To investors,

Bitcoin is starting the new year with a slight lift in price, but the true measure of success for the digital asset can be found in the underlying metrics. I want to highlight a number of data points for you this morning as we kick off 2025.

Bitcoin’s hash rate currently sits at an all-time high, which signals the increasing strength of the blockchain.

If you combine all of the computing power from Amazon AWS, Google Cloud, and Microsoft Azure, it still would not equal 1% of the bitcoin network. It is impressive that miners and node operators have assembled the decentralized computing network without central planning or a primary capital source.

From a holders’ perspective, on-chain wallet addresses with at least $100 in bitcoin is near all-time highs.

The same is true for on-chain wallet address with at least $1,000 as well.

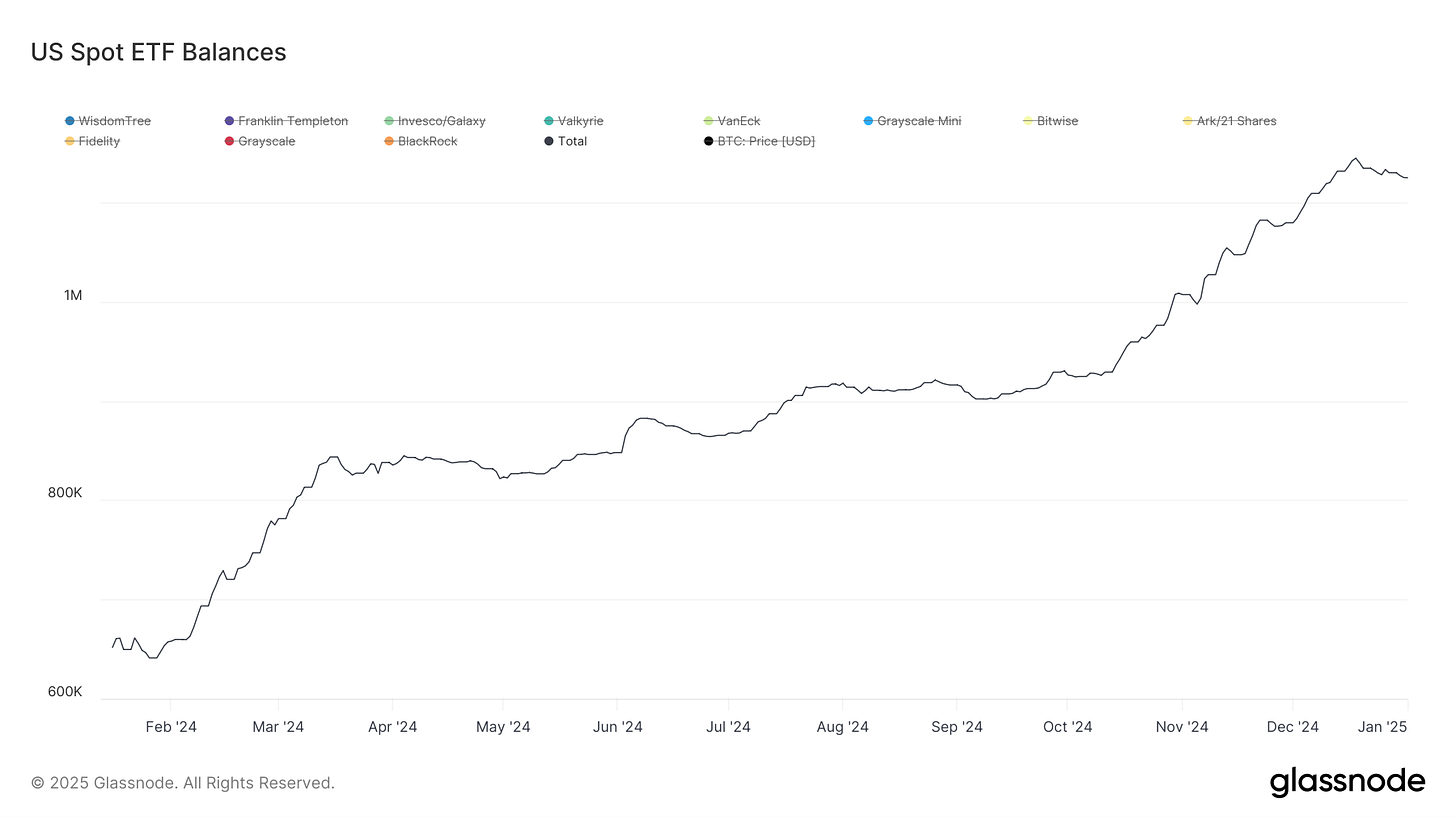

Institutions don’t want to be left behind by retail, so we have seen the total number of bitcoin held by the US-traded ETFs jump from approximately 650,000 bitcoin in January 2024 to more than 1,250,000 bitcoin a year later.

People and institutions want bitcoin. You can see this clearly with the falling amount of bitcoin left on exchanges. We recently crossed below 2,791,000 bitcoin, which is a level we haven’t seen since 2019.

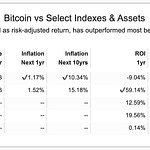

When capital flies into the market, the price goes up quickly. Bitcoin’s price saw more than a 100% gain in 2024. This has led to many people asking “is the bull run over?” We can look at MVRV Z-Score to understand the market position.

Here is how Glassnode describes this metric:

“The MVRV Z-Score evaluates whether BTC is overvalued or undervalued relative to its "fair value". Instead of using a traditional z-score method, the MVRV Z-Score uniquely compares the market value to the realized value. When the market value, measured as network valuation by spot price multiplied by supply, is significantly higher than the realized value, represented by the cumulative capital inflow into the asset, it has typically signaled a market top (red zone). Conversely, a significantly lower market value than the realized value has often indicated market bottoms (green zone).”

Although the price of bitcoin has increased nearly 500% in the last 2 years, we see that more than 1 out of every 2 bitcoin in circulation has not moved. This signals long-term holders with deep conviction, regardless of price.

We also know that more than 86% of all bitcoin in circulation are currently “in profit,” which means the coins last traded hands at a price lower than the price today.

Lastly, the number of transactions on the bitcoin network has been dropping throughout December 2024. We continue to see transaction volume holding lower in the last 24 hours.

You can make an argument that people are holding bitcoin, therefore they are not transacting their bitcoin. That would drive the transaction number lower. You could also argue that a lower number of transaction volume could show less interest in the digital asset. I will leave that data point for you all to decide.

Overall, bitcoin feels strong to start 2025. The network looks healthy, institutions and retail are holding bitcoin, and the bull market appears to still have more room to run. This does not mean that bitcoin’s price can’t go down in the short-run, but I believe we have another bitcoin all-time high price ahead of us before this bull market is over.

Hope you all have a great start to the new year. I will talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

Anthony Pompliano Reviews Bitcoin’s 2024 and Explains What He Thinks Will Happen in 2025

Anthony Pompliano records a solo episode breaking down the historical year of 2024 for bitcoin. Topics include institutional adoption, price hitting $100,000, bitcoin ETFs, nation states, MicroStrategy, other publicly traded companies, bitcoin miners, political environment, and where bitcoin goes from here.

Enjoy!

Podcast Sponsors

Ledger - Ledger secures 20% of the world’s digital assets. Their latest devices, Ledger Stax and Ledger Flex, feature secure touchscreens for safer, easier crypto management.

Franzy - Your is your gateway to franchise ownership—research, compare, and fund the right opportunity with confidence and transparency.

Bitdeer - A global technology company focused on Bitcoin mining, ASIC development and HPC for AI, backed by advanced R&D and a massive 2.5 GW global power portfolio.

Meanwhile - The world’s first licensed and regulated life insurance company built for the Bitcoin economy. Learn how to tax-optimize your BTC holdings for your life and beyond.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.