To investors,

Bitcoin hit $100,000 per coin last night for the first time in history. This historic milestone is psychologically important because humans like big, round numbers and there is no denying the success of bitcoin now.

You can see bitcoin dominating headlines at every major news outlet. Word of mouth is starting to spread. Google search volume is accelerating. The bitcoin marketing machine is working and the $100,000 threshold will be fuel on that fire.

But here is the funny thing — bitcoin is still drastically undervalued.

The market cap of gold is nearly $18 trillion and bitcoin is only worth $2 trillion. That gap is way to wide. I can make a very strong argument that bitcoin is at least 10x better than gold (it is more portable, durable, divisible, censorship resistant, etc), which suggests the digital asset’s market cap should eventually surpass gold’s market cap.

Rather than spend our time looking backwards this morning, I want to focus your attention on the work that is still left to do. There are two major milestones that I am looking forward to — the US strategic bitcoin reserve and nation-state adoption.

First, incoming President Donald Trump campaigned on the promise of a national strategic bitcoin reserve. There are plenty of critics that don’t believe we will see this come to fruition, but I have confidence we will see the reserve established.

Remember, Donald Trump, Donald Trump Jr, Eric Trump, RFK Jr, Tulsi Gabbard, Vivek Ramaswamy, Elon Musk, Howard Lutnick, and many others in the administration all own bitcoin. They understand the asset and see the value in it. Additionally, we have Senator Lummis putting forward legislation to get the reserve established.

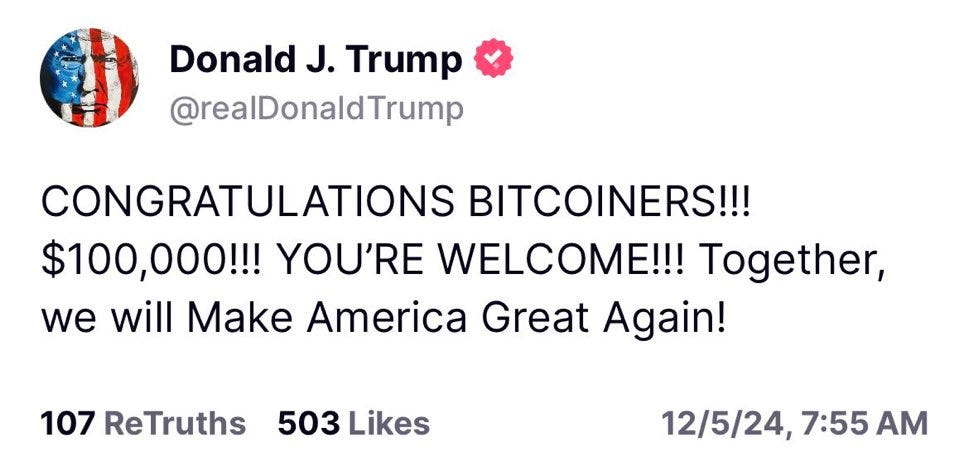

My current perspective is the strategic bitcoin reserve will start with holding the 200,000 bitcoin under US possession at the moment. A commitment to not sell these coins will create the crack in the dam that leads to the US buying more. And if you think Donald Trump is not thinking about bitcoin, let me show you his tweet from this morning:

It is becoming harder to argue that the next President of the United States is not pro-bitcoin. Bitcoin is also up nearly 50% since Trump was elected in early November, so the market seems to think he is good for the asset too.

As the United States embraces bitcoin, this will lead to the second milestone — a global race of nation states vying for bitcoin adoption. We have already seen nations like El Salvador and Bhutan buy bitcoin for their country’s balance sheets. But eventually I believe we will see every major nation adopt the asset.

Here is Russian President Vladimir Putin explaining that no one can ban bitcoin. Here is Federal Reserve Chairman Jerome Powell saying bitcoin does not compete with the US dollar. Do you get it yet? Do you see what I see?

The nation states are knocking on the door and they won’t be stopped from getting inside.

So what does this mean for you?

Absolutely nothing. Individuals will continue to dollar cost average into bitcoin. They will continue holding the asset regardless of the volatility. And the nation states are going to buy as much bitcoin as they can, which will drive the price higher because the hardcore bitcoiners will refuse to sell their bitcoin.

That is the beauty of a free market overlaid on a finite asset. The world will eventually realize the bitcoiners were right.

It will just take some time.

To all of you that bought bitcoin over the years and held it through the incredible volatility — congratulations. You likely accomplished this in the face of severe critiques from family and friends. You ignored the noise. And now you are being proven correct.

But although it feels like we have come a long way, there is still so much work to do. Be gracious in victory. Spend the time to educate others on bitcoin, just as someone did for you. Do not pull the ladder up behind you. There may be hundreds of millions of people who own bitcoin today, but there are still billions of people who don’t.

Let’s close that gap. It will only happen if everyone works together. That is what makes bitcoin so beautiful.

The people were able to front-run the institutions and nation states. Now we sit back and watch these large pools of capital fight over a few million bitcoin that are freely trading in the market. What an incredible time to be alive.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

Darius Dale Explains Why Wall Street Is Bullish On Bitcoin

Darius Dale is the Founder & CEO of 42Macro. In this conversation, we evaluate the bull market, the 60/30/10 investment portfolio, dollar strength, the impact of potential global refinancing, and can DOGE be successful in cutting government costs?

Enjoy!

Podcast Sponsors

Ledger - Ledger secures 20% of the world’s digital assets. Upgrade to Ledger Flex this Black Friday and get $70 in Bitcoin or save up to 40% on select wallets.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post