To investors,

The NFT industry has exploded in popularity this year. There was more than $2.5 billion in sales volume during the first half of 2021 and it has only accelerated since then.

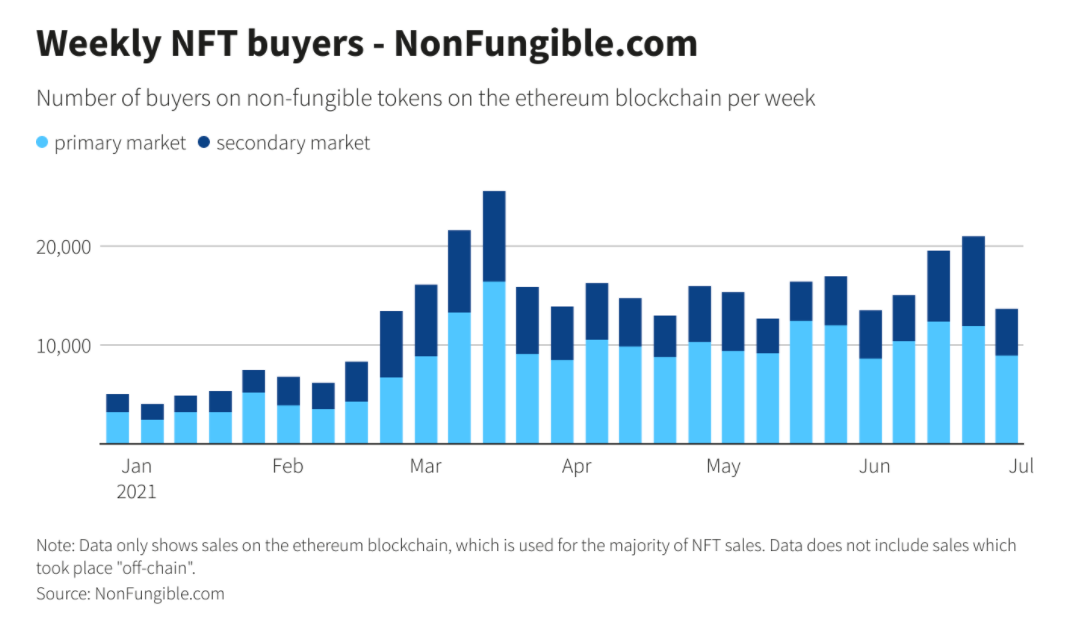

Here you can see the weekly NFT buyers through the end of June consisted of both primary and secondary market participants.

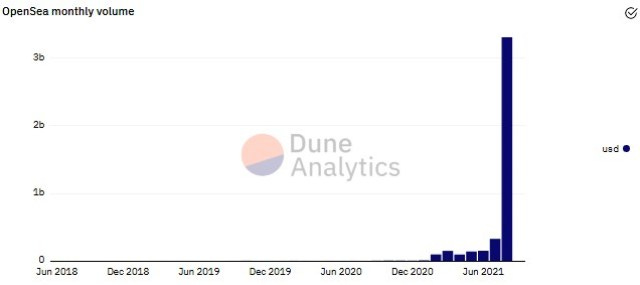

And this chart shows that NFT sales had hit a record high in Q2 of 2021.

But all records are made to be broken. OpenSea, the most popular NFT marketplace, saw more than $3 billion in NFT sales volume just during the month of August.

So what exactly is driving all this interest in non-fungible digital files? The short answer is that NFTs live at the intersection of a few different tailwinds. The positive perspective is that digital natives would rather own digital goods than physical goods, which means that we are watching the digitization of the collectibles industry. These digital natives want to use the NFTs as a way to play games, transact with each other, and generally recreate the collectibles industry.

Another perspective is that we are watching the real time creation of a new status game. Each individual that would normally drop $50,000 to $1,000,000 to purchase a car, watch, house, boat, etc is now realizing that you can spend the same money on a digital good and flex in front of more people on the internet. Only so many friends can check out your house and be impressed. But millions of people a month will see your Twitter avatar.

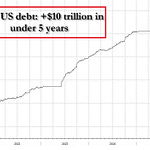

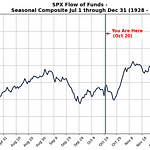

The less exciting perspective is that monetary and fiscal policy has created a manipulated financial environment. This means that many of the traditional assets, like bonds, now produce a negative real rate of return, which forces investors to push further and further out on the risk curve. The only way to drive returns and capture yield is to start doing things that you previously thought were insane. Ya know, like buying JPEG images on the internet for millions of dollars.

In reality, the truth is probably a combination of all of these perspectives. As with most things in life, there is no black and white answers. That is likely a good thing. You can’t argue with the attention and sales volume of the industry, so rather than sitting around complaining about it, you have to decide if you want to participate.

Many of you already know this, but I wrote to you almost exactly one year ago (September 21, 2021) and told you that the next big bet was going to be on digital art. There was approximately $10 million in market cap for digital art at the time and I laid out an argument for why the market would likely see a 6,000x increase in size in the coming years. So far, so good.

But as I’ve watched the NFT industry continue to grow in the last few months, it has become clear to me that I was drastically underestimating how big this whole thing will be. Comparing NFTs to the traditional art market was such an elementary analysis of the market. The non-fungible token industry is a market expanding technology that will eat into not only digital art, but also collectibles, high-end luxury goods, and much, much more.

Additionally, there is new technology that is being brought to life that will only increase the potential market opportunity as we move forward. One example is Ethernity Chain’s new “interactive NFT” with Dallas Cowboys QB Dak Prescott. The team describes the NFT with the following:

“At the peak of the collection is Ethernity’s first “Interactive NFT” with 3 settings set to change during the 2021 football season according to gameplay. Each week, the blockchain-based smart contract will trigger a change between digital trading cards according to Dak’s football QBR rating. This is a first for the Ethernity team, and the first for its community to experience real-time interactivity across its line of NFTs…

…Each week the NFT will change styles according to gamer performance: standard performance of a QBR rating of 60–75 sees Dak in futuristic blue and silver, in throwing motion, ready to lead his team to victory. A red hot performance with a QBR rating of 75+ sees Dak in fiery red being hoisted up by his teammates. A less than stellar performance with a QBR of 50–60 — happenstance in the ups and down of football — sees Dak set in a storm, with lightning striking, looking back, but ready for the next big play.”

Here are the various images that the NFT could embody:

This is the equivalent of your parents or grandparents autographed baseball changing colors whether the team is winning or not. It is the equivalent of a trophy you previously won that sits on your mantle morphing based on some new event that occurs. Obviously, this is nearly impossible in the physical world, but it comes to life easily in the digital world.

Having a collectible for a star athlete or professional sports team that changes based on their performance is just the tip of the iceberg though. Alethea AI, a startup that’s creating “intelligent” versions of NFTs, is taking this entire idea one step further. They recently announced:

“Alethea seeks to distinguish its NFTs by allowing users to embed AI animation, interaction, and voice synthesis capabilities into the digital art — enabling people to even converse with NFTs.”

Wait, what?! This sounds a little insane, right? Well, that is because it is insane. Here is a primitive example of an avatar NFT that has the ability to speak and answer questions.

The NFT isn’t the smartest AI bot that you have ever seen. It obviously needs to improve, but if you squint hard enough you can see a future world that is going to be wildly different than the current state.

So if you look at the NFT market and try to evaluate where it is headed from here, it is hard not to be incredibly bullish on the market cap growing significantly in the coming years. The digital art market will be peanuts in comparison to the totality of NFTs. You’re going to have interactive NFTs, intelligent NFTs, NFTs exclusively built for metaverses, and many applications that we haven’t even thought of yet.

Frankly, it is overwhelming to think through all the possibilities of where this is all going. I spend a lot of time talking about bitcoin in these letters, but that doesn’t mean that significant value is not going to accrue to other parts of the industry. These NFTs are a great example of where I would expect billions, if not trillions, of dollars to be made in the coming years.

If you’re an investor and just starting to learn about this new world, I highly suggest you take the time to get up to speed as quickly as possible. Just as every business had to figure out an internet strategy in the 1990s, every business is going to have to figure out their bitcoin strategy and every business is going to have to figure out their NFT strategy as well. Some will choose to sit it out. But many will choose to participate. As a market observer, I can’t wait to see how everything develops.

Enjoy your weekend. I’ll talk to everyone on Monday.

-Pomp

SPONSORED: LMAX Digital. Regulated, trusted and verified. For your security. Delivering deep institutional crypto liquidity to institutions, investors and traders globally.

Client types: funds, banks, proprietary trading firms, asset managers, family offices & brokerages

Spot BTC, ETH, LTC, BCH & XRP; all paired with USD, EUR, JPY & GBP

Access: FIX 4.2/4.4, API, ITCH, web GUI & mobile

Institutional custody solution: offline multi-sig. cold wallets & vault storage

Minimum trade size: 0.01 coins (BTC, ETH, BCH, LTC); 1 coin (XRP)

The institutional market demands of transparent price discovery, precise ultra-low latency execution and deep liquidity are satisfied & exceeded by the LMAX Digital technology stack.

LMAX Digital also streams real-time market data to the industry’s leading indices and analytics platforms - enhancing the quality of market information available to all participants, enabling a reliable overview of the spot crypto market.

LMAX Digital: secure, liquid, trusted crypto trading & custodial services. GFSC regulated.

THE RUNDOWN:

Mastercard Acquires Crypto Tracing Firm CipherTrace: Payments giant Mastercard has agreed to buy CipherTrace, a firm that scans blockchains for illicit transactions. The surprise acquisition announced Thursday by the companies in a press release gives Mastercard the ability to track over 900 cryptocurrencies. Details of the acquisition were not disclosed. Read more.

SEC Sets November Deadline for Final Decision on VanEck Bitcoin ETF: The Securities and Exchange Commission has once again delayed ruling on VanEck’s bid for a bitcoin exchange-traded fund. The U.S. regulator on Wednesday gave itself until Nov. 14 to approve or reject “VanEck Bitcoin Trust,” one of the earliest bitcoin ETF hopefuls to try its luck this filing cycle, and the first whose judgment day has been delayed three times. Read more.

Giancarlo on Coinbase-SEC Clash: ‘Don’t Apply 90-Year-Old Statutes’: Coinbase’s tussle with the U.S. Securities and Exchange Commission highlights the need for clearer rules for digital assets, according to former Commodity Futures Trading Commission Chairman Chris Giancarlo. In an appearance on CoinDesk TV’s “First Mover” Thursday, the regulatory veteran, nicknamed “Crypto Dad” for his favorable views of the technology, described the current rules as anachronistic and unevenly enforced. Read more.

Former Crypto-Friendly Regulator Quintenz Joins VC Firm A16z: Former crypto-friendly commodities regulator Brian Quintenz has joined venture capital firm Andreessen Horowitz as a part-time adviser. Announced Thursday, Quintenz becomes the latest high-profile addition to the firm, which has backed numerous projects in the tech and crypto industries. The prolific VC firm raised over $2 billion for its Crypto Fund III earlier this summer. Read more.

CFTC’s Berkovitz to Step Down Next Month: Dan Berkovitz, one of the top officials at the Commodity Futures Trading Commission, intends to depart the agency on Oct. 15. Berkovitz announced his departure on Thursday, noting he has worked with the CFTC, Congress and the private sector over the past 20 years on financial markets, including with the Dodd-Frank Act. He has served as a CFTC commissioner since September 2018. In a statement, the regulator thanked his fellow commissioners, the CFTC staff he worked with and the lawmakers whose work involves the agency.Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Dan Tapiero is the Managing Partner and CEO of 10T Holdings. He has more than 25 years of experience investing across asset classes on Wall Street and is one of the most well-known macro investors in the world. Dan previously spent time working with Julian Robertson, Stanley Druckenmiller, Steve Cohen, and many other luminaries.

In this conversation, we discuss bitcoin, ethereum, venture capital, digital asset ecosystem, raising $750 million, institutional investor interest, and billionaire Wall Street investor questions.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Polymarket - Polymarket is the world’s leading information markets platform where you can trade on the most pressing global questions and see unbiased, real-time data on what the market thinks will happen – all on the blockchain. Will Cardano support smart contracts by October? Will the US have more than 100,00 covid cases before 2022? For a limited time, sign up with referral code “Pomp” to get your first trade reimbursed up to $100. Click here to get started!

Cosmos is building the Internet of Blockchains, marking a new era of interoperability, scalability, and usability. The free flow of assets and data between blockchains with bridges to Ethereum and Bitcoin will unleash the potential of DeFi, NFTs, and much more. Dive into Cosmos at cosmos.network/pomp

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy bitcoin, ether, and over 30 other cryptocurrencies. Offering industry-leading security, insurance and uptime, Gemini is the go-to trusted platform for beginner and sophisticated investors alike. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

LMAX Digital - the market-leading solution for institutional crypto trading & custodial services - offers clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Mask Network - The portal to the new, open internet. Building on top of the existing social networks, the Mask extension allows borderless cryptocurrency transfer, decentralized file storage and sharing, decentralized finance, and many other features that were once impossible to interact with on traditional social media. Visit mask.io/pomp and use the extension to start exploring the decentralized application world.

Okcoin - Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Matrixport - Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Go download the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

Masterworks - Masterworks.io is the leading platform for blue-chip art investing with over 185,000 registered users. They have purchased over $180MM in art from artists like Banksy, Basquiat and KAWS.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.