conflict

Podcast Sponsors

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Velo Data: Do you want faster, easier crypto data? Sign up for Velo Data, a new product that we have been working on to solve this problem.

Base: Base is shaping the future of the onchain world with near-zero gas fees and rapid transaction speeds.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.