Many people have been asking me to discuss the bull case for DeFi. The following write-up is from the research team at dYdX, which spells out their perspective. I don’t agree with everything written, but I think they did a good job laying out the argument.

If you aren’t subscribed to the daily installment of The Pomp Letter, you should join 50,000+ other investors and subscribe today.

With the introduction of Bitcoin’s genesis block, the world had its first truly decentralized financial application. Bitcoin enabled anyone in the world to store wealth without the need for a centralized party. That wealth could be taken and sent anywhere in the world, the only requirement was an internet connection. As the Bitcoin network grew in terms of number of holders and value transferred, developers began looking for ways to create more complex financial transactions. This was at odds with how the Bitcoin community viewed the tradeoffs between security and expressive financial applications, which created an unmet opportunity for a blockchain that could facilitate more complex financial contracts.

When Ethereum launched, it aspired to be a world computer capable of powering an arbitrary number of applications through smart contracts. The ICO mania of 2017 reflected this vision, but Ethereum as a platform ultimately left much to be desired for most applications. Amidst all the noise, it became increasingly obvious that Ethereum was fertile ground for financial application experimentation. Ethereum drastically dropped the costs associated with a variety of financial transactions including capital formation, asset issuance (hence the ICO bubble), asset exchange, loan administration, collateral management, and much more. After the rubble of 2017 cleared, the Ethereum community was left with a burgeoning movement dubbed, “DeFi” (short for decentralized finance).

DeFi had immense promise given both how inefficient traditional finance was and how well its aims aligned with the core ethos of the crypto community. Ethereum’s smart contracts enabled money to be managed programmatically, without the need of a central party, which in turn created many efficiency gains. Similarly, DeFi applications were open and permissionless. Just like Bitcoin, anyone could access them, all they needed was an internet connection.

Compare this to the traditional financial system and it’s easy to see how much more desirable DeFi is. In the traditional world, financial applications are difficult to access, rigid, hard to use, and most importantly, expensive.

Early Signs of Product Market Fit

Shortly after the Ethereum community rallied around DeFi and allocated engineering resources towards building out infrastructure, early signs of traction emerged. In these early days, the most promising developments were DeFi primitives: building blocks that could be built on top of each other to create more expressive applications. The composability of these primitives help create strong network effects, where the value of products and services grow as the number of DeFi users increases.

The first use case to see large growth was stablecoins. Stablecoins are simple, they are assets designed to keep a peg to another asset, which in the case of the most popular stablecoins, is the dollar. With stablecoins, anyone can transact in dollars, globally, and with no delays. Stablecoins seem rudimentary on the surface, but being able to send dollars freely within the crypto ecosystem has always been difficult — the fiat world and the crypto world aren’t very interoperable.

Stablecoins really started to see growth when new primitives came to market. The ability to exchange stablecoins for crypto through decentralized exchanges such as dYdX, 0x, and Kyber or the ability to borrow and lend stablecoins through platforms like dYdX and Compound, made stablecoins that much more powerful. Users could remain on-chain for a lot of their banking needs.

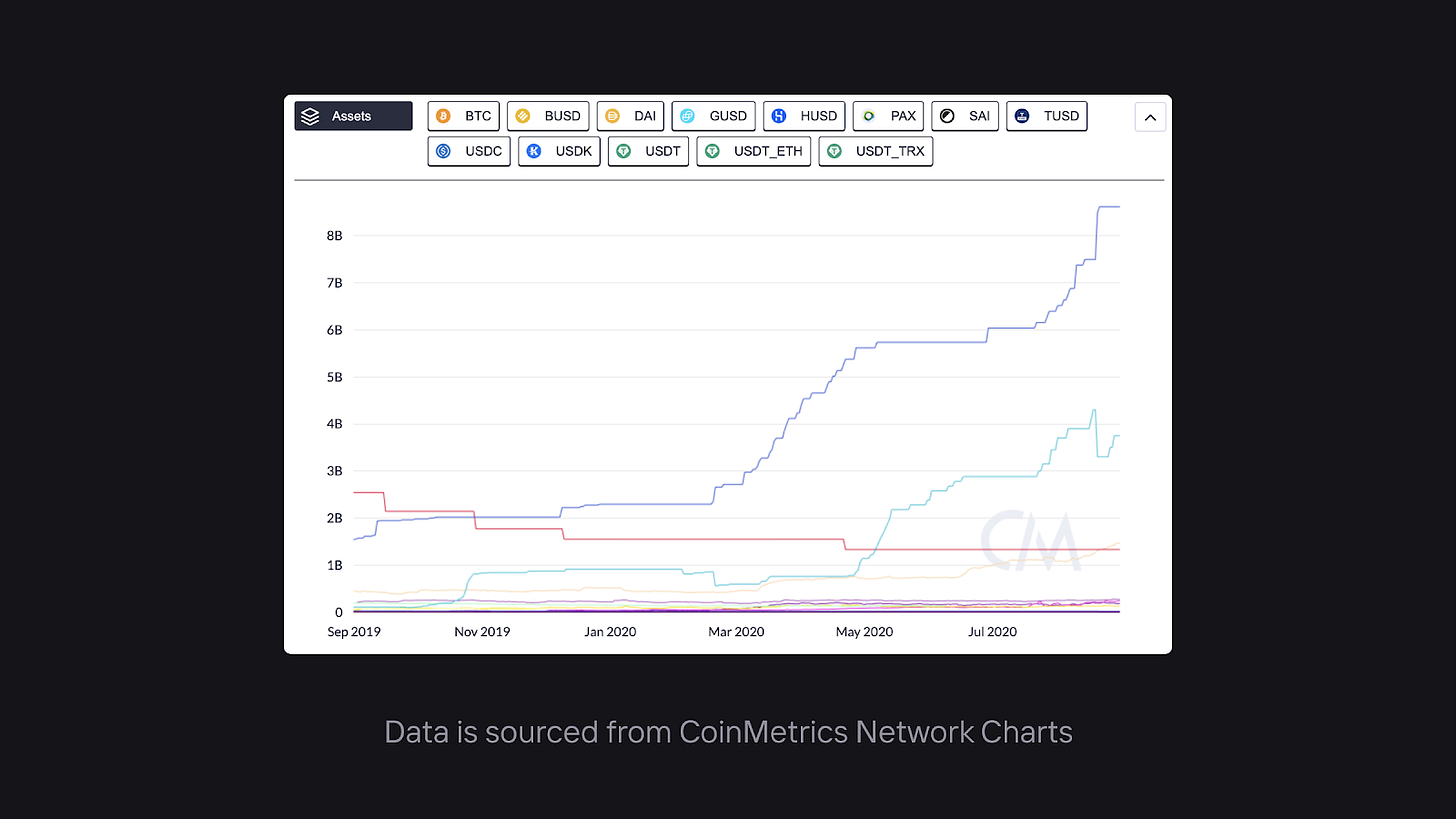

We can see clearly that stablecoin issuance really took off in late 2018, right as many of DeFi’s first primitives came to market. The amount of USDT tokenized on Ethereum has grown to over $6 billion USD from virtually 0. USDC has also seen astronomic growth, growing to over $1 billion market cap in less than two years.

Decentralized exchange was another primitive that took off in 2019. With decentralized exchanges, smart contracts handle all parts of the exchange process — they verify that each holder owns the assets, that they approved the transfer, and once those are satisfied, the contracts atomically swap assets between the two counterparties. Again, it seems simple, but the traditional exchange process can be costly and exposes users to a lot of counterparty risk. As we have seen time and time again, exchanges can go down with all of their customers’ crypto.

Automated market makers took the decentralized exchange concept one step further by removing the need for a centralized market maker to quote both sides of the book. There are many reasons AMMs have been a breakthrough model for decentralized exchanges. First, it’s extremely costly for token projects to engage market makers – the deals are very one-sided and concentrate too much influence in the market maker’s hands. Second, it’s expensive for market makers to provide liquidity on decentralized exchanges given the latency and cost of on-chain transactions. Through AMMs, projects can have liquidity from day one, making it much easier to bootstrap communities and networks.

The last DeFi primitive worth mentioning is borrow and lend markets, more specifically, borrowing and lending directly from a smart contract. These systems allow anyone with idle assets to deposit them into a shared lending pool and anyone who wants to borrow assets to draw down from this pool in exchange for interest. Developers have been able to build powerful products by building a top these lending markets. For example, dYdX’s lending markets power a global margin trading system — the ability for traders to earn interest helps bring more liquidity to the platform.

Where is DeFi Going?

DeFi has just started to scratch the surface in terms of decentralizing the most important pillars of traditional finance. 2020 has been a watershed year for DeFi — the primitives noted above are being leveraged to create both products that rival traditional solutions as well as net new products that aren’t available in today’s system.

The recent liquidity mining boom is actually an interesting play on yield generation. While most of the yields are a function of inflation rather than actual interest or cash flow, it’s being offered at a time where most traditional banks are offering savings rates close to 0%. Because of this, we’re seeing a massive influx of capital into the ecosystem. Even if it’s short term, this new capital helps fuel experimentation until something of value is found. Similarly, these protocols have intrinsic value via their cash flows. So even if the yields will collapse over time, they still have a floor that’s much larger than anything offered in the traditional banking system.

Decentralized exchange is also a vertical that will continue to grow in the short to medium term, and we expect them to surpass most centralized exchanges in the next few years. Already today, there have been numerous days in which trading on Uniswap has surpassed the trading on Gemini, Kraken, and even Coinbase. Developments like liquidity mining will boost the liquidity offered on decentralized exchanges to the point where traders will be able to exchange at a cheaper rate than they do on centralized exchanges, and without KYC. Additionally, decentralized exchanges are still in their v1.0 modes. At dYdX, we’ve worked hard to build margin trading and the very first synthetic BTC perpetual swap, all on-chain so users never have to give up custody of their funds. In the next few months, we will also be launching our Layer 2 solution with Starkware, which will greatly reduce costs, increase throughput, and enable more trading pairs as well as the ability to cross-margin on our perpetual markets.

Another area in which decentralized finance is subverting its centralized counterparts is lending. On-chain lending was always criticized for not being able to administer undercollateralized loans given the lack of legal recourse and identity, but this might change soon thanks to lending protocol Aave’s new credit delegation design. Through their system, token holders will be able to stake their assets behind the credit reputation of another address (tying to a user), enabling that address to borrow funds without overcollateralizing the loan. If that user doesn’t repay the loan, it is their staker that is punished, meaning token holders are incentivized to act in a way that doesn’t hurt them, in effect helping ensure only creditworthy borrowers are able to take out uncollateralized loans.

Lastly, the DeFi ecosystem has birthed its own insurance offerings, allowing users to buy protection against smart contract risk. One of the biggest barriers to adoption in the early days of DeFi was the lack of insurance. No traditional insurer would enter the space so ecosystem participants built their own solutions. Through protocols like Nexus Mutual and Opyn, DeFi users can secure their deposits without the need of a traditional bank or institution.

All of the innovation happening in the DeFi ecosystem is affirming the fact that decentralized finance can create financial applications that are more desirable than those that exist in the traditional world. We’re already seeing some DeFi projects overtake parts of the centralized crypto economy and it won’t be long until this activity starts to overtake the traditional world. There’s never been more of a need for a financial system that’s more fair, open, and efficient. At dYdX, we couldn’t think of a more exciting mission to build towards.

About dYdX: dYdX is building open, secure, and powerful financial products accessible globally. Trade Spot, Margin, and Perpetual Markets, with up to 10× leverage. dYdX runs on audited smart contracts on Ethereum, and enables trading with no intermediaries. It allows traders to move quickly, while maintaining full control of their assets.

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 50,000 other investors today.

THE RUNDOWN:

Coinbase Building Platform to Help Crypto Startups Launch Tokens, Raise Cash: Coinbase is developing a token crowdfunding platform for crypto startups looking to break into the space. CEO Brian Armstrong said on an Aug. 11 podcast with asset manager and host Patrick O'Shaughnessy that his exchange is indeed "working on" the platform first hinted last September – to be called "Coinbase Launch or something like that." Read more.

The Tapscotts Take Their Blockchain Research Institute Into Europe: Blockchain Research Institute, the education and innovation hub founded by father-and-son tech evangelists Don and Alex Tapscott, has opened a European arm. Announced Wednesday, Blockchain Research Institute Europe launches in partnership with Blockwall, an independent venture capital firm based in Frankfurt, Germany. The new BRIE think tank will bring together a gaggle of European industry leaders, academics, policymakers, entrepreneurs and researchers. Read more.

Minting Dozens of Coins a Day, Speculators Tap Into Crypto Craze: Fueled by a spike in speculative appetite, cryptocurrency entrepreneurs are offering new digital coins at a torrid pace reminiscent of the Bitcoin boom three years ago. Among the freshly listed: Porkchop, Davecoin, Spaghetti, Newtonium and Whale. Many have no obvious utility, but investors have poured billions into them up in hopes of riding one to an easy profit.The world of crypto has always attracted peddlers of get-rich-quick products when fans of rewiring the global financial system start buying into a new idea. In 2017, it was Bitcoin and the end of fiat currency. Read more.

China’s Digital Currency May Come With Hardware Wallets as Well: Mobile apps may not be the only medium for storing and transacting China’s digital yuan, according to the Terms and Services agreement from a major Chinese bank. The roll-out of China’s central bank digital currency may include hardware wallets as well. Over the weekend, China Construction Bank (CCB), one of the country’s big-four state-owned commercial banks, opened up a wallet service to public users within its mobile app for testing China’s central bank digital currency (CBDC), also known as DC/EP. Read more.

Deutsche Bank CEO Gives Grim Outlook for the Global Economy: The global economy will not return to pre-coronavirus levels for a “long time,” the chief executive officer of Deutsche Bank warned Wednesday. Business activity in the euro zone dropped sharply in the wake of the strict lockdown measures imposed in March, but have somewhat rebounded in recent months following the easing of certain restrictions. The United States has experienced a similar picture. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Ben Cohen is a sports reporter for The Wall Street Journal in New York covering the NBA, college basketball and college football. He is also the author of the new book titled: The Hot Hand: The Mystery and Science of Streaks.

In this conversation, Ben and I discuss:

The NBA

The playoff bubble

Lebron James

Damian Lillard

Kawhi Leonard

The financials of the Golden State Warriors

Bitcoin

His new book on the science of streaks

I really enjoyed this conversation with Ben. Hopefully you enjoy it too.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Athletic Brewing is re-imagining beer for the modern adult. They love beer. But they also love being healthy, active and at their best. The non-alcoholic beers are fully flavored, clean ingredient, and a fraction of the calories of full strength beer - they fit in any occasion. Check out www.athleticbrewing.com for more details and free shipping nationwide.

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

Unstoppable Domains is working to make the internet operate how it was originally intended, which means anyone can publish anything from anywhere. You can go to unstoppabledomains.com and claim your censorship resistant domain today.

BlockFi allows you to keep your crypto, put it up as collateral, and receive a USD loan funded directly to your bank account. They do loans ranging from $2,000 to $10,000,000, and they're perfect for helping you reach your financial goals of all sizes. Visit BlockFi.com/Pomp to learn more about putting your crypto to work without having to sell it by getting a loan or earning interest in their interest bearing accounts.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Blockset by BRD is your hosted blockchain infrastructure. Blockset enables enterprises and developers around the globe to deliver high-quality blockchain-based applications in a fraction of the time, at a fraction of the cost.

Bybit currently has over 300,000 users, with numbers growing in double-digit percentages monthly. The exchange features no overloads during volatility, low latency trading and 24/7 live customer support. Newly registered users can receive up to $90 in rewards!

If you enjoy reading “The Pomp Letter,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post