To investors,

President Joe Biden announced yesterday that he would not be seeking re-election in November. This is the latest development in an already chaotic Presidential election season, which has included criminal convictions, assassination attempts, and debates around the cognitive abilities of older candidates.

To add to the chaos, Biden announced his decision to leave the race via a written statement on Twitter. There was no press conference. There was no pre-recorded video. Just a typed-out statement and a hand-written signature, which is now being wildly questioned as to whether the signature is actually the President’s or not.

Regardless of those details, there is a high degree of uncertainty at the moment. This is when you would expect bitcoin to shine. The digital currency is supposed to be a certainty due to its structure, dependability, and resilience.

It appears that is exactly what happened. Bitcoin was trading under $67,000 right before Biden’s announcement. The currency then jumped more than 2% post-announcement. Uncertainty increased and so did bitcoin demand.

My read on this is that bitcoin is performing as you would expect given the circumstances. This is a positive sign. It is not the lone positive sign in the crypto market though.

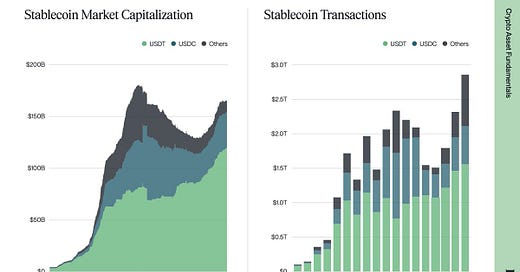

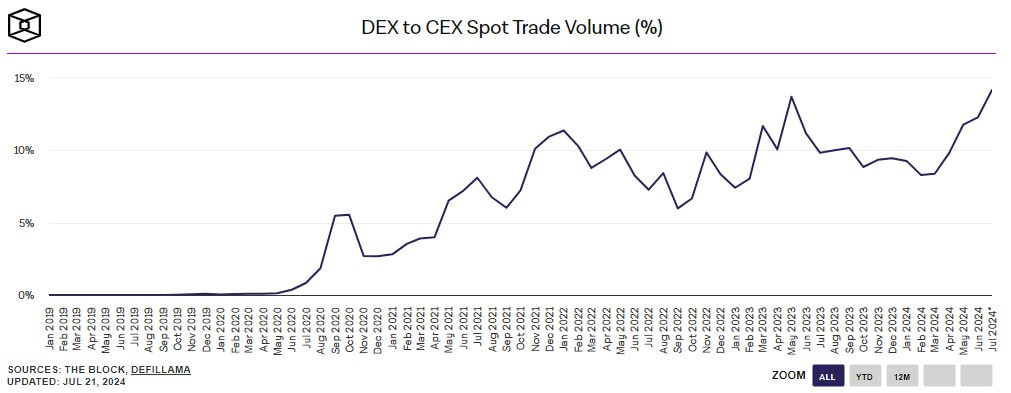

Bitwise’s Alyssa Choo pointed out recently there was $2.8 trillion of stablecoin transaction volume in Q2, which is an all-time high.

This is a clear signal from the market that people want US dollars on digital rails. We should only expect this demand to continue increasing over time given the long-term trend.

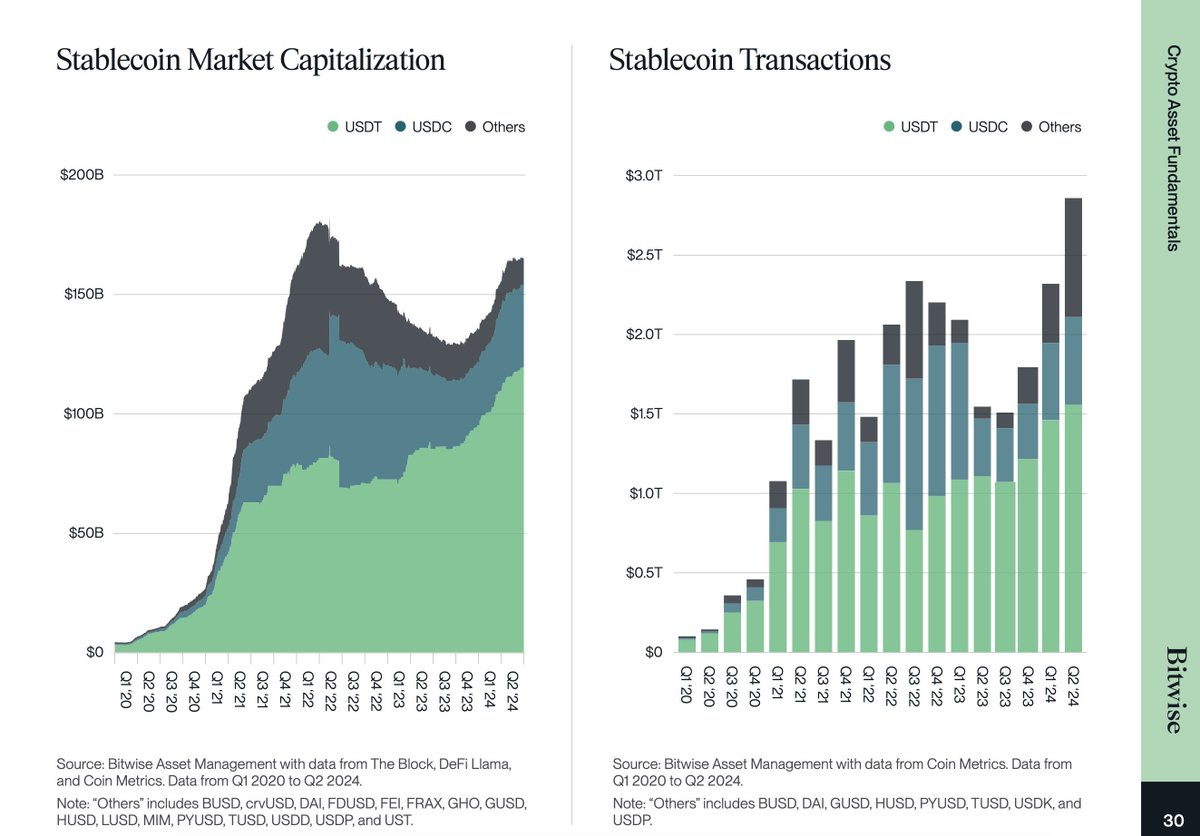

DACM’s Richard Galvin highlighted that DEX market share has hit a new all-time high as well.

This is interesting because it proves that capital is flowing towards decentralized trading venues. People will debate why market participants are doing this, but it is hard to ignore the data showing that it is happening.

Another data point that is impossible to ignore at this point is capital flowing into crypto funds. Jonah van Bourg tweeted the cumulative flows are at a multi-year high.

Lastly, VanEck’s Matthew Sigel shows that Polymarket open interest is growing parabolically lately. People want prediction markets.

These five charts tell me one thing — crypto is working in a way that was previously questionable. It may have taken longer than everyone wanted, but there are trillions of dollars sloshing around this new digital financial system.

Bitcoin is storing value during uncertain times. Prediction markets are beating the mainstream news to stories. Investors are putting capital to work in the industry. And stablecoins are becoming an important part of the global financial system.

Great things take time to build. It is cool to see the industry starting to hit its stride.

Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

Phil Rosen, the Co-Founder of Opening Bell Daily, and Anthony Pompliano, CEO of Professional Capital Management, discuss small cap vs big tech, future outlook for interest rate cuts, what Trump trade means for investors & impact on bitcoin, and Jamie Dimon change of mind on bitcoin?

Listen on iTunes: Click here

Listen on Spotify: Click here

Anthony Pompliano on Whether The Trump Trade Is Sustainable

Podcast Sponsors

Domain Money makes financial planning simple. No hidden fees and no sales pitches - you get a personalized roadmap to your goals, from dream vacations to retirement.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

Domain Money makes financial planning straightforward and accessible.

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post