To investors,

The last few weeks in financial markets have been a roller coaster. Fear is running wild and investors are worried there is no end in sight to the recent market drawdown. I come bearing good news though.

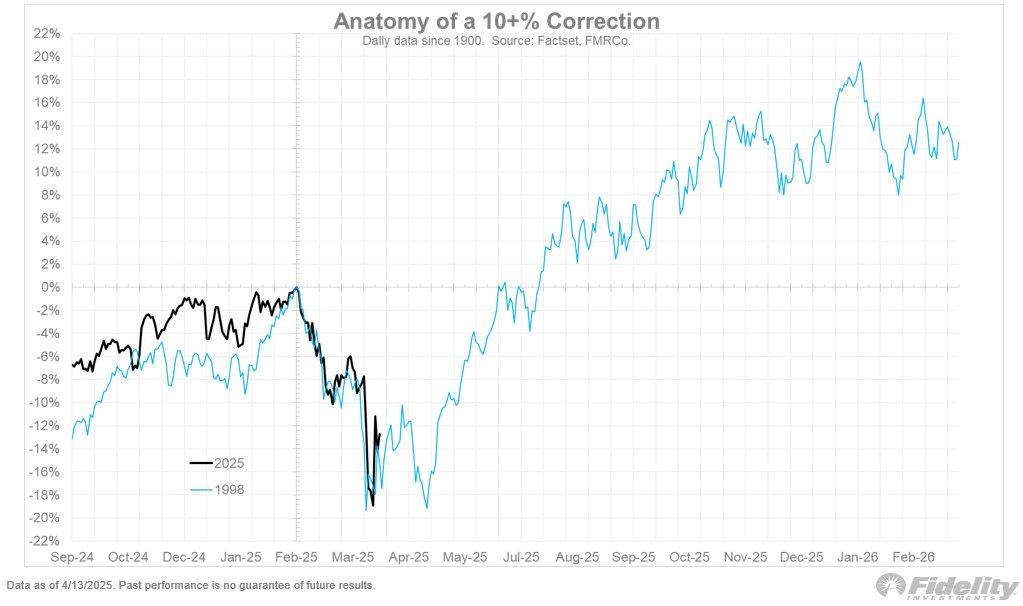

Fidelity’s Jurrien Timmer writes “Statistically speaking the further the market falls the more likely it is to recover. Yes, some 20% declines become 50% “super bears,” but more often than not the market has historically started to find its footing at -20%, as it appears to have done last week.”

This doesn’t mean the market is done declining, but the historical data suggests the odds are in our favor. That is better than nothing.

Raoul Pal shared the bitcoin price overlaid with M2 global liquidity at the end of last week. You don’t have to be Albert Einstein to realize we are likely close to, or have already seen, the bottom of this drawdown.

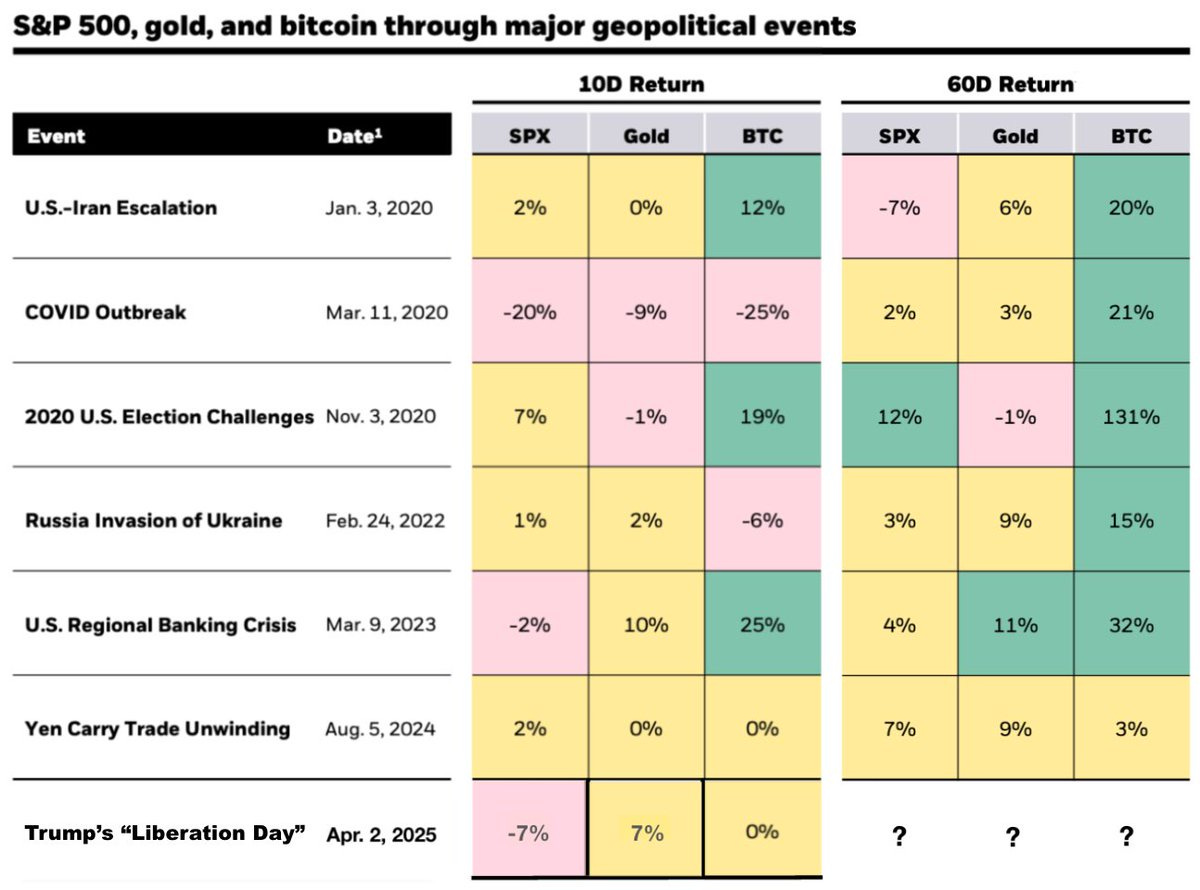

If we have already bottomed, the question becomes “how will stocks, gold, and bitcoin perform going forward?” Sam Callahan created an updated chart on various asset’s performance after recent economic events.

As you can see in the chart, bitcoin has almost always outperformed stocks and gold coming out of the major economic events over the last 5 years, including the US-Iran escalation in 2020, the pandemic, Russia invading Ukraine, and the regional banking crisis in 2023. Again, there is no guarantee bitcoin will outperform this time, but the odds are in our favor.

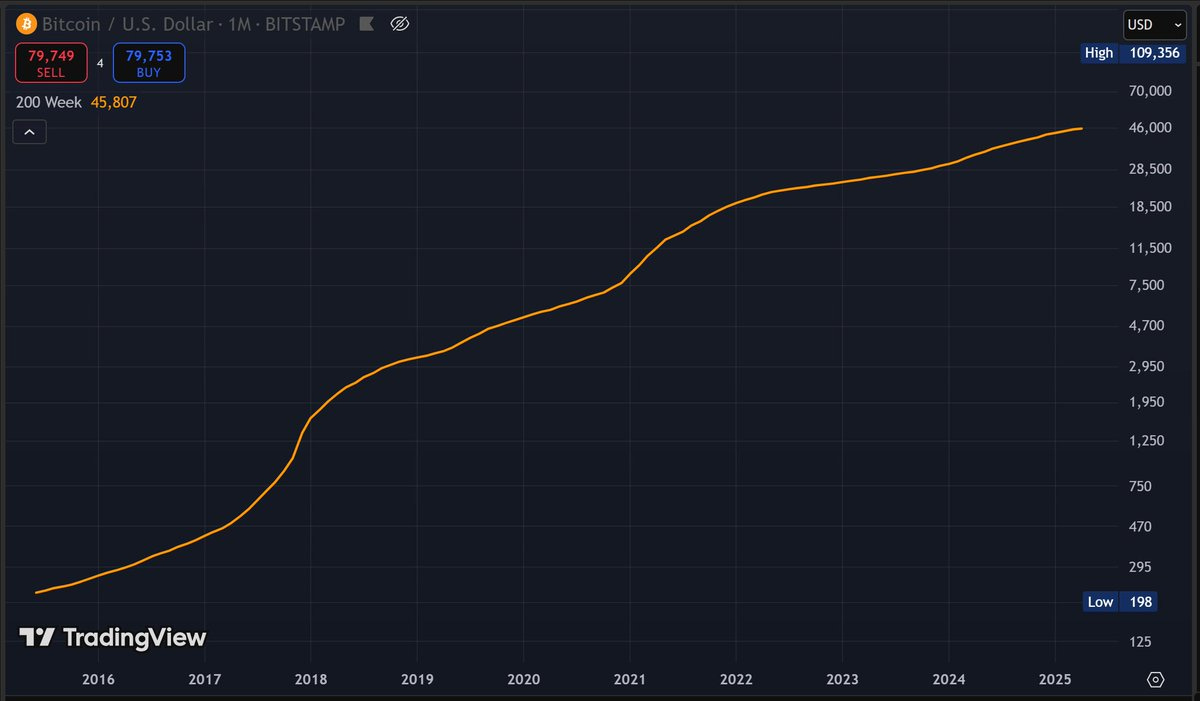

Don’t take my word for it though. Cole Walmsley reminds us that bitcoin remains one of the most attractive financial assets in the world to anyone who can avoid worry in the short-term. Cole writes “This is the most significant chart in financial markets. It's Bitcoin - measured with a 200 week moving average (aka 4 years at a time). Zoom out, and the truth becomes crystal clear: Bitcoin has never lost purchasing power. What does this hint at? Bitcoin is the most reliable savings technology on Earth.”

So what is going to happen in the short-term? I have no idea. It appears the odds are in our favor that financial markets have bottomed and bitcoin will likely outperform other assets coming out of the recovery. But that may not be right. No one can predict the future.

But you can find great comfort in bitcoin’s 200 week moving average — it continues to aggressively appreciate at an attractive rate. As I have discussed many times before, bitcoin is the new benchmark rate for young people. If you can’t beat it, you have to buy it.

I don’t make the rules. And if you think you are smarter than bitcoin, I wish you the best of luck out there.

Hope everyone has a great start to their week. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Jordi Visser Explains Whether He Thinks Bitcoin Will Hit All-Time High In 2025

Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos.

In this conversation we discuss what is happening in the market, world reserve currency outlook, how tariffs could impact markets, AI, machine learning, stock market, small businesses, and what a bitcoin future could look like.

Enjoy!

Podcast Sponsors

Figure Markets — Trade, borrow, and earn on your crypto with full transparency. The future of finance isn’t TradFi or DeFi—it’s both. Learn more about Figure Markets!

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more at www.reedsmith.com.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post