To investors,

A few people have been asking me why bitcoin spot ETF inflows have been occurring, but the price of bitcoin is not drastically increasing. This is a good question, so I figured I would do my best to answer.

We must first understand that financial markets are highly complex. There is almost never a single answer for why the price of an asset is moving up, down, or sideways.

Bitcoin is the perfect example.

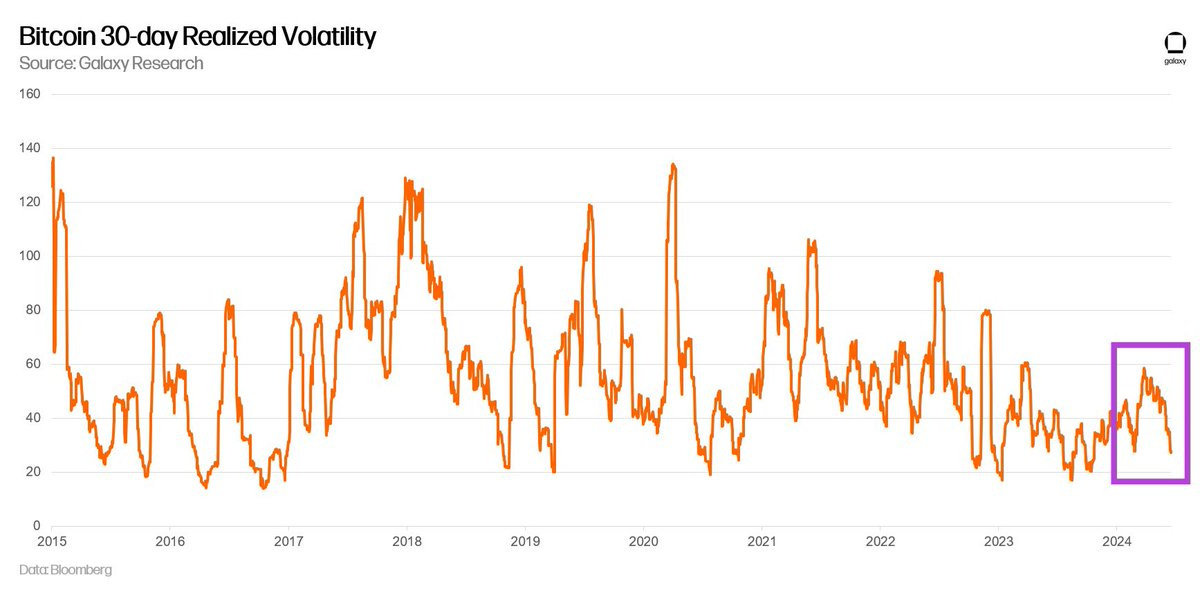

The second thing we must understand is that bitcoin’s volatility has been dropping significantly. Galaxy’s Head of Research Alex Thorn shared this chart, which shows a historically low reading on the 30-day realized volatility metric.

The next important data point is that ETF inflows have largely been from individual retail investors, not institutional allocators. CNBC’s Tanaya Macheel wrote over the weekend the following about comments made by Blackrock’s chief investment officer of ETF and index investments:

“The long-awaited bitcoin exchange traded funds launched in January, and financial advisors are on their way – though gradually – toward adopting them, according to BlackRock’s Samara Cohen.

For now, about 80% of bitcoin ETF purchases have likely been coming from “self-directed investors who have made their own allocation, often through an online brokerage account,” she said, speaking at the Coinbase State of Crypto Summit in New York City on Thursday.”

This is a narrative violation because people have been bragging about institutional adoption of the ETFs. I have also personally thought that much of the inflows must be coming from institutions given the billions of dollars that are now sitting in those funds.

It looks like I was wrong.

Bianco Research’s Jim Bianco points out a recent data point from JP Morgan suggesting that the spot ETFs are not only getting retail capital, but they are actually not receiving net new capital:

“tl:dr —$16 billion has flowed into bitcoin ETFs YTD. But $13 billion has left existing digital wallets, suggesting only $3 billion of net new money this year. As the chart from JPM below shows, estimates of flows into all digital assets are down from last year.

Add to this that BlackRock says (above) 80% of bitcoin ETF purchases have likely been coming from “self-directed investors who have made their own allocation via online brokerage accounts.

The narrative about these flows and their meaning does not match the reality of their actual nature. This means there has been hardly any adoption outside of degen money and swapping from on-chain to regulated brokerage accounts.

The movement from on-chain to regulated brokerage accounts is a big problem in the long run. What BTC needs is on-chain adoption. It needs to be part of a new financial system. The existence of the ETF is moving money off-chain, further away from this ultimate goal.”

Jim’s point here is interesting — not only is he arguing that retail has been moving capital from outside the system to inside the system, but he claims the ETFs are doing the opposite of what bitcoin originally set out to do.

This brings me to the Ether ETFs which will supposedly be approved before the end of the summer.

If these funds follow a similar path, there will be little to no institutional participation. Retail investors will move some of their capital from the spot asset to the spot ETF. And price will likely appreciate to a degree, but I doubt it will be the ~ 50% gain we saw in bitcoin’s price.

Lastly, it is important to be aware of the basis trade. Many of the sophisticated investors who are participating in the ETF market have been going long spot bitcoin and short futures. This allows them to clip basis points while remaining market neutral.

You can easily see the ETF inflows, but what most people have been missing in the analysis is the increase in short futures interest.

As I started this letter, financial markets are highly complex. There is never a single culprit for why an asset price goes up, down, or sideways. Bitcoin has been lulling everyone to sleep. Don’t view that as a bad thing. Spend your time trying to understand why it is happening.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Phil Rosen, the Co-Founder of Opening Bell Daily, interviews Anthony Pompliano. Topics include bitcoin, President Trump's recent support of the industry, interest rates, financial media, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Anthony Pompliano on Bitcoin, Bull Markets, Interest Rates, and the Presidential Race

Podcast Sponsors

Meanwhile is the world’s first licensed and regulated life insurance company built for the Bitcoin economy.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA. Open and fund an account today to receive a $100 USD funding bonus.

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

CrossFi is the Apple Pay for Crypto. For the first time in history, anyone with a web 3 wallet can spend crypto through a physical or virtual Visa card where Visa is accepted.

ResiClub - Your data-driven gateway to the US housing market.

Opening Bell Daily - Get the 5-minute newsletter that Wall Street reads.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post