To investors,

Will Clemente breaks down this week’s bitcoin situation using on-chain metrics to separate the signal from the noise. You can follow Will on Twitter or sign up for his email by clicking here. Here is Will’s analysis:

Hope all is well and you had a great week. It’s been another week of ranging for Bitcoin with some interesting price action in the later portion of the week, retesting range lows at 31K followed by a sharp rebound. Let’s take a look at what clues we can gather from on-chain.

Key takeaways:

Accumulation process is nearly complete

Profit-taking nearly reset on all time frames

The rate of which short-term holders have been selling has decreased, while the rate that long-term holders are buying has increased

Futures Open Interest creeping back up

Miners selling, hash rate trending down

Sitting on lower band of Stock-to-Flow

Large cluster of on chain volume forming at these levels

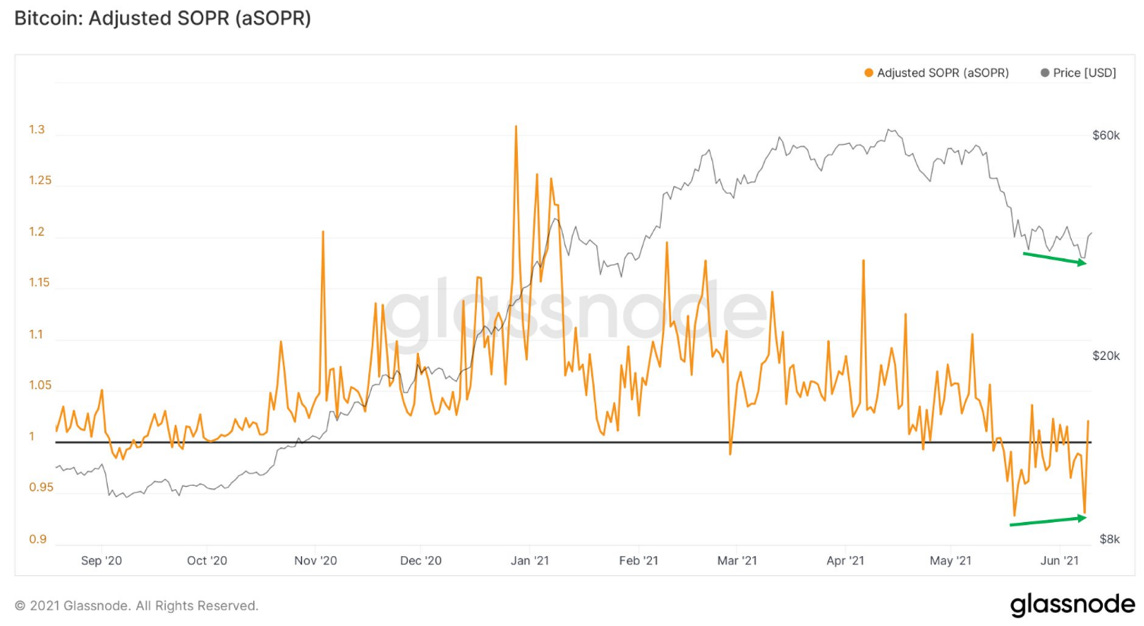

Firstly, I wanted to look at SOPR. This is something we look at often, a ratio of the profit-taking between coins trading on any given day. SOPR looks bullish for several reasons:

Back above the 1.0 threshold (coins are no longer being sold at a loss)

Double Bottom/Higher low

Deepest reset since March 2020

Bullish Divergence

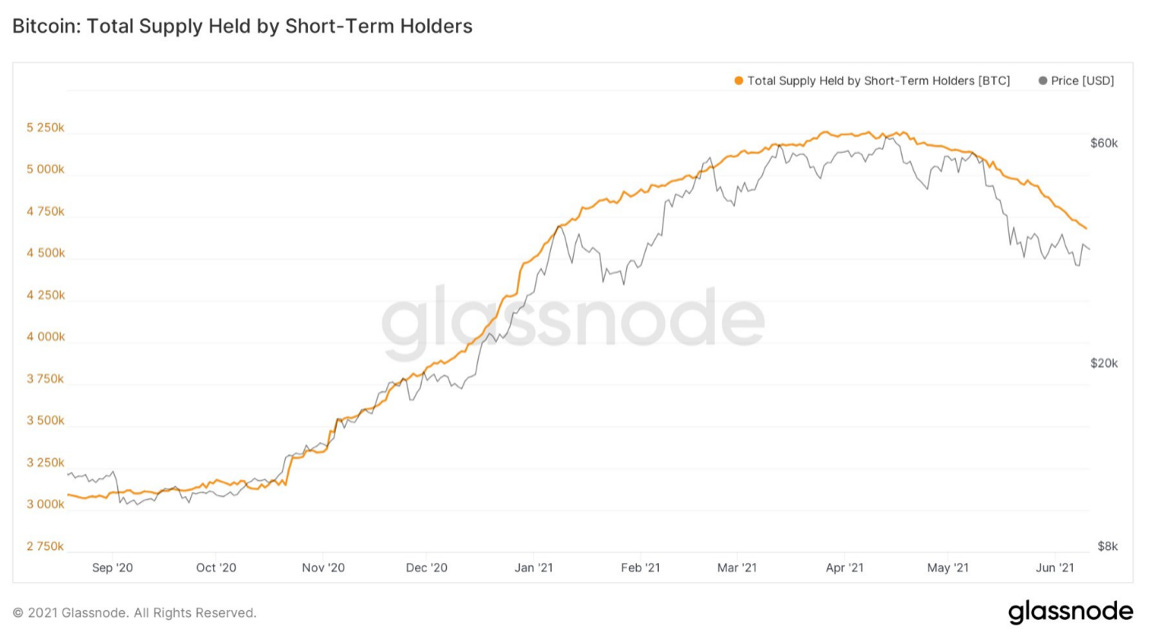

Would like to see SOPR stabilize above 1. One trend that we have been following for 2-3 weeks now is the rate of which Long and Short-Term Holders have been adding to their positions. In the last week, STHs moved 106,319 BTC out of their holdings. Over the last month STHs moved 422,188 BTC out of their holdings. Now let’s look at long term holders and compare.

In the last week long term hodlers have added 137,434 bitcoin to their holdings. In the last month they have added 389,968 BTC to their holdings.

With that noted you get the following when looking at the difference between STHs and LTHs:

7 day change: LTHs +31,115 (or) STHs -31,115

1 month change: STHs +32,220 (or) LTHs -32,220

Short-term holders had been selling at a greater pace than long-term holders were selling throughout the recent drawdown. However in the last week especially, long-term holders are now buying at a greater rate than short-term holders are selling. Along with what we looked at with SOPR, this shows that the re-accumulation process is almost complete.

*note some of this is short term holders aging into the long term cohort (155 day threshold)

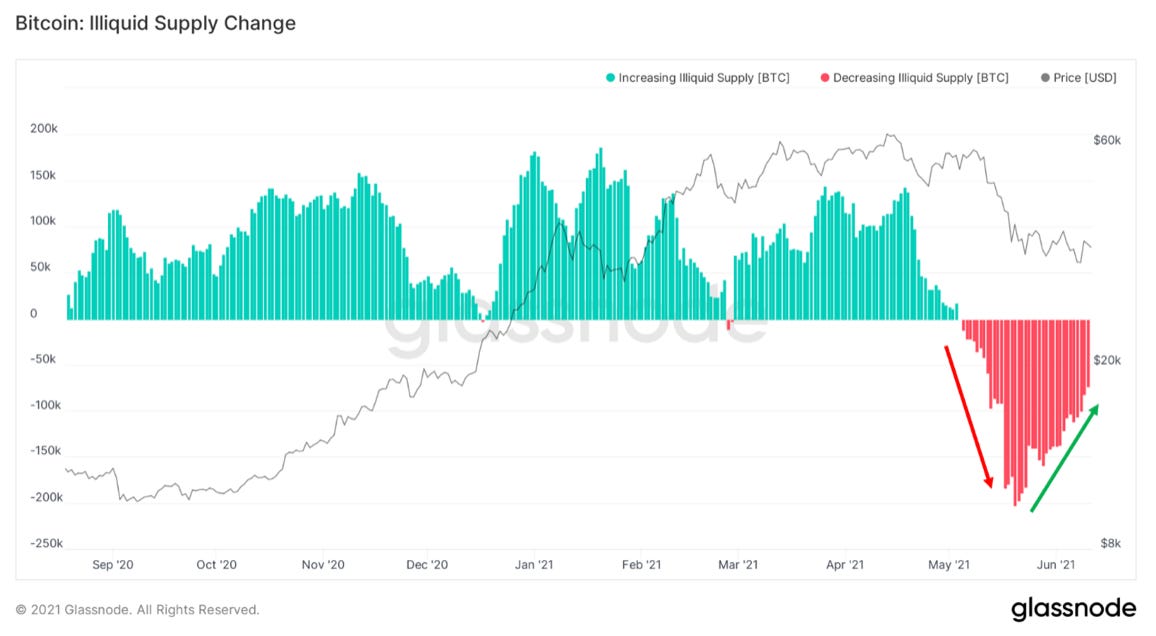

Another metric to look to asses accumulation is illiquid supply change. This is one of the main metrics that had been talked about throughout the early bull market, showing strong accumulation. It was even dubbed the “Rick Astley Indicator” by Willy Woo, given that these holders appeared that they were never gonna let us down. However, this metric flipped from strong accumulation to distribution quite rapidly at the end of May/early June as a lot of coins that appeared to be in strong hands were sold off amidst the price drop. However, since the price drop, this metric has started slipping back into what can be thought of as accumulation/strong hands.

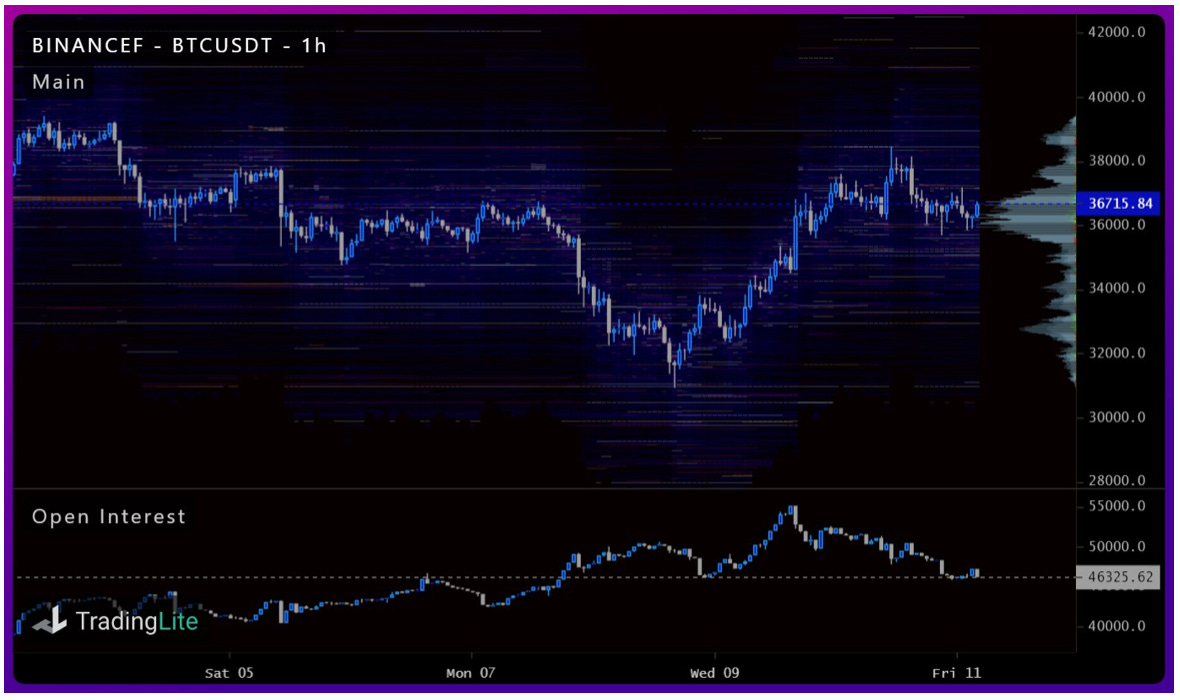

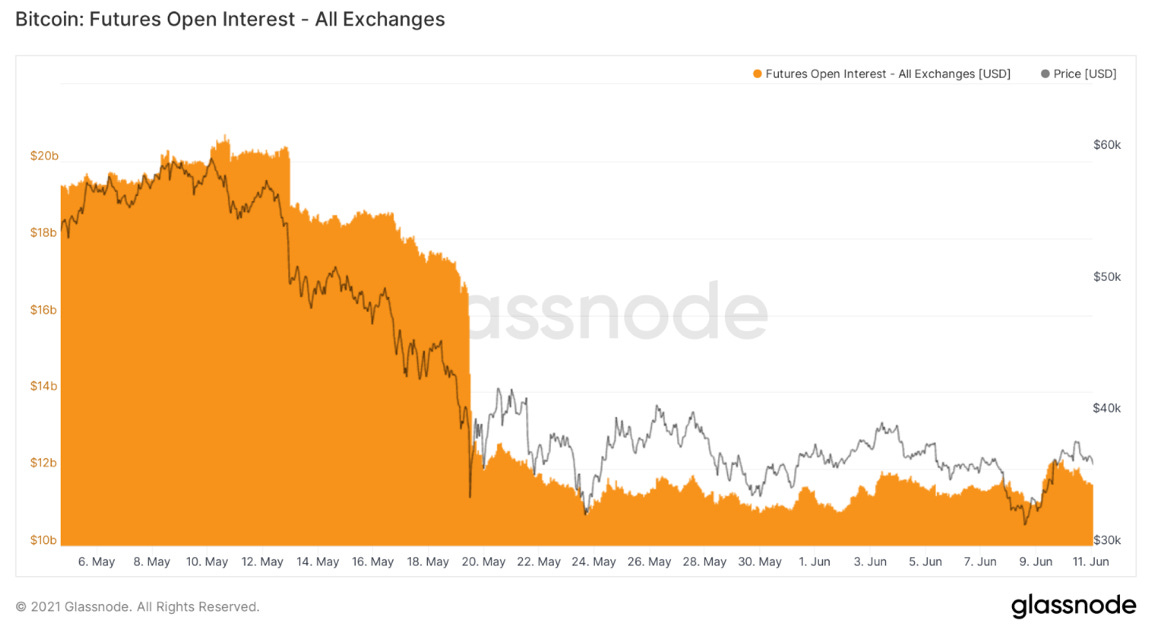

Futures Open Interest has started to creep back up, briefly reaching over $12.2B on Wednesday during the rally off 31K. As OI comes back, futures data will become more influential in trying to asses the market, with metrics such as funding rates.

One interesting thing that I saw was a huge increase of shorts piling on from Bitfinex throughout the week. The only other time I’ve seen something similar was the day before the liquidation crash to 30K a few weeks ago. Potentially this is just a big player hedging, but something to take note of.

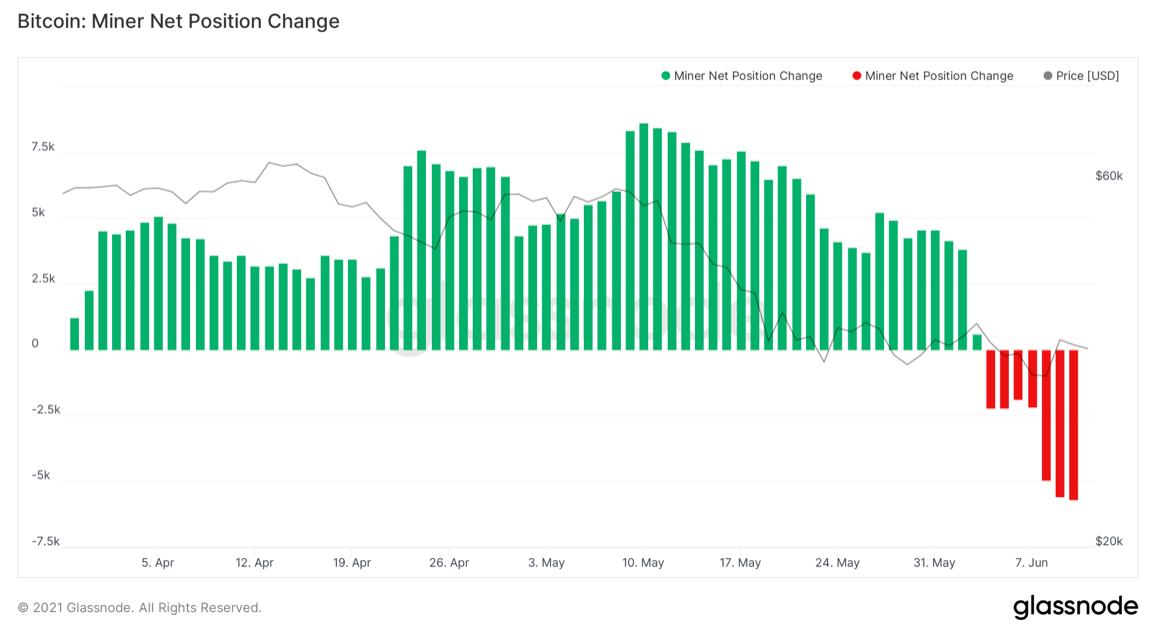

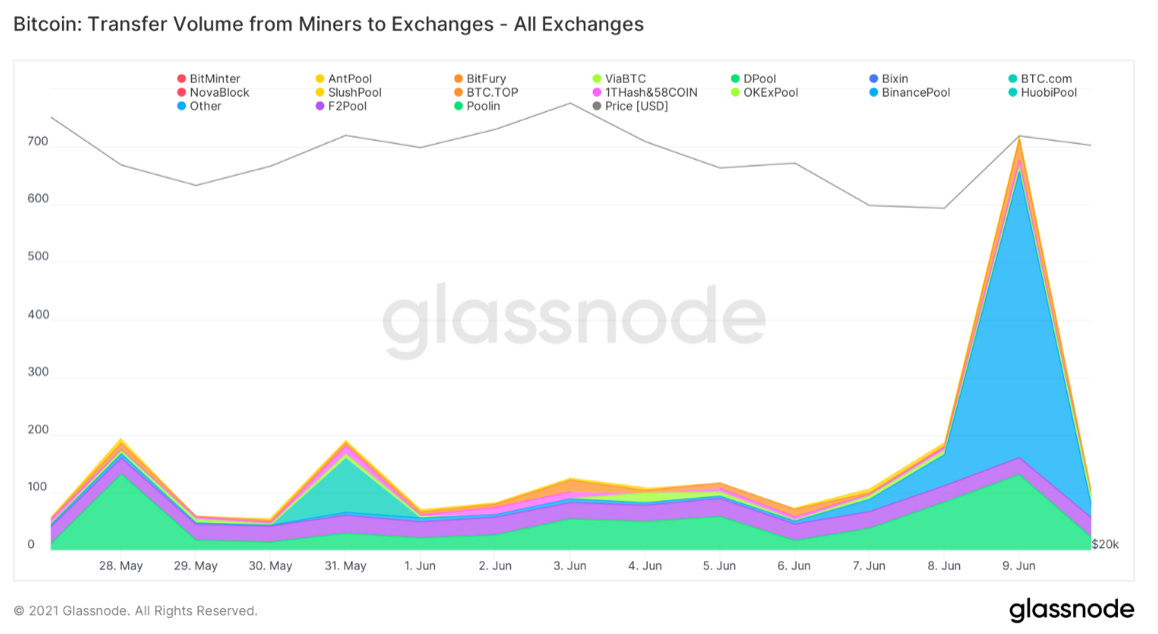

Miners have been selling off throughout the week, this comes after strong accumulation over the last month. From what I can tell it appears to be a lot of selling coming from Chinese miners mostly. This is not a large portion of supply, they’ve only sold about 4K BTC in the last week, just a change in trend to keep in mind.

Plan B’s stock to flow is currently having the largest deflection from the model price in its history. We’re sitting on the lower bound of the model’s outer band. If the model is going to stay valid price needs to start moving up soon.

In conclusion, the accumulation and profit-taking process we've been tracking is nearly complete. The rate of which short-term holders have been selling has decreased, while the rate that long-term holders are buying has increased. Futures Open Interest creeping back up; would expect that to come back in a big way if we get a strong move to either the up or downside. Miners selling, especially from China, hash rate trending down. Lastly, we continue to carve out a large cluster of on-chain volume at these levels. Looking forward to touching base on my channel Monday. Hope you all have a great weekend. Cheers!

That is it for today’s analysis. Hopefully you found this helpful. I highly suggest you subscribe to Will Clemente’s email where he breaks down on-chain metrics multiple times per week: Click here

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 180,000 other investors today.