To investors,

There are more than 37 million crypto tokens in existence today. That number blew my mind when I saw it recently. Most of these tokens are obviously inactive or not viable, but the fact that so many tokens have been created over the last 15 years tells a broader story — there is intense competition for attention and capital in the crypto industry.

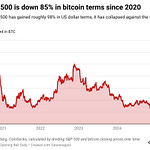

This increasing competition makes it even more impressive that bitcoin, the first cryptocurrency asset created, has continued to be the largest and most liquid asset in the market. Bitcoin Magazine pointed out this morning that bitcoin’s market cap dominance recently hit a new 4-year high.

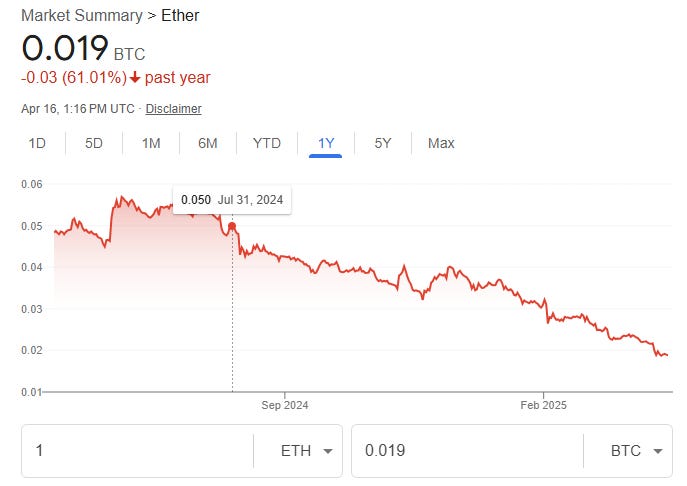

Pretty incredible, right? The story is even crazier when you look at bitcoin compared to Ethereum, the second largest cryptocurrency. Benjamin Cowen shows the bitcoin/ethereum pair has been down only for years.

Parker Lewis points out that ethereum is down 61% against bitcoin in the last year.

There are many theories as to why bitcoin continues to hold this dominance. One argument is a tech argument — bitcoin has perfect product-market fit, which is very hard to reverse once the right product has momentum. Another argument is a financial one — things in motion tend to stay in motion. Some will argue from a psychology perspective — bitcoin’s brand is the most well-known, which means that mindshare turns into capital flows.

But my favorite argument, mainly because I think it is the most true, comes from a common sense perspective. Fred Kruger tweeted this morning a great articulation of this idea:

“The rich need a place to store their wealth. In the 80s that was US Bonds. In the 90s, it was US Stocks. In the 00s, it was US and London Real Estate. In the 2010s, it was US Tech Stocks. Since 2020, Bitcoin has massively outperformed.

And now we have trade wars. Bad for stocks. Bad for real estate. Bad for bonds. Good for gold. and ultimately great for Bitcoin.”

Bitcoin is dominant because it provides the right solution to one of the biggest problems in modern society. Governments continue to debase their currencies, so the people run and hide in sound money assets. The 37 million other crypto assets have different focuses, but none of them are as big of an idea as bitcoin.

I don’t see bitcoin’s dominance disappearing. It may fluctuate from year-to-year, but ultimately — bitcoin is the idea whose time has come. I can’t believe we are so fortunate to be able to live through this historic development in human history.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Bitcoin And Gold Are Winning Together?

Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss bitcoin, crypto, gold, tariffs, Anthony recaps his trip to the White House, and he explains why he thinks bitcoin will skyrocket past gold.

Enjoy!

Podcast Sponsors

Figure Markets — Trade, borrow, and earn on your crypto with full transparency.. The future of finance isn’t TradFi or DeFi—it’s both. Learn more about Figure Markets or click here to claim your $50!

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Reed Smith - Smart legal solutions for complex disputes, transactions, and regulations. Learn more at www.reedsmith.com.

Bitwise - America’s largest crypto index fund manager and the only Bitcoin ETF issuer that publishes its wallet address plus donates 10% of profits to open source developers. Learn more at BitwisePomp.com

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

BitcoinOS - The operating system for bitcoin applications powered by zero-knowledge technology. Check out @BTC_OS on twitter to learn more.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Share this post