Stablecoins Are Eating The World

REMINDER - Crypto Investor Day Is One Week Away!

Reflexivity Research invites you to join us on Friday, October 25th in New York City as we continue to bridge the power of traditional finance with the innovation of crypto.

We’re inviting hundreds of institutional investors, capital allocators, and entrepreneurs together for the inaugural Crypto Investor Day. The event will be hosted by Reflexivity Research and moderated by Anthony Pompliano.

Expect top-tier speakers, plenty of networking opportunities and hours of insightful discussions around the future of crypto across the traditional finance and institutional landscapes.

No gimmicks or distractions, we operate our events on an insights-per-minute KPI.

To investors,

Stablecoins are the second best product in crypto after bitcoin. I would even argue that stablecoins are the only other product with true product-market fit.

The data is overwhelming.

Nic Carter’s Castle Island worked with Brevan Howard, Visa, and Artemis to publish a white paper on stablecoins. Two of the most compelling data points were:

Approximately 2 out of every 3 emerging market crypto users had converted stablecoins and their local currency.

About 40% of emerging market crypto users had used stablecoins to pay for a good or service.

These are large numbers in emerging markets. But the stablecoin story is not exclusive to emerging markets.

Philip Gradwell was recently hired as Head of Economics at Tether and shared the following three statistics:

#1 - USDT has 330 million on-chain wallets and accounts, a proxy for users, as of Q3 2024, plus tens of millions more who only use USDT on centralized platforms.

#2 - Growth is accelerating with Q3 welcoming 36 million new users, Tether’s best quarter yet.

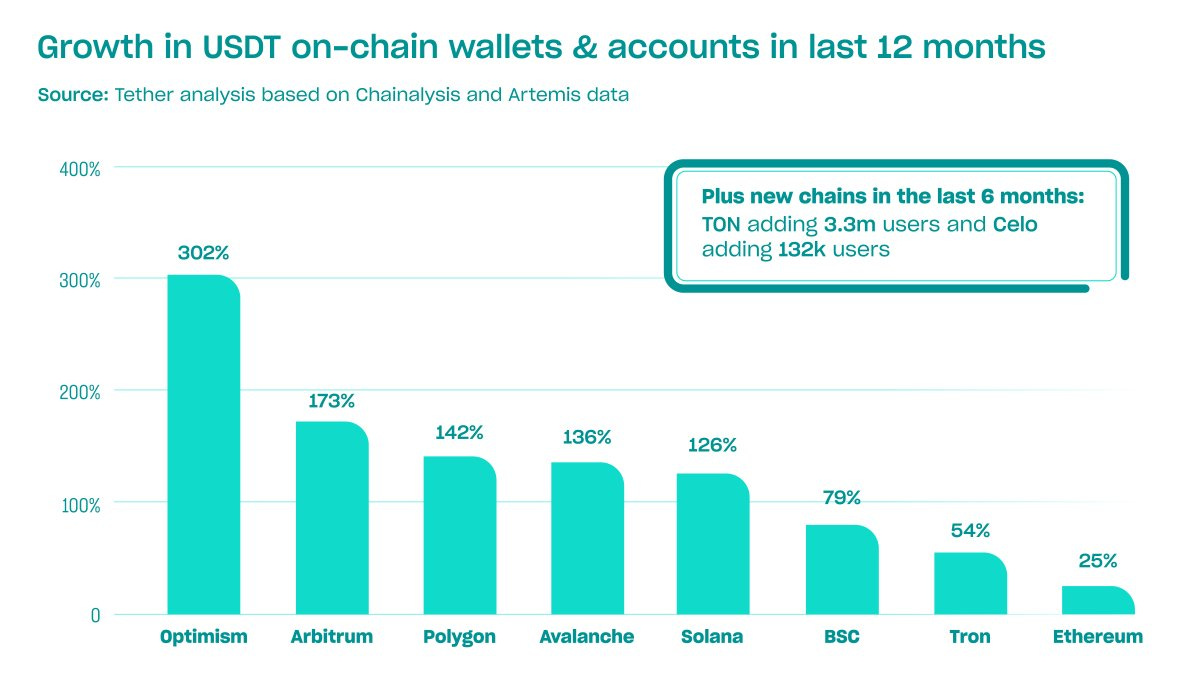

#3 - Fastest rate of growth is on Layer 2 chains and TON added 3.3 million users in its first six months.

These insights are great across the two sources because they tell us a few things about stablecoins that every investor should internalize. Here are my takeaways:

Stablecoins are a global story — both developed and developing nations.

Users are looking to hold stablecoins, along with transact with them.

Stablecoin usage trends towards the fastest, lowest cost blockchain, regardless of decentralization.

The US dollar is gaining adoption with the increased access that stablecoins bring, which is counter to the narrative that crypto is a threat to the US dollar.

There are hundreds of millions of people using these assets already, which suggests the user base will eventually be billions according to current growth rates.

If bitcoin tokenized gold, then stablecoins tokenized dollars. This upgrade proves the market wants dollars that are cheaper and faster to transact with.

I am watching the stablecoin story closely because of how strong the product-market fit has been. My expectation is we will see stablecoins eat into the market share of dollars.

Remember, 100% of dollars used to be physical currency. Today that number stands at less than 10%. Eventually 80-90% of dollars will be stablecoins in my opinion.

The challenge for investors is how to invest alongside this trend. Buying a stablecoin that is always worth $1 won’t allow you to make any money. You have to find unique ways to allocate capital and benefit from the trend.

You could invest in private companies behind these assets. Maybe crypto exchanges that embrace the assets will have an advantage. There will be payment processors who are stablecoin-friendly, which may drive outsized returns. But the exact investment strategy to benefit from the rise of stablecoins is still unclear.

Let me know if any of you have ideas. I would love to learn from you and think more critically today.

Hope everyone has a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 Talk or Hang Out With Anthony Pompliano 🚨

I want to meet you.

In order to get the meeting scheduled, you have to purchase a certain amount of my new book, How To Live An Extraordinary Life. You can do one of the following:

Buy 25 Books: We will have a 30 minute video call to discuss anything you want.

Buy 100+ Books: I will speak virtually at your event or company meeting.

Buy 500+ Books: I will speak in-person at your event or come to your office.

Buy 1000+ Books: You get to spend an entire day with me in-person, including breakfast, lunch, and dinner. I will also speak at your event or to your team.

You can use this link to purchase up to 100 books and then use this link for a discount on bulk buys over 100 books.

Here is how it works:

You reply to this email with the receipt or screenshot.

I will send you potential days/times for the call, meeting, or visit.

I have already done a few calls with people and spoken at different events. It is just as fun for me as for you, so I look forward to meeting many of you as well.

World’s Greatest Trader Reveals His Secrets - Tom Sosnoff

Tom Sosnoff is the Founder of TastyTrade and the CEO of TastyLive. He is also an entrepreneur with over $2 billion in exits.

In this conversation, we discuss economic data points that may be wrong, how he built such great products, how he thinks about trading 100 positions a day, why he makes 18,000 trades per year, and the daily mindset of a trader.

Listen on iTunes: Click here

Listen on Spotify: Click here

Podcast Sponsors

Domain Money makes financial planning straightforward and accessible. They tailor plans to your personal priorities and goals, whether it’s buying a house, funding college, or taking that dream vacation.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

Gemini is the safe and secure way to trade crypto. Use code Pomp100 and start trading crypto to earn $100 in BTC.

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

Folks Finance, built on Algorand rails but migrated to a crosschain platform via Chainlink, offers USDC lending with a 10% APY. I lent Algorand in the past on the platform with no problems. I also use USDC in my liquidity pools on Tinyman (also on Algorand) because they provide a more stable pair with less price fluctuation and thus less chance of impermanent loss.

Has anyone written about the effects of a collapsing USD on stablecoins? Granted, the USD will likely be the last global fiat currency to collapse, but I can't say I have seen/read how that affects (plays out for) people holding Tether, for example. Although, I do understand Tether also uses other assets besides US Treasuries to back their product, so... Just something that bubbled up in my mind.