If you are not a subscriber of The Pomp Letter, join 215,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

To investors,

The geopolitical chess game continues to evolve at an incredible rate. Over the last 24 hours, reports are surfacing that the United States is looking to ban imports of Russian oil and various options are being evaluated in an attempt to freeze Russia’s gold reserves. These punishments are being pursued as Russia continues their military offensive in Ukraine.

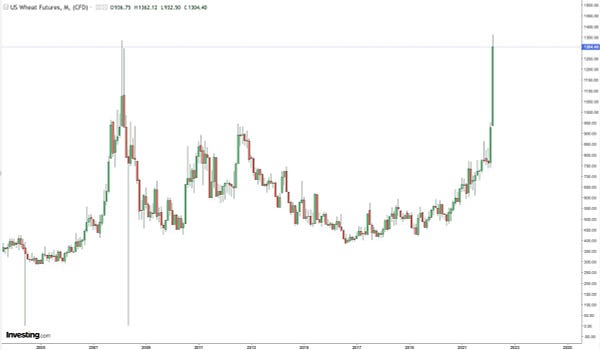

The implications of the current events are unknown, but we are beginning to see commodity prices spike aggressively. First, wheat has hit an all-time high.

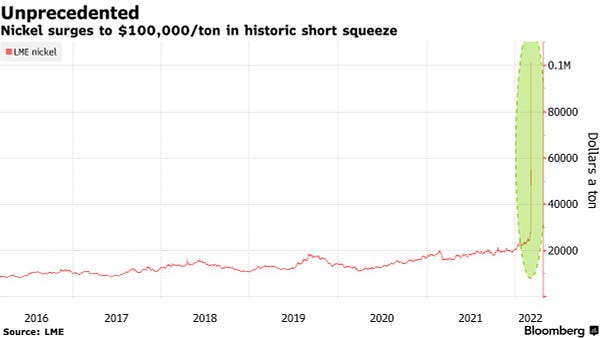

Nickel has been increasing by hundreds of percent as well.

And, of course, oil prices are going parabolic.

It shouldn’t be shocking that commodities, especially ones where Russia and Ukraine are major producers, are being driven higher during this conflict. The surprising part is how quickly it is happening and how large the moves in price have become. The joke on Twitter is that commodities are trading like shitcoins, which has a hint of truth to it.

But while all this is going on, I continue to ask myself what it all means for the future macro economy? No one has a crystal ball but can we use history as a guide?

Social Capital’s Chamath Palihapitiya recently explained on the All-In Podcast that every time energy prices have spiked by 50% or more in the last 30-40 years, it was followed by a recession. Sven Henrich highlighted this morning that the last time wheat prices reached these levels, a recession followed.

History doesn’t repeat perfectly, but the warning signs of a potential recession are growing louder and louder. Now the biggest curveball in the situation is that the Federal Reserve is still sitting with interest rates at 0%. Given that inflation is likely to come in at 8% or more during the next report, the normal reaction would be for the Fed to raise rates to bring that inflation more in-line with their goals and expectations.

We have now entered into a dicey situation where hiking of interest rates could actually accelerate us into a recession. This means that the Federal Reserve has a nearly impossible job. Allow inflation to continue to ravage the financial well-being of hundreds of millions of people or risk pushing the global financial system into a downward spiral across financial assets. This is a lose-lose scenario with no clear off-ramp.

So how does this play out for the United States, our allies, our adversaries, and the various fiat currencies that they control?

Zoltan Pozsar of Credit Suisse published a note yesterday that will blow your mind. Before I highlight what he said, it is important to understand who Pozsar:

Zoltan Pozsar is a Managing Director and is the Global Head of Short-Term Interest Rate Strategy based in New York. Prior to joining Credit Suisse in February 2015, Zoltan had a distinguished career in the public sector. During the Great Financial Crisis, Zoltan served at the Federal Reserve Bank of New York in charge of market intelligence for securitized credit markets and was the point person on market developments for senior Federal Reserve Board, US Treasury and White House officials throughout crisis. From 2011 to 2012, Zoltan was a visiting scholar at the IMF where he authored a number of papers, framed the Fund’s official position on shadow banking, and consulted G-20 working groups on global macro-financial developments. From 2012 until his arrival at Credit Suisse, he served as a senior adviser to the U.S. Department of the Treasury.

Essentially, Zoltan Pozsar is the epitome of the insider or establishment, especially when it comes to his views on currencies, financial assets, and markets. In the note, which is titled Bretton Woods III, Pozsar starts off with the following excerpt:

We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West.

A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money. Bretton Woods II was built on inside money, and its foundations crumbled a week ago when the G7 seized Russia’s FX reserves…

Pozsar then went on to explain why people should be concerned about recent commodity price moves:

The aggressor in the geopolitical arena is being punished by sanctions, and sanctions -driven commodity price moves threaten financial stability in the West. Is there enough collateral for margin? Is there enough credit for margin? What happens to commodities futures exchange s if players fail? Are CCPs bulletproof ?

I haven’t seen these topics in the wide offering of Financial Stability Reports, have you? Is the OTC commodity derivatives market the gorilla in the room? The commodities market is much more financialized and leveraged today than it was during the 1973 OPEC supply crisis, and today’s Russian supply crisis is much bigger, much more broad -based, and much more correlated. It’s scarier

Pozsar finished his piece with the following conclusion:

In this instance, price instability (surging and collapsing commodity prices) feeds financial instability: margin calls may trigger the failure of some smaller commodity traders and maybe even some CCPs – the commodity exchanges.

Again, commodity correlations are at 1, which is never a good thing…

The Fed and other central banks will be able to provide liquidity backstops…

…but those will be Band-Aid solutions. The true problem here is not liquidity per se. Liquidity is just a manifestation of a larger problem, which is the Russian-non-Russian commodities basis, which only China will be able to close.

Do you see what I see? Do you see inflation in the West written all over this like I do?

This crisis is not like anything we have seen since President Nixon took the U.S. dollar off gold in 1971 – the end of the era of commodity-based money.

When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities.

From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).

After this war is over, “money” will never be the same again…

…and Bitcoin (if it still exists then) will probably benefit from all this.

Reading this type of thought process from someone who understands the intricacies of the financial system, while also having a grasp of how policy makers are thinking right now, has to make you start thinking about how much bigger this situation could become. I don’t know how the future plays out, but my guess is that most people will start looking for a safe place to store their wealth, regardless of what happens.

Somehow, all roads lead back to bitcoin.

Hope you have a great day. Talk to everyone tomorrow.

-Pomp

If you are not a subscriber of The Pomp Letter, join 215,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

Do you want a job in the crypto industry?

My team and I have been working with the top HR teams in the industry to create a training program that teaches the fundamentals of crypto.

We cover everything from how central banks work to bitcoin’s technical architecture to smart contract platforms to niches of the industry, such as NFTs, DAOs, and much more.

This 3-week intensive program has 50+ events packed into the most valuable training program in crypto. We helped more than 400 people get hired last year and you can be one of them.

Our next cohort starts in March: CLICK HERE TO APPLY.

SPONSORED:

Western Rise creates performance clothing for travel, work, and play. They use the world's highest performance fabrics to be wearable for any occasion and comfortable in any situation.

Western Rise was founded by Will & Kelly Watters in Telluride, Colorado. Instead of chasing fads and trends, they decided to elevate classic staples to be more versatile than ever before. Every design detail and process is considered, removing anything unnecessary for maximum versatility.

Every item is backed by a lifetime guarantee with free returns. Get 20% off your first purchase when you use code "BBS" at checkout.

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Bitcoin 2022 is the largest Bitcoin event in the world that takes place 4/6 - 4/9 in Miami Beach. Click HERE to learn more and use promo code POMP for 10% off.

Fundrise is largest direct-to-investor real estate investment platform. Go to Fundrise.com/Pomp today and get $10 when you place your first investment.

Unstoppable Domains’ 10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domain here today.

Brave Wallet is the first secure crypto wallet built natively in a web3 crypto browser. Download the Brave privacy browser at brave.com/Pomp today.

Abra lets you trade, borrow, and earn interest on crypto. Earn up to 13% interest on USD stablecoins or crypto, borrow USD stablecoins, and trade in 110+ cryptocurrencies in a simple, secure app. Download Abra and get $15 in free crypto when you fund your account.

FTX US is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing up at FTX.US today.

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in digital assets inside your IRA. Visit choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Those products include BlockFi Wallet, no fee Trading, crypto collateralized Loans and the World's First Crypto Rewards Credit Card. To get $75 back on the first swipe of your BlockFi Rewards Credit Card, sign up today at http://www.blockfi.com/Pompcc

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pomp

Okcoin is the first licensed exchange to bring new cryptos to market. To get started, and go to okcoin.com/pomp

Exodus is the world’s leading desktop, mobile, and hardware crypto wallets, with over 150 assets. Founded in 2015 to empower people to control their wealth. Visithttp://exodus.com/pomp today.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

The Insiders Are Yelling Warning Signs