To investors,

Everyone wants bitcoin. That is becoming increasingly clear on a daily basis. We saw announcement after announcement this week proving the desirability of a scarce digital currency.

First, we saw Jimmy Patronis, CFO for the state of Florida, go on CNBC and advocate for bitcoin to be put on the state’s balance sheet.

Patronis highlighted the overreach of government surveillance, the debasement of the US dollar, and a path to resisting the woke policies of the current administration.

Next, we saw the central bank of Argentina open an “art exhibit” that features ASICs that are actively mining bitcoin.

This is the first central bank I am aware of that is mining bitcoin. Many people will point to the “art exhibit” label, but this looks like a clever way for the central bank to start mining bitcoin without sounding any alarms inside other countries or monetary authorities.

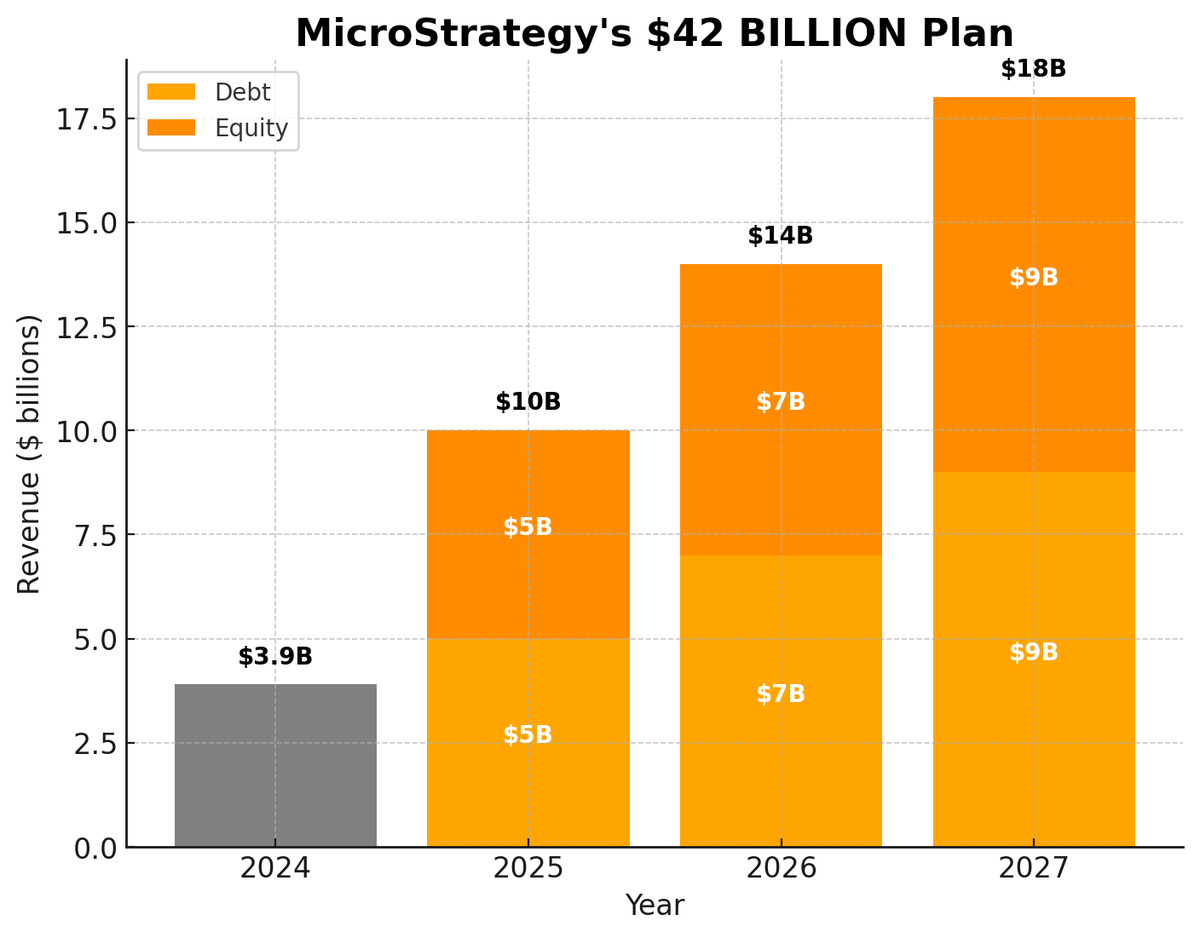

Next, MicroStrategy announced their intention to raise $42 billion in debt and equity over the next 3 years to purchase more bitcoin. They have already spent a few billion dollars in 2024, but the plan is to ramp up spending aggressively.

Lastly, Blackrock’s bitcoin ETF set a new record for single day inflow this week. More importantly, their ETF has seen the third largest inflows year-to-date of any ETF in financial markets.

As I said, everyone wants bitcoin, including individuals, financial institutions, corporations, and central banks. Satoshi created a piece of technology that solved one of the hardest problems in the world — protecting the purchasing power of people, companies, and governments.

An idea’s time has come.

Hope you all have a great end to your week. I’ll talk to everyone on Monday.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: I am co-hosting a conference with Lance Lambert and ResiClub on residential real estate in NYC on Friday November 8th. We have many industry experts speaking about the housing market, impact of interest rates, effects on the US economy, and what investors should know moving forward.

The event has been quite popular, so remaining tickets are limited. If you would like to attend, please grab your tickets: Click here

Bitcoin’s Future Under Donald Trump and Kamala Harris

I sat down with Phil Rosen, co-founder and Editor-in-Chief of Opening Bell Daily, to discuss the Presidential election’s impact on various financial assets. We walk through the various candidates, their economic plans, and how it should impact stocks, bitcoin, and bonds.

Enjoy!

Podcast Sponsors

Blockstream Mining Note 2 (BMN2) is an EU registered and issued Bitcoin mining security token designed to outperform BTC returns. Learn more and view live analytics on our performance dashboard.

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post