To investors,

Will Clemente breaks down this week’s bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up for his email by clicking here. Here is Will’s analysis:

Hope all is well and you had a great week. Last week we discussed how Bitcoin was moving into the later stages of the re-accumulation phase that we have been tracking throughout the last month. Since then, we retested range highs just above $41K before dipping back down to the middle trend line of the current range, trading between $37K-$38K at the time of writing. Firstly, let’s zoom out to some metrics that can help us establish positional awareness of where we stand in a broader sense Then, we’ll zoom into some of the trends that are key to watch over the next week(s) in my humble opinion.

These are the key takeaways from this week’s letter:

Bitcoin is very oversold in accordance with on-chain

BTC now sits on historically important inflection points for several major on-chain indicators

Long-term holders continue to scoop up discounted BTC

Selling from STHs continues to lose steam

Accumulation continues to grow stronger

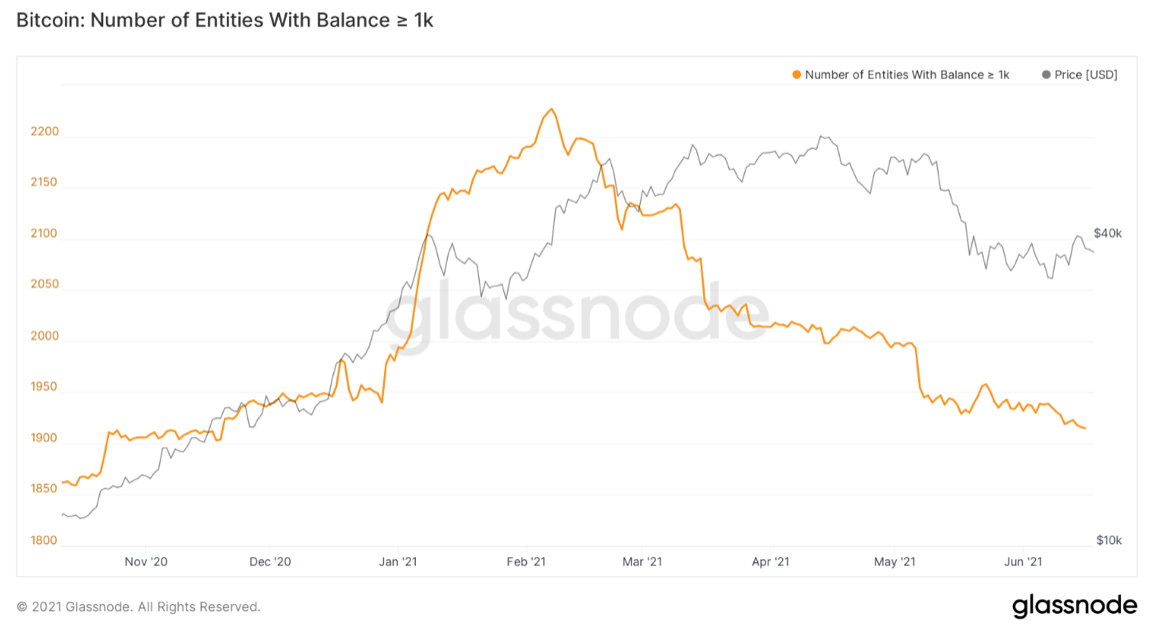

Still a lack of what resembles new institutional/high net-worth buyers. (whales)

NUPL is one of my favorite metrics to look at for determining broader market structure. This looks at the difference between realized cap (the capitalization of Bitcoin based on the price of which each coin was last moved) and market cap, and then dividing this difference by market cap. This can give a representation of market sentiment, as during the euphoric later stages of the bull market investors realize profits at a lower rate, and during bearish stages investors begin to realize profits at a higher rate. Glassnode separates these “stages” into different zones: Greed, Optimism/Denial, Hope/Fear, and Capitulation.

Glassnode is then able to apply this metric to long-term holders and short-term holders specifically. Looking at LTH-NUPL on a 14-day moving average, we are right on what has been the threshold for bull/bear markets historically. Between the 2013 double pumps we bounced off the lower band of the euphoria zone, whereas in the end of 2017 we dropped through the zone like a rock after a very small relief bounce. We will have to keep an eye on this over the next few weeks to get a better gauge of bull/bear in terms of this metric.

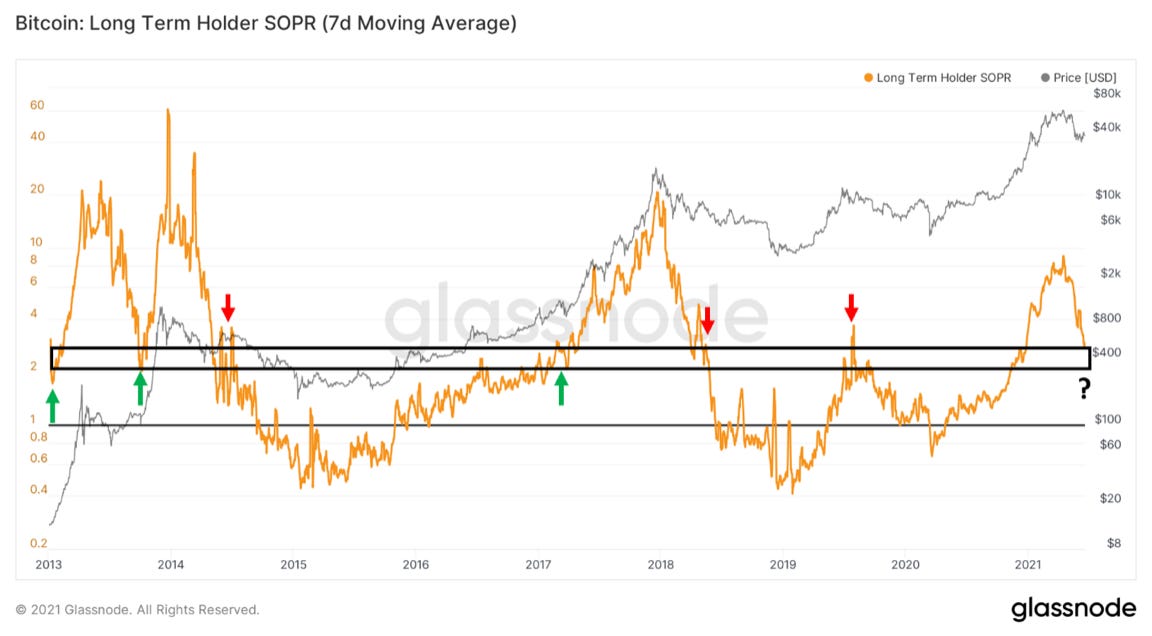

The next metric that suggests this same concept of being at an inflection point is long-term holder SOPR. We’ve discussed SOPR many times but have never looked at this metric in terms of long-term holders. The current level this metric is approaching served as support in 2013 and in late 2017, but also as resistance after the 2013 bull run, after the 2017 bull run, and in 2019.

And third we have MVRV ratio, which is a simple ratio of market cap to realized cap. This also is at a historically important level that has either served as support or resistance for Bitcoin.

Notice a commonality between the three: we are at a decision/inflection point for continuation over the coming weeks. One other thing to note: BTC did not reach any historically overheated or greed zones on these broader metrics. With this being said, Bitcoin needs to make a move up to gain momentum over these next weeks to clear this zone of uncertainty. However, zooming into some intermediate-term trends, in my opinion fundamental investor activity looks slightly bullish; hence why I have stated we have been in what looks like a re-accumulation phase. This week on-chain has confirmed my thoughts from last week that we are in the latter half of the phase. Let’s take a look at some of the metrics that make me think this.

One important thing to preface, I know I sound like a broken record here: selling continues to come from short term holders. Dormancy is still trending down. (younger coins being sold) This is also shown by looking at the raw number of supply held by short term holders, although some of this is STHs aging into the LTH cohort.

Next up we exchange net position change. This is showing that exchange flows are no longer bearish and have moved into net accumulation.

Next, we have illiquid supply change, something we had looked at last week as we took note of the decreasing amount of liquid supply. This looks at the 30-day change of supply to determine if supply is becoming liquid or illiquid in aggregate. Just as we had been expecting last week, the metric has now flipped green for the first time since before the sell-off.

Next up we have Long-Term Holder net position change. This continues to climb up. Long Term Holders have added 127,760 BTC in the last 7 days. This is offsetting the selling from short-term holders, which have reduced their positions by 122,423 BTC. This shows a net difference between the two of 5,337 BTC in favor of LTHs.

*Note: Some of this is STHs aging past the 155-day threshold to move into the LTH cohort.

Should also be noted: zooming out this metric looked similar during the 2013 bull run, but also following the 2013 and 2017 bull run peaks as well. Key takeaway: when Bitcoin is very undervalued experienced market participants begin to add heavily to their positions.

But not everything is bullish, one thing to take note of is the number of new whales coming onto the network. This continues to trend down. Would like to see an uptick in this, but not the end of the world as whales started to sell off in the middle of the 2017 bull run.

Finally, I wanted to show this chart recently put out by Willy Woo, showing a variant of his NVT Signal. This shows BTC is extremely oversold.

In conclusion, Bitcoin is very oversold in accordance with on-chain, long-term holders continue to scoop up discounted BTC, accumulation continues to grow stronger, still a lack of new institutional/high net-worth buyers. (whales) The next few weeks are crucial for Bitcoin in terms of directionality for broader metrics, but the re-accumulation process still looks bullish for the intermediate term. This was partially reflected by price this week in the recovery to the upper $30Ks.

Based off this analysis would expect possibly more sideways in the mid to upper $30Ks over the coming week, but the set up for the intermediate to long term (next few weeks) has looked increasingly bullish. In the very short term, the $41K-$42K is a crucial level to break, which serves as technical resistance and where the 200DMA stands. Looking forward to speaking with you guys tomorrow on Pomp’s pod. Have a great weekend.

That is it for today’s analysis. Hopefully you found this helpful. I highly suggest you subscribe to Will Clemente’s email where he breaks down on-chain metrics multiple times per week: Click here

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 185,000 other investors today.

Share this post