REMINDER - Crypto Investor Day Is This Week!

Reflexivity Research invites you to join us on Friday, October 25th in New York City as we continue to bridge the power of traditional finance with the innovation of crypto.

We’re inviting hundreds of institutional investors, capital allocators, and entrepreneurs together for the inaugural Crypto Investor Day. The event will be hosted by Reflexivity Research and moderated by Anthony Pompliano.

Expect top-tier speakers, plenty of networking opportunities and hours of insightful discussions around the future of crypto across the traditional finance and institutional landscapes.

No gimmicks or distractions, we operate our events on an insights-per-minute KPI.

To investors,

Prediction markets are quickly becoming the talk of financial markets. These novel products were promised as free market solutions to uncover hidden truths on a variety of topics.

Given that it is political season, all eyes are on these prediction markets to glean signal on who will be the next Commander-in-Chief. But there has been one big problem — recent articles have surfaced claiming the prediction markets are being skewed by a small number of whales who are placing outsized wagers on former President Trump.

This would obviously be a big problem if true. Whale manipulation of the odds could create a lack of trust in the prediction odds, which would eliminate most of the value these markets are supposedly creating.

I don’t think the markets are being manipulated by whales though.

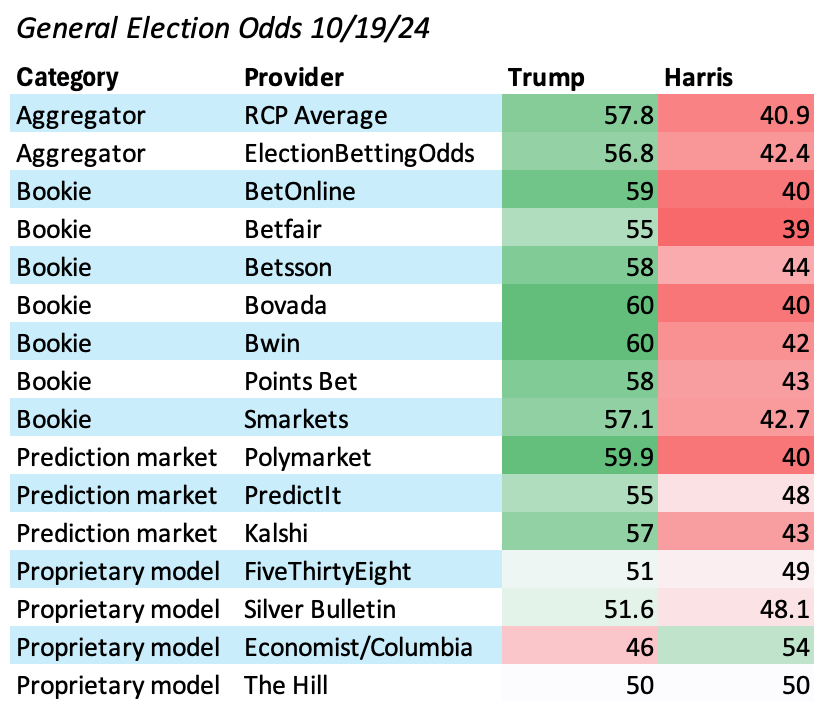

Castle Island’s Nic Carter explained “it's pretty obvious it's not just a lone trader that's upwardly manipulating Polymarket since all bookies and prediction markets give Trump roughly the same odds. The real divide is between the markets and the press/pundit driven proprietary models, which are more bullish Harris.”

This seems like a straightforward way to identify that a single group couldn’t possibly be manipulating aggregators, bookies, prediction markets, and proprietary models.

But there is more evidence.

Kalshi, which is the only prediction market where it is legal in the United States to bet on the Presidential election, released some of their internal data to disprove the manipulation theory as well. Kalshi founder Tarek Mansour tweeted the following:

“Media claim: a few big whales are driving Trump's odds up

Reality: The median bet size on Harris is LARGER than the median bet size on Donald Trump. Trump’s odds are not the result of a few people pushing the odds up. It’s the opposite.”

This data seems fairly overwhelming. Prediction markets seem to be creating a new data point in the market about the US election.

Here is the thing though — if the prediction markets end up being right, this could mark the beginning of the end for political polls. Why is that important? Because prediction markets are another example of free markets disrupting incumbent traditions dominated by academia and bureaucracy.

Bitcoin is the free market solution to money. Prediction markets are the free market solution to politics. There will be many more.

Now that the technology is available, and an entire generation has grown up with free market products, we should expect technologists to continue building these systems to take on incumbents.

Regardless of whether you use bitcoin or prediction markets, it is important to understand that free market products are good for the general population. More information. Less manipulation.

Welcome to the future.

You can check out Kalshi’s Presidential election prediction market here: Click here

Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 Talk or Hang Out With Anthony Pompliano 🚨

I want to meet you.

In order to get the meeting scheduled, you have to purchase a certain amount of my new book, How To Live An Extraordinary Life. You can do one of the following:

Buy 25 Books: We will have a 30 minute video call to discuss anything you want.

Buy 100+ Books: I will speak virtually at your event or company meeting.

Buy 500+ Books: I will speak in-person at your event or come to your office.

Buy 1000+ Books: You get to spend an entire day with me in-person, including breakfast, lunch, and dinner. I will also speak at your event or to your team.

You can use this link to purchase up to 100 books and then use this link for a discount on bulk buys over 100 books.

Here is how it works:

You reply to this email with the receipt or screenshot.

I will send you potential days/times for the call, meeting, or visit.

I have already done a few calls with people and spoken at different events. It is just as fun for me as for you, so I look forward to meeting many of you as well.

My Fox Business Appearance From Thursday

I spoke to Fox Business on how bitcoin has stumped Wall Street and the confusion that is created by a simple financial asset. Timeless investing principles still apply.

Enjoy!

Podcast Sponsors

Domain Money makes financial planning straightforward and accessible. They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post