To investors,

The letter today is from Will Clemente, who has become one of the best bitcoin analysts in the industry in my opinion. He recently started his own, free email that I highly suggest you subscribe to receive: Click here to get Will’s work each week

He will also be joining me each week for a new Saturday podcast episode that will review the weekly on-chain metrics as well. Will is a smart, hard working guy who has a bright future. Your support of his work would mean the world to me.

Hope you are all having a great week. At the time of writing, (7:30EST 5/6) Bitcoin sits just above $56,000 after a choppy week of trading. Price is up 5.28% on the week, with the high being $58,986 and low being $52,913. Let us dive into some of the on-chain trends that are developing.

Broader Cycle Trends Worth Noting

Firstly, we will take a look at some of the broader macro trends that are still pointing to this cycle being far from overheated. One of the most accurate metrics that can be used to estimate tops is MVRV Z-Score. MVRV was created by David Puell and Murad Mahmudov, but the idea of z-scoring it came from analyst on-wonder. This metric takes a ratio of Bitcoin’s market cap and its realized cap. Realized cap can be thought of as market cap based on the time coins were last moved. For example, if someone bought $100,000 of BTC at $1 and never moved them, $100,000 would be added to realized cap, rather than $5.6B of market cap (100,000 x 56,000). Remember, price trades on the margin. After taking this ratio of market cap to realized cap, the metric is z-scored, a term meaning that it is adjusted for volatility. This gives it a more precise signal.

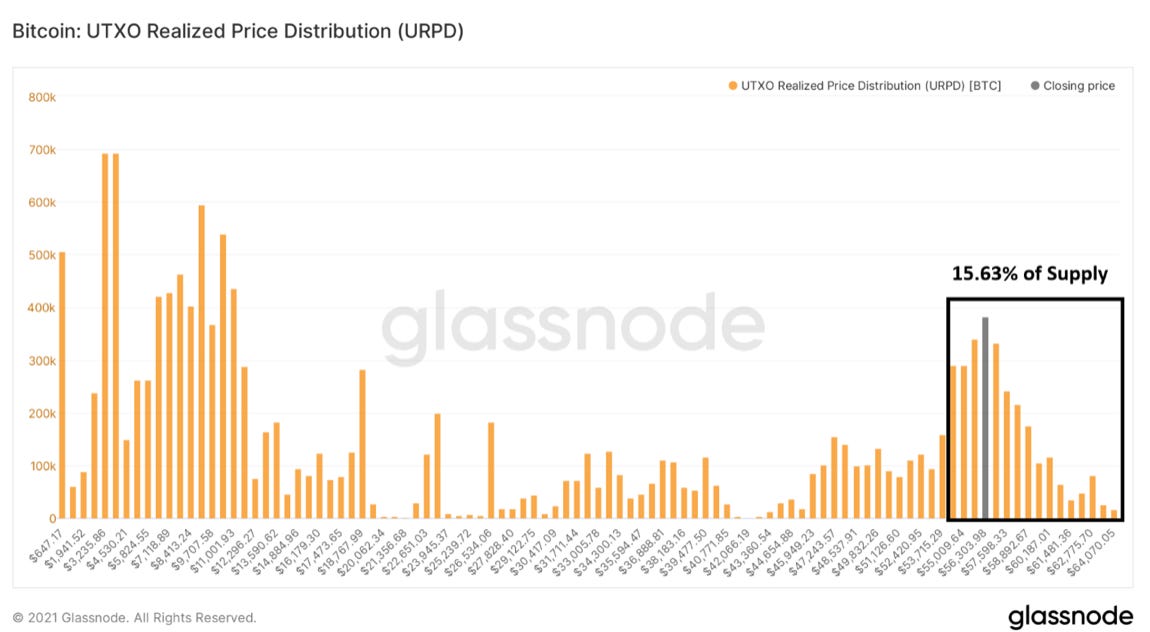

As you can see in the chart, the metric shows distinct cycle peaks (red zone), in addition to highlighting great buy zones during the bear market. (green zone) Contrary to a spike that would be seen during a cycle top, the metric has actually been declining over the last few weeks, thus giving it a lot of room to run. This is partially to do with market cap declining, but more importantly realized cap being up $43,545,000 since the beginning of April. This is bullish, meaning coins are moving at these higher sustained price levels, thus validating Bitcoin at these price levels. This is also supported by on-chain volume, with over 15.63% of BTC’s money supply having moved over the 1 trillion-dollar market cap threshold.

The second macro metric I wanted to touch on this week is market cap-thermocap. This metric takes a ratio of market cap to thermocap, which is the total of all revenue generated by the network and rewarded to miners over time. In Glassnode’s words, the metric “can be used to assess if the asset's price is currently trading at a premium with respect to total security spend by miners.” Similar to MVRV, this metric gives distinct spikes at cycle tops, as well as good zones to accumulate in the bear market. We can also see this metric cooling off, another indication that this bull run has a while to go before becoming overheated.

Developments this week

One of the first things that has been attention grabbing this week is stable coin prints. In the last 10 days alone, $6,688,804,340 of Tether & USDC have been printed. Roughly $30B of stable coins have now been printed above $50,000. This is showing a lot of new demand from investors entering the crypto space. Although it is unknown exactly how much of this capital is going to buy BTC, it is at least a substantial portion.

On a side note, it cannot be denied that some of this capital is going into other cryptocurrencies. Although most exchanges’ balances are trending down, Binance’s continues to go up. In my opinion this is a good way to visualize the capital that is flowing into highly speculative altcoins. Binance is minimally regulated compared to most other exchanges like Coinbase, therefore giving them the ability to offer so many coins and having derivatives built off them. This increase could also potentially be showing higher amounts of selling coming from the East as well, although I would suspect it’s a combination of both of these factors. Over the last week, it can be assumed that at least a portion of the recent selling has been derived from traders swapping their BTC holdings into speculative altcoins to capture those gains.

So after showing the increase in stablecoin printing, I’m sure you’re asking, “this sounds great, but who in the world is selling??” In addition to traders swapping coins to speculate on altcoins, the answer is younger coins; AKA inexperienced market participants. One way to determine this is by looking at Average Spent Output Lifespan. Since February, this metric has been trending downward, meaning older coins have decreased selling pressure. This lines up with when Tesla announced their $1.5B buy, is there causation there? That’s up for you to decide, but I suspect yes.

In regard to newer participants selling, we actually saw a cycle high in selling coming from coins that were 1 week to 1 month old recently.

There was also a huge spike in selling that came from coins aged 1 month to 3 months on Tuesday. This is interesting because it aligns with the weekly low of $52,913 on Tuesday.

The spike in selling of 1-3 month old coins also aligns with a large batch of 3,774 BTC ($211M at the time) that was moved onto exchanges around 8AM EST Tuesday. Perhaps this was a related event. Nonetheless, I suspect this large batch played a role in the sell-off, as price declined $3,000 after the inflow.

However, one thing is for sure. Miners are not selling, illustrated by this metric that tracks balance of all miner’s wallets.

Not only are miners not selling, but they are actually accumulating. The miner net position change metric has now been in the green for over a month.

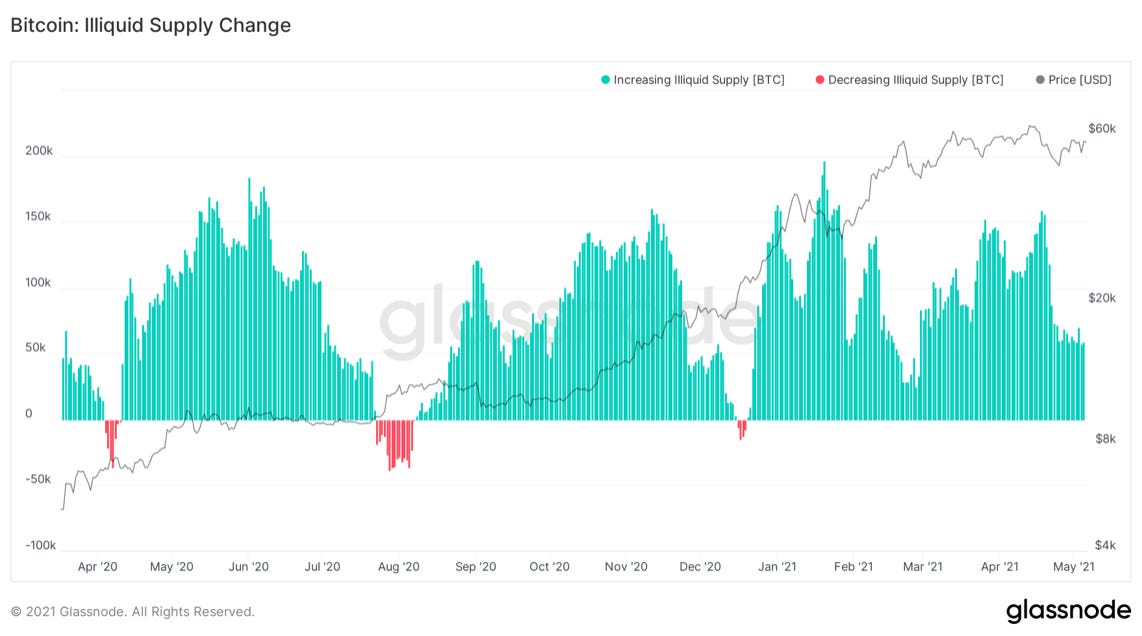

In conclusion, Bitcoin continues to consolidate, coiling up like a spring. Weak-hands continue to sell to older market participants. The phenomenon of coins moving to entities that statistically have very low likelihood of selling continues to persist.

In addition, the macro indicators show we are at a mid-way consolidation, building up a huge base of capital at these price levels. No signs of a market top are even close to flashing. HODL on. Talk to you all Monday, have a great weekend!

Cheers,

- Will

Do you want to work in the Bitcoin and crypto industry? Do you run a business that has open roles to fill? I recently launched the industry-leading job board focused on our industry. We have hundreds of open roles at companies like Coinbase, Gemini, BlockFi, and many others.

Get a Job or Post a Job here: http://www.pompcryptojobs.com

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support! Exodus, Cosmos, OKEx, Choice, Unstoppable Domains, BlockFi, Crypto.com, Public Rec, Circle, Gemini, Revolut, NEAR

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.