Today’s Off The Chain post is brought to you by Delphi Digital, the premier research firm dedicated to digital assets and DLT. Their in-depth report on Decentralized Finance (DeFi) released earlier this week has sparked great discussion among the crypto community. Below they highlight the biggest takeaways from the report. Full disclosure: I currently sit on the board of Delphi Digital.

Decentralized Finance (DeFi), also known as Open Finance, represents a broad category of financial applications being developed on open, decentralized networks. The objective is to build a multi-faceted financial system, native to crypto, that recreates, and improves upon, the legacy financial system. Some of the potential benefits of such a system include:

Permissionless financial services anyone with an internet connection can access, boosting financial inclusion.

Censorship resistance means no third-party can stop a transaction.

Immutable ledger where no third-party can reverse a transaction.

Reduced counterparty risk as there’s no need to trust a centralized third-party to custody funds or validate transactions.

Programmable smart contracts allow specific tasks to be automated or self-executed, leading to more efficient processes.

Composability allows for the creation of new financial products and services by combining different protocols.

So who is building this new decentralized financial system? Turns out there is a plethora of projects pioneering this nascent industry ranging from decentralized exchanges to lending & borrowing platforms to derivatives and prediction markets. This list goes on and on.

One of the more interesting trends we see accelerating is composability: the integration of multiple DeFi projects and protocols. A notable example is Veil, a peer-to-peer prediction market built on top of Augur and 0x (one of the most prominent decentralized exchange protocols). It utilizes 0x for faster trading by moving order creation and cancellation off-chain.

We broke down a few of these examples in the full report by categorizing some of the leading projects, which helps put perspective around how innovative this industry is becoming.

Decentralized exchanges (DEXs)

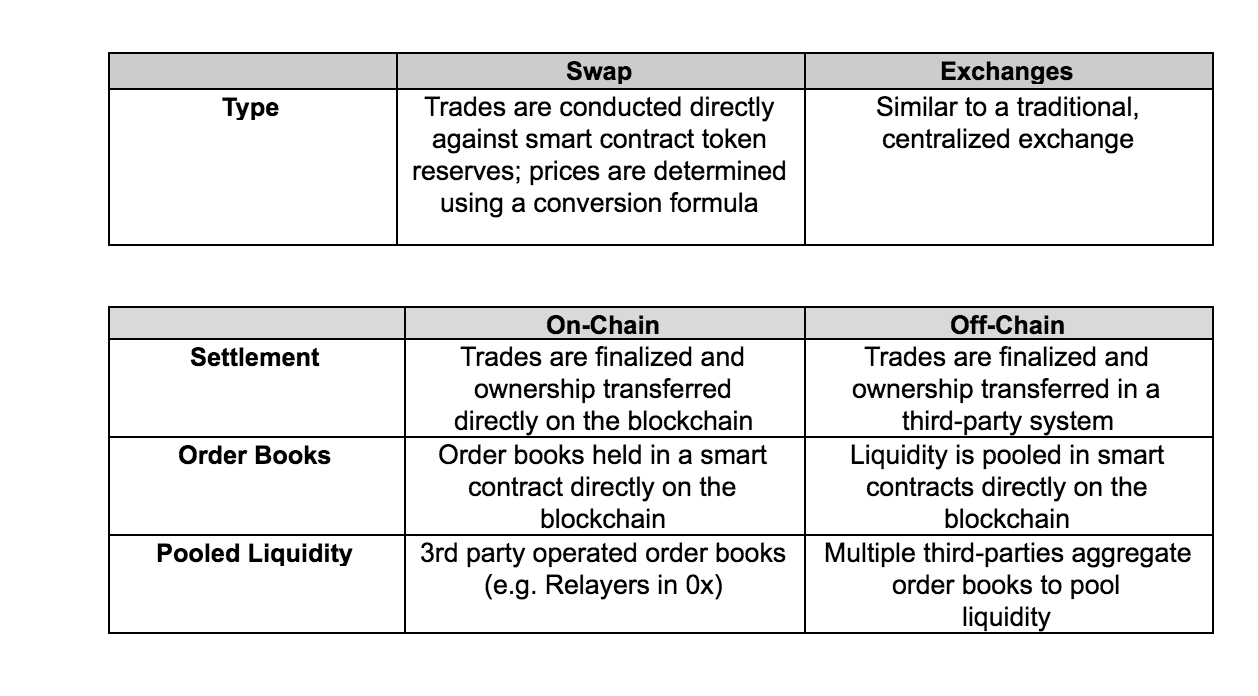

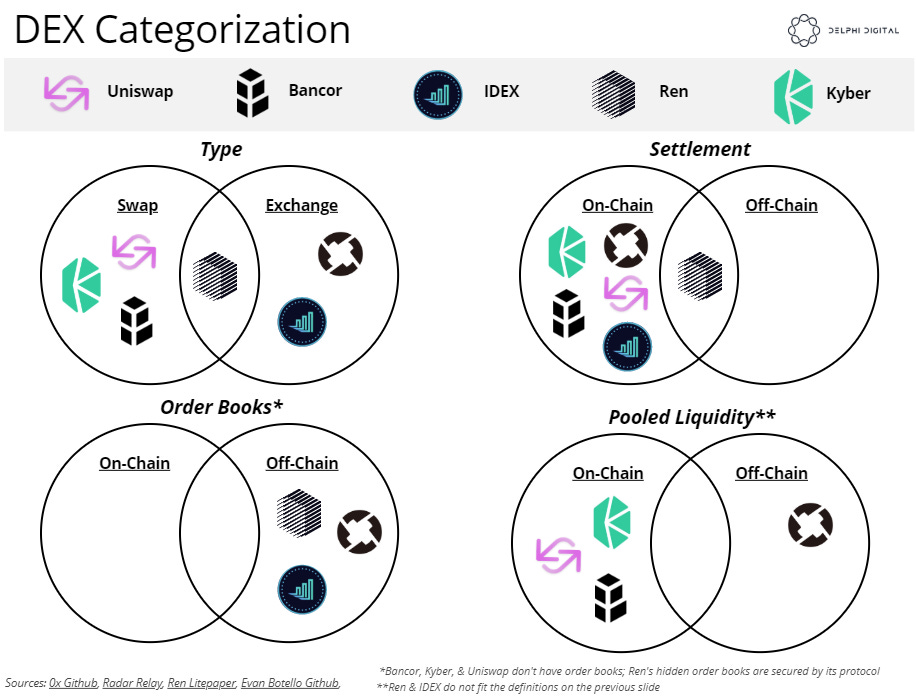

Decentralized exchanges are one of the more well-known sectors of the DeFi ecosystem. At their core, DEXs enable the peer-to-peer exchange of assets without giving custody of those assets to a third-party. This is very different from the centralized exchanges people are most familiar with where users deposit money or crypto assets to an exchange wallet before making trades. However, many DEXs are unique in their own way, so we broke down four key characteristics to simplify some of the major differences.

We also categorized some of today’s prominent DEXs into each of these categories to illustrate their unique features.

Decentralized exchanges are just one example of the infrastructure being built to support decentralized finance applications. Projects like MakerDAO and Compound are building decentralized lending and borrowing platforms, with over 2% of ETH’s supply locked up in Maker’s CDPs. Augur’s decentralized prediction markets have garnered attention in recent months as users get comfortable wagering on anything from the midterm election outcome to BTC’s year-end price. Again, the list goes on and on.

Despite the seemingly endless potential of this growing sector, it is important to recognize the risks and concerns behind the DeFi movement. Links to physical/traditional assets is non-existent currently, limiting the product/market fit of some of these projects. DEXs struggle with low liquidity. Many on-chain scaling solutions are still under development, capping transaction throughput. This is on top of the regulatory risk this nascent sector faces, which is arguably most important at this stage. Maturation of this market will likely alleviate some of these concerns, but they’re important to keep in mind as this sector evolves.

The open source nature of crypto should accelerate many of these trends as new projects emerge to build on top of today’s DeFi infrastructure. Our team is excited to keep an eye on projects integrating multiple DeFi protocols to offer new and unique products for users.

You can read the full report here: https://www.delphidigital.io/defi

The “Off The Chain” podcast has been downloaded 800,000+ times in 160 countries. You can listen to the latest episode with John Wu, CEO of Digital Assets at Sharespost here: Click here for Off The Chain podcast

THE RUNDOWN:

Square Is Staffing up for a New Cryptocurrency Unit: Square CEO Jack Dorsey said he wants to hire a few cryptocurrency engineers and a designer, to conduct work that will contribute to advancing an accessible, Internet-based financial system that benefits the greater community. The new employees be able to work from wherever they want, report directly to Dorsey, and can even be paid in Bitcoin, if they so choose. Read more.

Facebook Seeks Counsel to Forge Blockchain Partnerships for New Products: Facebook’s blockchain recruitment drive continues, as the social network looks to hire a lead commercial counsel for its initiatives with the technology. A new job posting at the company’s career page says the position will be responsible for “drafting and negotiating a wide variety of contracts related our blockchain initiatives, including partnerships needed to launch new products and expand such products internationally.” Read more.

Bitmain Set to Deploy $80 Million Worth of Bitcoin Miners: Bitmain, the largest manufacturer of cryptocurrency mining equipment by market share, is scaling up its capacity to mine ahead of an expected drop in electricity costs in China this summer. The Beijing-based company will be deploying about 200,000 units of its own mining equipment in the area to take advantage of the low electricity costs during the summer resulting from excess hydropower. Read more.

China’s Alibaba Partners With Chinese Software Giant to Promote Blockchain Development: Chinese e-commerce conglomerate Alibaba and Aerospace Information Co., a major software developer and provider, have signed a strategic cooperation agreement for cloud computing, blockchain and other technological services development. The two parties have agreed to take advantage of their respective brand technologies “to actively integrate resources and carry out in-depth cooperation” in the fields of cloud computing services, finance and taxation, government affairs and blockchain technology, among others. Read more.

Ex-NATO Secretary General Bullish on Blockchain as He Partners With Swiss Startup: Swiss blockchain identity network Concordium has hired former Danish prime minister and NATO secretary general Anders Fogh Rasmussen as a strategic advisor. The Concordium Foundation, the controlling entity behind the Concordium Network that launched a proof of concept in January, aims to tackle blockchain deployment in certain fields with Rasmussen’s expertise. Read more.

Interested in crypto research? Look no further. The premier research firm in the space, Delphi Digital, has two subscription offerings for individuals and institutions alike. Take a look at their Bitcoin and Ethereum reports to get a taste of their analysis. [Click here]

If you enjoy reading “Off The Chain,” click here to tweet to tell others about it.

Nothing in this email is intended to serve as financial advice. Do your own research.