🚨 READER NOTE: I am hosting the first book signing for my new book, How To Live An Extraordinary Life, in New York City tonight (Monday September 30th) at 7pm. There will be a short discussion about the book and then I will sign copies for anyone who attends. The event is free to attend.

You can RSVP to come to the event by clicking here. I look forward to seeing you there.

To investors,

Cheap capital is coming fast and furious. Crossborder Capital has reproduced their famous chart of global liquidity, which shows the cyclical uptick we are beginning to experience.

The rhythmic nature of global liquidity is almost hard to believe. Joe Carlasare points out:

“I’ve seen this chart shared dozens of times. However, it’s proprietary and I’ve never been able to recreate it. Call me a skeptic, but it seems that it would be prudent to understand the inputs of this chart before people put a lot of faith in it.”

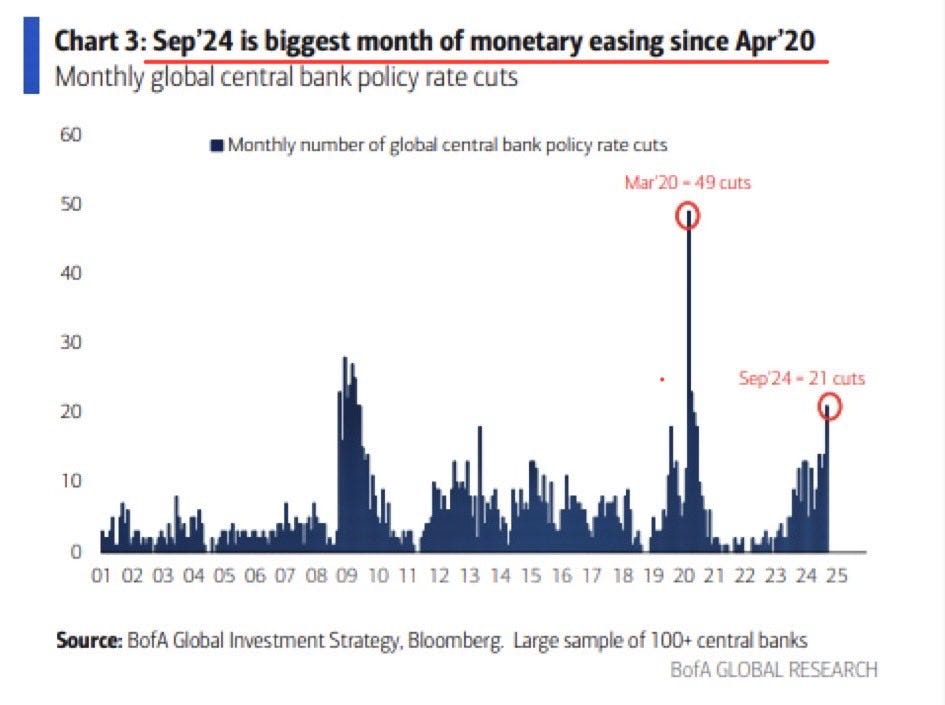

Whether you agree with Crossborder Capital’s chart or not, there are plenty of other data points showing cheap capital is on the way. A simple one is the number of monthly central bank policy rate cuts around the world.

September had the largest number of collective cuts globally since April of 2020. As central banks continue to cut rates, investors won’t be able to help themselves — borrowing and investing will accelerate.

Economist Daniel Lacalle shared a different chart of global net liquidity, while saying “global net liquidity is exploding. This means unprecedented monetary destruction, economic secular stagnation, and risky assets' expansion.”

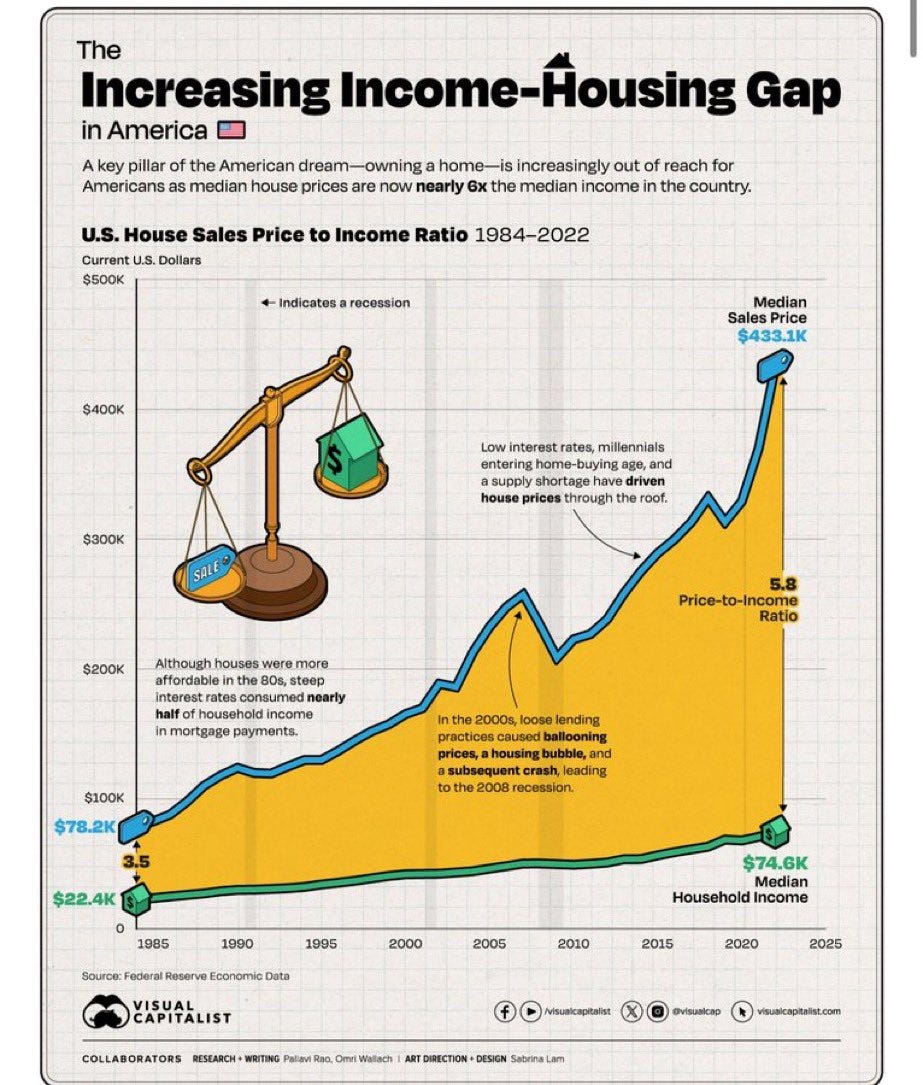

Monetary policy decisions have consequences though. An easy place to see the destruction of the US dollar is in the income-housing gap. John LeFevre says:

“The income required to afford the average house in the United States:

2020: $53,679

2024: $121,398”

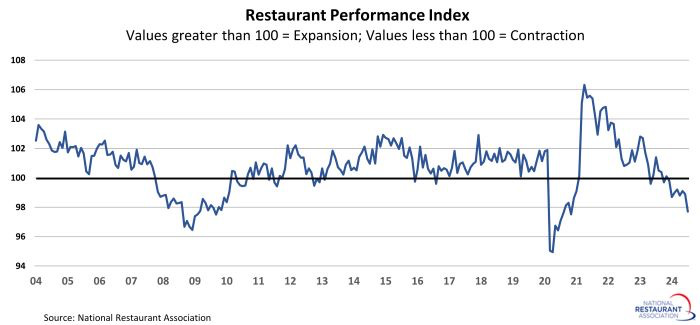

That is a monstrous increase in a half decade. But that is not the only concerning data point. Porter Stansberry shows “eating out is becoming a luxury for many Americans. The Restaurant Performance Index, which tracks the financial health of U.S. restaurants, is in its 10th straight month in contraction zone.”

Do you get it yet? Do you see what is happening?

Central banks are stimulating economies, which will devalue the dollar and other fiat currencies. It will flood the market with cheap capital. Your purchasing power will be eroded away and asset prices will be inflated.

Savers lose, investors win.

The only test that matters in finance for the foreseeable future is “did you invest or did you save?” Hopefully everyone reading this letter has an intelligent answer that balances emergency savings with an investment portfolio.

Regardless of what you do though, central banks are running their playbook. Drop interest rates. Print money. Stimulate to avoid catastrophe. Increase the debt. Kick the can down the road. Let someone else pay for today’s sins.

Everything is fine until we get to the end of the road. Fingers crossed that is no time soon. Hope you all have a great start to your week and I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 Set Up A Call With Anthony Pompliano 🚨

I want to set up a 1-on-1 Zoom call for 30 minutes to meet you.

In order to get the call scheduled, you have to purchase 25 books or more of my new book, How To Live An Extraordinary Life. Here is how this will work:

You purchase 25 books or more.

You reply to this email with the receipt or screenshot.

I will send you potential days/times for the call.

We will get on the call and discuss whatever you want for 30 minutes.

I have already done a few calls with people from Twitter and really enjoyed them, so I look forward to meeting many of you as well.

Anthony Pompliano records a solo episode to answer the questions, are stocks overvalued? Is bitcoin due for a crash? Topics include federal reserve, interest rates, Mag 7 vs. 2000s tech bubble, historical stock performances, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Are Stocks Overvalued? Is Bitcoin Due For A Crash?

Podcast Sponsors

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

Domain Money makes financial planning straightforward and accessible.They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post