To investors,

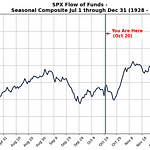

There is only one chart that is dictating financial markets right now. You can watch it exclusively and essentially tell where markets are headed for the next week or two.

Global liquidity.

It really is that simple. Stanley Druckenmiller famously said “it’s liquidity that moves the market.” He is the GOAT for a reason.

We know global liquidity has been dropping in recent weeks, so it is clear why the S&P 500 is going down — it is following global liquidity.

George Noble points out you can see the same thing affecting the MSCI World index as well.

But stocks aren’t going to do this exclusively. Back in November, Michael Howell showed bitcoin was poised for a pullback after global liquidity decreased.

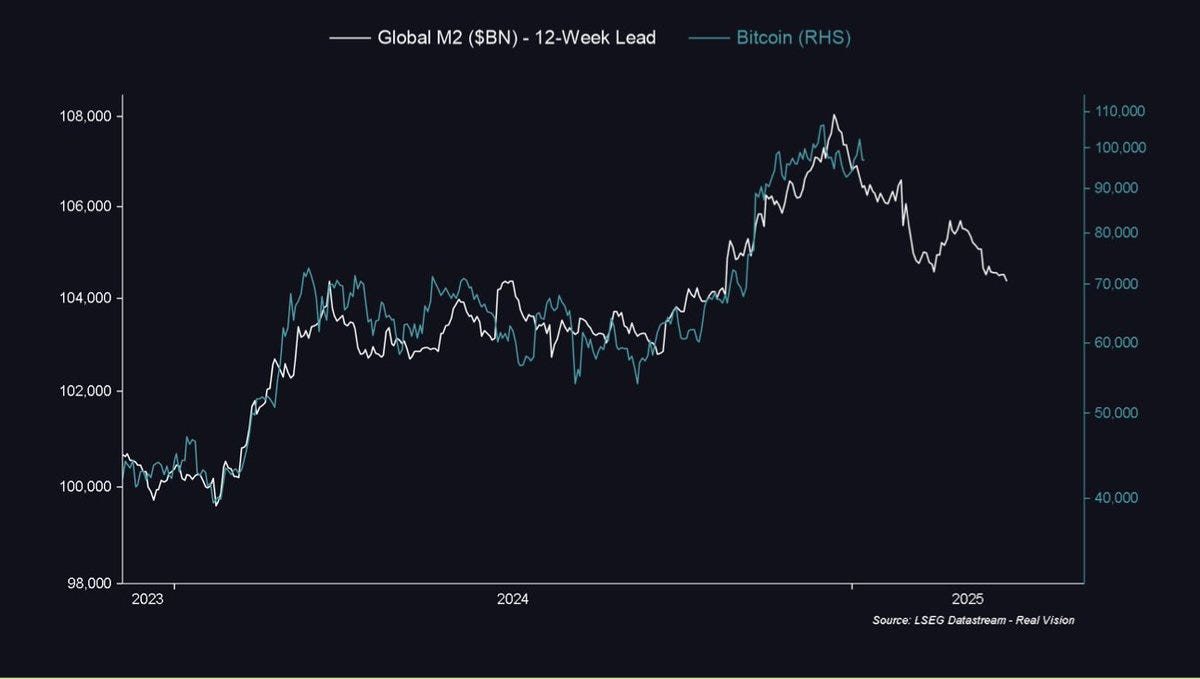

We know bitcoin is the asset most sensitive to changes in global liquidity thanks to the analysis that Sam Callahan did.

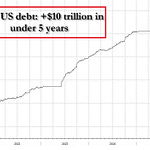

Raoul Pal highlights just how closely bitcoin has followed M2 supply.

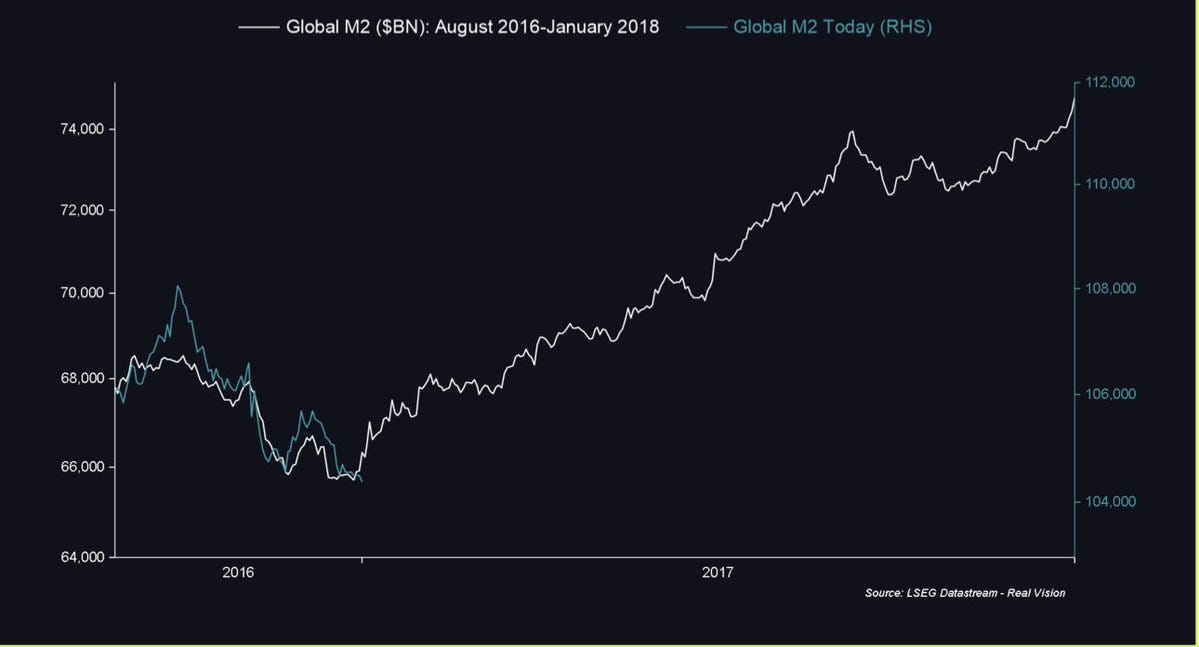

And he also shows that M2 supply seems to be following the 2016 and 2017 performance.

Sometimes investing is more simple than we like to think. Watch global liquidity. As Druckenmiller said, it will move the market.

Almost everything else is noise.

I hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: I am hosting Bitcoin Investor Week in NYC from February 24-28th. This will be the largest finance conference of the year focused on bitcoin. Speakers include Mike Novogratz, Cathie Wood, Jan van Eck, Anthony Scaramucci, Jack Mallers, and many others.

You can purchase tickets here: Get ticket for Bitcoin Investor Week

Dave Collum Highlights The Potential Financial Disaster He Sees Ahead

Dave Collum is a Professor of Chemistry at Cornell University.

In this conversation we discuss his 2024 year in review, bitcoin, gold, stock valuations, frontier justice, cancel culture, Elon Musk, government spending, healthcare administrations, and much more.

Enjoy!

Podcast Sponsors

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $500 in rewards.

Ledger - Ledger secures 20% of the world’s digital assets. Their latest devices, Ledger Stax and Ledger Flex, feature secure touchscreens for safer, easier crypto management.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intedneded to serve as financial advice. Do your own research.