Today’s letter is brought to you by Frec!

The wealthy have used a secret strategy to make money and save on taxes for decades — direct indexing and tax-loss harvesting.

The problem historically is that it takes a large team and lots of money to pull these strategies off. That is all changing now.

Frec makes direct indexing available to every investor at 1/10th the cost (0.1% annually to be exact).

It’s nearly identical to investing in ETFs, except it allows investors to take advantage of tax benefits — by owning the stock directly.

With Frec Direct Indexing, you can achieve index-like performance but end up with more money through tax loss harvesting.

Invest in popular indexes and we’ll automatically harvest your tax losses for you.

Automated and done for you. No extra effort required.

Sign up today and start saving money on your taxes!

To investors,

One of the promises of blockchain technology is a public ledger that can be audited by anyone, at any time, from anywhere in the world. Industry proponents historically point to this feature as a way to confirm how many bitcoin are in circulation, how many bitcoin are created on a daily basis, and the 21 million limit has not been changed.

That is not the only use case though. Yesterday we got another use case that could change finance.

Bitwise, a $1.5 billion asset management firm focused on the crypto industry, published the public bitcoin address for their spot bitcoin ETF holdings. Their announcement read:

“Today the Bitwise Bitcoin ETF (BITB) becomes the first U.S. bitcoin ETF to publish the bitcoin addresses of its holdings. Now anyone can verify BITB's holdings and flows directly on the blockchain. Onchain transparency is core to Bitcoin's ethos. We're proud to walk the walk with BITB.”

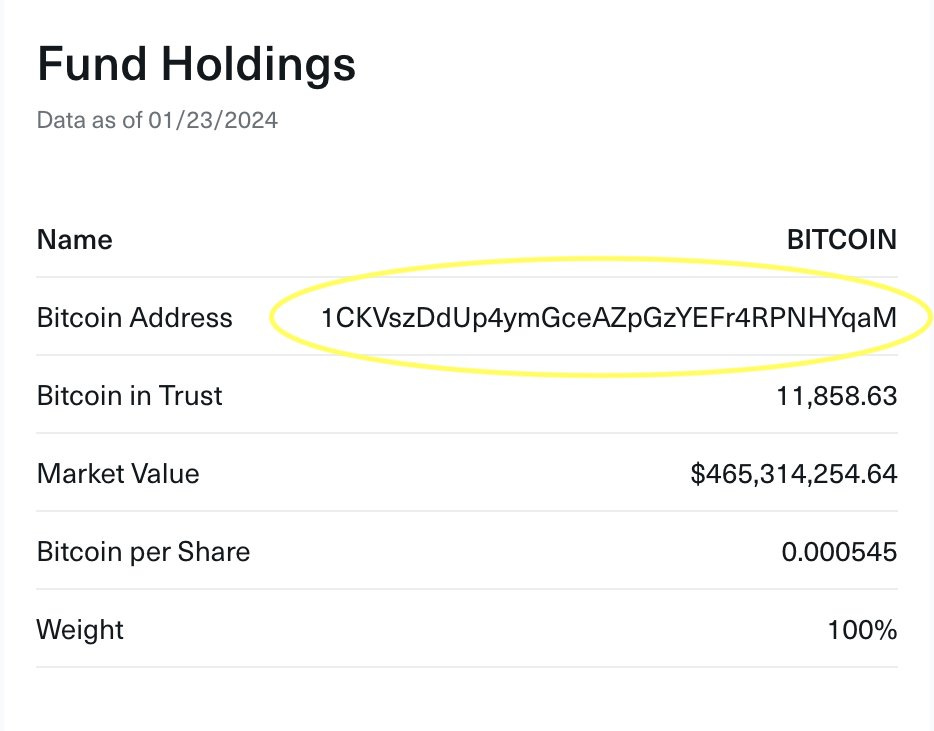

You can see the public address on the fund website too:

This may seem like a small item, but for the first time in history investors are able to verify the asset holdings of an ETF. It is easiest to understand the difference by looking at the gold ETF. There is reportedly billions of dollars in gold sitting in a vault, yet none of the GLD investors can verify or audit those holdings when they want.

Bitwise’s bitcoin ETF allows investors to do that now.

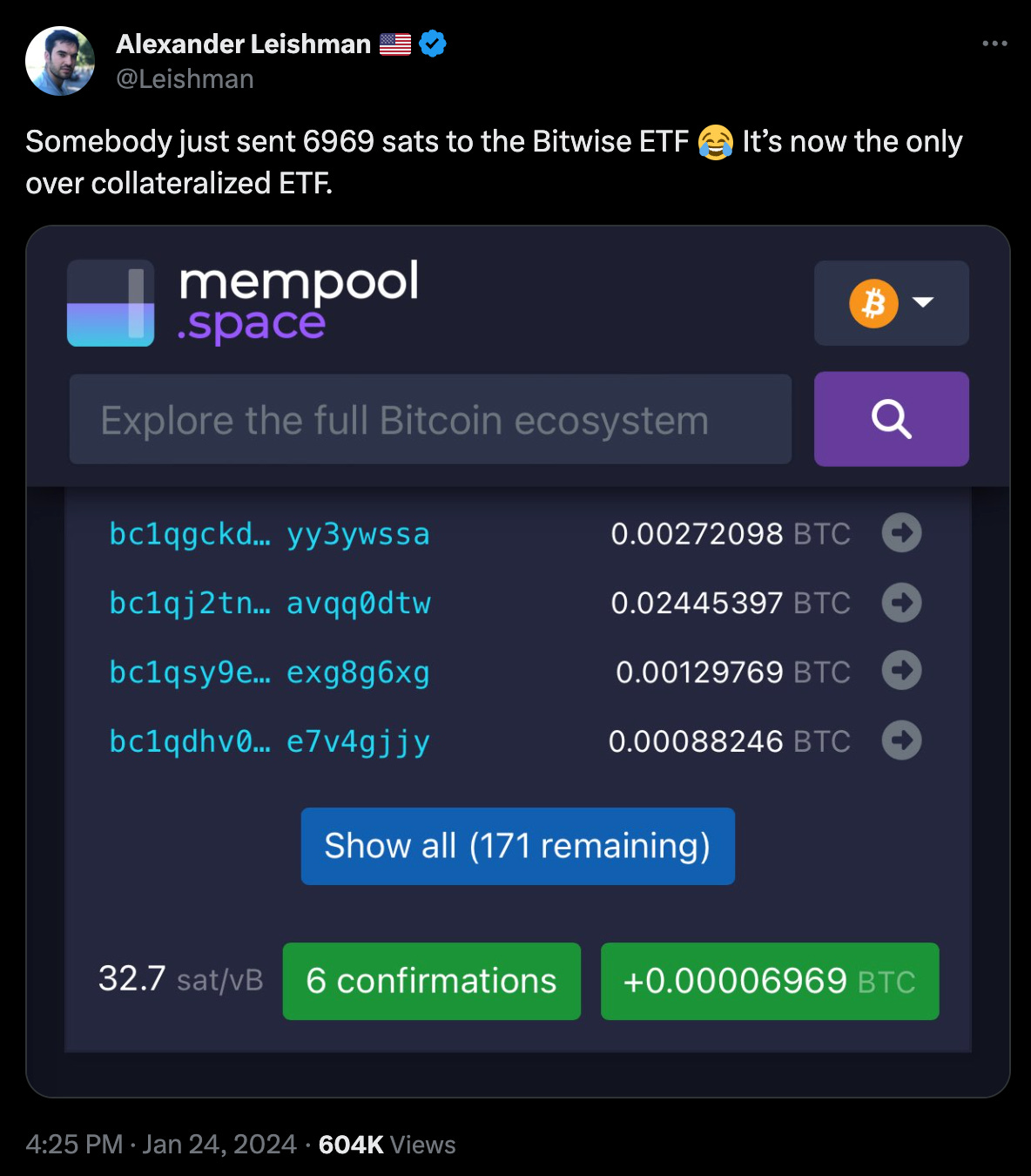

It wouldn’t be the crypto industry without some sort of chaos or jokes, so naturally someone sent 0.00006969 bitcoin to the public wallet address. This means that Bitwise now has the only over-collateralized bitcoin ETF on the market as well. Obviously, this is a joke, but it does highlight the ability for people to send bitcoin to this wallet address without Bitwise having to do anything.

This idea of on-chain audibility, along with on-chain governance of rules, is only going to become more important in the world. Last year we saw three of the largest bank failures in history occur, which potentially could have been identified earlier if anyone in the world could have audited the various bank holdings.

There will be less interest for companies to broadcast their internal balance sheets, but anytime a company is reportedly holding assets for customers or partners it makes sense for them to be publicly auditable.

Remember, the Pentagon has failed six straight audits.

Imagine a world where the government, who is entrusted with the citizens’ assets, had everything publicly verifiable. There would be less waste, more efficiency, and probably better outcomes.

Anything that can be on-chain likely will move on-chain in the future.

This on-chain world uses software to enforce the rules as well. The phrase “code is law” gets thrown around often to describe the phenomenon. This is possible because everything on-chain is digital. The assets are digital, the market participants are digital wallets, and the rules are written in a digital database.

There will be instances in the future that can’t come on-chain for rule enforcement. Take the current southern border crisis as an example — Texas has declared an invasion of their state and is fortifying their border. The national government sued them in court to prevent them from fortifying the border. The Supreme Court ruled in favor of the national government.

Texas is ignoring the Supreme Court decision and claiming this is a state’s right issue, not a federal government issue. Now a number of other states and governors are coming out in support of Texas and Governor Abbott.

The US Constitution clearly lays out rules for our nation. The problem in the analog world is how to interpret these rules, along with how to enforce them. Comparing these challenges to the on-chain world, where software requires crystal clear rules and enforcement directions in advance, it is easy to see why people will continue preferring the digital version.

Again, it won’t always be possible, but it will be the preference whenever it is possible.

The idea of on-chain audibility and governance is at its infancy. The trend is clear though — we are going to see more things move on-chain as time passes. You can’t stop an idea whose time has come. The better system is here. The early adopters are adopting it. Eventually the masses will follow.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Fred Thiel is the Chairman & CEO of Marathon Digital Holdings (NASDAQ:MARA), a digital asset company that mines cryptocurrencies with a focus on the blockchain ecosystem and the generation of digital assets.

In this conversation, we talk about energy harvesting, brand new bitcoin mining sites, bitcoin halving, hashrate, outlook for 2024, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Marathon Digital CEO Breaks Down Why Miners Are Well Positioned Post-Halving

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.