REMINDER - The BUILD Summit Is Two Weeks Away!

BUILD Summit, our annual conference in NYC for founders, is coming up next month on September 26th.

The event will provide top tier speakers, networking opportunities, and insightful business discussions on raising capital, scaling businesses, and building products.

Current speakers include angel investor Balaji Srinivasan, Khosla Ventures’ Keith Rabois, Perplexity CEO Aravind Srinivas, Eight Sleep Founders Matteo Franceschetti & Alexandra Zatarain, and Passes CEO Lucy Guo.

The event is free to attend and will be full of insights on how to operate a company at world-class level.

To investors,

There is a new article in Business Insider titled “United States of Bitcoin: Crypto miners got kicked out of China. Now they're sucking America dry.”

As you would predict, the writer presents a heavily biased view that bitcoin mining is bad. He cites the usual statistics of high energy consumption, points to a few local groups protesting specific bitcoin mining facilities, and then even suggests America is left holding China’s bag (“it's just the latest example of China kicking out burdensome industries only for them to end up on America's doorstep”).

What I found most interesting was the complete disregard for the positive argument for bitcoin mining. There was no mention of the former ERCOT President saying bitcoin miners were essential to Texas stabilizing their electricity grid. There was no mention of the thousands of jobs that have been created by the industry. There wasn’t even a passing comment about bitcoin’s success in protecting the purchasing power for hundreds of millions of people globally.

It is this last point that I believe should get much more attention.

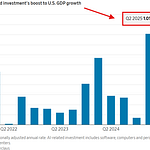

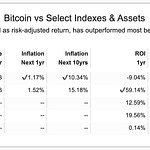

American citizens just lived through the highest inflation period over the last half century. Official government measurements reported CPI to be over 9% at the peak. This destruction of economic value for 300+ million Americans should be unacceptable in a developed nation that serves as the leading financial economy.

So what is an appropriate investment to solve this problem?

The answer is significantly higher than people are comfortable admitting publicly. Behind the physical safety of its citizens, a country should work tirelessly to protect the purchasing power of its people. Once you lose physical safety, people flee. And if you lose economic stability, people flee.

Ultimately, the people pay the government for protection — both physically and economically.

There is a balance though. Government have a very hard job. They must provide this protection, so they can keep their citizens happy, but accomplish the task without micro-managing their lives or exerting too much control. That is the challenge for every elected leader.

Serve the people without controlling the people.

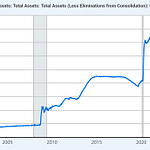

Economics is one of the best places to see how this can play out. The free market does a great job of regulating the economy over the long-run. Humans have no patience though, so we constantly intervene in the market. We can’t help ourselves.

But this is where bitcoin mining comes in. The decentralized network of machines has created and secured the strongest computer network in the world. These pieces of hardware prevent humans from intervening. The system is literally designed to save us from ourselves.

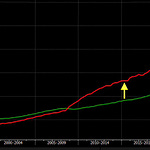

And along the way, bitcoin miners are protecting the purchasing power of bitcoin holders. The median home in the US cost 664 bitcoin in 2016. Today that same home costs 6 bitcoin. That is a 99% reduction in the cost of a home in less than a decade.

Who ensured that happened? Bitcoin miners.

That narrative was absent from the Business Insider article. It didn’t fit the preconceived perspective of the author. Thankfully, facts are still facts. We should spend whatever it takes to protect our purchasing power.

In my experience, it is worth reading the critiques of bitcoin. It helps every holder stay sharp and think critically about what they hold. Who knows, maybe the author will be like us and eventually become a bitcoiner after spending the time to learn more. Never say never.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

Dave Collum is the Department Chair and Professor of Chemistry at Cornell University.

In this conversion, we talk about the economy, inflation, stock market, investing outlook, politics, Trump, Harris, Vance, Walz, RFK Jr, geopolitical analysis, and how you can start to think more independently.

Listen on iTunes: Click here

Listen on Spotify: Click here

Disaster Is Coming To Financial Markets? Dave Collum Interview

Podcast Sponsors

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

Domain Money makes financial planning straightforward and accessible.They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.