Is The Bitcoin Bull Market Almost Over?

Today’s Letter is Brought To You By Range!

Looking for a tax strategy to offset those BTC gains?

Range has you covered -- they have rebuilt wealth management from the ground up, offering investors like you a modern all-in-one comprehensive suite of financial services.

With Range, you get everything in one place—investments, taxes, estate, real estate, equity, and cash flow. No more piecemealing your way to generational wealth while hunting for the right connections to manage all aspects of your money.

The traditional industry has you convinced that you have to pay ridiculously high fees to get sophisticated wealth management.

Let them know you’re done. You’ve found Range. The search is over.

To investors,

Bitcoin just had the highest monthly close in history. It feels like a decade ago, but the digital asset was trading just over $69,000 on November 1st of this year. A month later and we had experienced a nearly 40% gain in price.

Not bad for an election month filled with uncertainty.

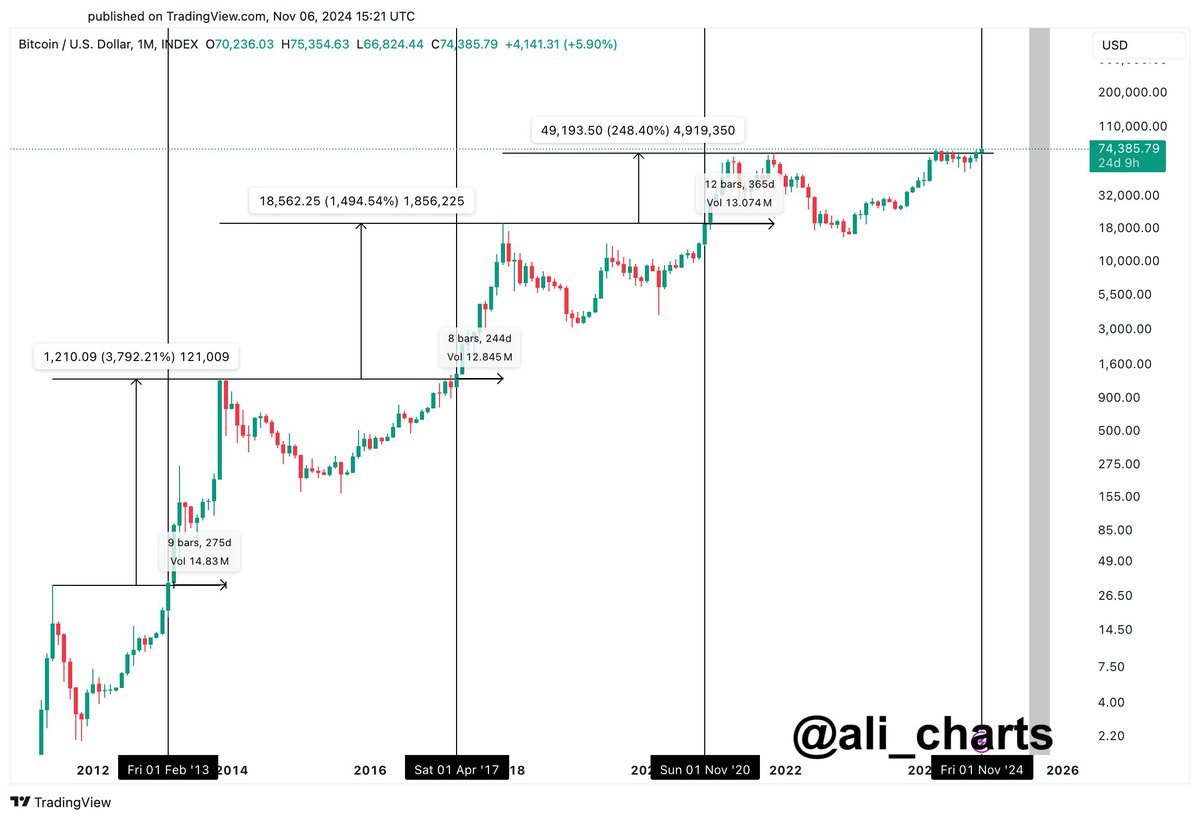

This monthly close is really important to pay attention to for a few reasons. First, Ali Martinez explains “historically, Bitcoin has reached market tops roughly 8 to 12 months after achieving a monthly close above its previous all-time high. If this pattern continues, the next potential market top for BTC could occur between July and November 2025.”

This previous pattern would suggest we still have quite a bit of time before bitcoin reaches the peak of the current bull market. But there are plenty of people who argue bitcoin has accelerated too quickly and we are already near the market top — let’s find more data that disproves this theory.

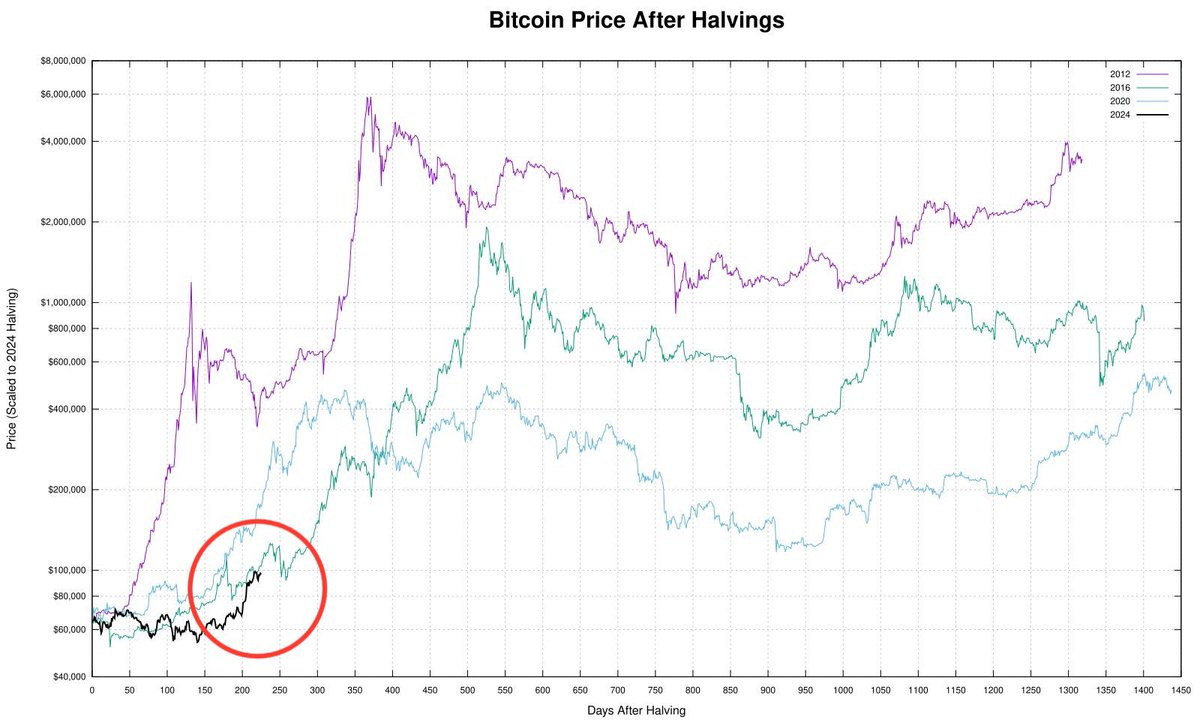

Quinten Francois writes “the average Bitcoin cycle:

Starts 170 days after halving

Peaks 480 days after halving

We are currently 225 days after the BTC halving.”

Next, Stockmoney Lizards (yes, it is a serious account with an awesome name!) highlights the “cycle top was always close when monthly RSI exceeded 90. We have a good way to go until we reach this.”

I tend to agree that the bull market is only getting warmed up. Another important data point that I am watching is the amount of bitcoin on exchanges. The more bitcoin that is available on exchanges, the more bitcoin that is theoretically available to sell quickly. It only takes the press of a button to sell the bitcoin on an exchange.

But the amount of bitcoin on exchanges has been plummeting throughout the year, which signals that most bitcoiners are not even thinking about selling yet.

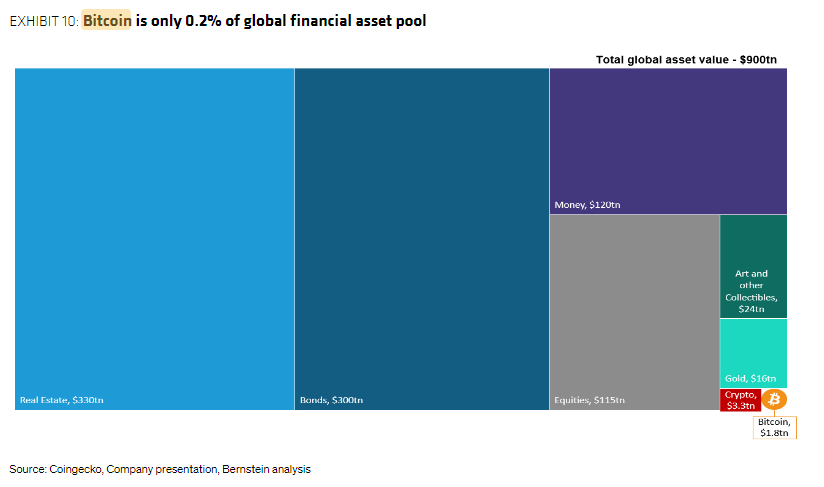

Add in the fact that Matthew Sigel, VanEck’s Head of Digital Assets Research, shows bitcoin is only 0.2% of global financial assets and you would think more capital is going to flow into the asset as the price increases.

As capital flows into bitcoin, which is a finite supply asset, the price of the asset should continue upwards. And most importantly — bitcoin’s price is the marketing department.

Decentralized technologies like bitcoin don’t have an executive team, a board of directors, or a coordinated marketing campaign. That doesn’t stop every media outlet, taxi driver, barber, and friend from talking about bitcoin when the price goes higher and higher.

Imagine what is going to happen when bitcoin breaks $100,000 for the first time. It will be front-page news in every publication. Every news station will be talking about it for hours on their television shows. The podcasts and twitter accounts will light up like Christmas trees. The viral word-of-mouth will be unlike anything we have seen before.

And that all leads to more capital flowing into bitcoin.

Which brings me to the finishing move for bitcoin vs the final boss — people will buy bitcoin because of the hype since they think they can get rich. But over time they will learn more about bitcoin, inflation, currency debasement, and other critical economic theories. These people will turn into hardcore bitcoin holders that are unwilling to sell their bitcoin for fiat currencies ever again (remember that 1 out of every 2 bitcoin in circulation has not moved in the last 2 years!).

Just look at this graphic of the difference in currencies:

Bitcoin has appreciated significantly over the last two years since the bottom of the 2022 bear market. Don’t let past market performance convince you that the asset can’t go higher in the coming months.

I am not predicting a certain price, nor a certain timeline. I am also not arguing that the 4-year cycles are over. I am merely pointing out that probability suggests the bitcoin bull market is not close to over and prices are going higher.

It will be interesting to watch what happens. Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

What Happens When Bitcoin Hits $100,000?

Anthony Pompliano records a solo episode explaining what happens when bitcoin hits $100,000. Topics include long-term thinking, hashrate all-time highs, long-term holders with conviction, historical trends, drawdowns, investing strategies, US government, and future outlook as bitcoin price rises.

Enjoy!

Podcast Sponsors

Bitkey – The hardware wallet built for bitcoin that replaces complex seed phrases with an easy three-key system. Available for $99.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

BetOnline is your #1 source for all your crypto sports and politics betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Ledger - Ledger secures 20% of the world’s digital assets. Upgrade to Ledger Flex this Black Friday and get $70 in Bitcoin or save up to 40% on select wallets.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

ASI or Quantum may one day destroy BTC. Government may outlaw or tax it to zero or minimal worth. Does the world want to replace our current overlords with Michael Saylor and other BTC whales? Best ever speculative vehicle though, until it isn’t.

Every cycle has a set of unique characteristics

For example, during the 2017 cycle, we had ICO boom and there was a ton of drama around Block Size, SegWit, New York Agreement, BCH fork etc. and then came CME Futures.

During the last cycle, we had Covid and tsunami of cash. Around late summer 2020, I started fielding inquiries from large Asset Owners, as part of my work.

It would be helpful to look at what's unique in this cycle.

Possibility of SBR, at the Federal and State level is definitely unique this time. Expectation of reasonable policies (Stablecoin, Market Structure, AML / KYC) and non-hostile administration would be a big help too. I don't think any of these are priced in yet.

A dream case scenario would be US moves ahead with some form of SBR, Stablecoin Bill and Market Structure Bill. That would create a panic among other central banks to shore up their balance sheets and their currencies. Also, there would be a mad rush among corporates to buy BTC in some form. Who knows where bitcoin price would end up if this scenario happens.

Net net, I believe that we have not peaked yet, but I don't know how to factor in these unique characteristics in the charts.