Today’s letter is brought to you by Bitcoin Investor Day!

I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for sophisticated Wall Street investors who are interested in bitcoin.

Speakers include Cathie Wood, Mike Novogratz, Anthony Scaramucci, Mark Yusko, Head of Digital Assets at BlackRock, Bitwise CEO, Head of Research at Fidelity & VanEck, and many more.

Tickets are only $50 and the venue is incredible. This will be one of the highest quality bitcoin conferences of the year. See you there!

To investors,

Bitcoin hit a new all-time high of $72,000 this morning. As Balaji Srinivasan highlighted, the digital currency has now hit a new all-time high in every currency in the world.

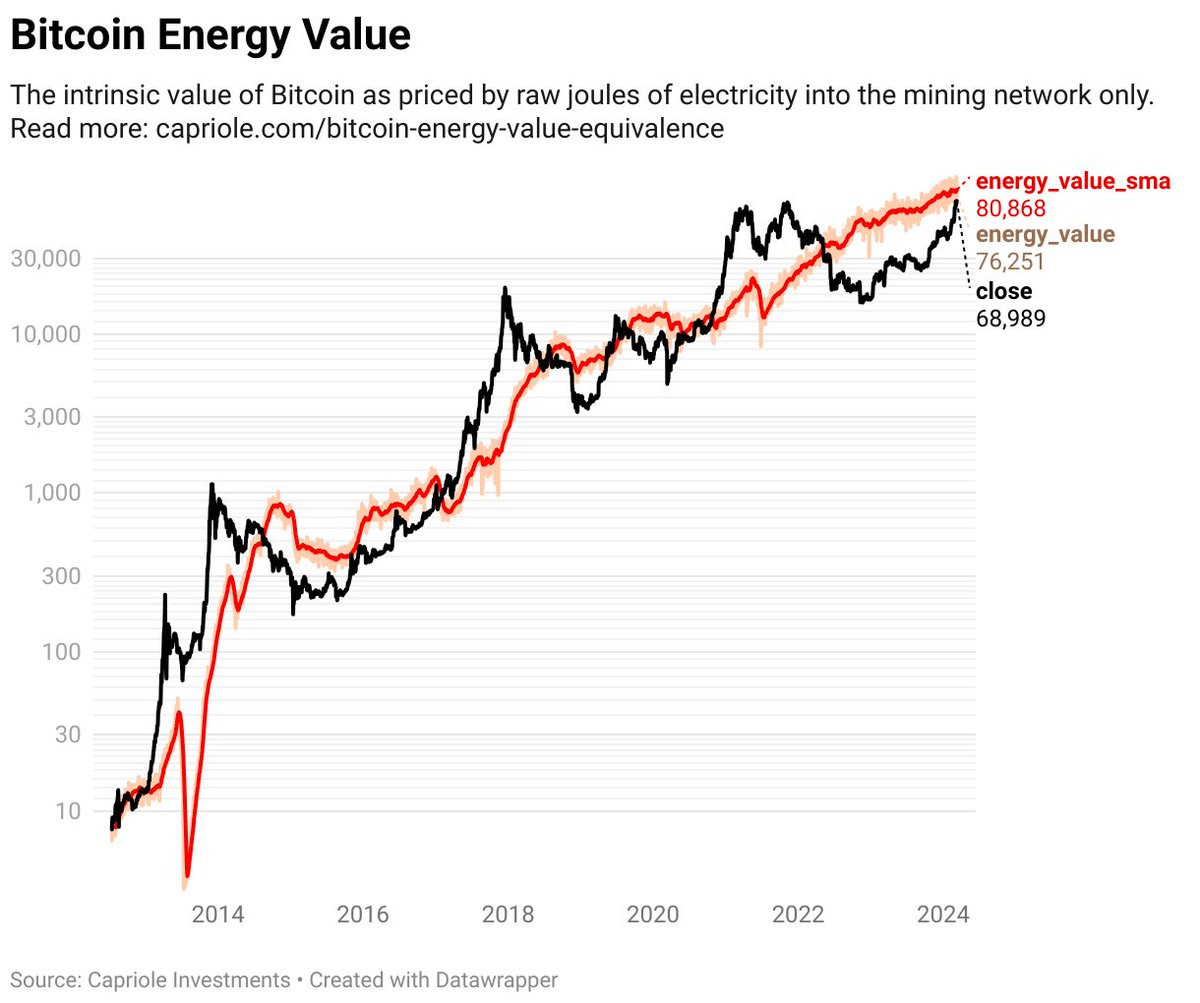

In many recent conversations, investors from the traditional finance industry have asked me “what is the value of bitcoin today?” They are specifically referring to the difference between price and value. One way to think about this is through bitcoin energy value. As Capriole Fund’s Charles Edwards points out, bitcoin’s energy value currently sits at approximately $81,000.

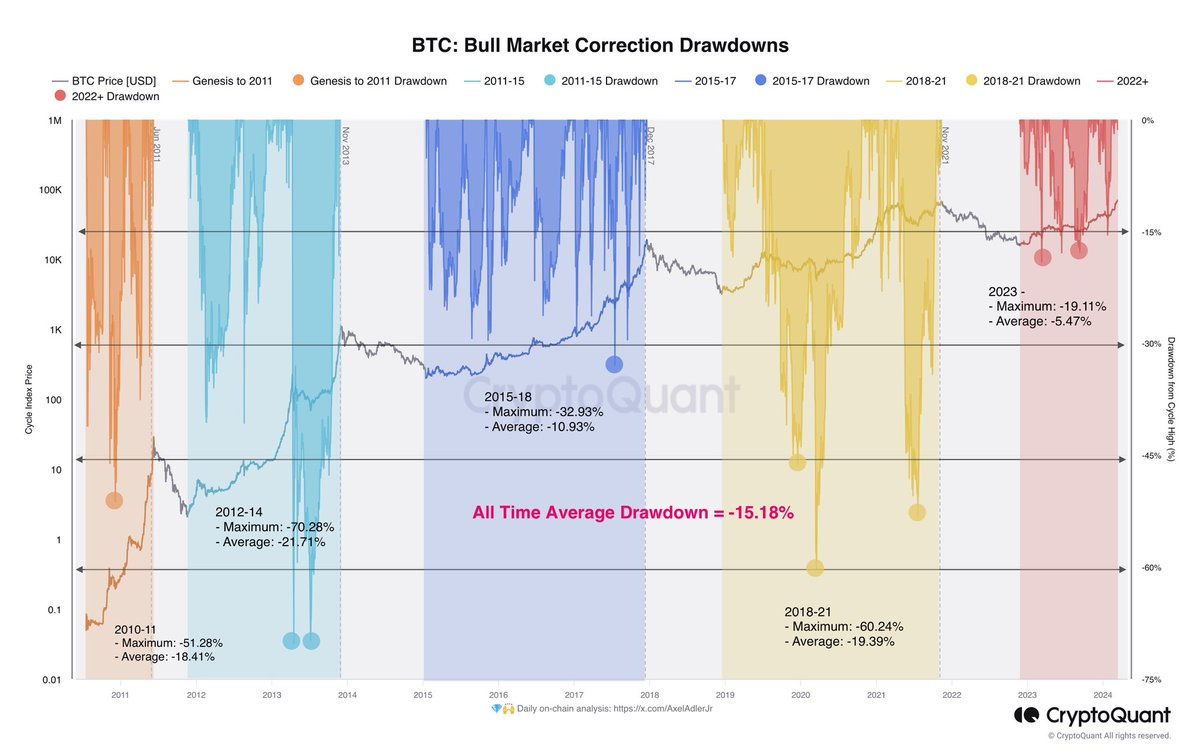

Regardless of the true value of bitcoin, the price has been acting in a different way than past market cycles. Bitcoin analyst Alex Adler Jr explains the risk of correction in this bull cycle by saying, “the average drawdown [in this cycle] is -5.47%, and the maximum is -19.11%. Compare this with past cycles and the all-time average drawdown of -15.18% to make informed decisions about your investments.”

Adler also shows “starting from October 2023, the volumes of daily transactions show growth, with the peak occurring on March 5 with a volume of $111 billion. The figure is simply huge, as some island nations have a smaller annual GDP.”

It is unprecedented for bitcoin to reach new all-time high prices before the halving. Given that we are less than 50 days away from that supply shock, it is hard to construct a bearish narrative through the end of 2024.

We can see that two events over the last year led to bitcoin’s rise and my guess is that the halving will be the third event on this chart in hindsight.

The spot bitcoin ETFs are still buying hundreds of millions of dollars of bitcoin per day. Microstrategy is pouring in hundreds of millions of dollars every few weeks. Most of the distribution platforms, such as Morgan Stanley, have not been turned on yet, but rumors are they have been racing to make the asset available to their clients.

And President Trump said on CNBC this morning that bitcoin has too many use cases now, so he would find it difficult to ban.

The funny thing about bitcoin is that it is immune to the noise. The network continues to produce block-after-block of transactions, regardless of what is happening in the world. Bitcoin didn’t care when the price was crashing and the bears were dancing on graves. Bitcoin doesn’t care today when price is surging and the world feels under-allocated to the asset.

Hard money is eating the world. Investors are realizing that they need the asset in order to be prepared for an uncertain future. Eventually everyone comes to the same conclusion.

Hope you have a great start to your week. I’ll talk to you tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

John Egan is the Head of Crypto at Stripe.

In this conversation, we talk about the crypto industry and how Stripe is interfacing with the technology, what they have been building, how their products work, bridging the gap between Web2 and Web3, stablecoins, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

How Stripe Is Building For Bitcoin & Crypto

Podcast Sponsors

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.